Bitcoin Investment: Bill Miller Sees Room for Growth

Bitcoin investment is becoming an increasingly popular option for savvy investors looking to capitalize on the burgeoning digital asset market. With financial experts like Bill Miller IV asserting that the cryptocurrency still has significant potential for growth, many are taking a closer look at its viability as a long-term holding. As cryptocurrency governance evolves, the need for robust supervision surrounding digital assets and stablecoin regulation has never been more critical. According to Miller, despite isolating challenges such as slow-moving regulation, the bitcoin market continues to outperform traditional stores of value, including gold. If you’re contemplating entering the world of Bitcoin investment, understanding its market potential is essential in navigating this rapidly changing landscape.

Engaging in Bitcoin investment, or putting capital into this leading digital currency, represents an exciting opportunity for prospective investors. As the landscape of cryptocurrencies and their governing frameworks shifts, many are exploring various forms of cryptocurrency with the intention of diversifying their portfolio. Bill Miller IV, a prominent figure in the investment community, highlights the dynamic nature of digital assets and the ongoing discussions surrounding stablecoin regulation. The overall governance of cryptocurrency is still taking shape, making it vital to stay informed about potential regulations that could impact the market. For those new to the concept, seeing Bitcoin not just as a currency but as a revolutionary asset can open new doors in the financial sector.

Understanding Cryptocurrency Governance in 2023

Cryptocurrency governance is an ever-evolving landscape as financial markets and regulations adapt to the increasing prominence of digital assets. In 2023, organizations involved in cryptocurrency are facing mounting pressure to create holistic and effective governance frameworks. Regulatory bodies are working to delineate clear rules regarding the operation and management of cryptocurrencies, ensuring that investors can engage with these assets safely and confidently. As key figures in the financial sector, like Bill Miller IV, emphasize the need for improved governance, we can expect to see advancements that prioritize accountability and transparency in the digital asset realm.

As we move forward, the role of cryptocurrency governance will extend beyond mere regulation. Stakeholders are beginning to recognize that effective governance must also include community engagement, technological development, and robust frameworks for dispute resolution. This comprehensive approach will empower various stakeholders within the crypto ecosystem to contribute to the discussions around governance, ensuring that the overall structure is not only resilient but also adaptable to changing market conditions.

The Market Potential of Bitcoin: A Closer Look

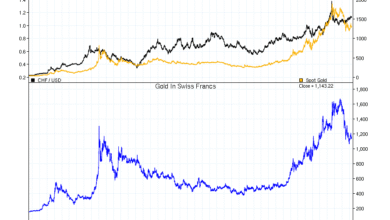

Bill Miller IV’s assertion that bitcoin has a considerable amount of room to grow is supported by several factors contributing to its market potential. With an ever-expanding user base, increasing institutional adoption, and the constant development of related technologies, bitcoin continues to solidify its position as a leading cryptocurrency. The potential for bitcoin to surge beyond current market valuations is immense, especially when considering its standout properties compared to traditional assets like gold. Miller’s insight regarding bitcoin’s superior functionality and easier transportability positions it as an attractive asset for long-term investors.

Moreover, the market potential encapsulated by bitcoin is also tied to its growing recognition as a hedge against inflation and fiat currency devaluation. The recent observations made by Miller regarding the shrinking gap between bitcoin and gold underline this narrative. As more investors seek alternatives to traditional safe havens, the demand for bitcoin as a viable store of value continues to rise. In an environment where fiat currencies are increasingly scrutinized, bitcoin’s intrinsic characteristics can offer a compelling alternative that retains value over time.

Navigating the Challenges of Stablecoin Regulation

The regulation of stablecoins, as pointed out by Bill Miller, remains a critical aspect of the broader cryptocurrency market. The current regulatory framework surrounding digital assets is still developing, with notable delays in legislation impacting stablecoins in particular. The lack of clear guidelines can create uncertainty and hinder innovation in the sector. Stakeholders—including businesses and consumers—are advocating for a more streamlined regulatory approach that enables stablecoins to function effectively as a medium of exchange while addressing inherent risks associated with volatility and market manipulation.

Furthermore, stablecoin regulation must balance the needs of the market with consumer protection and financial stability. It is essential that policymakers engage with industry experts to create regulations that support innovation while ensuring that consumers can safely engage with these digital currencies. By fostering a regulatory environment that promotes responsible stablecoin development, we can leverage the full potential of this innovation, paving the way for greater integration of digital assets within traditional financial systems.

Bill Miller’s Insights: Bitcoin’s Rise and Future

Bill Miller IV’s comments about bitcoin’s trajectory reflect not only his investment strategy but also a broader understanding of the digital asset market’s dynamics. His endorsement of bitcoin as a practical alternative to traditional currencies highlights its ongoing relevance in contemporary finance. By recognizing that bitcoin has surpassed conventional metrics and continues to prove its resilience in the face of volatility, Miller reinforces the notion that this digital asset is still in its early stages of market adoption and utility.

