Trump Banks Conservative Clients: Allegations of De-Banking

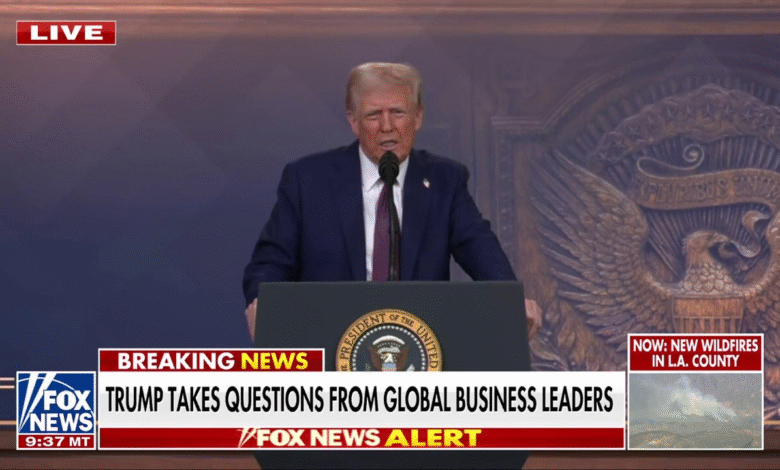

In a striking revelation, former President Donald Trump recently highlighted how major financial institutions like JPMorgan Chase and Bank of America rejected him as a client, reigniting discussions on how Trump banks conservative clients. During an interview with CNBC, he recounted how he was given mere days to relocate significant sums of money after being informed by JPMorgan that it would no longer serve him. Furthermore, Trump revealed that Bank of America declined to open a high-value account for him, stating that they were unable to do so. This has raised concerns about banking discrimination against conservative clients, suggesting that there may be a systemic bias at play within large banking conglomerates. As this narrative unravels, many are left questioning whether these actions are a reflection of a broader trend of de-banking conservative individuals and organizations.

The issue of financial accessibility for conservative figures in the political landscape has garnered increased attention lately, especially with Trump’s claims regarding his banking experiences. The denial of services from prominent banks like JPMorgan Chase and Bank of America has sparked an ongoing debate about the treatment of clients based on their political alignments. Critics argue that conservative banking clients may face undue challenges, highlighting a need for equitable financial practices across the board. As conversations about bank account accessibility develop, they serve to shine a light on potential discrimination within the banking sector and the impact this could have on conservative activists and businesses. Ultimately, these revelations challenge the notion of impartiality in banking and question whether political affiliations are influencing financial decisions.

Trump Banks Conservative Clients: Allegations of Discrimination

In a heated interview with CNBC, former President Donald Trump shed light on his experiences with major banking institutions like JPMorgan Chase and Bank of America, suggesting a broader issue of discrimination against conservative clients. Trump recounted how JPMorgan Chase gave him a mere 20 days notice to transfer “hundreds of millions of dollars” out of their bank, prompting speculation about the political motives behind such actions. This claim of de-banking conservative clients is not just an isolated incident but part of a pattern that many conservatives allege has been orchestrated by financial institutions under pressure from regulatory changes heralded by the current administration.

Further compounding Trump’s narrative was his assertion that Bank of America outright refused to open an account for him, even when he proposed to deposit over a billion dollars. These experiences resonate with many conservative individuals and businesses who feel marginalized by mainstream banking services. The question arises: are these banking giants enforcing a new standard of banking discrimination that targets specific political beliefs? As Trump navigated through smaller banks to secure his assets, the discussion grows around the critical need for an inclusive banking system that does not operate on political affiliations.

The Role of Major Banks in Political Affiliation Disputes

The controversies surrounding banks like JPMorgan Chase and Bank of America have ignited reactions across the political spectrum, particularly among those in favor of preserving a free and open banking environment. Trump’s candid statements raise serious questions about the institutional protocols behind account management decisions. While JPMorgan claims their decisions are free of political bias, the backlash from conservative clients suggests a distrust that runs deep. Many feel that the treatment of Trump as a client is reflective of a larger trend of de-banking conservative constituents by the financial elite.

Moreover, the ramifications of such discrimination extend beyond Donald Trump, impacting ordinary citizens who identify with similar political beliefs. The anecdotal evidence supporting such claims highlights concerns of equitable access to banking services. As the narrative of banking discrimination against conservatives grows, public scrutiny of banking giants intensifies, urging them to clarify their policies. The power of financial institutions in shaping political discourse remains a critical point of discussion as Americans evaluate their options in a space that is increasingly seen as politicized.

