Bank of England Interest Rates: March Meeting Insights

The Bank of England interest rates are at the forefront of discussions as the central bank prepares for its pivotal March meeting. With the benchmark interest rate standing at 4.5%, many economists predict that this level will be maintained to navigate the complexities of the current UK economic outlook. Rising concerns surrounding trade tariffs and their potential impact on UK inflation in 2024 further complicate the scenario, as businesses brace for possible repercussions. Observers are keenly watching how the central bank’s decisions will align with the government’s latest taxation changes, which have sparked unease among industry leaders. As Britain faces economic stagnation, the Bank of England’s interest rate stance will undoubtedly influence the trajectory of the nation’s financial landscape.

As the UK prepares for critical economic decisions, the stance of the Bank of England regarding interest rates is set to make headlines. The upcoming March meeting is crucial for determining whether the central bank will maintain its current benchmark rate in light of the nation’s emerging financial challenges. Chiefly, concerns about trade tariffs and their implications for inflation are heightening the urgency for strategic policymaking. The reluctance among businesses to accept new taxation changes adds another layer of complexity, prompting discussions about the implications for economic growth. Thus, the Bank of England remains under close scrutiny as it navigates the uncertain waters of the UK’s financial future.

Impact of the Bank of England Interest Rates on the UK Economy

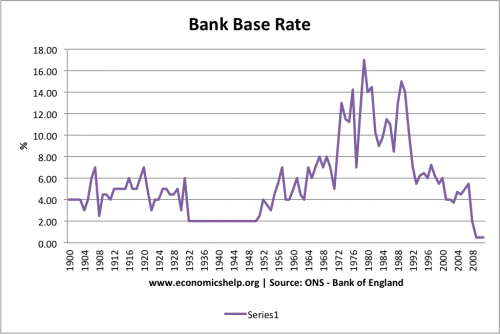

The Bank of England interest rates directly influence the economic landscape of the UK. Currently set at 4.5%, these rates play a crucial role in determining borrowing costs for both consumers and businesses. With the central bank expected to maintain this benchmark rate during the March meeting, economists are concerned about its implications on economic growth, particularly in light of stagnation signs and rising inflation. The plateauing of interest rates suggests a cautious approach by the BOE, which could lead to a prolonged period of economic uncertainty for households and enterprises alike.

In an environment marked by stagnant growth and looming trade tariffs, the persistence of high interest rates can stifle investment and consumer spending. As the BOE navigates these turbulent waters, the potential for increased taxation could further exacerbate the situation, leading to reduced disposable income for the average citizen. The crucial balancing act the Bank of England faces involves managing inflationary pressures while ensuring that the economy does not slip into a deeper downturn as a result of restrictive monetary policies.

The UK Economic Outlook Amid Uncertain Trade Tariffs

As the UK economy contends with fluctuating conditions, trade tariffs stand out as a significant factor influencing its future trajectory. With the potential imposition of tariffs under consideration, this has left businesses apprehensive about their operational capabilities. The uncertainty surrounding these tariffs may lead to a more conservative approach to investment decisions, suggesting that firms might hold off on capital expenditures until the situation stabilizes. Consequently, such delays in investments could have a cascading effect on economic growth, complicating the landscape that the Bank of England is tasked with managing.

In the face of these challenges, UK inflation rates are projected to rise in 2024, leaving consumers with shrinking purchasing power. The unpredictable nature of trade tariffs could push prices higher, further fueling inflationary concerns that the BOE must address. Policymakers are acutely aware that any escalation in tariff disputes could lead to increased costs of goods and services, complicating the already precarious balance of sustaining economic growth while controlling inflation.

The Bank of England’s Cautious Approach in 2024

The cautious approach taken by the Bank of England is increasingly evident, especially as it prepares for its next meeting amid considerable economic uncertainty. With key voting members expressing dissent regarding the pace of necessary rate cuts, the central bank’s strategy appears to prioritize stability over aggressive monetary easing. Despite some calls for more significant cuts, the overall sentiment within the committee leans towards maintaining the current rate, anticipating that inflation may soon demand more decisive action.

