US Tariff Rates Reach Highest Level Since 1934

US tariff rates have become a central issue in discussions about international trade, reflecting the highest levels seen since 1934, with an average effective rate of 17.8%. Despite recent trade agreements with nations like China and the U.K., these tariffs are still significant, particularly the 10% tariffs imposed during the Trump administration, which affect a vast array of goods. The implications of such tariffs extend beyond government policy, directly impacting consumers, who could face an estimated $2,800 increase in costs per household in the short run. As businesses adjust to these higher tariffs, particularly on imports from China, shifts in purchasing behavior are anticipated that may redefine market dynamics. Understanding the current landscape of US tariff rates is essential for consumers, businesses, and policymakers alike, as it shapes both domestic markets and international relations.

As we delve into the complexities of import taxes within the United States, particularly the various duties levied on overseas goods, it becomes clear that these rates wield considerable influence over the economy. The ongoing tariff discussions, particularly those relating to international trade agreements and their implications for American consumers, warrant close attention. Recent decisions by officials regarding tariffs on imports from countries like China and the U.K. showcase how trade policy continues to evolve and adapt. With significant financial burdens expected on households, these tariffs not only shape economic conditions but also alter consumer behavior across the board. Consequently, understanding these trade regulations is critical as we navigate the current economic landscape.

Understanding US Tariff Rates in 2023

In 2023, the average effective tariff rate on imports in the United States stands at a significant 17.8%, marking the highest level since 1934 according to a recent report from the Yale Budget Lab. This statistic reveals the continued impact of tariff policies initiated during President Trump’s administration, which sought to renegotiate trade agreements and impose tariffs on a wide array of imported goods. Despite efforts to forge new trade relations with countries like China and the UK, the current tariff levels signify an ongoing strain in international commerce and higher costs for American consumers.

The elevated US tariff rates are particularly consequential as they result from strategic economic decisions rather than market forces alone. While recent tariff reductions on China have been announced, the complexities of trade agreements mean that changes in tariff rates take time to materialize, and the overall cost burden on consumers remains significant. This environment fosters uncertainty among businesses and consumers alike, necessitating adaptations in purchasing behavior and supply chain management.

The Economic Impact of Tariffs on US Consumers

The economic implications of high tariff rates extend profoundly to American consumers, with estimates suggesting that the average household could face an increased cost burden of up to $2,800 in the short run. This figure illustrates the direct pressure that tariffs exert on retail prices, especially for everyday goods sourced from countries subjected to high tariffs. Historically, tariffs on imports work like taxes, leading to inflated prices passed on to consumers, which can significantly alter purchasing choices.

Moreover, as tariffs primarily affect products imported from nations like China, consumers are prompted to consider alternative purchasing options. This behavioral shift aims at circumventing additional costs, indicating that tariffs could inadvertently drive local business and production, albeit at greater prices for the current consumer base. Alongside higher consumer costs, there’s also a broader fear of inflation, compounded by ongoing tariff policies that create economic ripples affecting various sectors beyond just consumer goods.

Trump Tariffs: A Retrospective Analysis

President Trump’s administration ushered in a new era of tariffs that fundamentally reshaped U.S. trade dynamics. The imposition of tariffs on a diverse array of products aimed to protect American industries and rebalance trade deficits, especially with countries like China. These tariffs have far-reaching effects, challenging existing trade agreements and increasing tensions on the global economic landscape. As reports from Yale Budget Lab highlight, these policies contributed significantly to current high effective tariff rates, essentially institutionalizing what was once seen as an emergency economic measure.

Looking back on these tariff policies, it is clear they have had unintended (and often negative) repercussions for both consumers and businesses. Economists suggested that instead of protecting U.S. jobs, the tariffs have instead led to increased costs for importing key goods, altering consumer habits and expectations. As trade talks continue to evolve, understanding the long-term implications and sustainability of Trump-era tariffs will be crucial for American economic health moving forward.

Recent Changes in US Trade Agreements

Recent modifications in U.S. trade agreements, particularly with China and the UK, reflect an ongoing effort to recalibrate the economic landscape. With tariffs on China being officially set at 30%, down from previous highs, these adjustments aim to foster more cooperative economic relations while ostensibly relieving pressure on American consumers. However, it’s essential to recognize that any reduction in tariffs could be more symbolic than substantive, as long-term conditions and pathways for trade normalization remain complex and fraught with uncertainty.

