Cadillac Electric Vehicles: A Surge in New Buyers

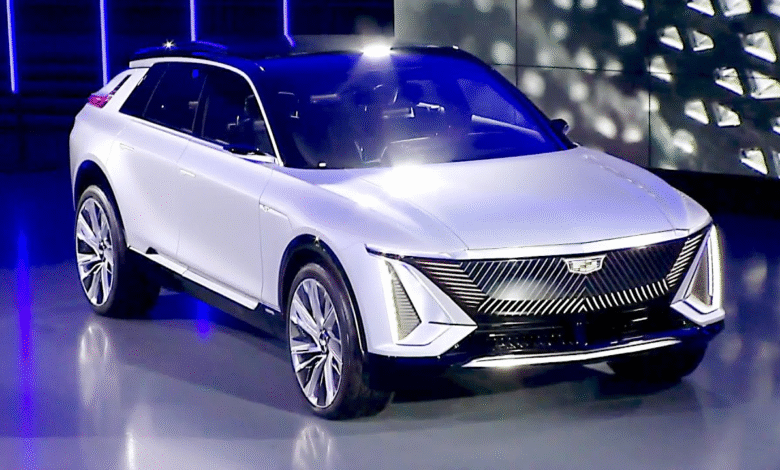

Cadillac electric vehicles have taken the automotive world by storm, redefining luxury with their innovative all-electric lineup. As the appeal of luxury electric SUVs grows, Cadillac is attracting new buyers, including many Tesla owners eager to trade in their EVs for Cadillac’s cutting-edge models. A substantial portion of these customers, nearly 80%, are fresh faces to the iconic brand, highlighting Cadillac’s successful strategy in capturing the electric vehicle market. The Cadillac Lyriq and the upcoming Escalade IQ stand out as prime examples of this shift, combining cutting-edge technology with the sophistication and comfort that Cadillac is known for. With its sights set firmly on becoming a leader in the luxury EV segment, Cadillac is poised to challenge established players like Tesla, making waves in the market with each new release.

The rise of Cadillac’s electric vehicle offerings marks an exciting chapter in the evolution of luxury automobiles. Known for their high-performance and innovative designs, Cadillac is now venturing into the electric realm, appealing not just to longtime fans but also attracting a younger demographic of eco-conscious drivers. With vehicles like the Cadillac Lyriq leading the charge and the upcoming Escalade IQ promising to deliver on the brand’s luxury promise, Cadillac is redefining what it means to drive a premium electric vehicle. This strategic pivot from traditional gas-powered models to electric results from a growing demand for sustainable options, providing consumers with a choice that aligns with their values. As the competition heats up with other brands, Cadillac is uniquely positioned to capture a significant share of the luxury electric market.

The Rise of Cadillac Electric Vehicles

Cadillac’s foray into the realm of electric vehicles (EVs) represents a significant transformation for the iconic luxury brand. New models like the Cadillac Lyriq and the Escalade IQ showcase not only technological advancements but also a commitment to sustainability. This shift is drawing a substantial number of new customers, particularly from competitors like Tesla, who are increasingly looking for alternatives in the luxury electric SUV market. The allure of zero emissions combined with Cadillac’s storied legacy of luxury is appealing to those who value both prestige and eco-friendliness.

As Cadillac launches a broader range of electric vehicles, nearly 80% of recent buyers of Cadillac EVs are newcomers to the brand. The Cadillac Lyriq, in particular, has seen a 25% uptick in Tesla owners trading in their vehicles. This trend not only underscores Cadillac’s ability to capture the luxury EV market but also highlights a shifting consumer preference, with many potential buyers associating electric technology with high-end features. Cadillac’s strategy to provide a diverse lineup—from the entry-level Optiq to the high-end Celestiq—positions it as a formidable player in the luxury electric landscape.

