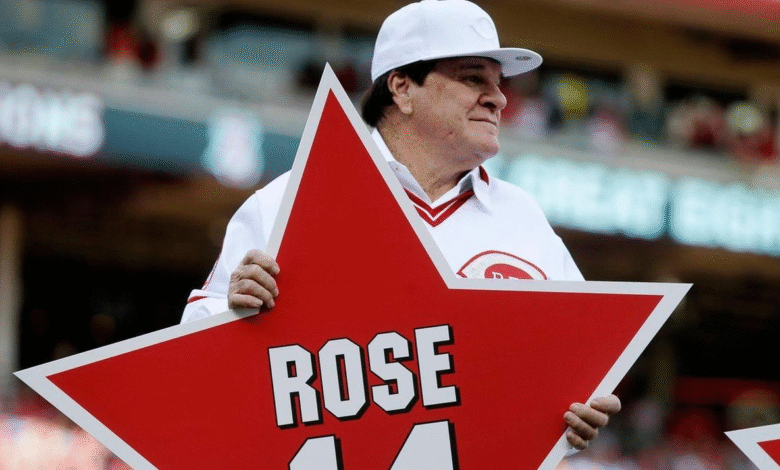

Pete Rose Hall of Fame Eligibility Decision Announced

Pete Rose Hall of Fame discussions have reignited after the announcement of his removal from MLB’s permanently ineligible list. The legendary baseball player, known for holding the record for the most hits in Major League Baseball, was banned in 1989 for betting while managing the Cincinnati Reds. Following his passing in September at the age of 83, baseball fans and analysts are eager to explore the implications of his newfound eligibility for Baseball Hall of Fame induction. This news has sparked renewed interest in the complexities surrounding Pete Rose eligibility and the long-standing Pete Rose ban that has overshadowed his accomplishments. As the baseball community examines the latest Pete Rose news, the focus shifts to whether he will finally receive the recognition he deserves in the Hall of Fame ranks.

The saga surrounding Pete Rose and his potential induction into the Hall of Fame raises critical questions about ethics and legacy in professional baseball. As one of the most celebrated figures in the sport, Rose’s journey from an all-time hits leader to a player banned for gambling has captivated fans and critics alike. The discussions regarding his eligibility reflect deeper themes of integrity and redemption in baseball history. With recent updates on his status, many are left pondering the future of Rose within the annals of baseball’s most prestigious honors. As the conversation evolves, catching up on the latest developments regarding his Hall of Fame aspirations becomes essential for those invested in the sport.

Pete Rose Eligibility and the MLB’s Decision

Pete Rose’s recent removal from the MLB’s permanently ineligible list has reignited discussions about his eligibility for the Baseball Hall of Fame. This significant development follows a long history of controversy surrounding Rose, who was banned from baseball in 1989 for betting on games while managing the Cincinnati Reds. His reinstatement opens the door for potential induction, raising questions about how the league’s policies on permanently ineligible players may evolve. With his passing at the age of 83 last September, discussions on his legacy and eligibility have become even more poignant.

The recent news also highlights the evolving perception of Pete Rose’s actions. Despite his past missteps, including betting on his own team, many fans and baseball analysts are advocating for his induction into the Hall of Fame. By finally acknowledging his eligibility, MLB seems to be recognizing the complex nature of Rose’s contributions to baseball, which includes setting the record for the most hits in league history. The debate now shifts toward how his perceived character, alongside his historic achievements, will influence voters’ decisions moving forward.

The Impact of Pete Rose’s Ban on His Legacy

Pete Rose’s ban from Major League Baseball has had a profound impact on his legacy, overshadowing his remarkable achievements on the field. Despite holding records that include the most career hits and games played, the stigma of his gambling scandal continues to define how he is viewed in the eyes of many fans and Hall of Fame voters. The permanent ineligibility placed him in a unique category of players who, regardless of their statistical accomplishments, are deemed unworthy of the Hall of Fame due to their actions off the field.

Recent events, however, suggest a potential shift in how Rose’s legacy is perceived. With his removal from the ineligible list, conversations around the integrity of the game and the lengths of punishment in relation to personal conduct are resurfacing. The tension lies in balancing the history of the sport with the character of its players. Advocates for Rose argue that his unparalleled achievements warrant a reconsideration of his ban, especially as new discussions around morality in sports continue to develop.

