China Rare Earth Export Controls: Strategic Impacts on US

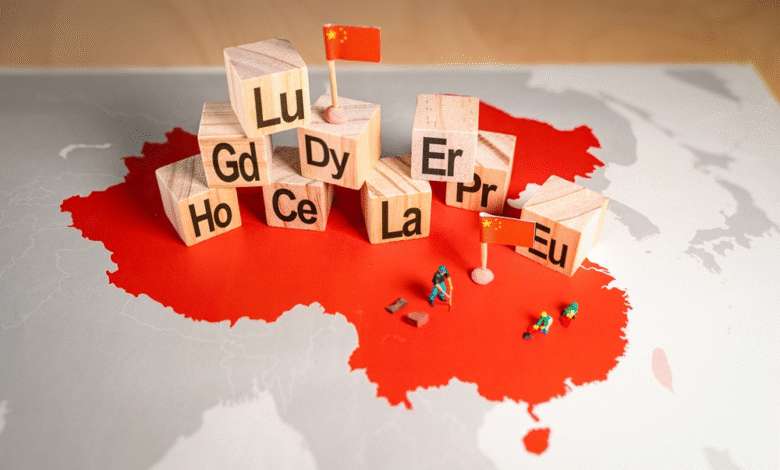

China rare earth export controls are shaping the landscape of international trade, fundamentally affecting the U.S.-China trade relations. As a significant player in the rare earth metals market, China’s restrictive measures on these essential minerals pose a challenge for American industries, particularly in defense, energy, and automotive sectors. Recently, China paused export restrictions on certain U.S. companies, yet the key exports of seven rare earth elements remain tightly regulated. These strategic resources are vital for advanced technologies, making China’s control over them a crucial factor in the ongoing economic negotiations with Washington. Thus, as discussions about trade policies evolve, the ramifications of these export restrictions continue to reverberate across global markets.

The topic of China’s management of rare earth export controls reflects a crucial dimension in the realm of international commerce and strategic resource allocation. Often referred to as rare earth elements (REEs), these materials are critical for manufacturing a range of high-tech applications, and their supply chain is heavily intertwined with geopolitical dynamics. China’s position as the principal provider of these resources means that any alterations in their export policies can have broad implications for global industries and technological advancement. As the U.S. and China navigate through trade disputes, understanding the nuances of export restrictions becomes essential for grasping the broader economic strategies at play. The strategic significance of these rare minerals continues to influence U.S.-China relations and raises questions about future cooperation or contention.

Current Status of China Rare Earth Export Controls

China’s stringent export controls on rare earth elements (REEs) represent a key aspect of its strategic trade relations with the United States. Although recent actions have seen a temporary pause on certain export restrictions affecting 28 American companies, significant curbs on the export of vital rare earth metals remain steadfast. This dual approach reflects China’s cautious navigation through the turbulent waters of US-China trade relations, balancing economic diplomacy with national security concerns surrounding these critical materials.

The seven rare earth elements—samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium—are crucial for various industries, particularly defense and technology. With the U.S. heavily relying on Chinese exports for these materials, the control over their shipment is viewed as a strategic leverage point for Beijing. The role of these elements in high-tech manufacturing and defense technology underscores their importance, thus making the restrictions a central topic in discussions regarding China trade relations.

Frequently Asked Questions

What are the current export controls on rare earth metals imposed by China?

China maintains strict export controls on seven rare earth metals crucial for various industries, including defense and energy. These controls include restrictions on elements such as samarium, gadolinium, and dysprosium, which remain in effect despite temporary relaxations for other dual-use items.

How do China’s rare earth export controls affect US-China trade relations?

China’s rare earth export controls significantly impact US-China trade relations, as these resources are essential for American defense industries and technology sectors. The ongoing restrictions create leverage for China in trade negotiations, underscoring the strategic importance of rare earth elements.

What is the significance of rare earth elements in global trade?

Rare earth elements are vital for many modern technologies, including electronics, batteries, and defense systems. China holds a dominant position in their production, which affects global supply chains and trade dynamics, particularly in US-China relations.

What recent changes have occurred regarding China’s export restrictions on American companies?

Recently, China paused export restrictions on 28 American companies for 90 days, allowing them to export dual-use items. However, the critical export restrictions on rare earth metals remain unchanged, indicating ongoing complexities in U.S.-China trade relations.

Why are rare earth metals considered a strategic resource in US-China relations?

Rare earth metals are deemed strategic due to their essential role in high-tech industries and military applications. China’s control over these resources gives it considerable leverage in negotiations with the U.S., particularly as American industries face shortages.

Which rare earth elements are still subject to export restrictions by China?

China continues to impose export restrictions on seven rare earth elements: samarium, gadolinium, terbium, dysprosium, lutetium, scandium, and yttrium. These elements are critical for various applications, including defense and renewable energy technologies.

What was the reason behind the recent adjustments to China’s export controls?

China’s recent adjustments to export controls appear to be part of a broader diplomatic effort to ease trade tensions, as evidenced by the temporary suspension of restrictions on some companies. However, the ongoing controls on rare earth metals reflect China’s commitment to maintaining strategic advantages.

How do China’s export controls on rare earths impact its economic relations with the United States?

China’s export controls on rare earths complicate economic relations with the United States by limiting access to essential materials needed for technology and defense. This lack of supply can hinder U.S. innovation and military readiness, highlighting the economic significance of these resources.

What measures is China taking to control the export of rare earth elements?

China is implementing stringent measures to control rare earth exports due to national security concerns. This includes combatting smuggling and consolidating government oversight of rare earth materials to ensure their strategic use aligns with national interests.

How might future US-China trade negotiations be influenced by rare earth export controls?

Future US-China trade negotiations could be heavily influenced by rare earth export controls, as these elements are critical to U.S. industries. China may leverage its control over rare earth supplies to negotiate favorable terms, affecting the overall trade landscape.

| Key Point | Details |

|---|---|

| Export Restrictions Paused | China has temporarily paused export restrictions on 28 American companies for 90 days. |

| Non-tariff Measures Lifted | China suspended non-tariff measures against 17 U.S. entities on the unreliable entity list. |

| Rare Earth Export Curbs Remain | Export restrictions on seven key rare earth elements have not been lifted. |

| Strategic Importance of REEs | China views rare earth metals as strategic leverage in trade negotiations with the U.S. |

| Recent Calendar Events | China’s commerce ministry made statements on rare earth controls amid trade talks with the U.S. |

Summary

China rare earth export controls continue to play a crucial role in the ongoing trade tensions with the United States. Despite some temporary pauses in restrictions affecting 28 American companies, the key export curbs on seven essential rare earth metals remain firmly in place, underscoring their significance in defense and technology sectors. This ongoing strategy reflects China’s leverage in international trade discussions and highlights the critical nature of rare earth elements in U.S. industries.