Thumzup Crypto Holdings: $250 Million in Digital Assets

Thumzup Crypto Holdings is making waves in the digital asset arena with its bold decision to invest up to $250 million in various cryptocurrencies. In a move that underscores a commitment to cryptocurrency diversification, Thumzup Media Corp. is expanding its treasury beyond traditional assets like Bitcoin (BTC) to include Ethereum (ETH), Ripple (XRP), and more. This strategic initiative not only enhances the company’s financial portfolio but also positions Thumzup as a forward-thinking entity in the rapidly evolving crypto market. As digital currencies gain traction, Thumzup’s diversification efforts reflect a growing corporate confidence in the potential of these assets to generate value. By embracing an array of high-utility cryptocurrencies, Thumzup is set to attract the interest of investors keen on modern financial strategies and digital innovations.

In the world of cryptocurrency investment, Thumzup Crypto Holdings represents an ambitious approach to asset management. With an allocated budget of $250 million directed toward digital currencies such as Bitcoin, Ethereum, and Ripple, Thumzup Media reflects a strategic pivot towards embracing the future of finance. This initiative marks an important step for companies looking to not only stay relevant but also thrive in a marketplace increasingly dominated by cryptocurrencies. Through diversification across multiple high-performing tokens, Thumzup aims to mitigate risks and capitalize on the momentum of the cryptocurrency market. Such strategic moves highlight a broader trend among corporations recognizing blockchain assets as a legitimate and compelling investment opportunity.

Thumzup Crypto Holdings: A Strategic Move into Digital Assets

Thumzup Media Corp’s recent board approval of a $250 million investment in cryptocurrencies signifies a bold step into the digital asset space. With a diversified treasury strategy that now includes renowned cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), Thumzup aims to enhance its financial stability and agility in a rapidly evolving market. The decision reflects a broader trend among corporations recognizing the potential benefits of integrating cryptocurrencies into their asset management strategies, not just for growth, but also for hedging against inflation and market volatility.

The company’s decision to diversify its holdings demonstrates confidence in the future of digital currencies and the transformative role they can play in financial management. By including a variety of digital assets, such as Solana and stablecoins like USDC, Thumzup Media positions itself to leverage different market conditions and capitalize on various growth opportunities within the crypto ecosystem. This strategic realignment aims not only to strengthen its balance sheet but also to engage a wider investor base excited about the potential of cryptocurrency.

Understanding the Importance of Cryptocurrency Diversification

Cryptocurrency diversification is becoming an essential strategy for investors, companies, and institutions alike. As the market for digital currencies expands, reliance on a single asset like Bitcoin can be risky. By diversifying into various cryptocurrencies such as Ethereum (ETH) and Ripple (XRP), investors can spread their risk and take advantage of the unique benefits each asset offers. This is particularly important in a market characterized by its volatility, where fluctuations can significantly impact asset prices.

For Thumzup Media, adopting a diversified cryptocurrency portfolio isn’t just about reducing risk; it’s also about optimizing potential returns. Different cryptocurrencies serve different functions within the digital economy, with some designed for quick transactions and others built for extensive contracts or decentralized applications. By holding a broad set of cryptocurrencies, Thumzup aims to tap into various aspects of the cryptocurrency market, positioning itself not just as a participant but as a leader within the digital asset revolution.

Bitcoin (BTC): The Cornerstone of Thumzup’s Crypto Strategy

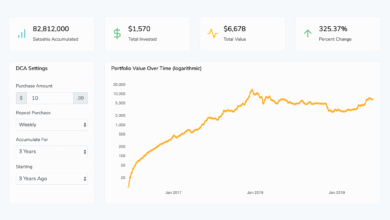

As the first and most recognized cryptocurrency, Bitcoin (BTC) plays a foundational role in Thumzup Media’s new treasury strategy. The cornerstone status of Bitcoin provides a sense of stability and assurance, attracting savvy investors even amid greater market fluctuations. By allocating a significant portion of its $250 million crypto holdings in Bitcoin, Thumzup demonstrates faith in Bitcoin’s long-term potential as a store of value and a digital reserve asset.

Bitcoin’s influence extends beyond mere speculation; it’s increasingly viewed as a legitimate asset class against inflation and economic uncertainty. Thumzup’s focus on Bitcoin reflects a growing wave of institutional adoption as entities recognize its robustness as a hedge and an alternative to traditional financial instruments. As Thumzup integrates Bitcoin alongside other digital currencies, it strengthens its overall portfolio while also reflecting broader trends in cryptocurrency investment strategies.