His perspective on the $20 trillion market gap between bitcoin and gold provokes thoughtful discussions about the future of digital assets. Miller’s observations about bitcoin’s advantages—such as its auditability and reduced susceptibility to theft—underscore the appeal of blockchain technology in financial transactions. As the sector evolves, and if regulatory frameworks catch up, the demand for bitcoin could potentially attract more investors, further solidifying its status as a cornerstone asset in the investment portfolios of individuals and institutions alike.

The Future of Digital Asset Supervision

The future of digital asset supervision hinges on creating a regulatory framework that is both comprehensive and adaptable. As outlined by Miller, the supervision of digital assets, particularly cryptocurrencies, is still in the nascent stages. There is a pressing need for federal agencies to establish clear guidelines that govern the buying, selling, and usage of cryptocurrencies, in addition to ensuring the safety of consumer investments. The proposed supervisory structures should encompass risk assessment protocols and frameworks that promote innovative financial products while safeguarding investors.

In the coming years, we’re likely to witness significant transformations in digital asset supervision, influenced by ongoing dialogue between regulators and industry stakeholders. As the regulatory landscape evolves toward stability, it will help foster investor confidence, encouraging wider adoption of cryptocurrencies and related technologies. A balanced and thoughtful approach to digital asset regulation will ensure that all participants in the market can benefit from the potential that cryptocurrencies offer.

Why Bitcoin is a Game Changer for Investors

Bitcoin stands out as a revolutionary investment opportunity that challenges traditional investment paradigms. Its decentralized nature and finite supply make it a unique asset that behaves differently from conventional investments. Investors like Bill Miller IV recognize bitcoin not only as a digital currency but as a critical component of a diversification strategy, which is increasingly important in today’s unpredictable economic environment. With its ability to provide a hedge against inflation and potential financial crises, bitcoin has gained traction among savvy investors who aim to secure their portfolios.”},{

Frequently Asked Questions

What is the current outlook for Bitcoin investment according to Bill Miller IV?

Bill Miller IV, chief investment officer at Miller Value Partners, recently stated that Bitcoin investment still has significant potential for growth. He sees Bitcoin as being in its early stages and believes that it has a lot of room to appreciate in value.

How does cryptocurrency governance impact Bitcoin investment?

Cryptocurrency governance is crucial for the evolution of Bitcoin investment. Bill Miller IV highlights that the framework around digital assets is rapidly changing, which could enhance investment opportunities as regulations become clearer.

What role do stablecoin regulations play in Bitcoin investment?

Stablecoin regulations are currently under discussion in the U.S. According to Bill Miller IV, the lack of clear rules may create uncertainties in the Bitcoin investment space. Nevertheless, he views the potential for clarified regulation as a positive development for investors.

What makes Bitcoin a better investment compared to gold?

Bill Miller IV asserts that Bitcoin has functional superiority over gold, making it a more attractive investment. Bitcoin is harder to steal, easier to store, and can be audited easily on a blockchain, which enhances its credibility as a digital asset when compared to traditional commodities.

What is the potential market value of Bitcoin compared to gold?

Bill Miller IV discusses that gold represents a $20 trillion market, while Bitcoin is currently valued at around $2 trillion. He believes that Bitcoin’s potential market value could grow significantly, given its advantages as a digital asset.

How has regulatory supervision affected Bitcoin investment trends?

The current state of regulatory supervision, especially regarding stablecoins, is seen as a developing area that directly affects Bitcoin investment. Bill Miller IV notes that as federal agencies continue to refine their stance on digital assets, this will likely create a more favorable environment for Bitcoin investors.

What are the advantages of auditing Bitcoin compared to traditional gold reserves?

Auditing Bitcoin is far more efficient than auditing gold reserves. Bill Miller IV highlights that Bitcoin can be verified instantly through public blockchain, whereas examining gold in Fort Knox could take thousands of labor hours. This efficiency positions Bitcoin favorably as an investment asset.

Why does Bill Miller IV believe Bitcoin could be seen as a check against fiat currency abuse?

Bill Miller IV argues that Bitcoin serves as a check on the irresponsible creation of fiat currency. Its transparent and auditable nature can provide accountability, suggesting that Bitcoin investment not only has monetary value but also an ethical dimension.

| Key Point | Details |

|---|---|

| Bill Miller IV’s Perspective | Believes Bitcoin is still at the beginning of its rise and has significant potential. |

| Regulatory Landscape | Expressed that U.S. regulatory frameworks for cryptocurrency are still developing, particularly with stablecoins. |

| Comparison with Gold | Points out that Bitcoin surpasses gold as a store of value, with a $20 trillion market gap vs Bitcoin’s $2 trillion market cap. |

| Auditability | Bitcoin can be audited easily via blockchain, while gold storage requires extensive resources. |

| Future of Bitcoin | Miller suggests Bitcoin’s functionality as a check on fiat currency is crucial, indicating it has a long way to go for wider adoption. |

Summary

Bitcoin investment is considered a strategic financial move by many experts, including Bill Miller IV, who sees substantial potential for growth in the cryptocurrency market. Despite its current valuation, Miller emphasizes that Bitcoin’s advantages over traditional assets like gold, along with the evolving regulatory landscape, indicate that Bitcoin is still in its early stages of adoption and that there is ample opportunity for investment.