Bitcoin Million Predictions: Tom Lee Sees Future Beyond $1M

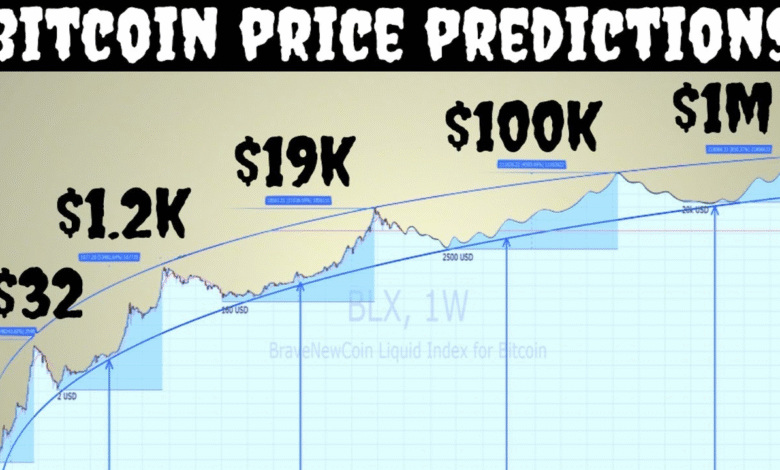

Bitcoin million predictions are making waves in the financial world, especially following insights from prominent analysts like Tom Lee of Fundstrat Capital. Lee suggests that if Bitcoin evolves into a legitimate alternative to gold, its value could soar beyond the $1 million mark, ultimately aligning with gold’s market capitalization. As 2023 unfolds, Bitcoin’s prospects continue to spark interest, especially with Bitcoin price forecasts hinting at unprecedented growth as adoption increases snowballs. Investors are eagerly watching this digital asset, often dubbed “digital gold,” and weighing its potential as a safe haven investment. With a growing market cap, Bitcoin’s trajectory is poised to challenge traditional assets, making discussions about its future ever more compelling.

The future of cryptocurrency is increasingly dominated by discussions around Bitcoin’s staggering potential, with many analysts re-evaluating its trajectory in light of recent market developments. Alternative terms like “digital currency” and “virtual asset” encapsulate the essence of what Bitcoin has become—a transformative force in the financial landscape. As we explore projections of Bitcoin reaching million-dollar valuations, the conversations often pivot towards its role as a hedge against inflation, similar to precious metals like gold. Predictions like those from Tom Lee, hinting at Bitcoin’s ascent, elevate the discourse surrounding its legitimacy and investment allure. The intersection of traditional finance and digital innovation is reshaping how we understand value in the modern economy.

Tom Lee’s Bold Bitcoin Million Predictions

Tom Lee, the Chief Investment Officer at Fundstrat, has made waves in the cryptocurrency community with his audacious prediction that Bitcoin could exceed $1 million. This estimate isn’t just a whimsical figure; it’s grounded in the notion that Bitcoin is increasingly being perceived as ‘digital gold.’ As more investors seek an alternative to inflation ravaging fiat currencies, Bitcoin’s adoption as a store of value appears to be solidifying. Lee’s analysis suggests that if Bitcoin can replicate the market capitalization of gold, this lofty price point may very well be within reach.

In his discussions and interviews, particularly on platforms like CNBC, Lee has stated that Bitcoin needs to establish itself firmly as a digital asset comparable to gold to achieve this valuation. He reasons that with growing regulatory clarity and wider acceptance by institutional investors, Bitcoin’s price could skyrocket. This is particularly significant as traditional economic conditions continue to provoke uncertainty, steering investors towards more stable, secure investments such as Bitcoin.

Bitcoin as Digital Gold: The Future of Cryptocurrency

The comparison of Bitcoin to gold has been an enduring theme in the cryptocurrency dialogue. As Tom Lee posits, Bitcoin’s potential to become ‘digital gold’ is founded on both its scarcity and increasing utility as a store of value. Gold has served as a reliable hedge against inflation for centuries, and Bitcoin offers similar attributes but in a modern, digital framework. The ongoing challenges in the global economy are likely to drive more individuals and institutions to consider Bitcoin as a secure asset class, thus augmenting its price trajectory.

Moreover, as Bitcoin’s market cap approaches that of gold, the implications could be transformative. If Bitcoin genuinely achieves a market cap comparable to that of gold, expected to exceed $10 trillion, the repercussions for the price of Bitcoin would be unprecedented. Tom Lee envisions this growth fueled by fundamental shifts in investor behavior, where Bitcoin is increasingly understood not just as a speculative asset, but as a secure means of wealth preservation.