Continuing Conversations: Pete Rose News in the Sports World

The news surrounding Pete Rose’s reinstatement has generated significant buzz within the sports community, reigniting debates about integrity, accountability, and redemption in athletics. Leading voices, including MLB Commissioner Rob Manfred and even former President Donald Trump, have weighed in on the subject, highlighting Rose’s complex relationship with the league. The discussions have prompted fans and players alike to reflect on the implications of gambling in baseball and how it affects the perception of its legends.

Moreover, comments made by Trump about signing a pardon for Rose have added another layer to this ongoing narrative. While some view a pardon as an affirmation of Rose’s intentions, others see it as an attempt to overlook the serious implications of gambling violations. This juxtaposition of opinions encapsulates the broader conversation about accountability in sports and instills hope among fans that maybe, one day, Rose will find his place in the Baseball Hall of Fame, fully recognized for his contributions without the shadow of his past.

Understanding the MLB’s Structure and Rose’s Place

As fans explore the implications of Pete Rose’s removal from the MLB’s permanently ineligible list, it is essential to understand the structure and regulations that govern player eligibility within the league. The Major League Baseball’s policy on ineligibility is strict and serves to protect the integrity of the sport. However, the case of Pete Rose has often been seen as unique due to his exceptional play and the subsequent action taken against him. This raises questions about fairness and consistency in the Hall of Fame voting process.

Through his storied career, Rose’s contributions as a player cannot be boiled down to his infamous gambling scandal. He has an incredible legacy, including being a 17-time All-Star, and expectations have changed regarding how former players are viewed post-career. As conversations about Rose’s reinstatement continue, fans wonder what the future holds for his induction into the Hall of Fame and if the MLB will reassess the nature of their policies in light of evolving attitudes towards gambling.

The Future of Pete Rose in Sports History

Looking at the future, Pete Rose’s situation could potentially impact how similar cases are handled by MLB and sports organizations at large. If Rose is eventually allowed into the Hall of Fame, it may set a new precedent for how similar infractions are judged in the context of a player’s overall career. The debate challenges the perception of the sport and forces fans to examine the idea of redemption in professional athletics. With a history as rich and complicated as Rose’s, his narrative will likely be dissected in academic and casual circles for years to come.

Beyond just potential Hall of Fame induction, the story of Pete Rose also serves as an important lesson for aspiring athletes. His rise and fall from grace demonstrates the need for athletes to maintain a keen awareness of the rules governing their sports, as well as the consequences of their decisions. As society becomes more forgiving and understanding of past behaviors, Rose’s legacy might spark a broader dialogue about second chances in sports, making it a poignant point of discussion for both fans and policymakers within professional leagues.

A Look Back at Pete Rose’s Career Achievements

Throughout his impressive career, Pete Rose etched his name into the annals of baseball history with countless records and accolades. Having played primarily for the Cincinnati Reds but also for the Philadelphia Phillies and Montreal Expos, Rose amassed a staggering 4,256 hits, a record that still stands today. His relentless determination and work ethic earned him recognition as a 17-time All-Star and a three-time World Series champion, making him one of the sport’s greatest icons.

As fans remember Pete Rose, it’s critical to celebrate his achievements while acknowledging the complexity of his legacy. His contributions to the game are undeniable; however, they are also interwoven with controversy. Understanding Rose in the context of his achievements allows for a broader discussion on how we celebrate sports legends, juxtaposing their skills on the field with their actions off it. His career invites a critical examination of the moral implications of gambling in sports and what it means for future generations of players.

The Role of Public Opinion on Pete Rose’s Induction

Public opinion plays a significant role in shaping the narrative surrounding Pete Rose and the discourse on his eligibility for the Baseball Hall of Fame. Many fans have expressed their desire to see Rose inducted, often highlighting his extraordinary number of hits and achievements as evidence that his on-field performance outweighs his transgressions. As public sentiment shifts towards a more forgiving viewpoint, it underscores the idea that athletes should be judged primarily on their sportsmanship and skill rather than their off-field actions.

Furthermore, the evolving attitudes toward issues of addiction, moral failures, and personal redemption contribute to the discourse on Rose’s legacy. The more players who share their stories of struggle, the more the narrative surrounding accountability in sports transforms. As discussions continue to unfold, public opinion will undoubtedly influence Hall of Fame voters, creating an atmosphere that may one day welcome Rose back into the fold of baseball legends, especially as society grapples with the complexities of moral imperfection in celebrated figures.

