Trump Tariffs Consumer Prices: What to Expect in 2025

Trump’s tariffs are poised to significantly impact consumer prices, sparking critical debate on their economic implications. The U.S. government’s planned increase in tariff rates on imported goods has economists concerned about rising costs for everyday consumers. According to a model from the Federal Reserve Bank of Boston, extreme tariff rates could boost core inflation by up to 2.2 percentage points, a consideration that directly affects U.S. imports and overall consumer demand. This potential price surge could apply to various sectors, including housing, automobiles, and essential services like healthcare and public transportation. As stakeholders assess the economic impact of tariffs, the broader implications for inflation and consumer purchasing power remain a hot topic.

The looming increase in tariffs proposed by the Trump administration raises urgent questions about how it will affect overall product costs for Americans. Many experts are closely examining the potential ramifications on retail prices and the broader economy, especially as these changes could alter consumer spending patterns. With the U.S. import landscape facing fresh challenges, the implications for core inflation are critical to understand. As import duties rise, sectors reliant on overseas goods may see price adjustments, influencing consumer behavior and demand within the market. Understanding the nuanced economic landscape created by these tariff adjustments is essential for consumers and businesses alike.

Understanding the Economic Impact of Tariffs on Consumer Prices

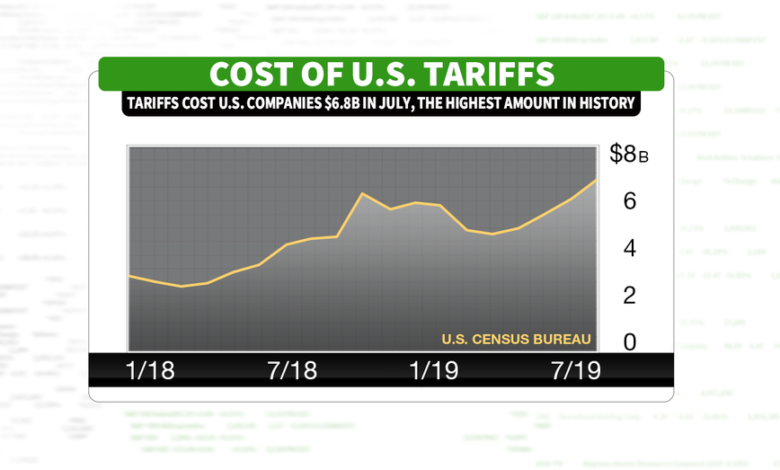

The economic impact of tariffs on consumer prices is a multifaceted issue that merits careful consideration. When the U.S. government increases tariff rates on imported goods, it raises the cost for businesses that rely on these products. This phenomenon is primarily seen in industries like automotive and housing, where imported materials significantly contribute to overall expenses. As production costs rise, businesses are often compelled to pass these expenses onto consumers in the form of higher prices, effectively leading to an uptick in core inflation. The Federal Reserve Bank of Boston predicts that these price hikes could translate to an increase in core inflation rates from 1.4% to 2.2%, which underscores the stark reality consumers may face in the wake of these tariff proposals.

Moreover, the implications of higher consumer prices due to tariff increases extend beyond just goods. As highlighted by economists, even services could see inflated costs because many service providers depend on imported goods for their operations. For example, hospitals may require foreign-sourced medical equipment, the increased costs of which would eventually reflect in healthcare services. This illustrates that tariffs can impact a broad spectrum of the economy, influencing not just retail prices but also essential services that society depends on.

The Interplay Between Tariff Rates and Core Inflation

Tariff rates play a significant role in shaping core inflation, which is a critical indicator of an economy’s health. With the recent proposals to increase tariffs on various imports, there are concerns about how this will affect the broader economic landscape. When tariffs are imposed, the immediate effect is a rise in the cost of imported goods, thereby raising prices domestically. This increase can contribute to overall core inflation, a measure that excludes volatile items such as food and energy, focusing instead on more stable prices influenced by items the average consumer purchases. Economists warn that elevated tariff rates could lead to a sustained increase in this inflation measure, complicating individual financial decisions as well as broader monetary policy.

