US Dollar Selloff Prediction: Peter Schiff’s Warning

As uncertainty looms over the U.S. economic landscape, experts are bracing for a significant US dollar selloff prediction that could reshape market dynamics. Renowned economist Peter Schiff recently highlighted that a convergence of inflation risks, trade tariff threats, and questionable fiscal policies may trigger a cascade of volatility across various asset classes, including the stock market and US Treasuries. Investors, in light of these potential developments, should prepare for a turbulent financial environment where the effects of tariffs and broader economic outlook concerns could lead to a sharp decline in the dollar’s value. Schiff’s alerts echo the urgency for investors to reassess their portfolios amid this predicted turmoil, as the impact of tariffs and rising market volatility challenge conventional investment strategies. The implications of these economic indicators on both domestic consumers and the broader financial system are immense, making it crucial for investors to stay informed about the evolving landscape.

In the face of heightened economic tensions, analysts are discussing the forecast for significant depreciation of the US currency, indicating a potential downturn for American assets as a whole. Influential voices in the financial sector, such as Peter Schiff, are cautioning about the ramifications of inflation, recurring trade tariffs, and inadequate fiscal policies that could disrupt market stability. As stock prices experience fluctuations and US Treasury yields come under pressure, the economic landscape might shift dramatically, signaling a challenging period ahead. Market participants must remain vigilant regarding how international trade policies and domestic economic strategies will shape their investment decisions amidst this climate of uncertainty and potential volatility. A thorough understanding of these interconnected factors is vital for navigating the impending economic challenges that could arise.

Understanding Peter Schiff’s Economic Predictions

Peter Schiff, a well-known economist and gold advocate, has been vocal about his predictions regarding the U.S. dollar and its impending selloff. His insights delve into the connection between the current economic landscape and an anticipated wave of market volatility. As Schiff warns, the intersection of inflation threats and fluctuating tariffs could create a perfect storm, significantly impacting investors’ portfolios. This prediction stands against a backdrop of increasing concerns regarding economic stability in the U.S., wherein Schiff posits that both Treasuries and stocks are susceptible to sharp declines.

Schiff’s perspective hinges on the notion that many market participants are unprepared for the repercussions of heightened tariff implementations. With previous experiences from escalating trade tensions still fresh, his warnings highlight both the psychological and financial parameters affecting U.S. equities. In a market characterized by excessive optimism, Schiff’s bearish outlook provides a sober reminder of the potential fallout as various asset classes, including the dollar, may react sharply to economic policy shifts.

The Impact of Tariffs on the Stock Market

Tariffs have long been a contentious point in economic discussions, particularly regarding their impact on the stock market. Economists like Peter Schiff emphasize that tariffs not only hinder trade but can also generate significant stock market volatility. In recent discussions, Schiff has pointed out that renewed tariffs could adversely affect corporate earnings, leading to a decrease in stock prices. As companies grapple with increased costs due to tariffs, this dynamic invites skepticism among investors who might anticipate a market downturn.

The relationship between tariffs and stock market performance encapsulates a broader economic outlook. As tariffs rise, consumer spending power diminishes, creating a ripple effect across various sectors. Schiff’s warnings serve as a clarion call to investors to reassess their strategies and consider the effects of U.S. trade policy on future stock performance. As such, monitoring tariff announcements can be crucial for those hoping to navigate through an increasingly volatile financial landscape.

The Deteriorating Economic Outlook and its Consequences

Current economic conditions suggest a looming crisis characterized by inflationary pressures and fiscal policies that may lead to long-term detrimental effects. Peter Schiff has argued that the length and depth of this economic downturn hinge upon the decisions made at the federal level. His assertion that Trump’s tax cuts could exacerbate economic instability illustrates the potential pitfalls of inadequate fiscal strategies. As consumers may face higher costs associated with tariffs and a depreciating dollar, the stage is set for a difficult economic period ahead.

The outlook for U.S. assets, including Treasuries and stocks, remains precarious under these conditions. Schiff advocates for a shift in focus from short-term consumer spending to fostering sustainable growth through investments in capital. This long-term view clashes with more traditional demand-side approaches that prioritize immediate economic stimulus. Understanding these differing perspectives is essential for investors trying to make informed decisions amidst the uncertainty surrounding future economic policy in the U.S.