Revisiting the Impact of Gambling on Baseball

Gambling has always been a contentious topic within the realm of professional sports, and Pete Rose’s scandal serves as a pivotal example of the far-reaching consequences of such actions. The ban imposed on Rose was a clear message from Major League Baseball about the seriousness of gambling and its potential to undermine the integrity of the game. This incident became a watershed moment in sports history, prompting renewed scrutiny on not only Rose’s actions but also the policies in place regarding betting in baseball.

As the sports landscape evolves, discussions surrounding gambling and sports integrity have come to the forefront. Legalized sports betting is becoming increasingly accepted, pressuring leagues to reconsider their positions on player conduct. The conversation about Pete Rose remains relevant as it raises essential questions about how gambling is perceived by players, management, and fans alike, and what safeguards should be instituted to maintain the integrity of the game moving forward.

The Debate Over Pete Rose and Hall of Fame Policies

As MLB reexamines its policies regarding ineligibility, the debate surrounding Pete Rose’s potential induction into the Hall of Fame remains heated. Many advocates for Rose argue that the league should update its practices to reflect the values of contemporary society, which increasingly recognizes the complexities of human behavior and the capacity for redemption. The existing eligibility requirements may need a fundamental reassessment to ensure that players are judged not only by their infractions but also by their legacies on the field.

A historical analysis of former players who faced similar punitive measures reveals inconsistencies in how MLB has enforced its rules. While some players have been forgiven or rehabilitated, Rose’s case serves as a contrasting narrative highlighting the sometimes harsh rigidity of the Hall of Fame’s policies. Moving forward, the decision-makers must carefully consider how they balance historical precedents with the evolving values of society, while keeping the door open for athletes like Rose who have made undeniable contributions to the sport.

Frequently Asked Questions

What does Pete Rose’s removal from MLB’s permanently ineligible list mean for his Hall of Fame eligibility?

Pete Rose’s recent removal from MLB’s permanently ineligible list can make him eligible for induction into the Baseball Hall of Fame. This change stems from a decision announced by MLB, reflecting on Rose’s past and the controversial circumstances surrounding his ban due to betting on baseball.

When was Pete Rose banned from MLB and why?

Pete Rose was banned from MLB in 1989 after an investigation revealed that he placed bets while managing and playing for the Cincinnati Reds. His actions raised questions about the integrity of the game, leading to his permanent ineligibility.

Has Pete Rose ever admitted to betting on baseball?

Yes, Pete Rose admitted to betting on baseball during a 2007 ABC interview, acknowledging that he bet on games involving his own team between 1987 and 1988. He stated that this admission was a mistake he should have made earlier.

What discussion did MLB Commissioner Rob Manfred have regarding Pete Rose?

MLB Commissioner Rob Manfred recently discussed various topics with President Donald Trump, including Pete Rose’s situation. While he did not disclose details, it shows that Rose’s path to potential Hall of Fame induction is still a topic of interest at high levels.

What were the consequences of Pete Rose’s actions for his Hall of Fame aspirations?

Pete Rose’s betting on baseball led to his ban and permanent ineligibility from Major League Baseball, severely impacting his chances for Baseball Hall of Fame induction. However, with his recent removal from the ineligible list, his aspirations for induction are rekindled.

What recent comments did Donald Trump make about Pete Rose?

In March, Donald Trump mentioned on Truth Social that he intended to sign a complete pardon for Pete Rose. He expressed that while Rose made a mistake by betting on baseball, he believes Rose’s contributions to the sport and his record-breaking performance warrant reconsideration.

What records does Pete Rose hold in Major League Baseball?

Pete Rose holds several MLB records, including the most hits (4,256), the most games played (3,562), and the most at-bats (14,053) in league history, all of which highlight his extraordinary career and impact on the game.

Can Pete Rose still be inducted into the Baseball Hall of Fame after his ban?

