Cisco Earnings Report: Strong Performance and Future Guidance

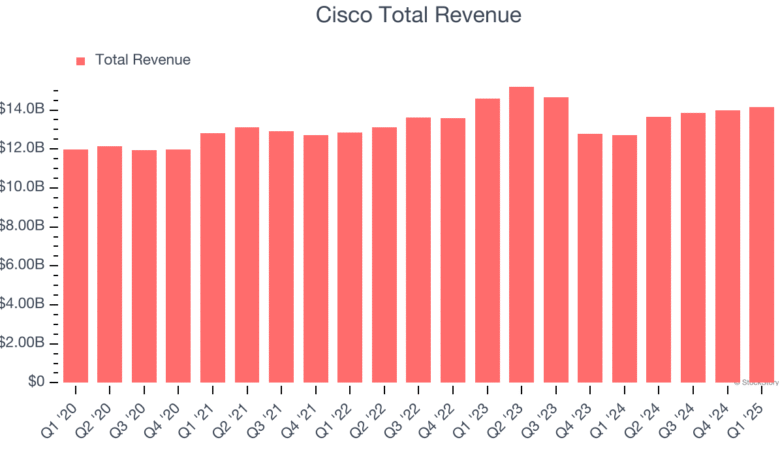

Cisco earnings report for the latest quarter has stirred excitement among investors, as the tech giant unveiled results that not only met but narrowly surpassed analysts’ expectations. With earnings per share clocking in at 99 cents against an anticipated 98 cents, and total revenues reaching $14.67 billion, Cisco showcased a commendable 7.6% revenue growth year-over-year. Particularly impressive was the surge in networking revenue, which jumped 12% to $7.63 billion, validating Cisco’s strong position in the market. Additionally, Cisco’s ongoing investment in AI infrastructure, alongside partnerships with major players like Microsoft, highlights its commitment to staying at the forefront of technological innovation. As Cisco provides fiscal guidance estimating adjusted earnings for the upcoming year between $4 and $4.06, market analysts are keenly assessing Cisco stock performance and its impact on the broader tech landscape.

The latest financial disclosures from Cisco, a leading technology conglomerate, have captured the attention of market analysts and investors alike. With quarterly metrics that surpassed proactive forecasts, Cisco’s financial health appears robust, driven by strategic expansion in areas such as AI-driven infrastructure and networking solutions. The company’s financial outlook is particularly noteworthy, reflecting strong revenue growth and positive earnings projections that could influence future stock valuations. Moreover, Cisco’s entry into collaborative efforts for AI infrastructure development signals its adaptability in a competitive environment, making it a key player to watch in the tech sector. Overall, a comprehensive market analysis reveals that Cisco’s evolving strategies are likely to solidify its market presence and could lead to significant growth in its fiscal trajectory.

Overview of Cisco Earnings Report

Cisco’s recent earnings report showcased a performance that narrowly surpassed Wall Street’s expectations, highlighting the company’s resilience in a challenging economic landscape. The adjusted earnings per share came in at 99 cents, slightly above the 98 cents anticipated by analysts. This performance is indicative of Cisco’s strategic focus on innovation and operational efficiency, reflecting a well-managed effort to navigate market complexities.

The reported revenue of $14.67 billion also exceeded expectations, marking a 7.6% increase year-over-year. This growth trajectory is notable as Cisco continues to solidify its position in the networking sector, offering products and services that meet the evolving demands of businesses today. The positive results not only point to Cisco’s financial health but also highlight the effectiveness of its fiscal strategies.

Cisco Revenue Growth Analysis

The robust revenue growth of 7.6% year-over-year is a key indicator of Cisco’s operational success. The tech giant reported impressive results in its networking segment, generating $7.63 billion, which exceeded analyst forecasts of $7.34 billion. This remarkable performance underscores the increasing demand for Cisco’s networking solutions, especially as businesses ramp up digital transformations and invest in comprehensive IT infrastructures.

Revenue in other segments, such as security, also showed positive movement despite falling short of estimates. With $1.95 billion generated in security revenues, Cisco is positioning itself as a vital player in cybersecurity, which is increasingly crucial in today’s digital landscape. As revenue from these segments continues to grow, Cisco is expected to maintain a stronghold in the tech industry.

