Crypto Market Crash: Tariff Fallout Turns Assets Red

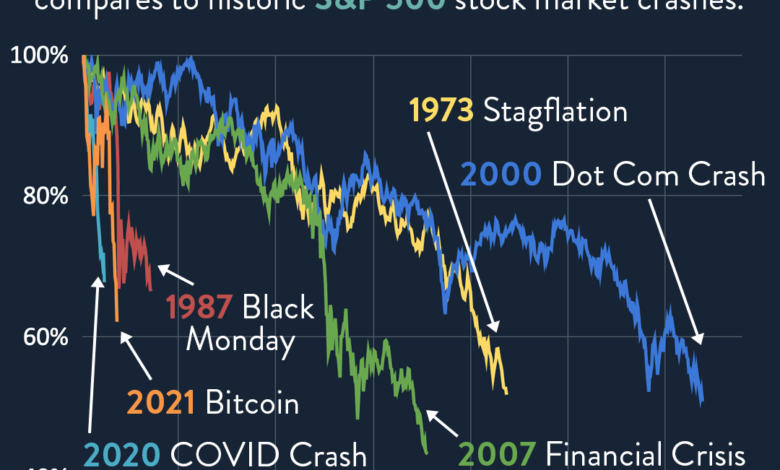

The crypto market crash has sent shockwaves through the digital asset market, wiping out nearly 4% of its total valuation in just 24 hours. As the unresolved impacts of rising tariffs loom large, the cryptocurrency decline has accelerated, particularly affecting major players like Bitcoin and Ethereum. Analysts observed a grim trend with the Bitcoin price drop falling beneath the crucial $82,000 mark, signaling heightened selling pressure amongst investors. Following this, Ethereum faced significant losses, compounding fears of a prolonged downturn across the entire sector. As traders reevaluate their strategies amid these turbulent market conditions, one thing is certain: the fallout from the latest economic policies continues to reshape the landscape for crypto enthusiasts across the globe.

In recent times, the digital currency landscape has witnessed a severe downturn, putting the spotlight on the emerging challenges faced by virtual currencies. With the surge of new tariffs impacting economic stability, investors are grappling with significant drops in their portfolios, particularly in leading cryptocurrencies. This phenomenon, often referred to as the cryptocurrency crash, highlights shifting investor sentiments and market fundamentals. As assets like Bitcoin and Ethereum grapple with declining values, market participants are forced to reassess their positions in an increasingly volatile environment. This evolving scenario underscores the need for vigilance and adaptability in the face of unpredictable market forces.

Impact of Tariffs on the Cryptocurrency Market

The recent introduction of a 10% tariff on select nations has sent shockwaves through the cryptocurrency market, intensifying the already bearish sentiment that has gripped the digital asset landscape. This decision by the White House has not only prompted immediate concerns among traders but also influenced broader market dynamics, as investors grapple with potential future implications. The cryptocurrency decline observed on Thursday, with an overall market cap sinking to $2.61 trillion, signifies that external economic policies can directly affect digital currencies, leading to destabilization in what is already a volatile market.

Moreover, the tariff’s ripple effects extend beyond immediate price impacts, potentially stunting innovation and investment within the cryptocurrency sector. As costs for transactions and imports increase, crypto-related businesses could face higher operational expenses, leading to higher barriers to entry for new ventures. This compounded pressure may result in a further decline in digital asset valuations, as market participants reassess their risk exposure in an environment fraught with uncertainty and policy shifts.

Bitcoin and Ethereum Price Drops Amidst Market Turmoil

Both Bitcoin and Ethereum faced significant price drops as the market reacted to the tariff news, with Bitcoin dipping below $82,000 and Ethereum experiencing a staggering 5.6% loss. The Bitcoin price drop was particularly concerning, as it not only shook investor confidence but also highlighted the growing correlation between traditional financial systems and the cryptocurrency market. Investors often view Bitcoin as a safe haven; however, its sharp decline in this tumultuous market underscores a growing volatility that is impacting even the more established cryptocurrencies.

Additionally, Ethereum’s struggles are emblematic of the broader troubles faced by many altcoins, as the digital asset market contends with waves of liquidations and margin calls. With market pressures mounting, traders are being forced to reevaluate their positions, leading to massive sell-offs and further losses. The current situation showcases the interconnectedness of crypto prices and external economic pressures, creating a challenging environment for crypto investors looking for stability in an unstable landscape.