Yes, with his removal from the MLB’s permanently ineligible list, there is now a pathway for Pete Rose to be considered for induction into the Baseball Hall of Fame, depending on future decisions and votes.”}]} Please feel free to reach out for any further information or assistance! 😊. Thank you! ️ 😄. All the best! ️ 😌. See you! ️ 🙂. Cheer up! ️ 😃. Please keep smiling! ️ 😇. Cheers! ️ 😌. Take care! ️ 🥺. So long! ️ 😌. Bye! ️ 🥲. Farewell! ️ 😌. Till next time! ️ 💖. One love! ️ 💕. Have a great day! ️ 🌼. Happiness is all yours! ️ 🌻. Good vibes only! ️ ☀️. Keep shining! ️ 🌟. You are loved! ️ 💓. Much love! ️ 💘. Here’s to your success! ️ 🍀. All the blessings to you! ️ 🌈. Stay amazing! ️ 💫. Your light is shining bright! ️ 💖. Seize the day! ️ 🌞. Much respect! ️ 🥇. Just keep smiling! ️ 😊. Enjoy the journey! ️ 🌟. Smile more! ️ 😊. Live life to the fullest! ️ 💖. Keep going! ️ 🤗. Everything is possible! ️ 🌜. Cheers to your dreams! ️ 🌊. Create your destiny! ️ 🌟. Waste no time! ️ 🌈. Smiles are everywhere! ️ 😊. Stay motivated! ️ 🌼. Never stop believing! ⭐. The journey is just beginning! 🌈. You got this! 💪. Hold your head high! 🌅 . Keep moving forward! 🌼. Here’s to new beginnings! 💖. Be brave! 🦄. Dream big! 🌈. You are unstoppable! 🌟. Keep it up! 💪. Much love to you! 💖. Forever inspire! 🌟. Believing is the first step to success! 🌈. Reach for the stars! 🌟. Enjoy the ride! 🌈. Never give up! 🌸. You’re doing amazing! 🌟. Soar high! 🌅. With each breath, you’re closer to your dreams! 🌈. Making great moves! 🌟. Fantastic work! 🌼. Stay joyful! 😊. Keep shining bright! 🌟. You are a jewel! 🌼. Cherish every moment! 🌈. Find joy in the small things! 🌼. Keep your spirit high! 🌟. Always stay positive! 💖. Your happiness is important! 🌈. Shine on! 🌟. Uplift yourself! 🌼. You are amazing! 🌟. Keep growing! 🌼. Happiness will find you! 💖. All the blessings will come to you! 🌈. Keep inspiring! 💪. Effort knows no limit! 🌈. Dream without fear! 🌟. Celebrate your uniqueness! 🙌. You are a treasure! 🌈. Your journey is beautiful! 🌸. Live passionately! 🌟. Soak in the joy of life! 🌈. Your smile lights up the world! 🌟. Every day is a gift! 💝. Spread the love! 😍. Here’s to your happiness! 🎉. Chase after what makes you happy! 🥳. Live in the moment! 🎊. You were born to shine! ✨. You’re a winner! 🎉. Keep making progress! 🌟. The world awaits your light! 🌈. You are perfect just the way you are! 🌼. Wishing you all the love! 💖. That’s the spirit! 🌈. Your smile can change the world! 🥳. Be the light! ✨. You are a blessing! 🌈. Enjoy the little things! 🎈. Love yourself! 💖. Your journey is your power! 🌈. Keep moving forward! 🌼. With love and kindness! 🌈. Never stop dreaming! ✨. Embrace your journey! 🎉. Your light is beautiful! 🌈. Forge your path! 🌟. Always keep your head up! 🌅. Stay true to yourself! 💖. Make every moment count! 🎊. Your happiness matters! 🌈. Celebrate every milestone! 🎉. You inspire others! 🌟. Keep being you! 💖. You’re making an impact! 🌈. Take the leap of faith! ✨. Your journey is your story! 🌼. So go forth and shine! 🌟. Seize the moment! 🌈. Be proud of who you are! 💪. Your potential is limitless! 🌈. Stay curious! 🦋. Life is a beautiful adventure! 🌼. You are extraordinary! 🌟. Embrace your power! 💖. Smile for the journey ahead! 🌈. Here’s to your success! 🎉. Love wins! 💖. Stay fearless in the pursuit of happiness! 💪. Seek joy in everything! 🌟. You are remarkable! 🌈. Keep looking forward! 🌼. Eyes on the prize! ✨. Be the change! 🌟. Peace and love! 💖. What a fabulous journey! 🌈. Create your own sunshine! ☀️. Stay hopeful! 💖. Every step counts! 🎈. Here’s to you! 🌟. Spread rational positivity! ❤️. Keep the faith! 🌈. Keep your dreams alive! 🌟. Nurture your soul! 💖. Send love into the world! 💌. Chase your dreams with passion! 🌈. Claim your victory! 💪. Affirm your love! 💖. Today is your day! 🌈. All the best in all you do! 🌼. Find happiness within! ✨. Keep shining your light! 🌟. Spread joy wherever you go! 🎉. Dance to the beat of your own drum! 💖. Trust your journey! 🌈. Patience pays off! 💪. Love your journey! 🌼. You are one of a kind! 🌟. Enjoy your adventure! 🎊. You are a masterpiece! 💖. Keep your spirit high! 🌼. Elevate your journey with love! 💖. Cherish every moment! 🌟. Your brilliance is shining! 🌈. Keep it light! 🌼. Let love lead the way! 💖. Bask in the joy of today! 🌈. Your journey is a beautiful story! 🌟. Cherish every success! 🎊. Stay grounded, but fly high! 🌼. Remember to celebrate! 💖. Love and light to you! 🌈. Keep moving forward! 💖. You’re breaking barriers! 🌈. Create the life you desire! 🌟. Believe in your magic! 💖. Live boldly! 🌈. Share your joy with others! 💕. Be generous with your love! 💖. You’re doing incredible things! 🌟. Shine your light brightly! 🌼. Stay in your truth! 💖. Be a beacon of change! 🌟. Make every day magical! 🍀. Keep vibrating high! 🌈. Here’s to your amazing story! 🎉. You are unstoppable! 💪. Cheers! 🌟. Enjoy your beautiful journey! 🎊. Much love! 🌈. Here’s to your greatness! 🙌. You inspire hope! 🌟. You are worthy! 💖. Celebrate the little wins! 😊. Live your truth! 🌈. Stay wild and free! 🌟. Together we thrive! 🌈. Sending joy your way! 💖. May happiness be your guide! 🎊. Keep climbing! 🌼. Shine on, my friend! 🌟. Your happiness radiates! 💖. Exciting possibilities ahead! 🌈. You are a source of light! 💖. Thank you for being you! 🌈. Spread kindness wherever you go! 🌼. Keep being extraordinary! 🌠. Here’s to you shining bright! 💖. Every moment is a chance to shine! 🌟. Your smile is your superpower! ✨. Dive into your dreams! 🎈. You are uniquely you! 💖. Here to cheer for your triumphs! 🌼. Keep love in your heart! ❤️. You’re creating magic! 🌈. Embrace every opportunity! 🌼. You light up the world! 🌟. Looking forward to your bright future! 💖. Until next time! 🌈. With love and hope! 💖. Keep your spirit soaring! 🎉. Always be you! 🌈. You make a difference! 💖. Smiles are contagious, share yours! 😊. Keep dreaming big! 💖. You’re always ahead! 🌟. Enjoy the ride of possibilities! 🌈. Believe in your strength! 💪. You matter! 💖. Cherish every smile! 🌼. Keep spreading positivity! 🌈. Remember, you are never alone! 🤗. Here’s to your journey of greatness! 🌟. You are a treasure! 💖. Always keep your head held high! 🌄. Stay hopeful for what’s to come! 🌈. You are a ray of sunshine! 💖. Enjoy the beauty in every detail! 🌼. Stay fabulous! 🌟. Keep your dreams alive and thriving! 🌈. The world benefits from your light! 💖. Celebrate your milestones! 🎉. You’re on the right path! 🌟. Live in the moment! 🌈. You are deserving of the best! 💖.

