TON Wallet: Integrated with Telegram for U.S. Users

TON Wallet is transforming how users manage cryptocurrency by seamlessly integrating within the popular Telegram app, which now boasts a massive user base in the United States. This self-custodial wallet allows Telegram users to send, store, and manage digital assets like USDT and toncoin, all without needing to navigate away from their messaging platform. With key TON Wallet features such as direct crypto transfers in chats, built-in trading tools, and staking capabilities, managing digital currencies has never been easier. By providing full control over private keys and funds, the TON Wallet ensures enhanced security for users’ assets. As the integration with the TON Blockchain deepens, Telegram users can enjoy an efficient, user-friendly experience in the burgeoning world of cryptocurrency.

The introduction of the TON Wallet within Telegram marks a significant milestone in the realm of digital currency management. This innovative self-managed wallet empowers users to effectively handle their cryptocurrency holdings without the complexities typically associated with traditional wallets. By leveraging Telegram’s vast user network, the TON Wallet streamlines transactions, making it simpler for individuals to engage in the exchange of digital assets. Additionally, the incorporation of diverse features enhances this experience, allowing for effortless interaction with the growing decentralized finance (DeFi) landscape. This strategic integration paves the way for broader adoption of cryptocurrency and bolsters the functionalities available to Telegram users.

What is the TON Wallet?

The TON Wallet is a groundbreaking self-custodial wallet integrated seamlessly into the Telegram app, allowing users to manage their digital assets within a secure and familiar environment. Unlike traditional cryptocurrency wallets, the TON Wallet enables users to possess full control over their private keys, thus enhancing the security of their assets. This integration means that Telegram users can send and receive various cryptocurrencies, including toncoin (TON) and tether (USDT), without needing to exit the app or download any additional software.

In essence, the TON Wallet revolutionizes the way individuals interact with cryptocurrencies by simplifying transactions and digital assets management. One of its standout features is the ability to stake tokens directly through the wallet, providing users the opportunity to earn yield on their holdings. Additionally, the TON Wallet includes built-in trading tools and market charts, empowering users to make informed trading decisions while engaging within their chat interfaces. Overall, it exemplifies a significant leap towards mainstream cryptocurrency adoption.

Key Features of the TON Wallet

The TON Wallet comes packed with several key features designed to enhance user experience and streamline the usage of cryptocurrencies. Users can easily send digital assets directly during Telegram chats, making transactions as simple as sending a standard message. Moreover, the integration of zero-fee USDT purchases via payment options such as Apple Pay, Google Pay, and credit cards through Moonpay makes acquiring cryptocurrencies more accessible than ever. This allows users, regardless of their technical expertise, to participate in the cryptocurrency economy.

Another notable feature of the TON Wallet is its capability to enable withdrawals directly to bank cards, a significant improvement for the conversion of crypto assets into fiat currency. This integration with banking systems via Moonpay helps eliminate traditional obstacles that often deter potential users from engaging with cryptocurrencies. The wallet also facilitates participation in decentralized finance (DeFi) initiatives by linking users directly to the TON Blockchain ecosystem, thereby broadening the range of financial services available at their fingertips.

How TON Wallet Enhances Digital Asset Security

Security is paramount when it comes to digital assets, and the TON Wallet prioritizes this aspect with its self-custodial model. Users retain complete ownership of their private keys, which means they have ultimate control over their digital assets. Unlike centralized wallets, where the provider holds the keys and can access the user’s funds, the TON Wallet ensures that users manage their own security measures against hacking or unforeseen access breaches.

Additionally, the wallet’s integration within a trusted platform like Telegram adds another layer of security since Telegram has established a reputation for prioritizing user privacy and data protection. The TON Wallet’s unique features, such as built-in tools for staking and trading, offer users not only secure transactions but also strategic opportunities for growth, all within a familiar interface. Such measures strongly align with the best practices of digital assets management and create a favorable environment for both novice and experienced cryptocurrency users.

User Experience with the TON Wallet

The introduction of the TON Wallet has transformed the user experience for Telegram’s vast audience. The wallet’s design embraces simplicity and intuitiveness, making it easy for users to navigate their cryptocurrency transactions within the messaging app. The ability to send and receive digital assets seamlessly enhances the social interaction aspect of cryptocurrencies, as users can easily share and transact with friends and communities.

Moreover, the wallet offers access to a comprehensive suite of features that cater to various demands in the cryptocurrency space. From tracking market trends to engaging in yield farming, the TON Wallet enriches the user experience by allowing individuals to manage their portfolio without needing complex knowledge of blockchain technology. This user-centric approach not only fosters deeper engagement but also paves the way for broader adoption of cryptocurrency in everyday life.