Understanding De-Banking: Impacts on Conservative Clients

De-banking conservative clients has become a focal point in discussions about financial access and equity, especially in the wake of Trump’s recent revelations. This trend sparks fears that banking access is contingent on political alignment rather than financial merit or need. For many conservatives, Trump’s assertions resonate deeply; they have witnessed similar experiences where their banking needs were unmet based on their political identity. The implications could be far-reaching, from stifling entrepreneurial spirit to creating a divide between financial institutions and segments of the population.

As allegations against major banks circulate, there’s a clear need for enhanced transparency and accountability. Many supporters of Trump argue that the banking sector’s approach, albeit denied by banks like JPMorgan, requires scrutiny in order to safeguard individuals’ rights regardless of their political opinions. Such dynamics complicate the relationship between banks and clients, heightening the discourse surrounding freedom of speech and financial freedom, as customers aspire to engage with banks that align with their values without fear of reprisal or discrimination.

JPMorgan and Bank of America: Responses to Allegations

In light of Trump’s allegations, JPMorgan Chase has publicly denied any claims of politically motivated account closures or discriminatory practices against conservative clients. The bank’s spokesperson emphasized their commitment to not engaging in any actions driven by political ideologies and acknowledged the need for regulatory reform in the banking sector. These statements aim to quell unrest among clients and reassure the public that financial dealings will remain impartial. However, the credibility of such reassurances largely hinges on how transparent these institutions remain in their practices moving forward.

On the other hand, Bank of America’s refusal to accommodate Trump’s banking needs has led to criticisms of their client acceptance policies. The challenge for these banks lies in rebuilding trust among clientele who feel sidelined due to their political beliefs. As Trump continues to leverage his experience to advocate for conservative clients, the dialogue opens up for better regulatory frameworks that protect individual rights in banking. Banks must reconcile their business practices with public sentiment to maintain their customer base and uphold a reputation for impartial service.

Exploring Alternatives for Clients Facing Banking Discrimination

For conservative clients who feel abandoned by major banking institutions like JPMorgan Chase and Bank of America, exploring alternative banking options has become essential. Many are turning to smaller, community banks that are often more flexible and willing to cater to diverse clientele without the political bias alleged against larger counterparts. This trend towards grassroots banking solutions emphasizes the need for inclusivity, allowing clients to align their financial needs with institutions that respect their political ideologies.

In addition to community banks, alternative financial services such as credit unions and fintech solutions provide vital options for those disillusioned with traditional banks. These alternatives often pride themselves on personalized service and a strong commitment to understanding their customers’ values. As stories of de-banking conservative clients gain traction, the call for more diverse banking choices underscores a significant shift in consumer behavior towards prioritizing ethical banking practices that respect individuality and offer a safe haven for all political beliefs.

Regulatory Challenges Influencing Banking Practices

The intertwining of regulatory pressures and banking policies has become a vital focal point in the discourse surrounding financial discrimination. Under the Biden administration, many banks purportedly face increasing scrutiny regarding their lending practices. Critics argue that such pressure can lead to conservative clients feeling the brunt of these restrictions, manifesting in practices like de-banking. Understanding the broader regulatory environment sheds light on why institutions may hesitate to take on clients from politically charged backgrounds.

As Trump points out, the regulatory landscape must evolve to protect all individuals equally in their financial dealings, regardless of political belief. The effects of recent regulations could inadvertently stigmatize conservative clients, whereby banks may opt for caution, avoiding what they perceive as potential backlash from regulators. It is pivotal for regulators to recognize the implications of their policies on banking practices and to instill fair treatment across the board, ensuring that all individuals receive equitable service.

The Financial Industry’s Reputation at Stake

The accusations against major banking institutions regarding discrimination raise profound concerns about their reputations and operational ethics. The trust of clients in financial systems is paramount, and any shadow of doubt cast by allegations such as Trump’s could undermine the integrity these institutions strive to uphold. If banks are to remain viable financial partners, fostering trust with clients who feel politically marginalized is crucial for their future business.

Banks must confront these allegations head-on, providing transparent explanations regarding their practices and client relationships. This crisis offers an opportunity for the banking sector to redefine its commitment to diversity and inclusivity by actively engaging with those who feel disenfranchised. Moving forward, institutions need to explore strategies that not only address current grievances but also establish stronger safeguards against potential biases that could open the door to discrimination.