Cisco’s AI Infrastructure Investments

Cisco has recognized the growing significance of artificial intelligence and is proactively investing in AI infrastructure. Partnering with industry leaders like BlackRock and Microsoft, the company aims to enhance its capabilities in this area, announcing plans to support AI initiatives alongside prominent companies. This investment reflects Cisco’s strategic vision to be at the forefront of technology that drives business innovation.

The recent collaboration is part of a broader trend where Cisco is also involved in significant projects such as the Stargate data center initiative, which involves partnerships with OpenAI and SoftBank. With AI infrastructure orders reaching $800 million in the last quarter and exceeding $2 billion for fiscal year 2025, Cisco’s commitment to this sector is clear, demonstrating confidence in the future potential of AI to transform business processes.

Cisco Fiscal Guidance for Upcoming Quarters

Looking ahead, Cisco has provided optimistic fiscal guidance with projected adjusted earnings per share ranging between 97 cents to 99 cents for the upcoming quarter. This forecast is promising compared to analysts’ expectations and reflects confidence in continued revenue growth amidst a complex global business environment. Cisco’s projected revenue of $14.65 billion to $14.85 billion shows a commitment to stability and growth in the coming months.

For the entire fiscal year 2026, Cisco expects adjusted earnings per share between $4.00 to $4.06 and revenue between $59 billion and $60 billion, slightly below the consensus estimates. This guidance indicates that while Cisco is navigating challenges such as tariffs, it remains confident in its ability to drive growth through innovation and strategic investments.

Cisco Market Analysis and Stock Performance

Cisco’s stock performance has seen a significant uptick, reflecting strong investor confidence and overall market sentiment. Currently, Cisco shares have increased by 19% in 2025, while the broader S&P 500 has gained around 10%. This outperformance suggests that investors are optimistic about Cisco’s growth prospects, particularly in AWS-like infrastructure and AI capabilities.

Market analysts are closely monitoring Cisco as it continues to adapt and innovate in a competitive landscape. The company’s ongoing strategic initiatives and strong financial results position it favorably within the tech sector, making it an attractive investment option. Cisco’s ability to execute its fiscal strategies effectively will be crucial for sustaining this momentum in stock performance.

Cisco Networking Revenue Growth

Cisco’s networking revenue showed a remarkable increase of 12% in the fiscal fourth quarter, indicating robust demand for its networking solutions. The revenue reached $7.63 billion, surpassing expectations significantly. This growth can be attributed to the rising need for advanced networking infrastructure as enterprises increasingly adopt digital technologies.

With businesses transitioning to hybrid work models and investing in cloud automation, Cisco’s networking segment is poised for continued growth. The company’s ability to meet these demands with cutting-edge products ensures its relevance and competitiveness, further solidifying its position as a leader in the networking industry.

The Role of Security in Cisco’s Revenue Streams

Despite experiencing a slight miss in estimates, Cisco’s security revenue of $1.95 billion—up 9% year-over-year—shows the persistent demand for cybersecurity solutions. As cyber threats evolve, more businesses are prioritizing security investments, and Cisco is well-positioned to be a go-to provider.

The company’s strategies in enhancing security offerings and addressing market needs reflect its commitment to protecting enterprises. As businesses increasingly recognize the necessity of robust security measures, Cisco’s growth in this segment is likely to continue, driving its overall revenue growth strategies.

Collaboration and Partnerships at Cisco

Cisco’s recent initiatives illustrate its commitment to collaboration and strategic partnerships. Through alliances with industry giants like Microsoft and BlackRock, Cisco aims to bolster its capabilities in AI infrastructure, positioning itself as a key player in this innovative sector. This proactive approach enables Cisco to leverage shared resources and expertise to enhance offerings.

Furthermore, being part of initiatives such as the Stargate data center for the Middle East underscores the company’s strategy to engage with cutting-edge technologies and innovative partners. By collaborating with tech leaders, Cisco is not only expanding its portfolio but also ensuring it remains at the forefront of technological advancements.

Understanding the Importance of Tariff Clarity for Cisco

Mark Patterson, Cisco’s finance chief, emphasized the complexities of operating in the current economic environment, even with some clarity on tariffs. Tariff regulations can impact costs and pricing strategies, making it essential for Cisco to navigate these challenges strategically.

The company’s proactive stance in addressing tariff-related concerns while focusing on growth initiatives sets the stage for sustained performance. By managing these factors effectively, Cisco can optimize its operations, ensuring continued success despite external pressures.

Frequently Asked Questions

What were the key highlights from Cisco’s earnings report this quarter?

