German Inflation Falls to 1.8% in July 2023

German inflation has taken a notable turn as it fell to an unexpectedly low rate of 1.8% in July 2023, according to preliminary data from the statistics agency Destatis. This decline contrasts with the 1.9% projected by economists surveyed by Reuters and reflects a slight decrease from June’s rate of 2%. As the German economy continues to grapple with various economic pressures, core inflation, which strips away the volatility of food and energy prices, held steady at 2.7% for July. Additionally, the services inflation rate demonstrated a reduction from 3.3% in June to 3.1%, highlighting shifting consumer pricing trends. As EU inflation news unfolds, these metrics are crucial for understanding the broader impact on Europe’s economic landscape and aid in conducting an inflation rate comparison across the region.

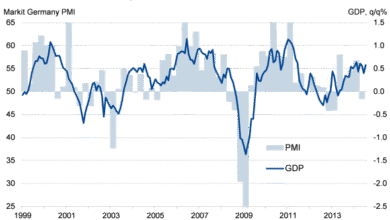

The topic of inflation in Germany represents a critical aspect of the country’s economic health, influencing everything from consumer spending to monetary policy. As recent figures reveal a cooling trend in price increases, analysts are paying close attention to shifts in core inflation and how these developments may affect the broader European context. Understanding the dynamics driving Germany’s inflation rates offers a window into the nation’s economic resilience, even amidst challenges such as global tariffs and changing consumer behavior. Furthermore, discerning July’s inflation figures helps observers anticipate future trends and responses from the European Central Bank. As inflation figures are published across the Euro zone, the implications for both Germany and the larger EU market are significant.

Understanding the Current State of German Inflation

In July 2023, German inflation showed a surprising cooldown to 1.8%, a figure that surprised many economists who had predicted a slight increase to 1.9%. This decline from June’s 2% inflation rate reflects a transient easing in price pressures within the German economy. The data, sourced from the national statistics agency Destatis, has caused analysts to reevaluate the trajectory of inflation in Germany, particularly in light of the European Central Bank’s (ECB) policies. Such drops in inflation rates may hint at broader economic adjustments and price stability, factors that are crucial in shaping both domestic and European monetary policy.

The recent dip in inflation also provides critical insight into the performance of the German economy amid various external pressures, including recent tariff changes imposed by the United States. These tariffs, which could affect supply chains and pricing structures, have brought uncertainty to the market. Consequently, understanding how German inflation metrics evolve will be vital for investors and policymakers alike, especially as they prepare for the upcoming euro zone inflation data expected to echo similar trends.

Core Inflation Trends in Germany

Core inflation, which strips out volatile food and energy prices, showed resilience at 2.7% for July, unchanged from the previous month. This stability suggests that underlying inflationary pressures remain, despite the overall decline in the headline rate of inflation. The steadiness in core inflation indicates that while consumer prices might be less affected by the fluctuations in energy and food costs, there are still fundamental pressures emanating from services and wage growth that could lead to sustained inflation in other sectors.

This core rate is especially significant as the European Central Bank focuses its monetary policy on managing long-term inflation expectations. The unchanged core inflation signals that, despite the recent easing in headline numbers, the ECB may have to maintain interest rates at a higher level for an extended period to curtail potential inflationary spirals. Consequently, businesses and consumers alike are keeping an eye on these figures as they directly impact borrowing costs and consumer spending patterns.

Impact of German Economic Performance on Inflation

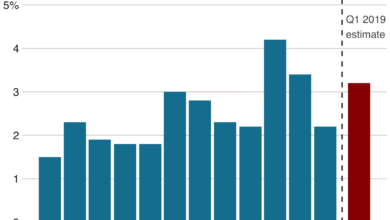

The relationship between German economic output and inflation rates is currently under scrutiny as Germany reported a slight contraction in its GDP of 0.1% for the second quarter of 2023. This contraction, following a growth of 0.3% in the first quarter, raises concerns about the sustainability of economic recovery in a post-pandemic landscape. While a minor GDP decline may seem negligible, it can amplify fears of recession and subsequently affect consumer behavior, business investments, and overall inflation expectations.

As the largest economy in Europe, Germany’s economic health is vital in influencing broader trends across the Eurozone. Analysts argue that the impact of a contracting economy may lead to decreased consumer spending and business investment, which, in turn, could contribute to lower inflation rates. The upcoming release of euro zone inflation data will be pivotal in assessing whether other member states are experiencing similar economic pressures and how these will affect the wider EU inflation narrative.

EU Inflation News: What to Expect

As the euro zone gears up for the upcoming inflation report, expectations are set at 1.9%, a figure that holds significant implications for economic policy across member states. With Germany’s recent inflation number coming in below projections, market participants are eager to see if this trend is mirrored in other EU economies. The relationship between economic performance and inflation within the Eurozone has become increasingly complex due to varying national monetary policies and external factors like global supply chain disruptions.

This anticipated inflation data will not only reflect the current state of the European economy but will also enable policymakers to devise strategies to manage inflation pressures effectively. Higher inflation across the EU could prompt the ECB to take measures, including adjustments in interest rates, to prevent an inflationary spiral. Hence, all eyes remain sharply focused on how the upcoming inflation data from member countries will correlate with the most recent German inflation figures.

Inflation Rate Comparison: Germany and the Eurozone

When comparing the inflation rate in Germany to that of the Eurozone, the trend becomes evident that Germany has remained somewhat insulated from broader inflationary pressures that other EU countries have faced. With Germany’s July rate at 1.8%, this sets it apart from the anticipated Eurozone inflation of 1.9%. This discrepancy can offer valuable insights into Germany’s economic policies and their effectiveness in shielding its economy from excessive inflation, which may be a result of its robust manufacturing base and disciplined fiscal practices.

