Private Payroll Growth Slows to 62,000 Jobs in April

Private payroll growth has shown a notable slowdown in recent reports, with only 62,000 jobs added in April, marking a significant decline from previous months. This figure represents the smallest increase since July 2024 and fell short of the expectations set by analysts, who had projected an increase of 120,000. The latest ADP payroll data highlights concerns about the current job market trends as employers navigate a complex economic landscape influenced by policy changes and consumer uncertainty. Employment statistics reveal that despite the modest overall growth, certain sectors like leisure and hospitality have performed well, contributing 27,000 new jobs. As we analyze these numbers, it’s essential to consider how these patterns in U.S. job growth will impact the larger economy and individual households moving forward.

The recent fluctuations in labor markets, indicated by the latest findings of private employment expansion, unveil a critical narrative in today’s economic climate. Observing the April payroll reports, we see that job creation has significantly decelerated, prompting discussions on hiring trends and workforce dynamics. Adapting to shifting economic policies and consumer behaviors, businesses are reconsidering their recruitment strategies. As is evident from the latest payroll updates, sectors like hospitality and trade are on the rise, yet some corners of the job market, such as education and health services, are facing challenges. Thus, it becomes increasingly important to dissect the components of these employment figures to better understand their implications for future economic health.

Understanding April Payroll Reports

April’s payroll reports highlighted a significant shift in the labor market, revealing that private payroll growth was unexpectedly low at just 62,000 jobs added. This stark slowdown came as figures were revised down from a robust 147,000 in March. The disparity between expectations and reality showcases the fluctuation often seen in employment statistics, particularly in a climate of economic uncertainty. Analysts had predicted a much healthier gain of 120,000 new jobs, making this report a key indicator of ongoing job market trends.

The ADP payroll data serves as an insightful precursor to the BLS report, which is eagerly anticipated by economists and stakeholders alike. The April data suggests that employers are cautious amid looming trade tensions and tariffs proposed by the Trump administration. This caution is reflected in various sectors, indicating how external factors can heavily influence private sector hiring.

Frequently Asked Questions

What does the recent ADP payroll data indicate about private payroll growth in April?

The recent ADP payroll data indicates that private payroll growth slowed to just 62,000 jobs in April, significantly lower than the anticipated 120,000. This marks the smallest gain since July 2024 and reflects a decline from the upwardly revised 147,000 jobs added in March.

How did private payroll growth for April compare to job market trends in previous months?

In April, private payroll growth fell to 62,000, a stark contrast to the March gains of 147,000. This slowdown shows a shift in job market trends, where uncertainty around tariffs and policies may have led companies to reduce hiring.

What sectors contributed to the slowdown in private payroll growth in April?

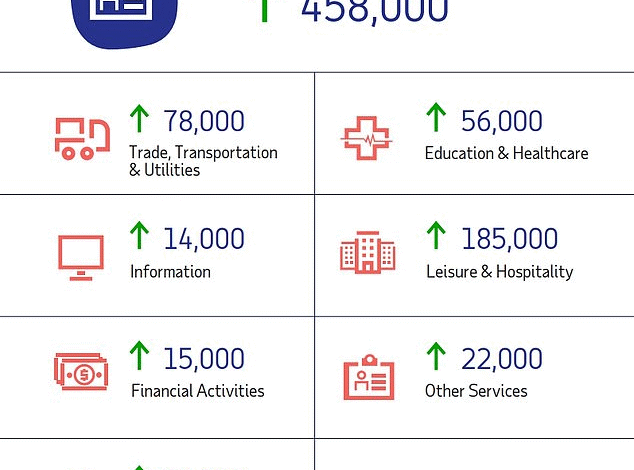

In April, the sectors contributing to private payroll growth included leisure and hospitality, which added 27,000 jobs, as well as trade, transportation, utilities, financial activities, and construction. However, the overall growth was hindered by job losses in education, health services, and information services.

How is the April payroll report expected to influence upcoming employment statistics?

The April payroll report, showing a slowdown in private payroll growth, may influence upcoming employment statistics, particularly the Bureau of Labor Statistics (BLS) report. Economists expect a job growth of 133,000 in the BLS report, highlighting the importance of monitoring both the ADP and BLS data for a complete picture of the job market.

What impact did wage growth have on private payroll growth in April?

Wage growth in April experienced a slight downturn, rising by 4.5% for those who stayed in their jobs, compared to 4.6% in March. Meanwhile, those who switched jobs saw a wage increase to 6.9%. This mixed data on wages may reflect the broader trends in private payroll growth and hiring practices.

What factors contributed to the decline in private payroll growth in April?

Factors contributing to the decline in private payroll growth in April include economic uncertainty and potential impacts from tariffs, which have made companies cautious in their hiring decisions, according to ADP’s chief economist, Nela Richardson.

What does the private payroll growth report suggest for future employment trends?

The sluggish private payroll growth in April suggests potential challenges for future employment trends, as companies face economic uncertainty and may exercise cautious labor hiring practices in the coming months.

Why are ADP payroll data and April payroll reports significant for understanding U.S. job growth?

ADP payroll data and April payroll reports serve as critical indicators for understanding U.S. job growth by providing early insights into employment trends. These reports highlight key sectors’ performance and can set expectations for the subsequent Bureau of Labor Statistics data.

| Key Point | Details |

|---|---|

| Private Payroll Growth | Private payroll growth slowed to 62,000 in April, well below expectations. |

| Comparison to March | This represents a decline from 147,000 in March. |

| Industry Gains | Leisure and hospitality added 27,000 jobs; trade, transportation, and utilities added 21,000; financial activities up by 20,000; construction rose by 16,000. |

| Wage Growth | Wages increased by 4.5% for those remaining in their jobs, while those changing jobs saw a 6.9% increase. |

| Job Losses in Other Sectors | Education and health services lost 23,000 jobs, and information services declined by 8,000. |

| Economic Uncertainty | Employers are cautious due to potential impacts from tariffs and economic uncertainty. Hiring decisions have become difficult. |

| Future Reports | The ADP estimate serves as a precursor to the Bureau of Labor Statistics’ nonfarm payroll data expected Friday. |

Summary

Private payroll growth in April shows a troubling slowdown, with only 62,000 new jobs added, significantly below expectations. This decline highlights challenges in the labor market amidst economic uncertainty stemming from potential tariffs and evolving consumer behavior. Despite gains in the leisure and hospitality sectors, the overall employment landscape reflects heightened caution among employers regarding future hiring.