In Cisco’s most recent earnings report, the company reported adjusted earnings per share of 99 cents, surpassing analyst expectations of 98 cents. Revenue for the quarter reached $14.67 billion, exceeding forecasts of $14.62 billion, marking a 7.6% year-over-year increase. Additionally, net income rose to $2.82 billion, up from $2.16 billion compared to the same quarter last year.

How did Cisco’s revenue growth compare to analysts’ expectations?

Cisco’s revenue growth this quarter was impressive, achieving $14.67 billion against the anticipated $14.62 billion. This 7.6% year-over-year growth demonstrates solid performance, especially in networking where revenue increased by 12%, reaching $7.63 billion, significantly above the $7.34 billion expected.

What fiscal guidance did Cisco provide following the earnings report?

Cisco provided optimistic fiscal guidance, projecting adjusted earnings per share for the first quarter to be between 97 cents and 99 cents, with revenue expectations of $14.65 billion to $14.85 billion. For the entire fiscal year 2026, the company forecasted adjusted earnings per share of $4 to $4.06 and revenue of $59 billion to $60 billion.

How is Cisco involved in AI infrastructure investment?

Cisco is actively investing in AI infrastructure, collaborating with partners such as BlackRock and Microsoft. The company announced its plans to enhance AI capabilities by launching switches and routers that can handle AI workloads, indicating a strong market focus on artificial intelligence as a key growth area.

What was the performance of Cisco’s stock following the earnings report?

Following the earnings report, Cisco’s stock has surged 19% in 2025, significantly outperforming the S&P 500, which has gained about 10%. This reflects investor confidence based on Cisco’s positive financial results and growth prospects.

How did Cisco’s security revenue perform in comparison to expectations?

Cisco’s security revenue reached $1.95 billion, which was a 9% increase year-over-year. However, this figure fell short of expectations set by analysts, who predicted security revenue of $2.11 billion for the quarter.

What insights can be drawn from Cisco’s market analysis regarding future growth?

Cisco’s market analysis indicates a robust growth trajectory, particularly through AI infrastructure investments that exceeded the company’s sales targets significantly. With a strong pipeline for AI-related projects, Cisco’s future revenue growth appears promising despite a complex operating environment.

Did Cisco’s earnings report indicate any challenges in the market?

Yes, during the earnings call, Cisco’s finance chief Mark Patterson noted that despite some clarity on tariffs, the company continues to operate in a complex market environment. This underlines the ongoing challenges even as Cisco performs well financially.

What new initiatives has Cisco launched in response to market demands?

Cisco has launched new switches and routers optimized for AI workloads and is involved in a Stargate data center initiative in the Middle East with partners like OpenAI and SoftBank. These initiatives reflect Cisco’s commitment to adapting to the evolving demands of the technology landscape.

How has Cisco’s fiscal outlook positioned the company in the tech market?

Cisco’s favorable fiscal outlook, combined with its strategic focus on AI infrastructure, positions the company as a key player in the tech market. With substantial revenue projections and a clear investment strategy in AI, Cisco is setting itself up for continued growth and industry leadership.

| Key Performance Indicators | Q4 Results | Forecasts |

|---|---|---|

| Earnings per Share (EPS) | 99 cents (adjusted) vs 98 cents expected | 97-99 cents projected for Q1 FY 2025, 4-4.06 for FY 2026 |

| Revenue | $14.67 billion vs $14.62 billion expected | $14.65-$14.85 billion projected for Q1 FY 2025, $59-$60 billion for FY 2026 |

| Net Income | $2.82 billion (71 cents/share) vs $2.16 billion (54 cents/share) last year | Consistent growth projected with anticipated earnings of $4.03 on revenue of $59.53 billion |

| Networking Revenue | $7.63 billion, up 12% | Growth expected to continue as Cisco invests in AI infrastructure |

| AI Infrastructure Orders | $800 million in Q4, over $2 billion for FY 2025 | Sales pipeline in hundreds of millions targeting back-end networks |

Summary

The Cisco earnings report highlights a strong performance that narrowly exceeded analysts’ expectations, indicating a positive outlook for the company. With an impressive earnings per share of 99 cents and a revenue boost of $14.67 billion, Cisco is not only improving its financials but also poised for future growth in artificial intelligence and networking sectors. The forecast for the upcoming quarters remains optimistic, suggesting stable growth and investments in cutting-edge technologies such as AI.