Trade agreements also serve as a pivotal tool for the U.S. in enhancing its global competitiveness, emphasizing not only tariff reductions but also aligning policy goals with trading partners. The recent agreement with the UK, although lacking in specificity, underscores a commitment to fostering transatlantic trade relationships, which could lead to more favorable economic outcomes in the future. However, the balancing act between lowering tariffs and protecting U.S. interests will require continued vigilance and strategic foresight.

The Impact of China Tariffs on American Trade

Tariffs imposed on Chinese goods have consistently been a focal point of trade discussions in the U.S., with their influence pertinent to understanding the current economic climate. The ongoing tariffs significantly affect both imports and exports, creating a ripple effect that extends beyond trade balances into consumer markets. As U.S. officials negotiate tariffs, many anticipate that these changes will have substantial implications for pricing, the availability of products, and overall economic interaction between the two countries.

Moreover, as China adjusts its tariffs on U.S. goods, an intricate dance unfolds. The decrease from 125% to 10% offers some relief; however, the extensive nature of tariffs levied creates a dual-edged sword where businesses must navigate higher production costs versus the advantages of accessing the vast Chinese market. The interplay of these tariffs dictates strategic shifts for American businesses, potentially reshaping supply chains and influencing market entry strategies.

Exploring UK Tariff Policy and Its Effects

The UK’s approach to tariff policy in light of recent trade agreements with the U.S. presents an intriguing study for economists and policymakers. The confirmation of a 10% tariff on the initial tranche of imported cars from the UK, as articulated by President Trump, signifies the U.S. intention to create a fairer trading environment while attempting to foster goodwill between the two nations. However, these tariffs are also a reminder of the complexities of post-Brexit trade relations.

As the UK adjusts its trading practices, the real implications of such tariffs will likely emerge in consumer shopping behaviors and business strategies. The introduction of these tariffs could inadvertently lead to elevated costs for British imports, thus influencing consumer preferences in favor of domestically produced goods. This situation introduces potential volatility in trade and consumer sentiment as both countries work to adapt their markets and industries under the weight of these tariffs.

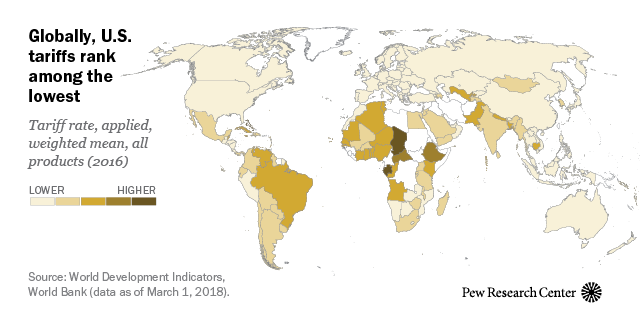

Comparing Historical and Current Tariff Rates

Historically, tariff rates have fluctuated significantly within the U.S., often reflecting broader economic trends and crises. Presently, the effective average tariff rate of 17.8% is striking compared to earlier periods, underscoring the unique challenges faced during the Trump administration’s trade reforms. Moreover, previous averages were considerably lower, highlighting a return to more protectionist stances reminiscent of the 1930s, driven by a desire to shield domestic industries from foreign competition.

Such a stark increase in tariff rates raises questions about sustainability and long-term implications for American domestic policies. Consumers today encounter higher prices, increased inflationary pressures, and continued uncertainty about future trade dynamics as tariffs take center stage in economic discussions. Studying these historical comparisons not only informs current debates but also underscores the cyclical nature of U.S. trade policy shifts.

Anticipated Consumer Behavior Amidst Tariff Changes

High tariff rates create an environment where consumers inevitably alter their purchasing behavior, often seeking to minimize additional costs associated with imported goods. As reported, the expected shift could lead to an effective tariff rate of about 16.4%, suggesting that as consumers adapt, they may turn to either lower-priced domestic alternatives or delay certain purchases altogether to assess their economic situations. This change signifies a fundamental shift in the consumer market, where elasticities of demand are tested against rising prices.

Equally noteworthy is the uncertainty surrounding how quickly these behavioral changes will manifest. Some consumers may react almost immediately by re-evaluating their shopping habits; others could take a more prolonged approach. This unpredictability presents challenges for retailers and manufacturers as they must not only anticipate evolving consumer preferences but also adjust their supply strategies to accommodate these new shopping paradigms.