Public Reaction to Banking Discrimination Claims

The public reaction to Trump’s claims about de-banking conservative clients has been predominantly critical of the financial industry’s practices. Many supporters perceive these incidents as part of a larger attack on conservative values, igniting discussions across social media platforms and numerous news outlets. The sentiment is that when prominent figures face such issues, it raises alarms about the state of banking freedom for the average citizen, creating a rallying point for those looking to advocate for change.

This backlash against major banks may ultimately compel them to rethink their approach to client relationships, as public opinion increasingly emphasizes the significance of equitable banking practices. The call for accountability extends beyond political affiliations; it underscores a commitment to ethical conduct that resonates across the political spectrum. By addressing these concerns, banks can work towards mending their reputations and establishing a more inclusive financial environment for all clients.

Future Implications for Banks and Conservative Clients

The allegations made by Trump about conservative clients facing banking biases suggest possible future shifts in the relationship between financial institutions and their clientele. Should this trend continue, we may see a marked increase in demand for alternative banking solutions that are perceived as less politically motivated. Banks that fail to address these concerns may risk losing a significant portion of their market as dissatisfied clients seek more accommodating environments for their financial needs.

As banks navigate these challenges, the future of financial services may become increasingly decentralized, with emerging platforms prioritizing user autonomy and respect for diverse political beliefs. This evolution could lead to a renaissance within the banking landscape, where inclusivity and ethical practices become the new standard. In response to allegations of discrimination, the industry could potentially reshape its policies and embrace a forward-thinking approach that aligns closely with the principles of fairness and equality.

Frequently Asked Questions

What happened with Trump bank accounts at JPMorgan Chase?

President Donald Trump reported that JPMorgan Chase gave him 20 days to move ‘hundreds of millions of dollars’ out of his accounts, raising concerns about de-banking conservative clients. Trump believes this treatment was due to political discrimination against him and his supporters.

Why did Bank of America reject Trump’s request for bank accounts?

During a CNBC interview, Trump claimed that when he sought to deposit over a billion dollars with Bank of America, CEO Brian Moynihan informed him that they could not provide him with an account, which Trump interprets as part of a broader trend of banking discrimination against conservative clients.

Is Trump being targeted by banks for being a conservative?

Trump has alleged that large U.S. banks like JPMorgan Chase and Bank of America have discriminated against him and conservative clients, suggesting that regulatory pressure from the Biden administration may be influencing these banking decisions.

What do banks like JPMorgan Chase say about de-banking conservative clients?

JPMorgan Chase has denied any intentions to close accounts for political reasons. A spokesperson stated that they do not target conservative clients or discriminate against them, emphasizing their desire for regulatory changes.

How are conservative clients impacted by Trump’s banking experiences?

Trump’s experiences with JPMorgan Chase and Bank of America highlight potential challenges faced by conservative clients in accessing banking services, raising concerns over whether political affiliations are influencing banks’ decisions.

Are there small banks that support Trump’s banking needs?

After facing rejection from major banks, Trump indicated that he turned to smaller banks to manage his finances, depositing amounts like $10 million across multiple institutions, which may be a more favorable option for conservative clients.

What does the term ‘banking discrimination’ mean in the context of Trump and conservative clients?

Banking discrimination, as discussed by Trump, refers to the alleged systemic rejection of banking services for individuals based on their political beliefs or affiliations, particularly affecting conservative clients.

| Point | Details |

|---|---|

| Trump’s Claims | Trump claims that major U.S. banks, JPMorgan Chase and Bank of America, rejected him as a customer, alleging discrimination against conservatives. |

| Cash Movement Demand | JPMorgan Chase allegedly gave Trump 20 days to move hundreds of millions of dollars. |

| Attempted Deposits | Trump stated he sought to deposit over a billion dollars at Bank of America but was denied an account. |

| Different Banks Used | After being denied, Trump turned to smaller banks, making multiple smaller deposits. |

| Regulatory Pressure | Trump attributed the banks’ rejection to pressure from regulators during the Biden administration. |

| JPMorgan’s Response | JPMorgan claimed they don’t close accounts for political reasons and acknowledged the need for regulatory changes. |

Summary

Trump banks conservative clients, a topic underscored by President Trump’s recent claims regarding his banking experiences with major U.S. banks. In his statements, Trump accused JPMorgan Chase and Bank of America of unfairly rejecting him based on political affiliations, which raises critical concerns regarding the banking industry and its treatment of customers with conservative values. While Trump asserts that these actions are part of a broader attempt to discriminate against his supporters, JPMorgan’s denial of targeting conservatives emphasizes the complexities surrounding financial services and regulatory pressures. As this situation evolves, its implications for conservative clients seeking banking services may prompt a reevaluation of their financial relationships.