Copper Tariffs: Trump Imposes 50% Duty on Imports

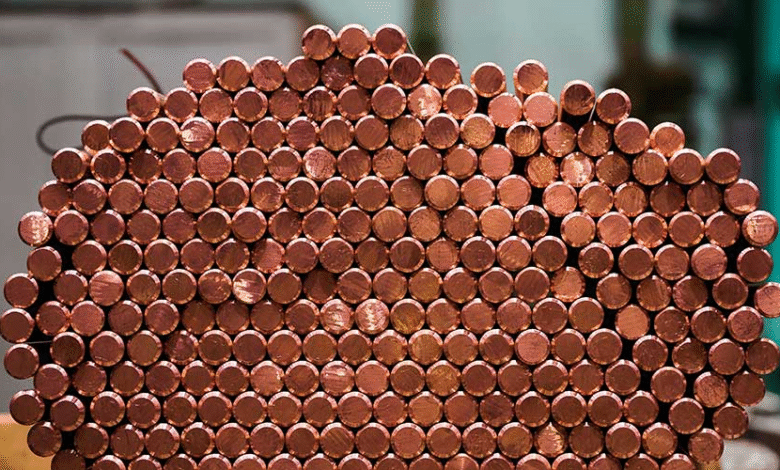

Copper tariffs have become a crucial topic in 2023 as the Trump administration has imposed a universal 50% tariff on all copper imports. This bold move, announced by the White House, aims to boost domestic production while addressing perceived trade imbalances. However, the immediate aftermath has seen a significant copper price drop, with markets reacting negatively and major mining companies like Freeport-McMoRan and Southern Copper experiencing sharp declines in their stock prices. The impact of tariffs on the economy is becoming a concern as experts predict rising costs for products that depend on copper, such as construction materials. In this evolving landscape, staying updated with copper market news is essential to understand how these tariffs will reshape the industry and the broader economy.

The recent imposition of tariffs on copper imports is reshaping the landscape of international trade and domestic manufacturing. These import tariffs set a new precedent within the context of trade policy, particularly under the administration that championed tariffs as a tool for economic correction. With steel and aluminum tariffs previously in place, the focus has now shifted to copper, a critical raw material that powers numerous industries. As we delve into the nuances of these trade barriers, it’s vital to consider their far-reaching implications, not just for copper prices, but on the overall market dynamics. Understanding the ripple effects of such legislation can help stakeholders navigate the turbulent waters of commerce.

Overview of Copper Tariffs in 2023

In 2023, the U.S. government, under President Donald Trump, has implemented sweeping changes to trade policy with the imposition of a 50% tariff on copper imports. This development aims to bolster domestic industries by promoting the use of locally sourced materials. While the White House cites the need to correct trade imbalances, the steep tariffs raise questions about their long-term effectiveness and the potential ramifications for the economy.

The introduction of these copper tariffs is part of a broader strategy that follows earlier tariffs imposed on steel and aluminum. By increasing the costs of imported copper, the administration hopes to protect American miners and manufacturers from foreign competition. However, experts warn that such import tariffs could have the opposite effect, leading to higher prices for products that rely on copper, further straining consumer budgets in an already volatile economic landscape.

Frequently Asked Questions

What are the Trump copper tariffs and how do they affect the copper market?

The Trump copper tariffs refer to the 50% import tariff imposed on copper by President Trump, effective from Friday. These tariffs are aimed at correcting trade imbalances and supporting domestic industries. The announcement led to a significant drop in copper prices, declining by as much as 18% in after-hours trading, and impacted major copper miners like Freeport-McMoRan and Southern Copper.

What causes the copper price drop following the imposition of new tariffs?

The recent copper price drop is primarily attributed to the announcement of the new 50% copper tariffs by the Trump administration. This immediate tariff increase caused panic in the markets, resulting in a sharp decline in copper prices and a negative reaction from mining companies.

How will the import tariffs in 2023 affect the economy and copper prices?

The import tariffs in 2023, particularly the 50% tariffs on copper, are likely to increase costs for products that use copper, such as construction materials and electronics. Experts warn these tariffs may stifle economic growth by raising prices and creating uncertainty in the copper market. This could have a downstream impact on various sectors reliant on copper.

What is the potential impact of copper tariffs on U.S. consumers?

The impact of copper tariffs on U.S. consumers could be significant. As costs for copper rise due to the new tariffs, consumers may face higher prices for products that utilize copper, including electrical appliances, construction goods, and electronics. This increase may compound inflationary pressures in the economy.

Why are copper tariffs being implemented and what are their objectives?

Copper tariffs are being implemented to support U.S. domestic industries and address trade imbalances as stated by the Trump administration. The objective is to protect local jobs and manufacturing by making imported copper more expensive while encouraging the use of domestically sourced materials.

When did the new copper tariffs take effect and what should traders watch for?

The new copper tariffs took effect on Friday following their announcement. Traders should watch for reactions in the copper market, potential changes in prices, and impacts on related industries such as electronics and construction materials.

What is the historical significance of the copper price drop linked to the Trump copper tariffs?

The historical significance of the copper price drop linked to the Trump copper tariffs is noteworthy, as the 18% decline marks the largest single-day decrease for copper since 1989. This unprecedented shift highlights the immediate and profound effects trade policies can have on commodity markets.

| Key Points |

|---|

| President Trump signed a 50% tariff on copper imports, effective Friday. |

| This follows previous tariffs on steel and aluminum implemented by Trump. |

| Copper prices fell dramatically, with a drop of up to 18% post-announcement. |

| Freeport-McMoRan and Southern Copper stocks declined by around 10% and 6%, respectively. |

| This could be the largest single-day decline for copper since 1989. |

| The administration claims the tariffs will support domestic industries. |

| Experts warn increased tariffs may lead to higher prices for copper-based products. |

| The U.S. imports nearly half of its copper, mostly from Chile. |

Summary

Copper tariffs have been imposed by President Trump as part of an effort to support domestic industries and address trade imbalances. With a significant 50% tariff on imports taking effect, this move has already led to dramatic price declines in the copper market. While the administration advocates that these tariffs could protect U.S. interests, market analysts are concerned about the broader economic implications, including potential rises in product costs in various sectors relying on copper. This situation continues to develop, and its impact on the U.S. economy will be closely monitored.