China Technology Sector: Opportunities Amid Tariff Concerns

The China technology sector is rapidly evolving, becoming a focal point for global investors seeking opportunities in artificial intelligence and other cutting-edge innovations. Despite recent concerns regarding China tariffs impact on the economy, analysts are optimistic about the resilience of Chinese tech stocks, particularly those involved in generative AI. Investor sentiment in China remains robust, with a noticeable shift towards domestic technology companies as fiscal policies adapt to market fluctuations. Reports from sources like Citi equity research China indicate that leading tech firms in this sector are still trading at attractive valuations compared to their U.S. counterparts. As the landscape develops, the interplay of economic policies, investment strategies, and technological advancements is likely to shape the future of the China technology sector in significant ways.

The technology industry in China has emerged as a powerhouse, attracting increasing attention from global markets. As this sector continues to innovate, particularly in areas like AI, it draws both interest and concern due to ongoing tariff debates. The sentiment among investors regarding Chinese technology firms is shifting, with a preference for domestic market leaders over those reliant on exports. Recent analyses highlight the favorable evaluations of key players, suggesting that there are many promising investment opportunities in the Chinese tech landscape. This evolving narrative around the tech ecosystem in China points to a broader trend of adaptation and resilience amidst global economic challenges.

The Future of China’s Technology Sector Amidst Tariff Concerns

China’s technology sector stands at a critical juncture as both domestic and global investors wrestle with the implications of increased tariffs. While concerns regarding the U.S. tariffs have rattled markets, many analysts, including those at Citi, project that the long-term trajectory for Chinese tech will remain positive. The rapid adoption of generative artificial intelligence across various sectors is creating new opportunities and driving innovation, effectively acting as a buffer against potential downturns caused by geopolitical tensions.

The resilience shown by Chinese tech stocks following the initial drop after the announcement of tariffs reflects a broader investor sentiment favoring domestic growth. Many larger technology firms, as highlighted by Morningstar, possess minimal exposure to the U.S. market, which insulates them from immediate tariff impacts. Additionally, with valuations indicating a substantial discount compared to American counterparts, savvy investors may find this a strategic moment to capitalize on the potential upside of Chinese tech.

Investor Sentiment Towards Chinese Tech Stocks

Recent reports suggest that international investor sentiment towards Chinese tech stocks is on the rise, a potentially bullish indicator for the sector’s future. According to Citi’s recent analysis, nearly 25% of global investors have reported increased optimism about the prospects of investing in China. This shift can be attributed to various factors, including attractive valuations and strong growth potential within the Chinese market, particularly in areas like social media and electric vehicles, driven by companies like Tencent and BYD.

The uptrend in investor confidence also correlates with significant capital flows into Chinese equities, as evidenced by emerging market funds increasing their allocations to China. This renewed interest is not merely a response to tariff uncertainties but is also spurred by the confidence in policy measures aimed at boosting the tech ecosystem, including support for high-tech industries and AI advancements. As investor sentiment continues to evolve positively, it’s likely that we’ll see further growth and innovation from Chinese tech firms.

The Role of Artificial Intelligence in China’s Tech Landscape

Artificial intelligence (AI) is playing an increasingly crucial role in reshaping China’s technology landscape, with startups like DeepSeek carving out a competitive edge in generative AI. Despite facing challenges related to U.S. export restrictions on advanced chips, these companies are proving that innovation can thrive even under stringent conditions. The focus on AI is not just about computational capabilities—it encompasses broader applications, including enhancing operational efficiencies and reducing costs for businesses across various sectors.

Furthermore, the Chinese government is actively supporting the integration of AI into traditional sectors, facilitating a diverse ecosystem of growth opportunities. For manufacturers and service providers, leveraging AI technology is expected to drive significant performance improvements. As evidenced by analysts from HSBC, the initial adjustments in earnings expectations are reflective of the tech sector’s adaptability in integrating new technologies that bolster productivity and growth.

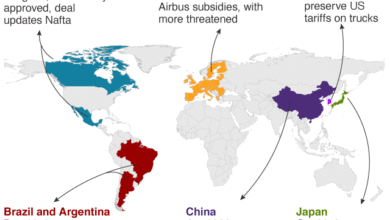

Long-term Impacts of China Tariffs on the Tech Sector

The long-term implications of U.S. tariffs on China’s technology sector remain a matter of significant debate among economists and investment strategists. Many analysts caution that while immediate effects may vary, the indirect consequences could be more pronounced if tariffs slow down economic growth overall. Morningstar’s assessment raises concerns about potential decreases in China’s GDP, which could have cascading effects on tech firms reliant on stable economic conditions for their growth.

However, it’s also important to note that certain segments within the Chinese tech industry may remain insulated from these effects. For instance, sectors heavily invested in domestic consumption, such as technology services, are likely to experience less disruption compared to companies dependent on exports. Therefore, despite tariff pressures, there are sectors within the Chinese tech landscape that may continue to flourish, offering promising investment opportunities.

