Crypto Scam: U.S. Uncovers Massive Fraud Network Linked to China

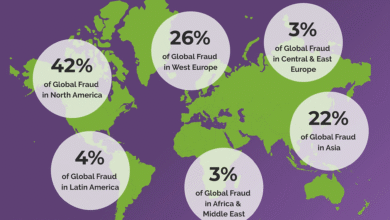

In recent months, a sweeping U.S. crackdown has unveiled a staggering crypto scam operation that has its roots in the Philippines and ties to China, showcasing the alarming rise of cryptocurrency fraud. Central to this illicit network is Funnull Technology, a company purportedly responsible for facilitating a staggering $200 million in investment fraud through fake crypto platforms. These online schemes, often referred to as ‘pig butchering’, employ deceitful tactics that manipulate unsuspecting victims into parting with their hard-earned money. The Federal Bureau of Investigation (FBI) is now on a mission to identify victims, as they work to dismantle the intricate web of scams proliferating across the internet. This scandal not only highlights the threat posed by online financial crime but also raises red flags about the vulnerabilities within the emerging landscape of digital currency investment.

The recent rise of deceitful practices in the realm of digital currency has brought attention to a growing wave of investment fraud activities, often described as cryptocurrency fraud. This phenomenon is particularly pronounced in regions like the Philippines, where unscrupulous actors exploit the booming interest in cryptocurrencies to perpetrate scams, including those orchestrated by the controversial Funnull Technology. Law enforcement agencies, including the FBI, have intensified their focus on tracking down victims affected by these schemes, many of which are linked to extensive international networks designed to deceive and defraud individuals. Those involved in these operations employ sophisticated methods to create a façade of legitimacy, making it imperative for potential investors to remain vigilant against such traps. As the landscape of virtual investment continues to evolve, awareness and education about these scams have never been more crucial.

Understanding the Philippines Investment Scams

The landscape of investment scams in the Philippines has become increasingly complex, particularly within the cryptocurrency space. Many of these schemes, often referred to as ‘pig butchering,’ combine elements of love scams and investment fraud. Victims are typically drawn into trusting relationships, where they are then persuaded to invest in seemingly lucrative cryptocurrency opportunities. Unfortunately, these investments often lead to substantial financial losses, with many individuals losing their life savings to fraudulent platforms.

As the U.S. crackdown has revealed, the scale of these scams is alarming. With hundreds of thousands of websites operating under the guise of legitimate investment platforms, the Philippines has become a central hub for cryptocurrency fraud. The involvement of companies like Funnull Technology highlights the coordinated efforts behind these scams, demonstrating how technological infrastructure is exploited to facilitate widespread investment fraud.

The Role of Funnull Technology in Crypto Scams

Funnull Technology Inc. has emerged as a significant player in the cryptocurrency scam landscape, providing essential services that enable fraudulent operations. By offering computer infrastructure to scammers, Funnull supports an extensive network that includes countless fake investment sites. This company’s activities have sparked concern among regulators, as it exemplifies the fusion of technology and crime, allowing fraudsters to execute their schemes without detection.

Moreover, Funnull’s strategies, such as bulk purchasing IP addresses and providing design tools for scam sites, enhance the legitimacy of these fraudulent platforms. By making it easier for scammers to create what appears to be legitimate websites, Funnull effectively facilitates a culture where cryptocurrency fraud can thrive. The ramifications of their actions extend beyond individual losses, affecting the broader crypto market and integrity.

FBI’s Pursuit of Victims in Crypto Fraud Cases

In light of the growing number of cryptocurrency scams, the FBI’s active role in identifying victims indicates a serious commitment to tackling this issue. By calling for reports from those who have fallen prey to scams associated with Funnull and others, the FBI aims to gather intelligence that can help dismantle these fraudulent networks. This initiative not only assists victims in seeking justice but also plays a critical role in preventing further scams.

The FBI’s focus on victim identification is essential for uncovering the full extent of cryptocurrency fraud operations. By connecting individual reports to larger trends and networks, the agency can develop strategies to combat future scams more effectively. This proactive approach serves to protect potential investors and restore credibility to the cryptocurrency market, which has faced significant challenges due to rampant fraud.