In essence, the interaction between tariff rates and core inflation reveals the delicate balance policymakers must navigate. Increasing tariffs might be intended to protect domestic industries, yet the resulting implications for inflation could prompt consumer behavior changes. As consumers face rising prices, their discretionary spending may decline, which can, in turn, slow economic growth. The Federal Reserve’s recognition of this potential strain on the economy illustrates the challenges faced in managing tariffs, inflation, and consumer sentiment.

Effects of Trump’s Tariffs on U.S. Imports and Consumer Demand

Trump’s tariffs are poised to have substantial effects on U.S. imports, directly influencing consumer demand across various sectors. By imposing higher tariffs, the government aims to limit the influx of foreign goods, which may initially seem beneficial for domestic production. However, the downside is that these tariffs create heightened prices for consumers who rely on a broader range of imported products. When faced with increased prices due to tariffs, consumer demand could wane as people seek alternatives or forgo purchases altogether, leading to potential shifts in market behavior.

The implications of this shift in consumer demand are particularly pronounced in key industries. For instance, if tariffs make new cars significantly more expensive, consumers may choose to keep their current vehicles longer or opt for more economical options, which can adversely affect sales numbers for automakers. Additionally, sectors dependent on consumer discretionary spending may begin to feel the pinch as households navigate the challenges posed by rising costs. This complex interplay between tariffs and consumer behavior highlights the potential for tariffs to disrupt not just pricing but the entire economic ecosystem.

Consumer Response to Rising Prices Amid Tariff Changes

As tariffs increase and consumer prices rise, understanding consumer response becomes crucial for businesses and policymakers alike. Historically, when faced with rising prices, consumers tend to adjust their spending habits by prioritizing essential goods and services over discretionary items. This shift can manifest in decreased sales for non-essential products, which may ultimately lead to a ripple effect throughout the economy as businesses respond by scaling back production or reducing their workforce. Polls and studies indicate that consumer confidence can also be impacted by price hikes, which can lead to delays in investment and spending decisions.

Furthermore, the psychological impact of inflation cannot be underestimated. When consumers perceive prices to be climbing, they may alter not only their buying habits but their long-term economic outlook as well. This change in perception can lead to a decrease in overall consumer confidence, which is a pivotal driver of economic growth. Businesses that are aware of these consumer sensitivities may adjust their strategies accordingly, potentially implementing sales or promotions to counteract negative effects. Understanding these dynamics is essential for predicting how tariffs influence consumer behavior and, in turn, the broader economy.

The Long-Term Economic Outlook Amid Tariff Discussions

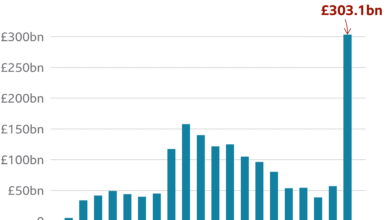

Looking towards the future, the long-term economic outlook amid discussions of tariffs is fraught with uncertainty. Current projections suggest that the economic growth rate may stabilize around 1.7%, a decline from earlier forecasts. This slow growth could be partly attributed to the impact of tariffs on consumer prices and overall demand. As consumers face increased costs, disposable income may shrink, leading to reduced spending and stunted economic expansion. The ongoing debate surrounding tariffs suggests that businesses and consumers alike must brace for potential changes that could affect investment strategies and spending decisions.

In addition to the immediate effects of tariff increases, the long-term consequences may extend to international trade relationships. Countries impacted by U.S. tariffs may seek to retaliate or develop alternative markets for their goods, further complicating the global economic landscape. Thus, the long-term economic outlook must consider not only domestic factors, such as inflation and consumer behavior, but also the international dimension of trade dynamics influenced by tariff policies.