Fundstrat’s Analysis and the Future Outlook on Bitcoin

Fundstrat, under Tom Lee’s guidance, continues to provide meticulous analytics and forecasts about Bitcoin and other cryptocurrencies. Lee’s insights connect digital currencies like Bitcoin and Ethereum to broader market trends, suggesting that their value will be increasingly integrated within the financial systems. This is underscored by regulatory advancements, such as the GENIUS Act, which aims to bolster the cryptocurrency market, making it a more viable investment for risk-averse institutional players.

Lee’s forecasts also highlight the trend towards mainstream acceptance of Bitcoin. As more financial products are designed around these digital assets, their legitimacy increases. With predictions of Bitcoin reaching a valuation between $200,000 and $250,000 based on a quarter of the gold market size, there’s a strong belief that, with proper momentum and adoption levels, Bitcoin might eventually rival gold’s market cap, steering its price significantly higher.

The Impact of Regulatory Advances on Bitcoin Price

Recent regulatory developments are set to have a monumental impact on Bitcoin and the cryptocurrency market as a whole. The approval of strategic legislations like the GENIUS Act, which provides a favorable framework for cryptocurrencies, is seen as a catalyst for growth. Tom Lee emphasizes that such positive regulatory news not only increases investor confidence but also fosters an environment ripe for institutional investment. As a direct result, Bitcoin could see a substantial rise in its market value.

The evolving regulatory landscape is essential in shaping how cryptocurrencies are perceived and utilized. As traditional finance integrates with blockchain technology, Bitcoin’s performance may benefit from enhanced legitimacy, ultimately driving prices upwards. Investors keen on capitalizing on this trend are looking toward Bitcoin as a hedge—akin to traditional assets like gold, further reinforcing its role as ‘digital gold’ in an increasingly complex financial ecosystem.

Investor Sentiment and the Bitcoin Price Forecast for 2023

As the world anticipates 2023, investor sentiment regarding Bitcoin remains notably optimistic. Tom Lee’s projections suggest that Bitcoin might endure its ups and downs but is likely to maintain an upward trajectory due to a confluence of market factors. This price forecast draws parallels with gold’s historical resilience, suggesting that investors may increasingly view Bitcoin not just as a digital currency but as a compelling asset class with strong growth potential.

The expectations are shaped by various macroeconomic indicators and investor strategies. Bitcoin’s potential rise is supported by trends in cryptocurrency adoption, heightened media attention, and a possible influx of retail investors intrigued by its performance in uncertain economic conditions. Additionally, Bitcoin’s upcoming halvings and supply constraints could further fuel interest, making 2023 a pivotal year for the cryptocurrency as it seeks to redefine its position in the global financial landscape.

How Bitcoin’s Market Cap Compares to Gold

When evaluating Bitcoin’s potential for reaching unprecedented price levels, it’s vital to consider its market cap in relation to that of gold. Currently, gold has a market capitalization that hovers around $10 trillion. Tom Lee’s assertion that Bitcoin could need to exceed $1 million to come close to matching this figure highlights the potential growth trajectory that Bitcoin may embark upon. For many investors, this comparison offers a tangible benchmark against which they can measure Bitcoin’s future prospects.

The increasing market cap of Bitcoin is reflective of both its growing adoption and its fluctuating presence in the global investment arena. As institutional investors begin to allocate funds to Bitcoin, the metrics of its market cap become increasingly significant. If Bitcoin is to achieve Lee’s ambitious targets, maintaining a robust market cap that parallels or exceeds that of gold will be paramount to its acceptance as a legitimate alternative.

The Role of Institutional Investment in Bitcoin’s Growth

Institutional investment is poised to play a crucial role in Bitcoin’s ascent to becoming recognized as ‘digital gold.’ Tom Lee’s outlook on Bitcoin’s future reveals that increased participation from institutional players could significantly stabilize and propel its price. The entry of institutional investors not only brings in substantial capital but also instills confidence among retail investors, who may be drawn in by the endorsement of recognizable firms and financial institutions.

As larger entities enter the space, the dynamics surrounding Bitcoin are expected to change. With a long-standing reputation for volatility, the participation of institutional investors can help mitigate risks associated with price fluctuations. Furthermore, as these large investors accumulate Bitcoin, the supply-demand dynamics will evolve, potentially yielding significant price increases, and supporting Lee’s prediction of Bitcoin’s valuation reaching a million-dollar mark.

Bitcoin’s Journey Towards Becoming a Stable Asset

In the quest for recognition as a stable asset, Bitcoin faces both challenges and opportunities. With its unpredictable price movements, Bitcoin has historically been viewed as a high-risk investment. However, as it gains traction as an alternative to gold, many analysts, including Tom Lee, believe that Bitcoin is on the path to becoming a stable asset that could rival traditional investments. The increasing number of Bitcoin holders and evolving financial products designed around it contribute to this narrative.

