Tesla Showroom Attack: Investigation by FBI and Police

The recent Tesla showroom attack in Texas has raised alarming concerns about the safety and security of Tesla facilities, specifically amid growing tensions surrounding Elon Musk’s leadership. Early Monday morning, authorities discovered multiple incendiary devices aimed at the showroom, prompting an immediate response from the Austin Police Department and the FBI. As the Austin Police investigation unfolds, officials are collaborating closely with the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) to determine the motivations behind this act, which has been noted as a part of a broader pattern of Tesla security incidents. With no suspects identified as of now, this incident has attracted significant media attention, especially following President Trump’s controversial remarks linking such attacks to domestic terrorism. The presence of incendiary devices has heightened fears around corporate safety, making this event critical to understanding the implications of such threats against prominent companies like Tesla.

The recent incident involving a Tesla facility, marked by the deployment of incendiary devices, calls attention to the pressing issue of security for innovative companies. This troubling episode, investigated by the Austin authorities and the FBI, has highlighted potential threats against establishments linked to major influencers like Elon Musk, often embroiled in significant media controversies. With the growing scrutiny around incidents categorized as domestic terrorism, it’s pivotal to explore the ripple effects these attacks can have on corporate security policies. As the investigation continues, the spotlight on Tesla also reflects the broader societal implications of escalating tensions toward corporate entities in America. Such events, coupled with the scrutiny of Musk’s political affiliations, may prompt a reassessment of the protective measures necessary to safeguard against similar acts in the future.

Tesla Showroom Attack: A Disturbing Trend

The recent attack on a Tesla showroom in Texas, where incendiary devices were found, raises alarm bells about the increasing frequency of security incidents targeting the company. These actions not only threaten the safety of Tesla employees and customers but also reflect a troubling trend of violence directed at businesses associated with high-profile figures such as Elon Musk. Each incident contributes to a growing narrative of domestic terrorism that has the potential to impact public perception and corporate governance strategies within the automotive industry.

Furthermore, this incident highlights the need for enhanced security measures at Tesla locations, particularly in light of ongoing criticisms and controversies surrounding Elon Musk. With tensions escalating, it is essential for companies involved in innovative industries to be prepared for security threats. The involvement of law enforcement and federal agencies like the FBI indicates the seriousness of these threats, calling for an immediate response to safeguard their facilities and public perception.

The Role of the Austin Police Investigation

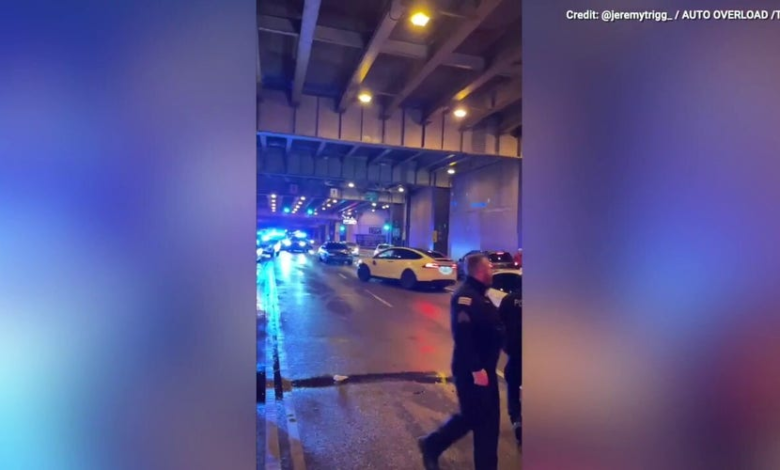

As the investigation into the suspicious devices at the Tesla showroom unfolds, the Austin Police Department has taken the lead in assessing the situation. They are collaborating closely with the FBI and the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF), indicating the severity of potential security threats. The swift action taken by law enforcement demonstrates their commitment to ensuring public safety and addressing the rising concerns over Tesla security incidents.

