Intel Q2 Earnings Report Exceeds Expectations for 2023

Intel’s Q2 earnings report reveals a mixed but hopeful outlook as the newly appointed CEO, Lip-Bu Tan, leads the semiconductor giant through a pivotal transformation. On Thursday, the company announced a revenue of $12.6 billion, surpassing Wall Street estimates of $11.92 billion, although it still faced a net loss of $2.9 billion. Despite the challenges, Intel’s stock has shown resilience, climbing approximately 13% this year as Tan implements significant operational cuts in chip factory construction aimed at streamlining the organization. Looking ahead, the Intel revenue forecast predicts third-quarter earnings could exceed analyst expectations, targeting $13.1 billion. With Tan committed to restructuring and restoring investor confidence, the Intel earnings report could mark the beginning of a turnaround for the iconic chipmaker.

In its second-quarter financial results, Intel has provided insight into its current performance and strategic direction under the leadership of CEO Lip-Bu Tan. The tech firm reported revenue exceeding prior expectations while simultaneously facing significant net losses, prompting cuts in factory construction projects. As the organization recalibrates its focus towards more economically viable chip manufacturing processes, the Intel revenue forecast looks promising for the upcoming months. Furthermore, the improvement in Intel’s stock performance amid these initiatives suggests a potential revival of market sentiments. Investors and analysts alike are watching closely as the company adapts to shifting market conditions and strives to reclaim its position in the competitive semiconductor landscape.

Intel Q2 Earnings Report Exceeds Expectations

Intel’s second-quarter earnings report, released recently, has significantly surpassed Wall Street estimates, highlighting a period of strategic transition under new CEO Lip-Bu Tan. The reported revenue of $12.6 billion was well above the projected $11.92 billion, demonstrating the company’s resilience despite broader industry challenges. Adjusted earnings per share, while still a loss of 10 cents, reflected the cautious optimism that permeates the company as it navigates its restructuring efforts. Analysts had expected a grim outlook, but Intel’s robust revenue numbers suggest that the company’s pivot might yield positive results sooner than anticipated.

This earnings report is crucial, as it marks the second showing since Tan took the helm. His leadership style focuses on simplifying management and operational efficiency, which is reflected in this quarter’s results. Though Intel incurred a net loss of $2.9 billion, the revenue figures indicate a stabilization effort, potentially reclaiming ground in the semiconductor market. Tan’s acknowledgment of the company’s past troubles, including an $800 million impairment charge, sets a clearer path toward recovery, emphasizing a future backed by data and customer commitments rather than speculative expansions.

Impact of Lip-Bu Tan on Intel’s Strategy

Under the leadership of Lip-Bu Tan, Intel is undergoing a vital transformation aimed at revitalizing its core product offerings and overall market strategy. As the new CEO, Tan has implemented significant operational changes designed to streamline processes and improve performance metrics. His announcement of reducing chip factory construction expenditures in favor of evaluating market demands directly aligns with Intel’s historical pattern of over-investment and inefficiency in manufacturing. This pivot is expected to foster a more sustainable growth model in the highly competitive semiconductor landscape.

Moreover, Tan’s decisive actions, including the consolidation of testing and assembly operations and the cancellation of projects in Europe, reflect a calculated approach to stabilize Intel’s foundry business. By focusing resources where they can yield the most substantial return on investment, Tan aims to address the systemic issues that have plagued Intel in prior years, including the company’s struggle to attract major clients in its foundry services.

Intel’s Revenue Forecast for Q3 and Beyond

Intel’s forecast for the third quarter signals an optimistic outlook, with the company projecting a revenue of approximately $13.1 billion, which exceeds analysts’ expectations. This anticipated growth is set against a backdrop of strategic layoffs, which have restructured the workforce to currently stand at around 75,000 employees. The goal of breaking even on earnings by the end of Q3 highlights a shift towards increased efficiency and a more responsive operational model. The analyst community appears cautiously optimistic as Intel’s strategy develops, particularly in light of the anticipated performance improvements.

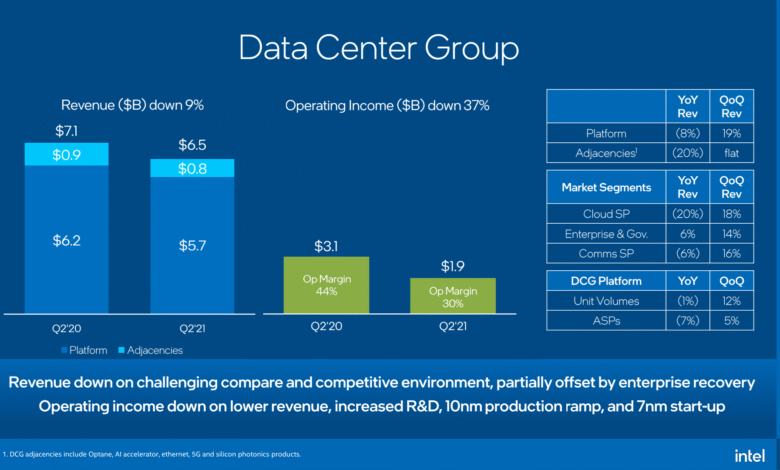

Looking further ahead, the key to Intel’s recovery will involve not just meeting quarterly forecasts but also reestablishing a foothold in critical markets such as data centers and personal computing. The noted increase in revenue from Intel’s data center group is a good indication that the company’s renewed strategic focus is beginning to pay off. By prioritizing sectors where they can directly challenge competitors like AMD and emphasizing the need for innovative chip designs, Intel is positioning itself for a stronger market presence.