Analyzing the Role of the Federal Reserve in Tariff Events

The Federal Reserve plays a pivotal role in navigating economic policies, particularly in times of increased tariffs and resulting inflationary pressures. By adjusting the federal funds rate, the Fed aims to stabilize prices while promoting maximum employment and economic growth. In light of forecasts suggesting a rise in core inflation due to tariffs, the Fed faces the challenge of addressing these pressures without stifling growth. As mentioned, during recent meetings, the Fed maintained its target for the federal funds rate, reflecting its cautious approach to the uncertain economic climate created by tariff discussions.

Moreover, the Fed’s responsibilities extend beyond mere rate adjustments; it also involves analyzing the broader economic implications of tariff policies on the U.S. economy. By assessing consumer spending, investment patterns, and global trade relationships, the Federal Reserve can provide guidance on the potential ramifications of tariffs on economic growth. Understanding this interplay underscores the crucial role of monetary policy in mitigating the adverse effects that can arise from increased tariff rates and consumer inflation.

Tariffs and Their Impact on Supply Chain Dynamics

The imposition of tariffs inevitably alters supply chain dynamics for businesses operating in the U.S. Many companies have grown accustomed to sourcing materials and products from international suppliers, benefiting from lower costs. However, as tariff rates rise, the financial calculus for these businesses shifts dramatically. The increased costs associated with tariffs may compel companies to explore new sourcing options closer to home, which could bolster domestic production but also strain existing supply chains. Industries reliant on global trade must adapt rapidly to these changes to maintain profitability and efficiency.

This adjustment in supply chain dynamics can lead to realignment within industries and affect competition in the global market. Domestic producers may find new opportunities to compete, but this transition takes time and requires investment in infrastructure and workforce development. The ripple effects of tariffs can lead to a re-evaluation of long-established supply relationships and potentially inspire innovation in product development and sourcing strategies that leverage domestic capabilities. Monitoring these shifts will be essential to understanding the long-term consequences of tariff policies.

International Trade Relationships in the Era of Tariffs

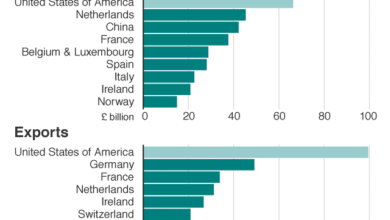

The current era of imposed tariffs signifies a transformational phase in international trade relationships. Countries affected by U.S. tariffs may reassess their trade partnerships, leading to strategic shifts in their export strategies. For instance, nations with close ties to the U.S. might consider renegotiating trade agreements to mitigate the adverse effects of tariffs on their economies. This reassessment can foster greater reliance on regional trade partners and could lead to the formation of new trade alliances. As international markets adapt to tariffs, the global economic landscape will likely undergo significant changes.

Furthermore, tariffs can ignite a cycle of retaliatory measures, complicating diplomatic relationships between the U.S. and its trading partners. Such actions can escalate tensions, leading to broader economic repercussions that affect consumer markets worldwide. Businesses must navigate these evolving trade dynamics carefully, balancing the need for competitive pricing with the complexities posed by fluctuating tariff rates. Ultimately, the international trade relationships in the era of tariffs will necessitate agile strategies that respond to these challenges while seeking new opportunities for collaboration and growth.

Consumer Insights on Tariffs and Price Increases

Understanding consumer insights regarding tariffs and price increases is crucial for businesses and policymakers alike. Recent surveys indicate that consumers are becoming increasingly aware of how tariffs impact their daily lives, particularly concerning rising prices of goods and services. As consumers grapple with budget constraints caused by tariffs, their buying patterns may shift, prioritizing staples over luxury items. This realignment of preferences showcases the significant influence tariffs exert on consumer behavior, highlighting the need for businesses to adapt their marketing strategies accordingly.

Moreover, consumer sentiments toward tariffs can shape political discourse and influence future policy decisions. A growing awareness among the populace regarding the relationship between tariffs, inflation, and consumer prices can lead to greater demand for transparent economic policies. Businesses that align themselves with consumer interests and advocate for fair pricing strategies may ultimately gain consumer loyalty in an evolving economic landscape. By prioritizing consumer insights, businesses position themselves to navigate the challenges imposed by tariffs effectively.