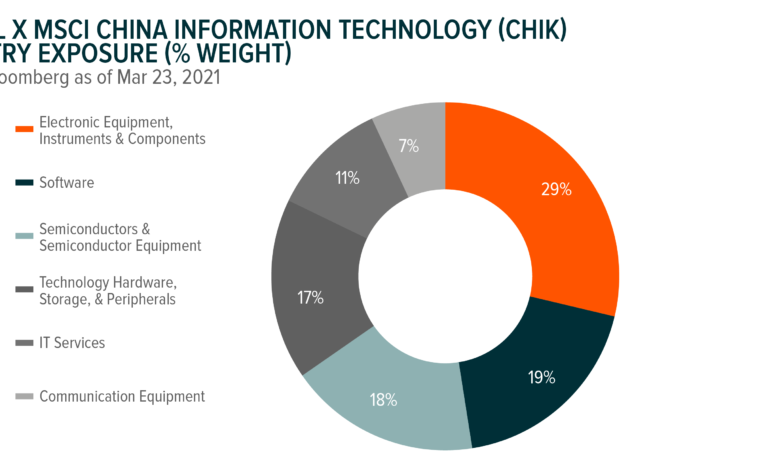

Citi’s Insights on Chinese Tech Stock Valuations

Citi’s latest equity research highlights the significant discrepancies in valuations between Chinese tech stocks and those of their American peers. Their analysis shows that leading Chinese companies boast an average price-to-earnings ratio substantially lower than that of the U.S. ‘Magnificent Seven’ tech firms. This presents a compelling case for value-oriented investors seeking entry points in an expanding market, especially as the sector is generally considered undervalued.

The research suggests that investors should lean towards domestic-oriented stocks, particularly in technology and internet services, which are expected to outpace their export-oriented counterparts. By selecting companies that are better positioned to weather tariff uncertainties, investors can capitalize on China’s evolving economic landscape. With a favorable outlook on specific sectors, the strategic allocation of investments is paramount in navigating current economic conditions.

Chinese Tech Companies Show Resilience in Volatile Markets

Chinese technology companies have demonstrated resilience in the face of volatile market conditions driven by U.S. tariffs. The stock performance of major tech firms, despite market jitters, signals an underlying confidence in their long-term potential. Investors are beginning to recognize the strength of these companies, as many have adapted their business models to focus on both domestic and international markets, mitigating risks associated with tariff impacts.

Furthermore, the comparative stability seen in the Chinese tech indices, with a year-to-date increase outpacing the broader Hang Seng index, illustrates that the sector has found ways to sustain growth even amid external pressures. Many analysts attribute this resilience to robust domestic demand and strategic positioning in high-growth areas such as AI and technology services, ensuring ongoing investor interest and potential for long-term gains.

Healthcare Sector’s Dynamics Amid Tariff Regulations

Interestingly, the healthcare sector in China has emerged as a relative safe haven amidst the evolving tariff landscape. With pharmaceuticals largely exempt from the latest rounds of U.S. tariffs, many analysts anticipate it to be insulated from the negative repercussions affecting other sectors. As investments in healthcare technology rise, coupled with the continued collaboration with U.S. firms, the sector is positioned for sustainable growth despite uncertainties in trade policies.

Moreover, companies within the Chinese healthcare space, such as Wuxi Biologics, are showcasing their operational efficiencies and capabilities to meet rising global demands for biopharmaceutical products. The bipartisan support for lowering drug prices in the U.S. further strengthens the case for Chinese firms, enhancing their attractiveness to investors seeking stable, reliable opportunities amidst geopolitical tensions.

Navigating Market Volatility in Chinese Tech Investments

Investors are advised to navigate the turbulence in the Chinese technology market with a strategy that balances risk against potential rewards. The current market volatility spurred by tariff announcements can create buying opportunities for those willing to adopt a long-term perspective on their investments. Analysts recommend focusing on sectors exhibiting robust growth potential and greater resilience to external shocks.

In light of the anticipated fiscal policy interventions and the ongoing push for technological advancement within China, the outlook for the tech sector remains cautiously optimistic. The integration of artificial intelligence and smart technologies will likely drive innovation, and investors may find value in allocating capital towards companies that are at the forefront of these trends. As market dynamics continue to evolve, staying informed and agile will be essential for capitalizing on growth opportunities.

Conclusion: The Strategic Landscape for Investing in Chinese Tech

The strategic landscape for investing in China’s technology sector is evolving, marked by volatility but also opportunities for discerning investors. With recent trends highlighting the strong fundamentals of major Chinese tech firms, there is a case to be made for maintaining a diversified portfolio that includes these undervalued stocks. Tariff uncertainties may pose challenges, yet the potential for growth driven by domestic consumption and technological advancement remains intact.