Intel’s Stock Performance Following Earnings Report

Following the release of its second-quarter earnings report, Intel’s stock showed a nuanced response by rising approximately 13% year-to-date. This recovery is particularly significant given the formidable decline of around 60% the previous year, marking it as one of the worst periods in the company’s history. The slight uptick in after-hours trading after the earnings call reflects investor confidence in Lip-Bu Tan’s strategic direction. They appear to appreciate the transparent approach he’s taking to communicate both the challenges faced and the recovery plan in motion.

Moreover, the improved stock performance indicates that shareholders are beginning to trust Tan’s leadership after a tumultuous period for the company. The combination of robust earnings surprises and a realistic outlook on future revenues contributes positively to investor sentiment. As Intel continues its restructuring and moves to cut back on operating costs while rationalizing its operations, investor expectations may continue to rise, depending on the realized results of Tan’s ambitious yet necessary plans.

Strategic Cuts in Chip Factory Construction

In a decisive move to address past mismanagement, Lip-Bu Tan has announced significant cuts to chip factory construction. This strategy is designed to align Intel’s production capabilities with actual market demand, which has been a recurring issue for the enterprise. By canceling construction projects in regions such as Germany and Poland, Intel aims to optimize its balance sheet and invest in areas expected to generate sustainable revenue streams. This shift away from unaccountable expansion reveals a critical understanding of market dynamics and fiscal responsibility amid the semiconductor industry’s ongoing evolution.

Tan’s strategy emphasizes prioritization over the past year’s excessive growth, which led to substantial losses. Through a clearer focus on customer-driven innovation and careful evaluation of investments, Tan is proactively shaping Intel’s future. The anticipated construction of a cutting-edge factory in Ohio is now contingent upon confirmed customer interest, indicating a significant change from speculative projects to a more calculated, accountable approach.

Challenges and Opportunities in the Foundry Division

Intel’s foundry division continues to face both challenges and opportunities. Recently reporting an operating loss of $3.17 billion against $4.4 billion in revenue, this division represents a significant risk factor for Intel’s overall performance. Tan has reiterated the need to stabilize this part of the business, particularly as it seeks to develop a robust customer base to support its operations. Identifying major clients is crucial for the foundry’s success, as Intel strives to compete effectively against leading rivals in the chip manufacturing space.

The challenges faced by Intel’s foundry division highlight the complexities of transitioning from a primary manufacturer of its chips to a service-oriented foundry model. Tan’s directive to closely review chip designs before production signifies a commitment to quality and customer satisfaction, aiming to foster greater client relationships. By ensuring that future designs are market-driven rather than simply reflective of internal capabilities, Intel is positioning itself to make a significant impact in the burgeoning foundry market.

Market Share and Competition in the Chip Industry

Intel’s endeavor to reclaim market share, particularly in its data center technology segment, comes at a crucial time. With competitors, especially Advanced Micro Devices (AMD), gaining traction, Tan understands the necessity of agile strategies to stay relevant. The reported $3.9 billion increase in revenue from the data center group signifies positive growth, showing that Intel can still compete effectively under the new regime. Targeted investments in design and production could very well allow Intel to recapture lost segments and innovate in new areas of technology.

Strategically, competing against seasoned rivals means prioritizing unique selling propositions in Lenovo’s offerings. Tan’s insistence on directly overseeing all chip designs marks a tactical shift intended to elevate quality and precision in product offerings. This stringent oversight aims to bolster Intel’s product credibility within a market that demands high-performance solutions. The path ahead is laden with challenges, yet Tan’s targeted focus on regaining lost ground may lay the foundation for a revitalized Intel.

Evaluating Earnings Amidst Economic Factors

As Intel evaluates its latest earnings in the larger context of economic conditions, it finds itself navigating a landscape of inflation, supply chain disruptions, and shifting consumer demand. The reported loss for the second quarter reflects not just company-specific issues but broader industry challenges that have yet to stabilize. Companies across technology sectors are contending with rising production costs and lower consumer spending, factors that undeniably impact revenue forecasts and operational viability.