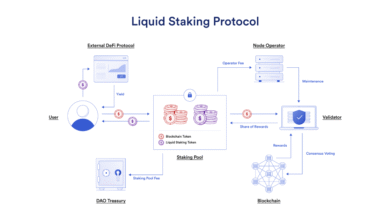

The Role of TON Wallet in Decentralized Finance (DeFi)

As the TON Wallet becomes more integrated into Telegram, its role in the world of decentralized finance (DeFi) cannot be overstated. By providing users with inherent access to DeFi services, such as staking and trading, the wallet serves as a critical entry point for those looking to participate in this revolutionary financial landscape. Users can easily access liquidity pools, lending platforms, and more right from the app, eliminating the need for separate DeFi platforms.

Furthermore, the wallet’s capability to bridge traditional finance with the decentralized ecosystem supports greater financial inclusion. The virtually borderless nature of cryptocurrencies allows users from varying backgrounds to engage with innovative financial products and services. As more users discover and utilize the features of the TON Wallet, the influence of decentralized finance will likely extend far beyond the cryptocurrency community, encouraging a significant shift towards a more inclusive financial future.

Telegram’s Vision for TON Wallet

Telegram’s decision to embed the TON Wallet within its platform illustrates a forward-thinking vision of integrating cryptocurrencies into daily communication and commerce. With over 87 million users in the U.S. alone, the messaging app is strategically positioned to become a major player in the cryptocurrency landscape. This reflects a belief that digital currencies should be as easy to use as traditional forms of currency, without compromising on security.

Through this move, Telegram is not merely facilitating transactions but is fundamentally altering how people perceive and utilize digital assets. By focusing on user experience and accessibility, Telegram is striving to demystify cryptocurrency, making it approachable for everyone. As adoption grows, so too does the potential for new use cases and innovations that can arise from this deep integration of messaging and digital finance.

The Future of TON Wallet and Cryptocurrency Adoption

Looking ahead, the TON Wallet is positioned at the forefront of a potential surge in cryptocurrency adoption. With the backing of a popular platform like Telegram, the wallet is set to attract both seasoned cryptocurrency enthusiasts and newcomers alike. Analyst predictions suggest that as digital finance becomes more ingrained in everyday applications, wallets like the TON Wallet will likely play a pivotal role in user engagement and retention.

The integration of features that simplify the use of digital assets can catalyze wider acceptance and encourage further experimentation with cryptocurrencies. As the capabilities of the TON Wallet expand, users may discover innovative ways to leverage their digital assets, pushing the boundaries of what is possible within the cryptocurrency ecosystem. Ultimately, as more users engage with the TON Wallet, the vision of a future where cryptocurrencies become a standard part of financial transactions and personal investments will become closer to reality.

Challenges Facing the TON Wallet

Despite its promise, the TON Wallet also faces significant challenges that could impact its adoption and usability. One such challenge is the inherent volatility associated with cryptocurrencies, which can deter potential users from engaging with wallets like TON. Ensuring that users understand the risks involved with digital assets management is crucial in fostering a culture of informed participation.

Another challenge is regulatory scrutiny that can arise as the cryptocurrency ecosystem continues to grow. As governments worldwide formulate policies regarding cryptocurrencies, the TON Wallet, like other wallets, will need to navigate compliance issues effectively. Staying proactive about regulatory developments will be vital in maintaining user trust and confidence in the wallet’s security and legitimacy.

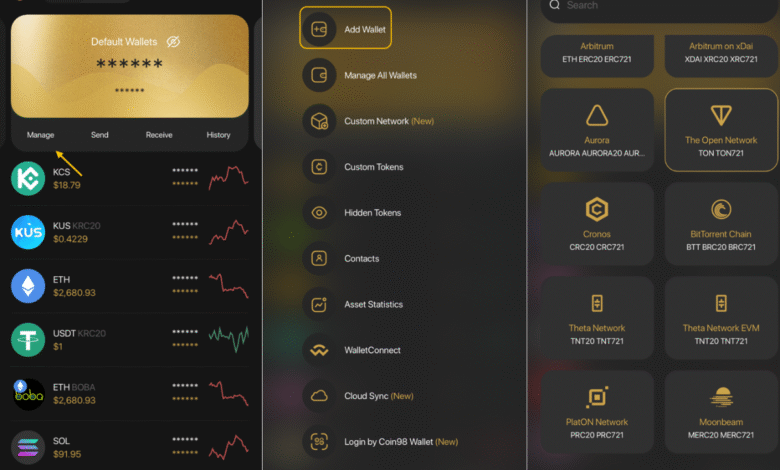

How to Get Started with Your TON Wallet

Getting started with the TON Wallet is a straightforward process for any Telegram user looking to manage their digital assets. First, users need to ensure they have the latest version of the Telegram app installed. Once logged into Telegram, they can access the TON Wallet via the search function or directly through the ‘Wallet’ option in their settings. Following the simple onboarding instructions prompts users to set up their wallet in just a few steps.