The Significance of U.S. Treasuries in Market Predictions

U.S. Treasuries have historically been viewed as a safe-haven investment, but Peter Schiff warns that they might also feel the effects of an impending market selloff. As tariffs rise and inflation escalates, the attractiveness of Treasuries could diminish, leading to selloffs among investors seeking better returns elsewhere. Schiff’s analysis points to a scenario where rising long-term interest rates can further strain the fiscal health of the federal government, leading to a potential crisis that could destabilize markets.

The dynamics of U.S. Treasuries are complex and respond swiftly to changing investor sentiments. With the growing perception of economic instability, including fears regarding inflation and debt, many investors may reconsider their exposure to Treasuries. Schiff’s warnings serve not only as a cautionary tale but also as a call to reassess asset allocations in the face of potential volatility, ensuring that investors remain vigilant amidst shifting economic tides.

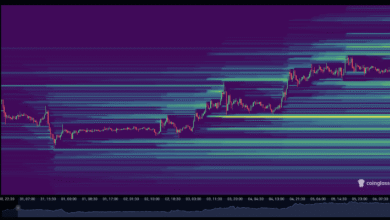

Navigating Market Volatility Amidst Economic Challenges

Navigating market volatility requires a keen understanding of economic signals and events, especially during turbulent times. Peter Schiff has highlighted the immediate need for investors to reassess their portfolios considering potential selloffs across the board, from the U.S. dollar to stocks and Treasuries. In a market fraught with uncertainty, this navigation involves recognizing and responding to the underlying economic indicators significant to asset pricing.

Investors can benefit from a comprehensive strategy that accounts for these factors, especially considering how tariffs and economic policies might shift market dynamics. By staying informed and adaptable, individuals can mitigate potential risks stemming from economic fluctuations, thereby increasing their resilience to the unpredictability of market movements. Schiff’s insights stress the importance of vigilance and strategic foresight in the face of potential downturns.

Analyzing the Broader Impact of Economic Policy on Markets

The relationship between economic policy and market performance is integral to understanding how shifts influence investor behavior. Peter Schiff articulates a critical viewpoint on current U.S. policies, emphasizing their potential to create instability across asset classes. The nexus of tariffs and inflation poses a complex challenge that could adversely affect everything from consumer spending to investment strategies, warranting thorough analysis by market participants.

Notably, Schiff’s perspective reveals a concern for long-term economic health compared to short-term gains often celebrated in the markets. By scrutinizing how government actions can profoundly affect market trajectories, investors gain insight into the broader implications of their investment choices. This deep analysis equips individuals with the tools necessary to adapt their strategies amid evolving economic landscapes.

The Role of Inflation in Shaping Market Expectations

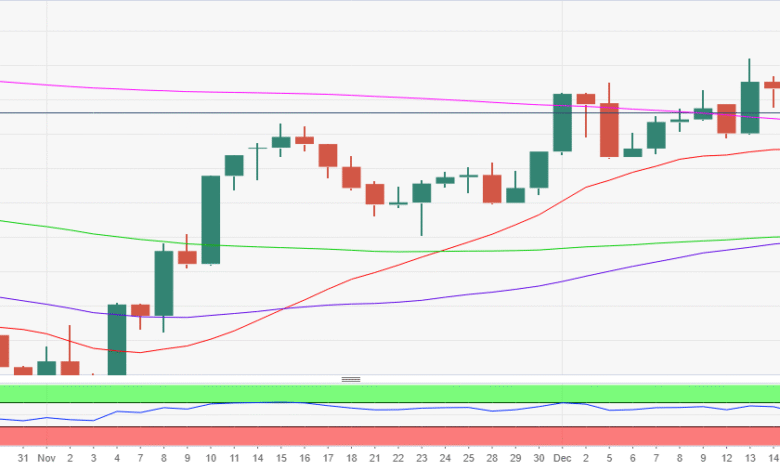

Inflation plays a pivotal role in shaping market expectations, influencing everything from consumer prices to interest rates. Peter Schiff has warned that rising inflation concerns could catalyze significant adjustments in investor sentiment. Market participants often react sharply to inflation indicators, with reactions that can lead to rapid asset price changes and volatility across markets. Consequently, investors must remain cognizant of inflation trends as they navigate their portfolios.

The connection between inflation and market performance also emphasizes the need for agility in investment approaches. As inflationary pressures mount, traditional investment tactics might require reevaluation. Schiff’s forewarnings serve as a reminder that both monetary policy actions and inflationary trends could define the next phase for asset classes, underscoring the importance of proactive financial planning and investment adaptation.