Frequently Asked Questions

How do Trump’s tariffs impact consumer prices?

Trump’s tariffs are designed to increase tariffs on U.S. imports, and this can significantly impact consumer prices. Economists have suggested that these higher tariff rates could lead to a rise in core inflation by approximately 1.4 to 2.2 percentage points in extreme scenarios. Products affected include housing, automobiles, and various consumer services.

What are the expected tariff rates under Trump’s policies?

Under Trump’s trade policies, proposed tariff rates may reach up to 60% on Chinese imports and around 10% on imports from other countries. These increased tariff rates could have a ripple effect on consumer prices across multiple sectors, raising the cost of goods and services.

Will Trump’s tariffs contribute to core inflation in the U.S.?

Yes, the anticipated increases in tariff rates on U.S. imports are expected to contribute to core inflation. Some models predict that this could lead to a rise in inflation rates, further impacting consumer spending and overall economic stability.

How do tariffs affect consumer demand in the U.S.?

Tariffs tend to decrease consumer demand by raising prices on imported goods. As the cost of goods increases due to higher tariffs, consumers may reduce their spending, which in turn affects overall economic growth.

What sectors are likely to be affected by Trump’s tariffs?

Trump’s tariffs could impact several sectors including housing, automobiles, and consumer services such as healthcare and finance. These price increases can lead to higher costs for essential services and goods, thereby affecting consumer decisions.

Are White House economists concerned about inflation due to tariffs?

White House economists claim that tariffs will not significantly contribute to inflation, asserting that the U.S., as the largest consumer market, has leverage over foreign suppliers, which may absorb some of the economic impacts of the tariffs.

What has the Federal Reserve stated about the economic impact of tariffs?

The Federal Reserve has expressed that assessing the full economic impact of tariffs is challenging. Despite existing economic pressures, they have kept the federal funds rate target unchanged, indicating a cautious approach to potential inflation related to tariffs.

How might tariffs affect consumer services?

Tariffs might not only increase the prices of goods but also affect consumer services. For instance, hospitals that rely on imported medical equipment may see their costs rise, leading to higher charges for services offered to consumers.

What is the forecast for U.S. GDP growth amid Trump tariffs?

Economic forecasts suggest that U.S. GDP will continue growing, albeit at a slower rate of around 1.7% in 2025. The ongoing tariffs and their economic ramifications could impact this growth trajectory and consumer confidence.

What precautions should consumers take regarding tariffs?

Consumers should remain aware of potential price increases due to Trump’s tariffs. Monitoring price trends and being prepared for changes in the cost of living can help consumers make informed purchasing decisions.

| Key Point | Details |

|---|---|

| Expected Price Increases | Trump’s tariffs could raise consumer prices significantly, with projections suggesting a 1.4% to 2.2% increase in core inflation under extreme scenarios. |

| Specific Tariff Rates | Tariffs proposed could reach 60% on Chinese imports and 10% on imports from other countries. |

| Sectors Affected | Housing, automobiles, and services like nursing and public transportation may see price hikes. |

| Economists’ Opinions | While some predict inflation increases, White House economists argue that tariffs won’t lead to meaningful inflation. |

| Federal Reserve Response | The Federal Open Market Committee has maintained its federal funds rate target, factoring in potential tariff impacts. |

| GDP Forecasts | U.S. GDP growth is projected to be 1.7% for 2025, slower than earlier forecasts. |

| Global Impact | Companies are facing challenges as they may shift production outside the U.S., citing cost and productivity. |

Summary

Trump tariffs on imports are projected to influence consumer prices significantly, with experts estimating a potential inflation rise of over 2%. These tariffs, particularly high rates on goods from China and other countries, could impact various sectors, including housing and automobiles. While the White House holds a contrary view, stating tariffs may not substantially affect overall inflation, the consensus among some economists warns consumers and businesses to prepare for price increases as the global economic environment evolves.