China’s Involvement in Cryptocurrency Fraud

China’s connection to the extensive crypto scam operations exacerbates the challenges faced by authorities aiming to address this issue. With significant resources and cyber expertise, many scams traced back to China have resulted in immense financial losses for victims globally. This situation underscores the need for international cooperation in tackling transnational financial crimes, especially as scams often use sophisticated methods to obscure their origins.

Furthermore, the designation of individuals like Liu Lizhi highlights the criminal elements operating behind these scams. By overseeing the registration of fraudulent domains and collaborating with cybercriminals, Liu’s role sheds light on the structured nature of these fraud networks. As countries grapple with the complexities of cryptocurrency regulation, understanding the depth of international involvement is crucial for developing effective countermeasures.

Protecting Yourself from Crypto Scams

Navigating the world of cryptocurrency can be daunting, especially with the rising prevalence of scams designed to exploit newcomers. To protect oneself from potential fraud, it is essential to thoroughly research any investment opportunity and be wary of platforms that guarantee high returns with minimal risk. Recognizing the hallmark signs of common scams can significantly reduce the likelihood of falling victim to fraudulent schemes.

Additionally, staying informed about the latest regulatory actions and known scams can empower investors to make safer choices. Utilizing resources provided by law enforcement agencies, such as the FBI’s initiatives to document scams, can assist individuals in recognizing and reporting suspicious activity. Education is key to safeguarding against these insidious crypto scams that not only threaten individual finances but also undermine the integrity of the cryptocurrency market as a whole.

The Economic Impact of Crypto Scams

The ramifications of cryptocurrency scams extend far beyond individual victim losses and pose significant threats to the economy. With the U.S. victims reporting losses exceeding $200 million linked to fraudulent schemes, the broader implications include decreased trust in legitimate cryptocurrency platforms and potential regulatory crackdowns. Such actions could hinder innovation within the sector, deterring reputable investors and developers from entering the market.

Moreover, as fraudulent activities proliferate, the risk of stunted economic growth in regions heavily impacted by these scams becomes evident. Countries like the Philippines, where the concentration of scams is notable, may see diminished foreign investments and a tarnished reputation within the global economy. This cycle of distrust impacts not only individuals but also hinders the potential of cryptocurrencies to revolutionize finance.

Fighting Cryptocurrency Abuse Globally

Global efforts must be unified to effectively combat the rising tide of cryptocurrency scams. Countries around the world need to collaborate on best practices, share intelligence, and develop regulatory frameworks that can adapt to the rapidly changing digital financial landscape. By imposing stringent regulations on companies like Funnull, governments can deter criminal actors from exploiting technology for fraudulent purposes.

Through combined international efforts, coupled with enhanced public awareness campaigns, it is possible to establish a more secure environment for cryptocurrency investment. Technology companies must also play a critical role by implementing security measures and reporting suspected fraudulent activities to the authorities. This collective approach can significantly reduce the prevalence of scams and protect investors from falling victim to fraud.

Legal Measures Against Cryptocurrency Fraud

With the rise of cryptocurrency scams, legal frameworks must adapt to address the nuances of digital financial fraud effectively. Agencies like the U.S. Treasury and the FBI have already begun to enforce sanctions and regulations aimed at curtailing the operations of companies like Funnull Technology. These actions are essential for setting a precedent that illegal activities in the cryptocurrency market will not be tolerated.

Additionally, enforcing legal measures against individuals linked to fraudulent activities is critical for deterring others from engaging in similar conduct. By prosecuting those involved in scams and providing restitution for victims, law enforcement can instill greater confidence in the system and reinforce the commitment to safeguarding public interest in cryptocurrency investments.

The Future of Cryptocurrency Regulation

The landscape of cryptocurrency regulation is evolving as authorities grapple with the complexities of digital currencies and the accompanying risks of fraud. As evidenced by the recent sanctions against Funnull Technology, regulators are beginning to take a more assertive stance in holding companies accountable for enabling scams. The future will likely see a blend of stricter regulations that aim to protect consumers while fostering innovation within the crypto space.