Cadillac’s Competitive Edge Against Tesla

In the competitive luxury electric SUV market, Cadillac is leveraging its strong heritage and innovative designs to attract Tesla owners. With the introduction of models like the Cadillac Escalade IQ, the brand is not merely entering the EV space but reshaping expectations for what an electric luxury vehicle can offer. As reported, around 10% of Tesla owners are now considering Cadillac EVs, indicating a significant conquest rate that could sway the industry’s balance in Cadillac’s favor.

Cadillac’s ability to appeal to disillusioned Tesla owners can be attributed to its robust marketing strategy and the appeal of its diverse vehicle portfolio. The Cadillac Lyriq offers a unique blend of style, performance, and advanced technology, giving it a competitive advantage. Add to this the whispers of dissatisfaction surrounding Tesla’s recent corporate image and you have a fertile ground for Cadillac to attract those seeking a fresh start in the luxury electric market.

Understanding Tesla Trade-Ins and Market Shifts

The trade-in trend from Tesla to Cadillac reflects broader market shifts that could redefine consumer perceptions of electric vehicles. With an increase in the percentage of Tesla owners opting for Cadillac vehicles, it raises important questions about brand loyalty and consumer expectations. The influence of social and political factors, such as Elon Musk’s public statements, appears to be pushing some Tesla owners toward Cadillac as they seek a brand that aligns more closely with their values.

In particular, Cadillac’s strategic positioning around its luxury electric SUV offerings plays a crucial role. By appealing to an audience that values both automotive performance and craftsmanship, Cadillac is successfully converting customers who might have otherwise remained loyal to Tesla. This trend is expected to continue as the Cadillac EV lineup grows and evolves, bolstering the brand’s image as a luxury alternative to Tesla’s more mainstream offerings.

Cadillac’s Luxury Electric SUV Lineup

Cadillac’s electric vehicle lineup is rapidly expanding, showcasing a variety of luxury SUVs tailored to meet the desires of modern consumers. The Cadillac Lyriq, recognized for its elegant design and cutting-edge technology, has already earned positive reviews from buyers and critics alike. Meanwhile, the upcoming Escalade IQ stands as a testament to Cadillac’s commitment to luxury and innovation in the SUV segment. These models signify Cadillac’s intent to not only compete in the luxury electric vehicle space but to dominate it.

With the Cadillac EV portfolio now including the Optiq, Lyriq, Escalade IQ, and a bespoke Celestiq vehicle, the brand is setting itself apart from rivals. Each model is equipped with advanced features and luxurious details tailored to enhance the driving experience. As demand for electric luxury SUVs continues to surge, Cadillac’s emphasis on creating high-performance, stylish, and environmentally friendly vehicles positions it well for future growth in the evolving automotive market.

Exploring Consumer Preferences and Market Trends

As the dynamics in the car market evolve, understanding consumer preferences plays a vital role for brands like Cadillac. The promising data indicates that many of Cadillac’s clients are opting for these luxury EVs over traditional gas-powered vehicles and earlier favorites from Tesla. In particular, the Cadillac Lyriq has emerged as a favorite among luxury SUV enthusiasts, showcasing the brand’s competitive appeal amidst shifting market trends.

The trend of luxury crossover buyers gravitating towards electric vehicles reflects a broader societal shift toward sustainability without sacrificing performance or comfort. With brands like Cadillac stepping up to meet this demand, the landscape of electric vehicle ownership is likely to change as new models are introduced and traditional perceptions are challenged. This shift highlights Cadillac’s opportunity to not only attract Tesla trade-ins but to forge a new identity in the luxury car segment.

The Cadillac Experience: Luxury Meets Innovation

Cadillac’s entry into the electric vehicle market is not just about providing a product; it’s about creating an unforgettable experience for new customers. By integrating technology and comfort within the luxurious realm of Cadillac, the brand aims to redefine what owning a luxury EV means. This compelling combination of advanced engineering and exquisite design offers consumers a compelling reason to shift loyalty from brands like Tesla.