The Role of Economists in Tariff Policy Analysis

Economists play a critical role in analyzing and forecasting the impacts of tariff policies on both a domestic and global scale. By interpreting data surrounding consumer behavior, trade flows, and price elasticity, economists provide insights that help stakeholders navigate the volatile landscape set by changing tariffs. Their analyses often indicate how these policies influence market dynamics, especially regarding goods heavily taxed under current U.S. tariff structures.

Moreover, their research into substitution effects sheds light on how consumers might respond to higher prices caused by tariffs. Understanding these economic behaviors allows businesses to develop strategies to mitigate adverse effects from tariffs, whether through diversification of supply sources or innovating product offerings. Ultimately, the insights provided by economists shape the dialogue surrounding tariff policy and its ramifications for broader economic health.

Frequently Asked Questions

What are the current US tariff rates and how do they affect consumers?

The average effective tariff rate on imports in the U.S. currently stands at 17.8%, the highest since 1934. These tariffs impact consumers by increasing the cost of imported goods, resulting in an estimated average cost of $2,800 per household in the short run.

How do Trump’s tariffs impact overall US tariff rates?

Trump’s tariffs have significantly increased the average effective tariff rate in the U.S., which has gone up by 15.4 percentage points during his second term. Many tariffs, including a 10% tariff on nearly all imports, remain applicable, contributing to the currently high tariff environment.

What changes were made to US-China tariffs recently?

Recently, U.S. officials agreed to reduce the total tariff on China to 30%, down from at least 145%, for a temporary period of 90 days while trade discussions continue. This reduction signifies an ongoing shift in the tariff landscape amid efforts to improve trade relations with China.

How do US trade agreements influence tariff rates?

Recent trade agreements with China and the U.K. have led to some reductions in tariff rates, but the overall average effective tariff remains high at 17.8%. The U.K. trade deal has only a minimal impact, with a 10% tariff set for the first 100,000 imported cars, highlighting the complex nature of tariffs and trade agreements.

What is the historical context of US tariff rates?

US tariff rates have fluctuated greatly over the years; currently, the average effective tariff rate of 17.8% is the highest since 1934. Prior to recent trade agreements, tariffs were at an alarming 28%, the highest since 1901, reflecting a long-standing trend of changing trade policies.

What is the expected impact of US tariffs on consumer purchasing behavior?

Economists expect that higher US tariff rates, particularly on Chinese products, will lead consumers to change their purchasing behavior. Many may seek alternatives to mitigate increased costs, potentially affecting market dynamics and driving the effective tariff rate to 16.4%, the highest since 1937.

How do UK tariff policies compare to US tariffs?

The UK tariff policies recently agreed upon under trade agreements with the U.S. suggest a 10% tariff on specific imports, notably while the overall tariff landscape in the U.S. remains significant at 17.8%. Thus, while the U.K’s tariff rates provide some relief, they do not substantially lower the overall burden on American consumers.

What was the estimated tariff impact on American households in recent reports?

Recent reports estimate that the current tariff policies are projected to cost the average American household about $2,800 in the short term. These costs reflect the heightened tariffs imposed on a wide range of goods, impacting consumer shopping habits significantly.

| Key Point | Details |

|---|---|

| Current Average Tariff Rate | 17.8% – the highest since 1934. |

| Impact of Tariffs | Projected cost to average households is $2,800 in the short run. |

| Tariff Reductions with China | Tariffs on China reduced to 30% from at least 145% for 90 days. |

| Tariff Rate on U.S. Exports to China | China lowered its tariffs on U.S. exports from 125% to 10%. |

| UK Trade Agreement | 10% tariff on the first 100,000 imported cars from the U.K., down from 25%. |

| Pre-Agreement Tariff Rates | Overall average effective tariff rate was 28% before the recent agreements. |

| Economic Behavior Changes | Consumers may change purchasing behaviors to avoid higher costs. |

| Projected Effective Tariff Rate Consideration | Estimated to be 16.4% when considering substitution effects. |

Summary

US tariff rates have reached historically high levels, with an average effective rate of 17.8%, reflecting the impact of various tariffs imposed by the Trump administration. Despite recent trade agreements designed to lower rates with key partners like China and the U.K., household financial impacts remain significant. As consumers adjust their purchasing behavior to mitigate additional costs from tariffs, ongoing trade discussions may further influence future rates.