Looking ahead, effective regulation will require a delicate balance between protecting investors and allowing the cryptocurrency industry to mature. As more jurisdictions tackle the issue of cryptocurrency fraud, collaborative efforts and adaptive regulatory frameworks will be essential for ensuring a secure investment environment. By focusing on both prevention and enforcement, stakeholders can pave the way for a safer and more trustworthy cryptocurrency ecosystem.

Frequently Asked Questions

What is a crypto scam and how does it operate?

A crypto scam refers to fraudulent schemes aimed at deceiving individuals into investing in counterfeit cryptocurrency platforms. These scams often mimic legitimate trading sites, enticing victims through fake relationships and misleading returns, ultimately resulting in stolen funds.

How does Funnull Technology contribute to cryptocurrency fraud?

Funnull Technology, based in the Philippines, is a significant player in cryptocurrency fraud by providing IT infrastructure for numerous scam websites. It supports operations that enable ‘pig butchering’ schemes, where victims are lured into investing large sums before losing everything.

What steps is the FBI taking against cryptocurrency scams linked to Funnull?

The FBI is actively seeking to identify and help victims of cryptocurrency scams connected to Funnull Technology. They have issued warnings and are working to track and prosecute those involved in these fraudulent activities.

What types of scams are associated with ‘pig butchering’ in cryptocurrency?

‘Pig butchering’ scams involve building trust with victims through online relationships before manipulating them into investing in fake cryptocurrency platforms, leading to significant financial losses.

Are there other countries involved in crypto scams like those in the Philippines?

Yes, the cryptocurrency fraud network, including Funnull Technology, is linked to operations in China, highlighting a broader, international issue of crypto scams that often span multiple jurisdictions.

How can victims report crypto scams operating from the Philippines?

Victims of cryptocurrency scams operating in the Philippines should report their experiences to the FBI or local law enforcement authorities. Providing details about the scams can assist in ongoing investigations and help prevent further victimization.

What should I look for to avoid falling into a cryptocurrency scam?

To avoid falling into cryptocurrency scams, be cautious of offers that promise high returns with little risk, ensure platforms are licensed and regulated, verify the legitimacy of investment opportunities, and remain skeptical of unsolicited communications.

How can sanctions against companies like Funnull affect cryptocurrency scams?

Sanctions against companies like Funnull Technology aim to disrupt their operations and deny them resources necessary for running cryptocurrency scams. This can limit their ability to operate fraudulent platforms and protect potential victims.

What are the financial implications of being involved in crypto scams?

Being involved in crypto scams can lead to substantial financial losses, as seen with U.S. victims reporting over $200 million lost linked to fraudulent sites operated by Funnull. Victims often face emotional and financial distress.

What is the role of cloud service companies in cryptocurrency fraud?

Some cloud service companies unknowingly support cryptocurrency fraud by providing IP addresses to firms like Funnull Technology. Cybercriminals exploit these resources to create and maintain scam websites.

| Key Point | Details |

|---|---|

| U.S. Sanctions Funnull Technology Inc. | Sanctioned on May 29 for operating a massive crypto scam network, linked to China. |

| Role of Funnull | Provides infrastructure for hundreds of thousands of fraudulent crypto websites, known for ‘pig butchering’ scams. |

| Victim Losses | Over $200 million reported lost from U.S. victims due to scams facilitated by Funnull. |

| Sanctioned Individuals | Includes Liu Lizhi, responsible for managing fraudulent domain names and operations. |

| FBI Victim Outreach | FBI is actively seeking to identify victims of scams linked to Funnull. |

| Scam Tactics | Fraudulent platforms mimic legitimate sites to trick victims into investing. |

Summary

The emergence of a massive crypto scam network, particularly linked to Funnull Technology Inc. and operating from the Philippines, highlights the ongoing risks associated with cryptocurrency investments. This elaborate scheme has reportedly defrauded individuals in the U.S. out of over $200 million, utilizing sophisticated tactics to appear legitimate. With the U.S. Treasury and the FBI now targeting such operations, it is essential for potential investors to remain vigilant and recognize the signs of fraud within the cryptocurrency market.