The Cadillac experience goes beyond the car itself. The brand is keen on establishing long-term relationships with its customers, emphasizing service, quality, and innovation. Initiatives such as personalized customer support and exclusive events underscore Cadillac’s commitment to customer satisfaction. As new buyers, including many from Tesla, discover the Cadillac difference, this experience could be pivotal in building a loyal customer base that values not just the vehicle but the entire brand ethos.

Electrifying the Future: Cadillac’s Vision

Cadillac’s vision for the future involves leading the charge in the luxury electric vehicle segment. By expanding its current lineup and committing to innovative designs, Cadillac aims to establish itself as a frontrunner among luxury brands as consumer preferences shift toward electric mobility. With the introduction of models like the Cadillac Escalade IQ and the high-end Celestiq, the brand is showcasing a roadmap for how luxury can intersect with sustainability.

Looking ahead, Cadillac’s strategy focuses on diversification within its EV lineup while maintaining the ethos of luxury that has long been associated with the brand. As the automobile industry leans more heavily on electric vehicles, Cadillac’s forward-thinking approach positions it as a brand of choice for discerning buyers. By emphasizing the importance of both performance and environmental issues, Cadillac is preparing not just to enter the market, but to lead it.

Technology and Performance in Cadillac’s EV Range

The technological innovation behind Cadillac’s electric vehicles is a major factor contributing to its recent surge in popularity. With features such as advanced driver-assistance systems, state-of-the-art infotainment options, and powerful electric drivetrains, Cadillac is ensuring that performance and luxury go hand-in-hand in its EV lineup. The seamless integration of technology within models like the Lyriq has positioned it as a strong competitor in a market dominated by existing brands.

This focus on technology is also key to Cadillac’s broader appeal among younger consumers who prioritize advanced features alongside luxury. By utilizing the latest technology, Cadillac is not just keeping pace with competitors like Tesla; it is setting new benchmarks for what luxury electric vehicles can accomplish in terms of performance and functionality. This paves the way for Cadillac to attract a new generation of buyers looking for sophistication matched with cutting-edge technology.

Sustainability and Cadillac’s Electric Future

As discussions around sustainability gain momentum in the automotive industry, Cadillac is prioritizing eco-friendly practices across its electric vehicle lineup. Recognizing the importance of reducing carbon footprints, Cadillac is committed to producing electric vehicles that do not compromise on luxury or performance while ensuring environmentally sustainable production practices. This dedication resonates well with a growing demographic of consumers who are looking for ways to reduce their environmental impact without sacrificing quality.

The shift towards sustainability is reflected not only in Cadillac’s choice of materials and manufacturing processes but also in its broader corporate ethos. By aligning its vision with the demands for luxury and environmental responsibility, Cadillac is carving out a niche for itself in the competitive luxury EV market. Offering consumers an electric vehicle that feels good on the road, and morally satisfying in their contribution to the environment is a winning combination that is expected to propel Cadillac forward.

Frequently Asked Questions

What makes the Cadillac Lyriq a popular choice among luxury electric SUVs?

The Cadillac Lyriq stands out in the luxury electric SUV market due to its innovative design, advanced technology, and impressive performance. As part of Cadillac’s expanding EV lineup, the Lyriq offers features such as a spacious interior, cutting-edge infotainment systems, and exceptional electric range, making it an attractive option for those looking to transition to an electric vehicle.

How does the Cadillac Escalade IQ differ from other Cadillac EV models?

The Cadillac Escalade IQ distinguishes itself by offering the luxury and grandeur associated with the Escalade name while incorporating all-electric performance. As Cadillac’s full-size luxury SUV, it features a spacious cabin, advanced technology, and a powerful electric drivetrain, making it ideal for both luxury and sustainability-conscious consumers.

Are Cadillac EVs a good trade-in option for Tesla owners?

