Celsius Shares Set to Surge Over 30% Following Upgrade

Celsius shares could see an impressive surge of over 30% as the latest growth narrative is “heating back up,” thanks to a promising upgrade from TD Cowen. This optimistic outlook is fueled by analysts who highlight Celsius’ strong growth potential, suggesting that the company’s recent performance could dramatically elevate its stock value. Investors in the stock market should pay close attention to the developments surrounding Celsius shares, as strategic insights could lead to lucrative investment opportunities. With the stock market trends exhibiting a favorable response to such upgrades, Celsius is positioned for potential gains that could positively impact its valuation. Therefore, keeping tabs on Celsius’ performance metrics will be essential for those looking to capitalize on the anticipated rise in its stock prices.

Investors are increasingly focused on the potential of Celsius’ equity as momentum builds with a newly announced rating change from financial analysts. This analysis indicates a robust forecast for Celsius stock, where the company’s adherence to growth strategies can significantly influence its future market position. Market watchers are calling attention to Celsius’ resurgence, emphasizing its valuable investment characteristics following notable upgrades. As trends within the financial landscape shift, awareness of emerging opportunities within the health beverage sector could benefit those considering Celsius as part of their investment portfolio. Ultimately, this period of heightened evaluation signifies an opportune moment for stakeholders to assess the trajectory of Celsius shares.

Celsius Shares Set for Significant Growth

Celsius shares are currently positioned for a potential upswing, with a projection of over 30% increase based on recent analysis by TD Cowen. This optimism follows a series of strategic upgrades and favorable market sentiments that highlight the company’s growth potential. Analysts suggest that the recent performance metrics of Celsius, coupled with their innovative market strategies, could serve as a catalyst for this anticipated surge in share value.

As investor confidence in Celsius continues to build, monitoring the stock market trends will be crucial. The financial community is increasingly responding to the company’s robust business model and growth narrative, indicating that their upgrades are well-founded. Investors looking for opportunities might consider Celsius as a viable option, especially as analysts paint a promising picture for the company’s future.

The Impact of TD Cowen’s Upgrade on Celsius Stock Prediction

TD Cowen’s recent upgrade of Celsius provides a significant boost to the company’s stock prediction, reflecting the growing optimism about its market performance. This upgrade is not just an isolated event; it signifies a broader trend in the stock market where recommendations from analysts have historically influenced stock valuations. Such positive outlooks can encourage more investors to consider Celsius as part of their investment portfolio.

As analysts point to Celsius’ growth potential, the current sentiments may lead to increased trading volumes and heightened interest among investors. This reaction could further stabilize and uplift Celsius shares, adding momentum to its stock performance. Keeping abreast of analyst upgrades and market responses is essential for investors seeking to optimize their investment strategies.

Understanding Celsius Growth Potential in Today’s Market

Celsius growth potential remains a hot topic among analysts and investors alike. With the company’s recent strategic initiatives and market positioning, many believe that it is well-equipped to capitalize on emerging trends in the beverage industry. These factors collectively buttress the company’s prospects for significant market share and revenue growth, especially as health and wellness products continue to gain traction.

Moreover, as consumers pivot towards healthier lifestyle choices, Celsius is strategically positioned to meet this demand. The alignment of the company’s product offerings with market preferences encourages a positive outlook on its growth trajectory. Investors need to evaluate how these elements play into the broader context of stock market trends, thereby making informed decisions about investing in Celsius shares.

Analyzing Market Trends Related to Celsius Investment

Current stock market trends reflect a growing interest in health-focused beverage companies, including Celsius. As consumers become more health-conscious, the demand for products that align with these values is on the rise. This trend is pivotal to understanding why many analysts believe that Celsius shares will experience substantial appreciation in the near future.

Investment in Celsius can be seen as aligning with a broader movement towards products that promote well-being. As the market continues to evolve, equities that are aware of and responsive to these changes generally perform better. Therefore, Celsius represents not just a stock to watch, but a lucrative investment opportunity in a thriving sector.

Celsius Stock Market Analysis: Key Metrics to Watch

Investors should closely monitor key performance metrics that indicate Celsius’ potential for growth. Metrics such as sales growth, market share expansion, and customer acquisition rates provide insight into the company’s operational efficiency and market positioning. As TD Cowen’s upgrade suggests, these factors could significantly influence Celsius shares.

Additionally, with the consumer goods market showing signs of resurgence, Celsius stands to benefit from favorable stock valuations based on its performance. Tracking these metrics is essential for investors who wish to understand the company’s trajectory and capitalize on its growth potential. As analysts stress, a clear understanding of these indicators can guide investment decisions effectively.

Celsius Investment Strategies for Long-Term Growth

Investors seeking to take advantage of Celsius’ growth potential should consider various investment strategies tailored to long-term success. A strategy focusing on regular monitoring of market developments, coupled with an understanding of Celsius’ operational changes, can prove beneficial. By staying updated with the latest analyst reports, such as those from TD Cowen, investors can align their strategies with market movements.

Moreover, considering a diversified portfolio that includes several growth-oriented stocks like Celsius can mitigate risks while maximizing potential returns. Keeping an eye on industry trends and consumer behavior will be key to optimizing investment in Celsius, ensuring that investors leverage profit opportunities as they arise.