However, this disparity raises critical questions about the sustainability of Germany’s lower inflation rates. As other European nations grapple with rising costs, Germany must balance between supporting its economy while ensuring that inflation remains manageable. Policymakers must closely monitor inflation comparisons and strategize to maintain Germany’s economic stability amid potential external shocks and pressures from neighboring Eurozone countries.

Future Prospects for German Inflation Rates

Looking ahead, the outlook for German inflation suggests a need for vigilance as external economic factors continue to exert influence on domestic prices. With inflation sitting at 1.8% in July, the immediate future could see varying pressure points, particularly as the impact of recent geopolitical tensions and tariff impositions unfold. Economists warn that any significant shifts in energy prices or supply scarcity might trigger a rebound in inflation rates, particularly impacting goods and services that fall outside the core inflation category.

Moreover, as the ECB contemplates its next moves in monetary policy, predicting the trajectory of inflation becomes increasingly complex. With fluctuating global economic conditions and potential shifts in federal policies of key partners like the U.S., it is crucial for German economists and policymakers to stay ahead of trends to mitigate adverse impacts as they arise. Thus, ongoing analysis and adaptation strategies will be essential to maintaining economic stability and controlling inflation effectively.

Factors Influencing the Decline in Inflation

Several factors are contributing to the recent decline in Germany’s inflation rate, most notably the stabilization of energy prices and the significant adjustments in supply chain issues. As global energy markets adjust, the costs associated with transportation and production have begun to stabilize, allowing for a decrease in consumer prices. Furthermore, the easing of pandemic-related supply chain disruptions has enabled a more consistent flow of goods, which plays a crucial role in reducing costs passed on to consumers.

Additionally, government fiscal measures aimed at alleviating the financial strain on households and businesses further support this inflation decline. Various subsidies and tax reductions have been implemented to counteract the effects of rising costs on essential goods and services. However, the sustainability of these factors in continuing to drive inflation down remains uncertain, particularly with evolving international trade dynamics and changing consumer behavior post-pandemic.

The Influence of Consumer Behavior on Inflation

Consumer behavior plays a pivotal role in shaping inflation trends in Germany, especially in a time of economic uncertainty. With inflation rates fluctuating, consumers may alter their spending patterns, choosing to save more or invest in essential goods rather than luxuries. This shift can lead to decreased demand in certain sectors, ultimately impacting prices and, as a result, inflation rates. Understanding these behavioral changes is critical for businesses and policymakers alike in forecasting and responding to market trends.

Moreover, consumer confidence significantly influences inflation, as it shapes spending habits and investment decisions. A decline in consumer confidence typically results in reduced spending, which could further decrease inflation by diminishing demand for goods and services. As such, monitoring consumer sentiment becomes essential in predicting inflation trends and understanding the broader economic landscape in Germany as it navigates through these volatile times.

Conclusion: The Future of German Inflation

In summary, the decline of German inflation to 1.8% in July 2023 presents a favorable scenario when compared to previous months, indicating a potential stabilization in prices. However, the stability of core inflation at 2.7% suggests the existence of persistent underlying pressures that could resurface. As the German economy continues to react to external shocks and domestic policies, there remains a pressing need for continuous observation and adaptive strategies to ensure inflation rates are controllable.

As we move forward, it is crucial for stakeholders – from consumers to policymakers – to remain informed about inflationary trends and their implications on economic policies. The interconnectedness of global markets means that shifts in one area can ripple through the economy, highlighting the importance of a proactive approach to managing inflation in Germany and across the Eurozone.

Frequently Asked Questions

What was the inflation rate in Germany for July 2023?

In July 2023, German inflation fell to a cooler-than-expected rate of 1.8%, which is below the 1.9% anticipated by economists.

How does the core inflation in Germany compare to overall inflation in July 2023?

In July 2023, core inflation in Germany, which excludes food and energy costs, remained stable at 2.7%, while overall inflation dropped to 1.8%.

What impact do recent U.S. tariff changes have on German inflation?

Economists are closely monitoring recent U.S. tariff implementations, as they could potentially influence German inflation rates and overall prices in Europe.

How did Germany’s inflation rate in July 2023 compare to June 2023?

In comparison to June 2023, where the inflation rate was recorded at 2%, July 2023 saw a decrease to 1.8%.

What does the decrease in inflation indicate about the German economy?

The decrease in German inflation, in conjunction with a slight contraction in second-quarter GDP, suggests a cooling economy, which is being analyzed for its broader implications.

When will Euro zone inflation data be released and what is the expectation?

Euro zone inflation data is set to be released later this week, with expectations for a 1.9% reading, indicating wider economic trends that may affect German inflation.

| Key Point | Details |

|---|---|

| German Inflation Rate | 1.8% in July (below the 1.9% forecast) |

| Previous Month’s Rate (June) | 2% |

| Core Inflation Rate | Stable at 2.7% |

| Services Inflation Rate | Decreased from 3.3% in June to 3.1% in July |

| Impact of U.S. Tariffs | Potentially affecting prices in Europe |

| GDP Growth | Contracted by 0.1% in Q2 |

| Upcoming Eurozone Inflation Data | Expected at 1.9% |

Summary

German inflation experienced a notable decline to 1.8% in July, which was less than the anticipated 1.9%. This decrease, along with stable core inflation and a reduction in services inflation, reflects ongoing economic adjustments in response to external factors, such as tariffs imposed by the U.S. The contraction in Germany’s GDP by 0.1% during the second quarter adds to the complexity of the economic landscape as Euro zone inflation data is anticipated soon, contributing to the overall discourse on inflation trends.