Concerns regarding the UK economic outlook, particularly in relation to wage growth and inflation, contribute to the BOE’s hesitance. The central bank has to navigate the potential repercussions of its monetary policy against a backdrop of stagnation and uncertain global conditions. As inflation is forecasted to rise to 3.7%, exceeding the target, the BOE’s decision-making becomes even more critical to ensuring that price stability is not compromised.

Trade Tariffs and Their Economic Implications for the UK

Trade tariffs loom large over the UK economy, particularly as the net effects could ripple through various sectors, impacting everything from consumer prices to international trade relations. The potential implementation of tariffs raises questions about the cost of imports, which could lead to higher prices for consumers and businesses alike. The uncertainty surrounding these tariffs inhibits business confidence, hindering growth prospects as firms reconsider their investment plans in light of potential increased costs.

Furthermore, the impact of these tariffs could extend to the broader UK economic performance. As the Bank of England contemplates interest rate stability during its March meeting, it must also factor in the implications of tariffs on inflation and productivity. With conflicting pressures from economic data and external trade dynamics, the Bank faces a complex decision-making environment as it strives to maintain economic resilience amid potential tariff challenges.

Inflation Trends and the Bank of England’s Position

UK inflation trends have been a primary concern for the Bank of England, particularly as predictions for 2024 indicate a rise to 3.7%. This increase not only exceeds the bank’s inflation target of 2% but also complicates monetary policy decisions ahead. The Bank has emphasized the need to address inflation with focused measures while being cautious of triggering further economic slowdown with excessive rate cuts.

The interplay between inflation and interest rates is crucial, especially as consumers grapple with the impact of higher prices on basic goods and services. With fixed-rate contracts and rising living costs, the Bank’s decisions on interest rates become even more critical to maintaining economic stability. Emerging pressures from inflation will likely compel the BOE to reassess its policies to ensure that inflation does not spiral out of control, while also encouraging economic growth as the country emerges from a period of stagnation.

The Role of Government Fiscal Changes in Economic Planning

Upcoming government fiscal changes loom large over the UK economy, particularly as Chancellor Rachel Reeves prepares for the Spring Statement that will address the current budget scenario. With increasing taxes and further public spending cuts proposed, the potential implications for the economy could be considerable. Business leaders are particularly concerned that these changes may lead to a tightening of economic conditions, which could stifle growth and investment at a crucial time.

The Bank of England will need to monitor these fiscal adjustments closely, as they have direct implications for the central bank’s monetary policy. With a tightening fiscal environment potentially exacerbating inflationary pressures, the BOE may need to adapt its strategies to ensure that economic growth is not unduly hampered. The delicate balance of fiscal and monetary policies will be vital in navigating the uncertainties the UK economy faces in the coming months.

Consumer Confidence Amidst Economic Uncertainty

Consumer confidence plays a pivotal role in the UK economy, especially in light of rising inflation and stagnant growth as signaled by recent economic surveys. With households facing increased financial pressures and uncertainty regarding trade tariffs, there is a notable shift in consumer behavior toward caution. This hesitation can result in diminished spending, leading to further strains on the economy, which relies heavily on consumer expenditure for growth.

Given the relationship between consumer sentiment and economic health, the Bank of England must consider how its monetary policy affects public perception and confidence. If interest rates remain steady amid growing inflation, consumers may feel pressured, potentially exacerbating the economic slowdown. Policymakers need to address these trends to foster stronger consumer confidence and encourage spending to support overall economic revival.

Forecasting Economic Growth amidst Inflation Concerns

Looking ahead, the forecast for economic growth in the UK amid escalating inflation poses significant challenges. With the Bank of England projecting a potential rise in inflation rates, the outlook for growth might appear bleak without concerted efforts to stimulate the economy. The central bank has already cautioned about the need for careful policy implementation to avoid stalling economic activity while trying to keep inflation in check.