Mass Liquidations: A Recipe for Market Chaos

The crypto market experienced widespread mass liquidations, with nearly 200,000 traders impacted due to the rapid downturn following the tariff announcement. The forced closings of positions, amounting to $562.82 million, emphasize the extreme volatility and risks associated with leveraged trading in cryptocurrencies. In environments like these, where prices can swing widely in mere hours, traders who rely on margin trading are often the most vulnerable, facing significant losses that can lead to a cascading effect throughout the market.

This phenomenon of mass liquidations serves as a stark reminder of the inherent risks within the cryptocurrency realm. As traders scramble to adapt to the unfolding situation, the combined pressures of a bearish market and impending economic uncertainty could lead to further sell-offs. Consequently, this detrimental cycle not only affects individual traders but leads to broader implications for market stability as liquidity evaporates and assets are rapidly devalued.

Ethereum’s Performance: Navigating Losses

As the crypto market reels from the recent tariff-induced turmoil, Ethereum has not been spared, recording a significant loss of 5.6%. This steep decline reflects the vulnerabilities that many altcoins face in a volatile market environment dominated by uncertainty and fear. Traders’ sentiments oscillate between desire for recovery and the reality of ongoing economic pressures, resulting in heightened selling activity that exacerbates Ethereum’s challenges. The digital asset’s performance highlights its sensitivity to broader market trends and external factors, as investors reassess their portfolios amidst the chaos.

Moreover, Ethereum’s losses serve to illustrate the interlinked fates of cryptocurrencies in a bear market. As prices continue to fluctuate dramatically, many investors are left exploring defensive strategies to safeguard their assets. This has led to increased interest in stablecoins or non-correlated investments, as traders attempt to navigate the tumultuous waters of the cryptocurrency cosmos during these challenging times.

The Role of Market Sentiment in Crypto Declines

Market sentiment plays a crucial role in driving cryptocurrency prices, particularly during times of economic uncertainty. As fear and uncertainty spread among investors following the announcement of new tariffs, the crypto market quickly responded with a marked decline as panic selling ensued. This phenomenon is characteristic of speculative markets, where shifts in sentiment can lead to rapid and considerable price fluctuations.

Understanding this dynamic is essential for both new and seasoned traders. The importance of managing emotions and making informed decisions based on data rather than fear cannot be overstated. By cultivating a disciplined investment strategy and remaining aware of the emotional currents that drive market movements, traders can better navigate the unpredictable nature of crypto markets and potentially mitigate the impact of volatile situations like the current tariff fallout.

Regulatory Pressures and Their Effects on Crypto

The crypto market is increasingly subjected to regulatory scrutiny, an aspect that remains pivotal in determining the direction of cryptocurrency valuations. The latest tariff regulations have heightened this scrutiny, leading crypto investors to question the stability of their investments amid changing policies. Regulatory changes can have an immediate impact on market confidence, leading to declines in valuations as investors reassess their positions in response to potential ramifications.

This landscape poses challenges not only for individual traders but also for institutional investors looking to enter the digital asset market. A clear regulatory framework is essential for fostering a safer investment environment in the cryptocurrency space. Until then, the uncertainty surrounding regulations will likely cause fluctuations in sentiment and pricing, emphasizing the need for critical awareness among market participants regarding both regulatory developments and their implications.

Strategizing During Volatile Markets

In times of significant market volatility, such as the current crypto market crash, it’s vital for traders and investors to strategize effectively to safeguard their investments. Diversifying portfolios can help cushion against severe downturns, allowing investors to spread out risk across different assets rather than concentrating on a single cryptocurrency like Bitcoin or Ethereum. Utilizing stablecoins or non-correlated assets can also provide a semblance of security during times of drastic price movements in the digital asset market.

Additionally, keeping abreast of market developments and employing risk management techniques is critical in such an unpredictable landscape. Setting stop-loss orders and staying informed about global economic conditions can help traders minimize losses and capitalize on potential recovery trends as the market stabilizes. By preparing adequately, investors can navigate the turbulent times of the cryptocurrency decline more confidently.