Investing Strategies Amid Predicted Market Shifts

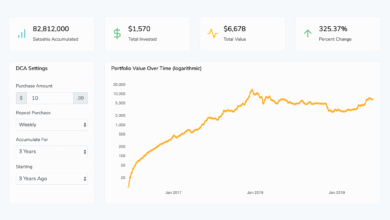

In light of Peter Schiff’s predictions regarding potential selloffs in the U.S. dollar and stocks, adjusting investment strategies becomes imperative. Market volatility necessitates a reconsideration of how assets are allocated, particularly as Schiff suggests a broader economic downturn looms. Strategic investments in commodities like gold may be beneficial as a hedge against inflation and downturns in traditional asset markets.

Moreover, diversifying portfolios through a mix of asset classes designed to withstand economic shifts may help mitigate potential risks. Investors need to focus on long-term stability rather than short-term profits, drawing from Schiff’s insights that emphasize the importance of structural investments over mere consumer-driven growth. Evaluating these strategies in light of changing economic conditions can prove vital in bolstering financial resilience.

The Future of the Dollar and Economic Reform

The future of the U.S. dollar remains uncertain as analysts like Peter Schiff call attention to the potential for a significant selloff. Schiff’s forecasts highlight the importance of rethinking fiscal policies and their effects on the dollar’s strength. As tariffs and inflationary pressures mount, the dollar may face challenges that not only threaten its purchasing power but also its standing as a global reserve currency.

Reforming economic policy could be pivotal in stabilizing the dollar and restoring investor confidence. Schiff advocates for a focus on fiscal prudence, where sound monetary policies can reinforce the dollar’s strength and stability. The interplay between economic reform and market performance underscores the critical need for policymakers to reassess current strategies to safeguard against potential economic fallout.

Frequently Asked Questions

What is the current prediction for a US dollar selloff based on recent market trends?

The current prediction for a US dollar selloff is concerning, as economist Peter Schiff warns of a potential sharp decline stemming from inflation risks, tariff threats, and flawed fiscal policies. These factors are expected to lead to renewed volatility across financial markets.

How do Peter Schiff’s views on the US dollar selloff correlate with stock market volatility?

Peter Schiff believes that the impending selloff in the US dollar will be closely tied to stock market volatility. He suggests that rising trade tensions and inflationary pressures may simultaneously affect equities, Treasuries, and the dollar, prompting a substantial market correction.

What potential impact do tariffs have on the US dollar selloff prediction?

Tariffs are predicted to have a significant impact on the anticipated US dollar selloff, as Schiff indicated that renewed ‘reciprocal’ tariffs could catch investors off guard. This results in higher prices paid by American consumers, which could further depress the dollar’s value.

How might economic outlook changes influence the US dollar selloff prediction?

Changes in the economic outlook, particularly concerning inflation and fiscal policy, could greatly influence the US dollar selloff prediction. Schiff warns that if the market doesn’t fully account for these shifts, investors may face unexpected volatility in the dollar and broader asset classes.

What lessons can investors learn from past US dollar selloffs as predicted by Peter Schiff?

Investors can learn from past US dollar selloffs that a combination of rising tariffs and inflation can precede significant market downturns. Schiff’s advice underscores the importance of remaining alert to shifting economic indicators and preparing for potential adverse movements in the dollar and other assets.

| Key Point | Details |

|---|---|

| Economic Risks | Inflation risks, tariff threats, and flawed fiscal policies are converging to create instability in U.S. markets. |

| Market Predictions | Peter Schiff predicts a sharp selloff in U.S. dollar, Treasuries, and stocks due to potential renewed trade tensions and inflationary pressures. |

| Tariff Impacts | Schiff warns that new tariffs could trigger a market reaction similar to past selloffs, potentially affecting prices beyond current expectations. |

| Consumer Burden | Schiff highlights that tariffs will shift costs to American consumers rather than affecting foreign exporters. |

| Fiscal Policy Concerns | Schiff criticizes Trump’s tax cuts as not addressing the supply side and predicts they will result in higher interest rates and inflation. |

Summary

The prediction of a US dollar selloff is influenced by a confluence of economic risks, including inflation and policy flaws. Peter Schiff emphasizes the urgency for investors to prepare for significant market volatility driven by potential new tariffs and the resultant economic impacts on U.S. consumers. If these predictions materialize, the outlook for the dollar and broader financial markets could be particularly challenging in the coming months.