The police response has been crucial in mitigating risks associated with the incident. Early statements from law enforcement emphasized the importance of maintaining transparency with the community, ensuring that the public remains informed about safety measures being taken. This partnership between local and federal agencies signifies a united front against domestic threats, which many believe can be linked to broader societal tensions exemplified by controversial figures and political decisions.

FBI Involvement in Tesla Security Incidents

The FBI’s involvement in the investigation of the Tesla showroom attack underscores the broader implications of security challenges faced by high-profile companies like Tesla. Investigating such incidents through a federal lens allows for more comprehensive intelligence gathering, ensuring that potential threats are adequately addressed. This level of cooperation between local and federal law enforcement highlights the significance of this event, not just for Tesla, but for the entire corporate landscape.

Moreover, the FBI’s engagement may also be seen as a response to potential domestic terrorism threats that have been suggested in relation to attacks on Tesla properties. With the complexities of such incidents often transcending local jurisdiction, the FBI’s resources and expertise become invaluable in dissecting motives and identifying patterns associated with past attacks.

Elon Musk Controversy: Impact on Tesla’s Brand Safety

The incidents of violence directed at Tesla locations are often interwoven with the public controversies surrounding CEO Elon Musk. Musk’s outspoken nature and involvement in political discussions have made the company a target for criticism and, in some cases, violence. As Tesla navigates these turbulent waters, ensuring brand safety is paramount. Protecting their employees and facilities from harm is not just a matter of physical security but also of maintaining brand integrity in a world where public sentiment can shift rapidly.

The controversies surrounding Musk’s decisions, particularly during his time within the Trump administration, have sparked debates about the responsibility of corporate leaders in fostering a safer environment. Addressing these issues head-on is crucial for Tesla as it seeks to mitigate risks and reinforce its commitment to corporate social responsibility, all while continuing to innovate in the electric vehicle market.

Domestic Terrorism and Its Link to Tesla

The assertion that attacks against Tesla properties might be categorized as domestic terrorism reflects broader societal issues related to extremism and backlash against progressive corporations. Such a label raises questions about the motivations behind these actions and how they align with larger trends in political and social unrest. Understanding these dynamics is pivotal for Tesla as it looks to protect its interests and maintain its innovative spirit amidst adversity.

Linking corporate incidents to domestic terrorism not only highlights the risks involved for companies perceived as disruptive but also illuminates the responsibilities they hold in safeguarding their public image. This is particularly pertinent as Tesla continues to push boundaries in technology and sustainability, often drawing ire from traditionalists who may view these advancements as threats to established norms.

Lessons from Past Incidents at Tesla Locations

Analyzing previous incidents at Tesla locations offers crucial insights that can enhance future security protocols. Each attack or vandalism incident serves as a case study, revealing vulnerabilities that can be fortified. By understanding the motivations behind these attacks and the modus operandi of perpetrators, Tesla can develop robust preventive measures to deter future incidents effectively.

In addition, learning from these events can help Tesla shape its public relations strategy in addressing fears and concerns of stakeholders. Proactively communicating the steps being taken to ensure security and support for affected employees can reinforce trust in the brand, showcasing a commitment to safety without compromising innovation.

Community Response to Tesla Security Threats

The local community’s response to the attack on the Tesla showroom has been one of solidarity and concern. Residents and customers have expressed their dismay over such violence occurring in their neighborhood, emphasizing the importance of safety in commercial spaces. Community dialogues regarding security implications can foster a sense of shared responsibility and proactive measures to support local businesses like Tesla.

Engagement from the community can lead to partnerships that enhance safety protocols at Tesla locations. Initiatives ranging from enhanced surveillance to community watch programs could emerge as collective responses to protect local business interests. Understanding the interconnectedness of public safety and corporate well-being could spur new collaborations that benefit both entities.

The Future of Tesla Based on Current Events

Looking ahead, the implications of the Tesla showroom attack will likely influence the company’s strategies moving forward. As they navigate the complexities of ongoing controversies and security threats, Tesla may need to invest more in security infrastructure and crisis management protocols. The challenge will be balancing innovation with the need for robust protection measures, ensuring the company can continue its trajectory of growth and technological advancement.