One of the significant factors in Bitcoin’s transition towards a stable asset is its community support and technological advancements. Innovations in blockchain technology and advancements in the security of Bitcoin transactions are strengthening its case as a foundational economic asset. With greater acceptance and utility, coupled with Lee’s prediction of a massive price influx, Bitcoin’s journey illustrates the potential evolution of how we perceive digital currencies in the modern economy.

Ethereum: A Surprising Contender in the Crypto Space

While Tom Lee focuses heavily on Bitcoin and its potential as ‘digital gold,’ he also identifies Ethereum as a strong contender in the cryptocurrency market. With its capabilities extending beyond simple transactions to enabling decentralized applications, Ethereum stands to benefit significantly from the trends toward digital assets. Lee estimates that if Ethereum is valued similarly to established projects, it could soar into the $10,000 to $20,000 range, a testament to its growing importance in the financial sector.

Ethereum’s unique attributes—such as smart contract functionality and its application in the burgeoning world of decentralized finance (DeFi)—position it favorably among both retail and institutional investors. As the cryptocurrency landscape evolves, Ethereum’s versatility and adaptation to new financial paradigms could assert its role as a pillar alongside Bitcoin. Lee’s insights underline a crucial narrative: while Bitcoin aims for exceptional heights, Ethereum is carving its niche, both equally vital to the future of digital assets.

Frequently Asked Questions

What is Tom Lee’s prediction for Bitcoin’s price in relation to gold?

Tom Lee, the Chief Investment Officer of Fundstrat, has predicted that Bitcoin could exceed $1 million per coin if it truly becomes recognized as digital gold. He believes that this valuation is necessary for Bitcoin to match gold’s current market capitalization.

How does Tom Lee’s Bitcoin prediction relate to the concept of digital gold?

Tom Lee’s Bitcoin prediction emphasizes Bitcoin’s potential to serve as digital gold, suggesting that as adoption increases, Bitcoin’s price could rise significantly, possibly exceeding $1 million. He draws parallels between Bitcoin and gold to highlight its value proposition as an alternative store of wealth.

What factors contribute to Tom Lee’s Bitcoin price forecast for 2023?

Tom Lee’s Bitcoin price forecast for 2023 includes the increasing adoption of Bitcoin, improving regulatory clarity, and advancements such as the approval of the GENIUS Act. These factors could enhance Bitcoin’s role as a digital asset, potentially driving its price toward his prediction of $1 million.

How does Bitcoin’s market cap compare to gold according to Fundstrat’s analysis?

According to Fundstrat’s analysis, Tom Lee estimates that Bitcoin needs to reach a price of $200,000 to $250,000 to equate to 25% of the size of the gold market. This perspective underlines the potential for Bitcoin’s market capitalization to grow significantly if it gains traction as digital gold.

What does Tom Lee say about Ethereum in the context of digital assets?

While Tom Lee focuses primarily on Bitcoin’s potential to become digital gold, he also recognizes Ethereum’s potential within the crypto ecosystem, especially as stable assets gain popularity. He suggests that Ethereum could be valued between $10,000 to $20,000 based on its current standing relative to other digital currencies.

Why is Tom Lee optimistic about Bitcoin’s future price movements?

Tom Lee’s optimism regarding Bitcoin’s future price movements stems from its increasing adoption, potential to be seen as digital gold, and the positive impact of regulatory developments. He consistently highlights these factors during his analyses and predictions concerning Bitcoin’s long-term valuation.

| Key Point | Details |

|---|---|

| Predicted Price Target | Bitcoin could exceed $1 million as it is increasingly viewed as ‘digital gold’. |

| Comparative Market Capitalization | To match gold’s market capitalization, Bitcoin needs to reach over $1 million. |

| Tom Lee’s Predictions | Tom Lee believes Bitcoin’s price could settle around $200,000 to $250,000, which is just 25% of gold’s market cap. |

| Regulatory Impacts | Advancements in regulation, such as the GENIUS Act, may positively influence Bitcoin’s market. |

| Other Cryptocurrencies | Ethereum has potential in the stablecoin environment, with price predictions between $10,000 to $20,000. |

Summary

Bitcoin million predictions suggest that the cryptocurrency could see substantial growth in the coming years. As Bitcoin is becoming recognized as ‘digital gold’, predictions such as those made by Tom Lee highlight its potential to exceed the $1 million mark. This surge in value is supported by increasing adoption and favorable regulatory changes that could further bolster its market position.