Once activated, users are encouraged to explore the various features available to them, such as sending and receiving cryptocurrencies, managing decentralized finance options, and utilizing built-in trading functionalities. The intuitive interface allows users from all backgrounds to quickly familiarize themselves with digital assets management, making the transition to cryptocurrency both simple and effective. Users can engage with the TON community, learn more about crypto products and services, and ultimately enjoy the benefits that come with possessing a self-custodial wallet.

Frequently Asked Questions

What is TON Wallet and how does it integrate with Telegram?

TON Wallet is a self-custodial wallet integrated directly into the Telegram messaging app, enabling users to manage their digital assets seamlessly. This integration allows Telegram users to send, store, and trade cryptocurrencies such as toncoin (TON) and tether (USDT) without the need for external applications, providing full control over their private keys and funds.

How can I send digital assets using TON Wallet within Telegram?

Sending digital assets with TON Wallet is as easy as sending a message. Users can initiate transactions directly in Telegram chats, allowing for quick and efficient transfers of cryptocurrencies, enhancing the user experience with built-in trading tools and market charts.

What are the key features of TON Wallet?

TON Wallet offers several features, including the ability to send and receive cryptocurrencies, access to trading tools, staking for yield, and purchasing USDT without fees via Apple Pay or Google Pay. Users can also withdraw funds directly to their bank cards through Moonpay’s off-ramp, streamlining the process of managing digital assets.

Is TON Wallet secure for managing my cryptocurrencies?

Yes, TON Wallet is designed as a self-custodial wallet, which means users retain full control over their private keys and funds. This level of ownership enhances security, as users are responsible for their digital assets without relying on third-party custodian services.

What cryptocurrencies can I manage with TON Wallet?

With TON Wallet, users can manage a variety of digital assets, including toncoin (TON) and tether (USDT). The wallet supports seamless transactions and exchanges between these cryptocurrencies within the Telegram platform.

How does staking work within TON Wallet?

Staking in TON Wallet allows users to earn yield on their holdings by locking up their cryptocurrencies, thereby contributing to the network’s operations. This feature is integrated within the wallet, making it easy for users to participate in blockchain activities while managing their digital assets.

What is the significance of the TON Wallet launch for users in the U.S.?

The launch of TON Wallet in the U.S. signifies a major advancement in integrating decentralized finance (DeFi) into everyday life, allowing millions of Telegram users to access cryptocurrency services directly within an app they already use. This initiative aims to simplify digital asset management and promote wider adoption.

Can I access sports and games using TON Wallet?

Yes, TON Wallet serves as the primary gateway to the TON Blockchain ecosystem, which includes various applications such as games, payments, and DeFi platforms. Users can experience an array of services that enhance the utility of their digital assets.

How do I get started with TON Wallet in Telegram?

To start using TON Wallet, simply navigate to t.me/wallet or go to the ‘Wallet’ option in your Telegram Settings. From there, you can create your wallet, manage your digital assets, and explore the features available to you.

What role does The Open Platform (TOP) play in the development of TON Wallet?

The Open Platform (TOP) is a key developer behind the TON Wallet, focusing on embedding cryptocurrency functionalities into Telegram. Their efforts aim to enhance the user experience and promote Web3 tools within the app.

| Key Features | Description |

|---|---|

| Self-Custodial | Users control their own private keys and funds. |

| In-App Cryptocurrency Management | Users can send, store, and manage digital assets like USDT and TON directly within Telegram. |

| Zero-Fee Transactions | Users can make fee-free USDT purchases via Apple Pay, Google Pay, and credit cards. |

| Built-in Trading Tools | Access to trading tools and market charts for users within the Telegram app. |

| Staking Features | Users can stake their assets for yield. |

| Direct Withdrawals | Withdraw funds directly to bank cards using Moonpay’s off-ramp. |

Summary

The launch of the TON Wallet within Telegram signifies a pivotal advancement for the TON Wallet ecosystem, enabling users to manage their cryptocurrencies easily and efficiently. This self-custodial wallet allows for the seamless integration of financial transactions within a familiar messaging platform, enhancing the appeal of decentralized finance (DeFi) to a broad audience. As this service gains traction among Telegram’s vast user base, it stands to revolutionize how digital assets are handled, making cryptocurrencies more accessible and user-friendly for everyone.