Long-Term Prospects for Bitcoin and Ethereum

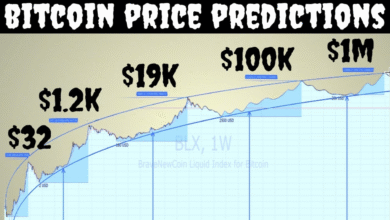

Despite the short-term challenges faced in the crypto market, Bitcoin and Ethereum’s long-term prospects remain a subject of interest for investors. Historical trends suggest that, while prices may experience sharp fluctuations due to external pressures, the foundational technology and the demand for cryptocurrencies often return to a growth trajectory over time. Institutional interest in blockchain technology and its applications continues to rise, reinforcing the potential value of these digital assets in the long run.

Furthermore, the ongoing development of decentralized finance (DeFi) applications and the growing adoption of cryptocurrencies can create future avenues for recovery and growth. As the digital asset market matures and adoption increases, both Bitcoin and Ethereum could leverage their positions to capture new value and utility within emerging ecosystems. Thus, while the current market conditions may be grim, there is optimism for the eventual resurgence of these leading cryptocurrencies.

The Psychological Impact of a Crypto Crash

The psychological toll of a cryptocurrency crash can weigh heavily on investors, often leading to panic and rash decision-making. When market downturns occur, fear can override rational investment strategies, prompting traders to sell off assets at a loss rather than riding out the volatility. This psychological aspect is even more pronounced in markets like cryptocurrencies, which are known for their rapid price changes and speculative nature.

Understanding the emotional landscape of trading is essential for long-term success in the digital asset market. Encouraging a mindset focused on research and strategic planning rather than immediate emotional reactions can help mitigate the adverse effects of a market crash. Educating investors about potential market psychology can empower them to navigate setbacks with a resilient approach, ultimately supporting healthier investment practices during turbulent times.

Frequently Asked Questions

What are the causes and impacts of the recent crypto market crash?

The recent crypto market crash has primarily been driven by macroeconomic factors such as the introduction of a 10% tariff on select nations by the U.S. government. This policy shift caused widespread panic in the digital asset market, resulting in nearly a 4% decline in overall cryptocurrency values. Bitcoin and Ethereum experienced significant price drops, contributing to the 196,887 traders facing liquidations.

How did the tariff impact on crypto contribute to the recent cryptocurrency decline?

The tariff impact on crypto markets created immediate instability, which incited fear among investors. As tariffs introduced uncertainty about global trade, digital assets reacted negatively, exacerbating the ongoing bearish trends. This led to a marked decline in Bitcoin price and other cryptocurrencies, ultimately erasing billions from the digital asset market.

What is the current state of the digital asset market following the crypto market crash?

The digital asset market is currently in turmoil following the recent crypto market crash. With an aggregate market cap now at $2.61 trillion—a considerable drop—major cryptocurrencies like Bitcoin and Ethereum have witnessed steep losses. Investors remain anxious as volatility persists, making it a challenging landscape for trading.

What led to the significant Bitcoin price drop during the crypto market crash?

The significant Bitcoin price drop can be attributed to a series of factors including bearish market sentiment following the tariff announcements. After briefly hovering above $83,000, Bitcoin fell below $82,000 as fears crested through global markets, driving speculative selling and further contributing to its decline amid the broader crypto market crash.

What should investors know about the Ethereum losses in the current crypto market crash?

Investors should be aware that Ethereum losses during the recent crypto market crash have exceeded 5.6%. This decline is reflective of weak market sentiment, coupled with the broader sell-off across digital assets. Understanding the volatility of Ethereum and its correlation with market trends can help investors navigate future uncertainties.

| Key Points |

|---|

| Total Market Valuation: $2.61 Trillion, down nearly 4% |

| Mass Liquidations: Nearly 200,000 traders affected, $562.82 million in positions closed |

| Impact of U.S. Tariff Policy: Introduction of 10% baseline tariff causing market unease |

| Leading Cryptocurrencies Performance: Bitcoin down 3.5%, Ethereum down 5.6% |

| Meme Tokens Volatility: DOGE down 8.5%, ADA down 9% |

| Bitcoin Derivative Losses: $186.91 million attributed to Bitcoin trades |

Summary

The recent crypto market crash reveals how quickly bullish sentiments can turn bearish due to external economic pressures. On Thursday, the crypto market faced significant declines, losing nearly 4% of its total valuation as a result of mass liquidations and a reaction to new U.S. tariffs. Key cryptocurrencies like Bitcoin and Ethereum suffered notable losses, reflecting the overall uncertainty in digital asset markets. The developments underline the ongoing volatility within the crypto landscape, making it crucial for traders to navigate these changes with caution.