Ethereum (ETH): Expanding Horizons in Crypto Investment

Ethereum (ETH), known for its smart contract functionality, is a major addition to Thumzup Media’s cryptocurrency treasury. As the second-largest cryptocurrency by market capitalization, Ethereum’s blockchain technology facilitates decentralized applications and innovations like Non-Fungible Tokens (NFTs). By including Ethereum in its diverse crypto portfolio, Thumzup not only embraces the potential of smart contracts but also positions itself at the forefront of the decentralized finance (DeFi) movement.

Investing in Ethereum aligns with Thumzup’s vision of capitalizing on innovative technologies and financial solutions that resonate with the needs of modern investors. The company can explore various use cases of Ethereum, from locking assets in liquidity pools to joining the DeFi trend, which aims to democratize access to financial services. As Ethereum continues to evolve, with enhancements like the transition to Ethereum 2.0, Thumzup is poised to leverage these advancements for optimal growth and strategic advantage.

Ripple XRP: Essential for Cross-Border Transactions

Ripple (XRP) has emerged as a critical asset for companies looking to enhance their involvement in the cryptocurrency space, particularly regarding cross-border transactions. For Thumzup Media, incorporating XRP into its treasury strategies allows the corporation to partake in the increasingly important remittance market. Ripple’s blockchain technology is designed specifically for speed and efficiency, addressing significant pain points in traditional banking and financial systems.

By investing in Ripple, Thumzup positions itself to benefit from Ripple’s partnerships with leading financial institutions globally, which can lead to potential returns as adoption rates increase. Furthermore, as more countries explore the integration of blockchain into their financial systems, Ripple’s relevance and utility could see significant growth, making it a strategic asset in Thumzup Media’s diversified approach to cryptocurrency investment.

The Role of Thumzup Media in Crypto Education

As Thumzup Media expands its presence in the cryptocurrency space, it also has a unique opportunity to educate its shareholders and the public on digital assets. With many still unfamiliar with the complexities of cryptocurrencies, Thumzup can lead initiatives that provide valuable insights into how these assets function and their potential benefits. By prioritizing educational efforts, Thumzup not only strengthens its brand but also cultivates greater market understanding.

Educational programs focusing on topics such as the fundamentals of Bitcoin (BTC) and Ethereum (ETH), as well as the importance of cryptocurrency diversification, can empower investors. As interest in digital currencies grows, Thumzup’s role as an educator can serve to enhance investor confidence and promote a healthy relationship with the dynamic world of cryptocurrency. This commitment resonates well with the ethos of informed investing and can lead to heightened shareholder loyalty.

Future Trends in Cryptocurrency and Corporate Adoption

The cryptocurrency landscape is continually evolving, with increasing adoption across corporations and financial institutions. As Thumzup Media positions itself within this landscape with its $250 million crypto treasury, it stands at the forefront of a burgeoning trend where traditional businesses leverage digital assets. With institutional players entering the market, future trends suggest that cryptocurrencies will become an integral part of corporate asset management strategies.

Corporate adoption of cryptocurrencies, driven by technological advancements and regulatory developments, will likely pave the way for more businesses like Thumzup to recognize the value in digital currencies. As more companies encompass diversified portfolios that include Bitcoin, Ethereum, and various altcoins, the traditional finance sector will face considerable changes. Thumzup’s early adoption of this revolutionary strategy may also influence other corporations to follow suit.

Thumzup Media: Bolstering Shareholder Value through Crypto Investments

Thumzup Media’s innovative approach to cryptocurrency investments is fundamentally aimed at enhancing shareholder value. By diversifying its cryptocurrency holdings and having a substantial allocation towards established assets like Bitcoin, Ethereum, and Ripple, Thumzup is strategically positioning itself to generate optimal returns. This proactive strategy not only mitigates risks associated with market volatility but also opens avenues for potential profits that align with shareholder interests.

Furthermore, as the market for digital assets matures, Thumzup’s early initiatives to engage with cryptocurrencies may serve to bolster investor confidence and attract new stakeholders. The company’s commitment to diversifying its portfolio showcases its foresight and adaptability in navigating today’s financial landscape. As it continues to publish regular updates on its crypto initiatives, Thumzup establishes transparency, which is paramount in ensuring ongoing investor trust and commitment.

Analyzing the Impact of Recent Moves in Cryptocurrency Markets

Recent movements within the cryptocurrency markets have underscored the rapid maturation of digital assets. Price fluctuations, regulatory updates, and technological advancements contribute significantly to the sentiment and activity surrounding cryptocurrencies. Thumzup Media’s response to these market dynamics by diversifying its holdings signals a proactive stance that many investors can learn from, as understanding these impacts is essential for navigating investment opportunities effectively.