Economists remain divided on the exact implications of these trends, as fluctuating inflation and unimpressive growth figures trickle down to consumers and businesses. As the government prepares to announce budget changes, combining fiscal policy with the central bank’s interest rate strategy will be essential in steering the economy towards sustainable growth. If executed correctly, this dual approach could lead to a brighter economic future for the UK, despite the formidable challenges it currently faces.

Monitoring Wage Growth and its Significance

Wage growth remains a crucial factor in shaping the economic landscape, especially against a backdrop of rising inflation and interest rates. Sustained wage increases are necessary to offset the impact of inflation on consumer spending power, which is critical for economic recovery and growth. The Bank of England must monitor wage growth closely as it considers its upcoming monetary policy decisions, particularly as slower wage growth could exacerbate the challenges of maintaining consumer confidence and spending.

Additionally, if wage growth does not keep pace with inflation, the Bank may be compelled to implement more aggressive measures to ensure that purchasing power is not eroded further. Ultimately, decisions made by the Bank of England regarding interest rates and inflation targets will have far-reaching effects on wage dynamics and overall economic health in the UK, making it imperative for policymakers to find a balance that supports sustainable growth.

Frequently Asked Questions

What decisions is the Bank of England expected to make regarding interest rates in its March meeting?

The Bank of England is widely anticipated to maintain its benchmark interest rate at 4.5% during its March meeting amidst economic uncertainty and challenges posed by trade tariffs and inflation.

How do trade tariffs impact the Bank of England’s interest rate decisions?

The potential impact of trade tariffs on the U.K. economy is significant, influencing inflation rates and economic stability, which the Bank of England considers when deciding on interest rates.

What is the current UK economic outlook ahead of the Bank of England’s March meeting?

The UK economic outlook is nuanced, with signs of stagnation in growth data, which may lead the Bank of England to keep interest rates steady while evaluating inflation risks in the coming months.

What are the implications of the Bank of England maintaining a 4.5% interest rate?

Maintaining a 4.5% interest rate suggests that the Bank of England is exercising caution due to current economic challenges, allowing for stability as the economy grapples with inflation and taxation changes.

What are analysts predicting for UK inflation in 2024 following the Bank of England’s recent decisions?

Analysts predict that UK inflation might surge temporarily to around 3.7% in 2024, exceeding the Bank of England’s target due to rising energy prices and economic pressures, prompting careful consideration in future interest rate setting.

Why might the Bank of England consider a future rate cut despite maintaining the current rate?

The Bank of England might consider a rate cut in the future due to persistent wage growth and inflationary pressures that could necessitate a more accommodative monetary policy to foster economic growth.

How might upcoming government budget changes affect the Bank of England’s interest rate strategy?

Upcoming government budget changes may lead to increased taxation and spending cuts, influencing the Bank of England’s strategy to maintain interest rates amidst evolving economic forecasts and fiscal pressures.

What factors are influencing the Bank of England’s caution in its interest rate decisions?

Factors influencing the Bank of England’s caution include weak economic growth signals, trade tariff uncertainties, inflationary pressures, and increased tax burdens on businesses that could further strain the economy.

| Key Aspect | Details |

|---|---|

| Current Interest Rate | 4.5% during March meeting |

| Economic Conditions | U.K. economy facing stagnation and uncertainty around trade tariffs; signs of slow monthly growth. |

| Taxation Changes | New government taxation changes perceived negatively by businesses, which argue it may harm growth. |

| Inflation Risks | Potential rise in inflation due to higher energy prices and trade tariffs impacting consumer income. |

| Monetary Policy Committee Stance | Majority favor maintaining rates despite dissent for potential cuts; focus on persistent wage growth and inflation. |

| Future Outlook | Expectations of possible rate cuts later in the year if economic conditions allow for it. |

Summary

The Bank of England interest rates are poised to remain at 4.5% as the central bank confronts a complex economic landscape marked by stagnation and trade uncertainties. This decision reflects a cautious approach amid critical taxation reforms and inflationary pressures. Moving forward, all eyes are on the upcoming financial policies and the potential for rate adjustments based on evolving economic indicators.