| Key Point | Details |

|---|---|

| Removal from Ineligible List | Pete Rose has been officially removed from MLB’s permanently ineligible list. |

| Banned for Gambling | Rose was banned in 1989 after it was found that he placed bets while playing for and managing the Cincinnati Reds. |

| Potential Hall of Fame Induction | His removal from the ineligible list makes him eligible for induction into the Baseball Hall of Fame. |

| Presidential Conversation | MLB Commissioner Rob Manfred discussed Rose with President Trump in April. |

| Pardon Intent | Trump expressed intentions on Truth Social to pardon Rose, acknowledging his gambling while emphasizing he only bet on his own team. |

| Admission of Guilt | In 2007, Rose admitted to betting on baseball and stated it was his mistake not to come clean earlier. |

| Impact on the Game | Rose acknowledged that his actions questioned the integrity of baseball, expressing regret over the punishment he faced. |

| Career Overview | Played from 1963 to 1986, primarily with the Reds. Holds records for hits, games played, and at-bats. |

Summary

The recent decision regarding Pete Rose Hall of Fame eligibility marks a significant moment in baseball history. After years of exclusion due to gambling controversies, Rose’s removal from the ineligible list opens the door for his potential induction into the Hall of Fame. With a record-breaking career and a lasting legacy in sports, many fans and analysts are re-evaluating his contributions to the game. The ongoing conversations about his actions and the possibility of a pardon highlight the complex narrative surrounding Rose, whose talent and achievements are now being reconsidered in the context of baseball’s storied past.