Additionally, as prominent figures like Donald Trump Jr. invest in Thumzup, the effects ripple across the market, signaling to other investors the potential value in cryptocurrency involvement. This highlights the interconnectedness of market players, where individual actions can influence broader market sentiments. Analyzing the integration of such insights into investment strategies illustrates the growing complexity of digital assets and the importance of staying informed in an ever-changing landscape.

Frequently Asked Questions

What is the significance of Thumzup Media’s $250 million in cryptocurrency diversification?

Thumzup Media’s decision to diversify up to $250 million in digital assets, including Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), and more, marks a pivotal strategy for enhancing their treasury holdings. This diversification allows Thumzup to mitigate risks and capitalize on the potential growth of multiple cryptocurrencies, positioning them as a forward-thinking player in the evolving crypto market.

How does Thumzup Media plan to allocate its $250 million crypto treasury?

Thumzup Media aims to allocate its $250 million treasury across a range of cryptocurrencies, such as Bitcoin (BTC), Ethereum (ETH), Solana, and Ripple (XRP). This approach not only broadens their exposure to various digital assets but also aligns with their strategy of cryptocurrency diversification to enhance overall value for TZUP shareholders.

Why is Thumzup Media including Ethereum (ETH) in its cryptocurrency holdings?

By including Ethereum (ETH) in its cryptocurrency holdings, Thumzup Media acknowledges the significant role ETH plays in the digital asset ecosystem. As a leading platform for smart contracts and decentralized applications, Ethereum’s inclusion helps diversify Thumzup’s portfolio beyond Bitcoin (BTC), potentially increasing overall investment returns.

What impact could Donald Trump Jr.’s investment in Thumzup Media have on the company’s crypto strategy?

Donald Trump Jr.’s acquisition of shares in Thumzup Media could increase exposure and interest in the company’s forward-looking crypto strategy. As Thumzup expands its holdings in Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP), this endorsement may attract more retail and institutional investors who are looking to get involved in cryptocurrency diversification.

How does Thumzup Media’s crypto strategy reflect market trends?

Thumzup Media’s strategy to hold $250 million in cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP) reflects broader market trends towards corporate adoption of digital assets. This move indicates a growing recognition of cryptocurrencies as viable treasury assets for operational strategies, helping businesses adapt to evolving financial landscapes.

What cryptocurrencies are included in Thumzup Media’s $250 million treasury plan?

Thumzup Media’s $250 million treasury plan includes a diversified portfolio of cryptocurrencies, specifically Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Solana, Dogecoin, Litecoin, and the stablecoin USDC. This variety aims to enhance potential returns and reduce risks associated with holding digital assets.

How does Thumzup Media leverage cryptocurrency diversification for shareholder value?

Thumzup Media leverages cryptocurrency diversification by holding a variety of digital assets, including Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP). This strategy allows Thumzup to hedge against volatility in any single asset, potentially increasing overall shareholder value through broader market participation and capital growth in emerging crypto sectors.

What are the potential benefits of Thumzup Media’s investment in Ripple (XRP)?

Investing in Ripple (XRP) offers Thumzup Media access to a unique cryptocurrency focused on facilitating cross-border payments and remittances, which can enhance their overall treasury strategy. The addition of XRP complements their holdings in Bitcoin (BTC) and Ethereum (ETH) and reflects Thumzup’s commitment to a diversified approach in the cryptocurrency market.

| Key Point | Details |

|---|---|

| Approval of $250 Million Plan | Thumzup Media Corp. has received board approval to invest up to $250 million in digital assets. |

| Diversification of Crypto Holdings | The approved cryptocurrencies include BTC, ETH, SOL, XRP, DOGE, LTC, and USDC, moving beyond just Bitcoin. |

| Strategic Positioning | Thumzup aims to diversify its treasury to enhance value for shareholders and optimize market exposure. |

| Corporate Confidence | This decision reflects a growing confidence in the potential of digital assets as a treasury strategy. |

| Notable Investor Interest | The announcement follows Donald Trump Jr.’s acquisition of 350,000 shares in Thumzup, boosting visibility. |

Summary

Thumzup Crypto Holdings is making a significant move by diversifying its portfolio with a substantial investment of $250 million in various cryptocurrencies. This strategic decision not only aims to broaden their asset base beyond Bitcoin but also reflects the company’s confidence in the digital assets market. By holding a diverse range of cryptocurrencies like Ethereum, Ripple, and Solana, Thumzup is positioning itself to maximize potential market gains while delivering value to its shareholders. This proactive approach underlines the growing corporate recognition of cryptocurrencies as a viable operational and treasury strategy.