Celsius and Strategic Analyst Upgrades: What Investors Should Know

Understanding the significance of strategic analyst upgrades is crucial for investors focusing on Celsius. Such upgrades, like those from TD Cowen, can create a positive feedback loop that encourages more investors to enter the market, ultimately pushing share prices higher. These upgrades signal confidence in the company’s performance and future outlook, which can significantly impact stock dynamics.

Investors should be aware that these strategic positions are often based on comprehensive research and assessments of market conditions. By analyzing the rationale behind such upgrades, investors can better gauge the underlying factors that may drive Celsius shares upward in value, thus making informed investment decisions.

Navigating Stock Market Risks with Celsius Shares

Investing in Celsius shares, like any investment, comes with its risks. Market volatility and economic fluctuations can impact stock performance even amidst positive forecasts. Therefore, investors should conduct thorough due diligence, analyzing both historical performance and upcoming market trends that could influence Celsius.

Moreover, understanding the competitive landscape and how Celsius compares to its peers is essential in mitigating investment risks. This comprehensive approach will arm investors with the knowledge necessary to navigate potential pitfalls while seizing growth opportunities inherent in Celsius’ performance.

Celsius Financial Health: An Investor’s Perspective

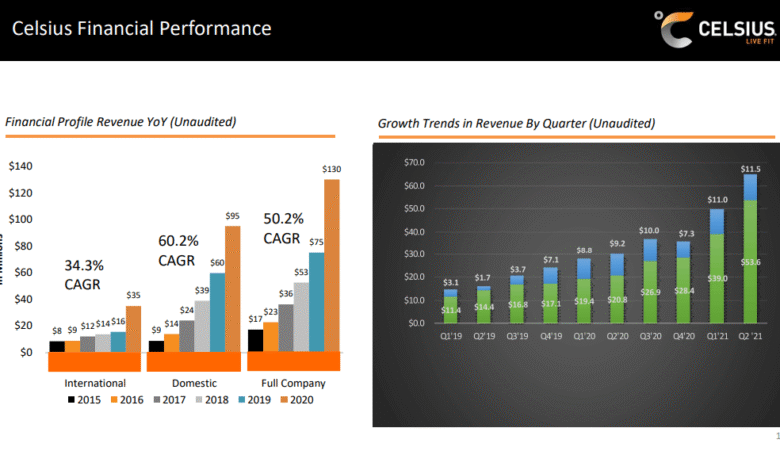

Assessing Celsius’ financial health is fundamental for potential investors. Key indicators such as revenue growth, profit margins, and cash flow must be analyzed to understand how well the company is navigating its operational landscape. Positive financial metrics can reassure investors of the company’s stability and future performance, reinforcing the optimism surrounding Celsius shares.

In light of the recent upgrade by TD Cowen, many analysts are optimistic about Celsius’ ability to maintain its growth trajectory. Investors must conduct a holistic analysis of these factors to make informed investment decisions while being aware of the overall market conditions that may affect stock pricing.

Frequently Asked Questions

What is the current Celsius stock prediction according to analysts?

The current Celsius stock prediction is optimistic, as analysts, including those from TD Cowen, suggest that Celsius shares could rise by over 30%. This prediction is based on the company’s recovering performance and growth potential.

How has the TD Cowen upgrade affected Celsius shares?

The TD Cowen upgrade has positively impacted Celsius shares by highlighting the company’s growth potential. Analysts believe this upgrade reflects a renewed investor interest and could lead to a significant rise in stock prices.

What are the main factors contributing to Celsius’ growth potential?

Celsius’ growth potential is attributed to its strategic market initiatives, recovery performance metrics, and favorable analyst recommendations, including the TD Cowen upgrade that has sparked optimism among investors.

What stock market trends should investors watch regarding Celsius investment?

Investors should monitor stock market trends such as performance metrics, market reactions to analyst upgrades like those from TD Cowen, and overall investor sentiment towards Celsius shares. These factors will provide insight into potential investment opportunities.

Why is it important to follow Celsius’ performance metrics?

Following Celsius’ performance metrics is crucial as they serve as indicators of the company’s recovery and future growth potential. Positive metrics could amplify the bullish sentiment surrounding Celsius shares, suggesting a promising investment opportunity.

| Key Point | Details |

|---|---|

| Celsius Shares Growth Potential | Celsius shares could rise by more than 30%. |

| Analyst Upgrade | Upgrade from TD Cowen highlights recovery and performance improvement. |

| Market Response | Analysts predict a positive market response, boosting stock prices. |

| Investor Guidance | Investors should monitor performance metrics and strategies for indicators of growth. |

| Sector Trend | Overall market trend shows analysts’ upgrades positively impacting stock valuations. |

Summary

Celsius shares are poised for an upward trajectory as analysts predict a growth surge of over 30%. With a recent upgrade from TD Cowen indicating a favorable recovery outlook and positive market responses, investors should remain vigilant and monitor key performance metrics. This optimistic assessment aligns with broader market trends where analyst upgrades have historically led to increased valuations, making Celsius an exciting stock to watch in the coming months.