Yes, Cadillac EVs, particularly the Lyriq, are becoming popular trade-in options for Tesla owners. Approximately 10% of Cadillac EV buyers are trading in their Teslas, attracted by Cadillac’s luxury offerings and compelling features that provide a strong alternative to the Tesla experience.

What is the significance of Cadillac’s focus on the luxury electric vehicle market?

Cadillac’s commitment to the luxury electric vehicle market is significant as it positions the brand to capture a growing segment of consumers who prioritize both luxury and sustainability. With models like the Lyriq and Escalade IQ, Cadillac aims to become the leading luxury EV brand, especially as competitors like Tesla face challenges in consumer perception.

What are the key features of the Cadillac EV lineup?

Cadillac’s all-electric vehicle lineup includes the Lyriq, an entry-level Optiq crossover, the full-size Escalade IQ, and the performance-oriented Lyriq variant. These models feature advanced technology, high-performance electric drivetrains, and luxurious interiors, catering to the needs of discerning buyers in today’s market.

How does Cadillac attract new customers from other brands like Tesla?

Cadillac attracts new customers, including many Tesla owners, through a robust EV portfolio and a focus on delivering high-quality luxury electric vehicles. With nearly 80% of recent Cadillac EV buyers being new to the brand, Cadillac showcases its competitive edge in technology, luxury, and performance, incentivizing customers to switch from Tesla.

What should potential buyers know about the Cadillac Lyriq’s performance?

Potential buyers should know that the Cadillac Lyriq offers impressive performance features, including rapid acceleration, a long electric range, and sophisticated handling. It is designed to compete directly with other luxury electric SUVs, providing a seamless driving experience while emphasizing Cadillac’s commitment to innovation and luxury.

How is Cadillac responding to the growing competition in the electric vehicle market?

Cadillac is responding to the growing competition in the electric vehicle market by expanding its EV lineup and investing in new technologies. With models like the Lyriq and Escalade IQ, Cadillac aims to set itself apart in the luxury segment by providing consumers with unique offerings that blend performance, luxury, and sustainability.

What kind of consumer market is Cadillac targeting with its EVs?

Cadillac is primarily targeting the luxury consumer market with its electric vehicles, aiming to attract both existing luxury buyers and those transitioning from mainstream brands like Tesla. By offering high-end features and sophisticated design, Cadillac aims to position itself as the go-to brand for luxury electric vehicle enthusiasts.

Is the Cadillac Escalade IQ expected to rival Tesla models?

Yes, the Cadillac Escalade IQ is expected to rival Tesla models, particularly in the luxury SUV segment. With its premium features, advanced technology, and powerful electric performance, the Escalade IQ aims to compete directly with Tesla’s higher-end models, showcasing Cadillac’s capabilities in the electric vehicle market.

| Key Point | Details |

|---|---|

| New Buyers | Cadillac’s EV lineup is attracting new customers, with 8 out of 10 being new to the brand. |

| Tesla Trade-Ins | Approximately 10% of new Cadillac EV buyers are Tesla owners trading in their vehicles. |

| Market Strategy | Cadillac sees an opportunity to increase its share of Tesla owners amid Tesla’s declining sales. |

| Current EV Model Lineup | Cadillac offers models like the Optiq, Lyriq SUV, Vistiq, and Escalade IQ, with plans for a high-end Celestiq. |

| Competitive Landscape | Cadillac aims to become the top luxury EV brand, distinguishing its marketing strategy from Tesla. |

| Consumer Behavior | Current Tesla owners are not actively comparing to Cadillacs, indicating a deliberate move away from Tesla vehicles. |

Summary

Cadillac electric vehicles are shaping a new chapter for the luxury brand, appealing especially to a growing demographic of first-time buyers. As Cadillac continues to expand its all-electric lineup, it is poised to attract even more customers from competitors like Tesla, especially during a time when the latter faces challenges in consumer perception. The strategic positioning of models like the Lyriq and Escalade IQ not only enhances Cadillac’s portfolio but also solidifies its commitment to becoming the leading luxury EV brand in the market.