However, amidst these pressing economic factors, Intel’s proactive and transparent communication regarding its financial health and future plans has resonated with stakeholders. The anticipated earnings for the upcoming quarter, hinting at a potential break-even point in earnings, provide a glimmer of hope that the company’s efforts to reduce operational costs and refine product offerings could yield dividends. Investors are watching closely to see if the company’s adjustments will translate into sustainable growth despite the economic headwinds.

Future Innovations and Upgrades at Intel

Intel’s future innovations hinge on the upcoming 14A chip manufacturing process, which aims to emphasize customer needs rather than speculative ventures. This approach aligns with Tan’s broader strategy to ensure that all technological advancements are grounded in definitive market demands. By focusing on confirmed customer commitments, Intel is not merely reacting to trends but actively shaping its technological roadmap, which could result in products that resonate more effectively with client specifications and preferences.

The 14A process embodies a critical shift towards economic accountability within Intel’s operations, promoting reliability and efficiency in production. As the company prioritizes innovations, the emphasis on customer feedback could catalyze new ideas that set Intel apart in an increasingly crowded marketplace. Tan’s vision revolves around fueling sustainable innovations and fostering designs that align intimately with user needs and requirements, positioning Intel to adapt and thrive in a competitive industry future.

Frequently Asked Questions

What were the key highlights of Intel’s Q2 earnings report?

In Intel’s Q2 earnings report, the company reported revenues of $12.6 billion, exceeding analyst expectations of $11.92 billion. Although they faced a loss of 10 cents per share, the anticipated revenue for Q3 stands at $13.1 billion, indicating improving performance as the company transitions under CEO Lip-Bu Tan’s leadership.

How did Intel’s stock perform following the Q2 earnings report?

Following the Q2 earnings report, Intel’s stock experienced a slight rise in after-hours trading, reflecting market confidence after the company exceeded revenue expectations and outlined a strategic plan for cost reductions and factory construction cuts under CEO Lip-Bu Tan.

What changes has CEO Lip-Bu Tan implemented in response to Intel’s Q2 earnings report?

In response to Intel’s Q2 earnings report, CEO Lip-Bu Tan announced significant cuts in chip factory construction and a focus on consolidating operations. His strategic adjustments aim to revitalize Intel’s product lines and reduce operational costs amidst challenging market conditions.

What is Intel’s revenue forecast for the third quarter following the Q2 earnings report?

Intel’s revenue forecast for the third quarter, as detailed in the Q2 earnings report, is projected to be $13.1 billion. This figure surpasses the average market analyst estimate of $12.65 billion, suggesting a positive outlook for the company’s recovery.

What were the highlights of Intel’s performance in the Q2 earnings report compared to last year?

In the Q2 earnings report, Intel reported a net loss of $2.9 billion, a decline from a loss of $1.61 billion compared to the same period last year. Despite a challenging year, Intel’s revenue of $12.6 billion demonstrated resilience, signaling a potential turnaround under new leadership.

How is Intel planning to recover from its operational losses indicated in the Q2 earnings report?

Intel plans to recover from its operational losses, as highlighted in the Q2 earnings report, by implementing significant cost-cutting measures, including layoffs and reducing factory construction expenses. The company aims for improved efficiency and profitability through strategic investments aligned with confirmed customer commitments.

What impact did Intel’s Q2 earnings report have on its foundry division?

Intel’s Q2 earnings report revealed significant operating losses in its foundry division, which lost $3.17 billion on $4.4 billion in revenue. CEO Lip-Bu Tan announced drastic spending cuts in this area and emphasized the need to find major customers to stabilize this segment of the business.

What does Intel’s Q2 earnings report reveal about its manufacturing strategy?

Intel’s Q2 earnings report highlights a shift in its manufacturing strategy, moving away from speculative investments to a more accountable model based on verified customer commitments. This change aims to optimize operations and prevent over-investment as the company adjusts to market demands.

How does Intel’s client computing group performance relate to its Q2 earnings report?

In the Q2 earnings report, Intel’s client computing group saw a 3% annual decline in sales, totaling $7.9 billion. Despite this setback, the data center group reported a 4% revenue increase, underscoring a varied landscape within Intel’s businesses as they navigate recovery.

| Key Metrics | Intel Q2 Performance | Analyst Expectations |

|---|---|---|

| Earnings per Share | Loss of 10 cents per share | Loss of 4 cents per share (projected) |

| Revenue | $12.6 billion | $11.92 billion |

| Net Loss | $2.9 billion | N/A |

| Next Quarter Revenue Guidance | $13.1 billion (midpoint) | $12.65 billion (avg estimate) |

| Year-to-Date Stock Performance | +13% | N/A |

Summary

The Intel Q2 earnings report reveals that the company surpassed Wall Street’s revenue expectations amidst significant restructuring efforts under new CEO Lip-Bu Tan. With a focus on economic accountability and a disciplined approach to spending, Intel is taking steps to stabilize its operations and regain market leadership, particularly in the data center sector. After a challenging year in 2024, this report reflects both a strategic pivot in operations and a cautious optimism for upcoming quarters.