Overall, a cautious yet optimistic approach could yield significant returns as the Chinese technology sector continues to adapt and innovate. By leveraging insights from equity research and staying attuned to market developments, investors can position themselves to effectively navigate the complexities of the current environment. As China marches towards becoming a leading hub for technology and innovation, aligning investment strategies with these trends is critical for future success.

Frequently Asked Questions

What is the current sentiment around Chinese tech stocks amidst U.S. tariffs on China?

Despite the recent U.S. tariffs on China causing initial drops in the stock market, investor sentiment around Chinese tech stocks remains relatively positive. Analysts indicate that many larger technology firms are less exposed to the U.S. market, suggesting that the overall impact may be limited. Furthermore, investor interest in Chinese tech has grown, with allocations to China hitting a 16-month high, as reflected in Citi’s positive outlook on various sectors within the China technology sector.

How is artificial intelligence in China affecting its technology sector?

The surge in interest in domestic generative artificial intelligence is significantly benefiting China’s technology sector. Chinese startups, such as DeepSeek, are launching competitive AI models that claim to outperform those like OpenAI’s ChatGPT. This focus on AI not only enhances the technological capabilities of Chinese firms but also helps in reducing operational costs, driving growth in the tech sector despite challenges such as U.S. restrictions.

What impact do tariffs have on investor sentiment toward the China technology sector?

Tariffs have introduced some uncertainty in the market, causing volatility; however, they have not significantly deterred investor interest in the China technology sector. Analysts from Citi reported that nearly one-quarter of international investors are feeling more optimistic about Chinese tech despite the tariff challenges. This reflects a broader confidence in the sector’s resilience and growth potential.

How does Citi’s equity research assess the valuation of Chinese tech stocks?

Citi’s equity research indicates that the valuations of leading Chinese tech stocks are surprisingly inexpensive compared to their U.S. counterparts. Their analysis shows that the average price-to-earnings ratio of prominent Chinese tech firms is 52% lower than that of the U.S.’s ‘Magnificent Seven’ tech stocks, with expectations for recovery in valuations as market conditions stabilize.

What sectors within the China technology sector are expected to perform well?

Analysts are favoring domestic-focused sectors over export-oriented ones within the China technology sector due to uncertainties from tariffs. Specifically, Citi emphasizes the potential for growth in the Chinese internet, technology, and transportation sectors. Companies involved in services, such as social media and gaming giants like Tencent, are expected to lead this growth, along with electric vehicle manufacturers like BYD.

What role does artificial intelligence play in the future growth of China’s technology sector?

Artificial intelligence is poised to be a catalyst for growth in China’s technology sector, driving innovation and efficiency in firms. The adoption of AI technologies helps companies reduce costs and improve productivity. With supportive policy measures and the continuous development of competitive AI capabilities, China’s tech sector is likely to see sustained growth propelled by advancements in artificial intelligence.

How are Chinese healthcare stocks performing in relation to tariffs and the overall technology sector?

Chinese healthcare stocks are viewed as relatively insulated from the impacts of new U.S. tariffs, especially since pharmaceuticals were not included in the latest tariffs. Analysts believe that many biotech firms maintain U.S. partnerships, mitigating direct export challenges. Consequently, the healthcare sector remains a promising area of investment alongside the technology sector, highlighting its growth potential amidst global uncertainties.

What are the long-term forecasts for the China technology sector in light of current market conditions?

Long-term forecasts for the China technology sector suggest a potential for significant growth despite current market instability. Analysts expect fiscal interventions to support the sector, and projected advances in technologies, particularly in AI, are likely to fuel ongoing interest and investment. Overall, while tariffs introduce challenges, the fundamentals of China’s tech industry indicate resilience and adaptability.

| Key Aspect | Details |

|---|---|

| U.S. Tariffs Impact | Recent tariffs led to a drop in Chinese stocks, but they later rebounded. |

| Technology Sector Outlook | Analysts predict growth in China’s technology sector, driven by generative AI interest. |

| Valuation Insights | Chinese tech stocks are comparatively undervalued, with lower price-to-earnings ratios than U.S. counterparts. |

| Investment Preferences | Preference for domestic firms over export-oriented due to tariff uncertainties. |

| Growth Drivers | AI adoption is expected to reduce costs for Chinese firms. |

| Positive Investor Sentiment | International investor optimism for Chinese tech has increased. |

| Healthcare Sector Stability | Healthcare firms are less affected as pharmaceuticals were excluded from new tariffs. |

Summary

The China technology sector is poised for significant growth, primarily propelled by the increasing interest in domestic generative artificial intelligence. Despite recent challenges, including tariffs affecting global trade, analysts believe that the resilience in the technology sector will continue to attract investor confidence. With comparative undervaluation of Chinese tech stocks and a focus on domestic consumption, the sector is expected to outperform in the coming months. As the market adapts to these economic changes, the outlook remains optimistic for technological innovation and growth within China.