Moreover, how Tesla addresses these incidents will shape its future corporate identity. Elections in the political climate often lead to heightened scrutiny of businesses, making it essential for Tesla to manage its public narrative carefully. By taking a proactive stance in addressing security threats and engaging with the community, Tesla can not only mitigate risks but also reinforce its position as a leader in the electric vehicle market.

Frequently Asked Questions

What happened during the Tesla showroom attack in Texas?

The Tesla showroom attack involved the discovery of multiple incendiary devices at the location in Texas. The incident occurred on Monday morning, prompting a swift response from the Austin Police Department, who confirmed the involvement of the FBI in the investigation.

Is the Austin Police Department leading the investigation into the Tesla showroom attack?

Yes, the Austin Police Department is involved in the investigation of the Tesla showroom attack. However, the FBI is leading the investigation, with assistance from the Bureau of Alcohol, Tobacco, Firearms and Explosives (ATF) as they assess the nature of the incendiary devices found.

What is the FBI’s role in the Tesla security incidents?

In the recent Tesla security incidents, including the showroom attack, the FBI is taking the lead in the investigation. An FBI spokesperson confirmed their active role, highlighting the seriousness of the situation and the collaboration with local police and federal agencies.

Are there any suspects identified in the Tesla showroom attack?

As of now, there are no suspects identified in the Tesla showroom attack. Police and the FBI are continuing their investigation and have reported no further immediate threats to the public.

How does Elon Musk’s controversy relate to the Tesla showroom attack?

Elon Musk’s controversy, particularly regarding his ties to the Trump administration and discussions about spending cuts, has contributed to a negative environment around Tesla. Past comments by President Trump suggesting links between attacks on Tesla properties and ‘domestic terrorism’ have raised concerns during incidents like the Tesla showroom attack.

What measures are being taken to ensure security at Tesla locations after the showroom attack?

Following the Tesla showroom attack, increased security measures are likely being evaluated and implemented to protect Tesla locations. This includes close cooperation with law enforcement agencies, who are investigating this security incident to prevent any future attacks.

What other incidents have affected Tesla properties apart from the showroom attack?

Aside from the recent Tesla showroom attack, the company has faced various security incidents and acts of vandalism, which have been partly tied to public backlash against CEO Elon Musk’s controversial statements and political affiliations, further complicating the security landscape for Tesla.

How can the public stay informed about the ongoing investigation into the Tesla showroom attack?

The public can stay informed about the ongoing investigation into the Tesla showroom attack by following updates from the Austin Police Department and the FBI, who will release information as it becomes available. Social media and news outlets are also good sources for real-time updates.

What are the potential legal repercussions for those responsible for the Tesla showroom attack?

If suspects are identified in the Tesla showroom attack, they could face serious legal repercussions, including charges related to domestic terrorism, as suggested by statements from political figures regarding the nature of attacks against Tesla properties.

Are there safety concerns for customers visiting Tesla showrooms after the attack?

Currently, there are no reported ongoing threats to public safety following the Tesla showroom attack. However, Tesla may enhance security measures to ensure customer safety at their locations as the investigation continues.

| Key Point | Details |

|---|---|

| Incident Description | A Tesla showroom in Texas was targeted with incendiary devices. |

| Agencies Involved | Austin Police Department and the FBI are investigating the incident. |

| Response Action | The police bomb squad secured the devices without any injuries reported. |

| Current Status | There are currently no suspects, and the investigation is ongoing. |

| Context | The attack is seen as part of ongoing criticism and vandalism related to Tesla’s CEO Elon Musk and his political ties. |

| Political Implication | Former President Trump suggested that attacks on Tesla properties could be termed ‘domestic terrorism’. |

Summary

The Tesla showroom attack has raised significant alarm, marking yet another incident targeting the company’s properties. This attack has drawn attention not only for the incendiary devices placed at the showroom in Texas but also due to the ongoing investigation led by the FBI. As the situation develops, it remains crucial to monitor how these incidents reflect on Tesla and its CEO, Elon Musk, particularly in a politically charged environment where such acts may be perceived as acts of domestic terrorism.