Bitcoin vs Gold: Should You Revise Your Investment Strategy?

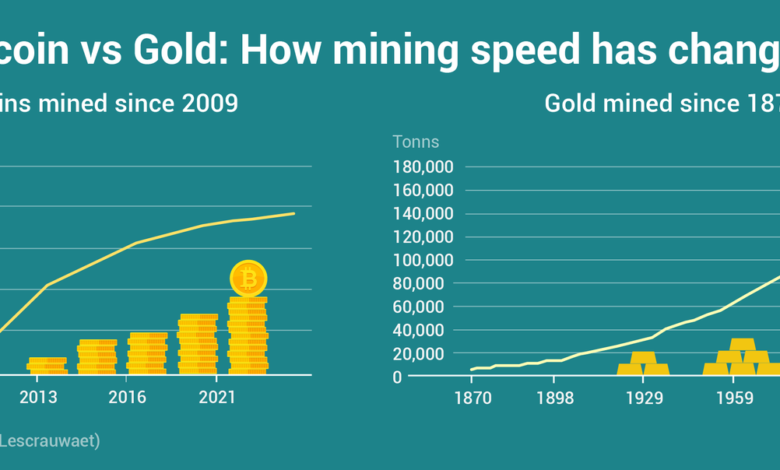

The debate of Bitcoin vs Gold remains a hot topic among investors, especially as the economic landscape continues to shift. While Bitcoin prices have sharply declined, marking a significant drop below previous highs, gold is experiencing an impressive price rally, recently surpassing the $3,000 mark. Investors are now faced with crucial decisions on whether to sell Bitcoin for gold, considering the stability that gold offers compared to the volatility of crypto markets. As a hedge against inflation and global crises, gold’s allure is undeniable, prompting many to reconsider their investment strategies. With the backdrop of rising tensions and changing monetary policies, the conversation around investing in gold versus Bitcoin is more relevant than ever.

In the ongoing discussion about digital currencies and traditional assets, a comparison of cryptocurrency and precious metals emerges as pivotal for modern portfolios. With the volatility of virtual currencies like Bitcoin clashing against the tried-and-true stability of gold, investors are reevaluating their assets in light of market trends and financial strategies. The surge in gold prices continues to attract attention, especially as economic uncertainty leads many to seek reliable stores of value. Whether through diversifying portfolios or adjusting investment tactics, understanding the dynamics of digital assets versus physical commodities is essential for making informed financial decisions. Ultimately, the interplay between these distinct investment vehicles shapes investor sentiment in significant ways.

The Shifting Trends: Bitcoin vs. Gold

In recent months, the contrasting trajectories of Bitcoin and gold have raised vital concerns for investors. Following a historical peak with Bitcoin exceeding $100,000, the cryptocurrency has now experienced a notable decline, prompting many to question whether holding onto their investment is strategically wise. In stark contrast, gold has witnessed a remarkable surge, recently crossing the $3,000 mark per ounce. This divergence prompts a critical examination of the dynamics at play in the investment landscape and whether converting Bitcoin to gold could be a favorable adjustment.

Several factors contribute to this trend reversal for Bitcoin; primarily, the economic implications of U.S. policies under the new president have dampened investor sentiment. The volatility inherent in Bitcoin as a digital asset contrasts sharply with gold’s perceived stability, especially during periods of economic uncertainty. In this context, the question arises: Should investors consider diversifying their portfolios to include gold, or does Bitcoin still hold long-term potential?

Understanding Bitcoin Price Dynamics

The substantial drop in Bitcoin price has been attributed to a combination of market speculation and external economic factors, including rising inflation and anticipated interest rate changes. These conditions have aligned to make traditional assets like gold more appealing, as they offer a hedge against inflation. In earlier bullish trends, many cryptocurrency investors gravitated toward Bitcoin, confident in its potential for astronomical returns. However, as prices have fallen from their highs, a sense of urgency is building among investors to reassess their positions.

Even though the current scenario is challenging for Bitcoin holders, it is essential to recognize that fundamentals still support its investment potential. The cyclical nature of Bitcoin, often reflecting broader market sentiments, suggests that the current decline could be a prelude to recovery. As noted by historical performance trends, including the documented Bitcoin price corrections that have led to subsequent new highs, investors must weigh their options carefully before making drastic decisions.

The Gold Price Rally: Driving Forces Behind Stability

Unlike Bitcoin, gold’s recent price rally can largely be attributed to global economic uncertainties and geopolitical tensions. As countries like China and India continue to bolster their gold reserves amidst a backdrop of fluctuating currencies, the demand for gold as a safe-haven asset has surged. Central banks are buying massive quantities of gold, signaling a significant shift in trust away from the dollar. This trend reinforces gold’s position as a stable investment compared to the volatility often associated with cryptocurrencies.

In addition to market demand, gold’s unique properties make it a compelling alternative for risk-averse investors. The tangible aspect of gold provides a sense of security unattainable with digital currencies. As inflation concerns loom large, investors increasingly perceive gold as a hedge, making its consistent price increase an attractive factor, particularly relevant for those wary of Bitcoin’s price swings.

Is It Time to Sell Bitcoin for Gold?

As Bitcoin’s price fluctuates, the question of whether to liquidate investments in favor of gold becomes increasingly pertinent. Selling Bitcoin for gold may appear to be a sound decision, particularly for those looking to secure profits made during the past bullish cycles. This strategy not only captures value but also diversifies an investment portfolio, aligning with more stable growth principles associated with gold. Balancing risk by acquiring a tangible asset like gold may cater to the conservative investor’s mindset.

However, the decision to convert Bitcoin to gold must be weighed against the cryptocurrency’s historical resilience and potential for recovery. Strong investors may choose to hold their Bitcoin, anticipating a turnaround as market conditions shift. Ultimately, the choice depends on personal risk tolerance and investment goals; some may find security in gold’s stability while others may opt for the high-risk, high-reward potential of remaining fully invested in Bitcoin.

Strategies: Navigating the Dual Investment Landscape

To effectively navigate the current investment climate, a balanced approach that leverages both Bitcoin and gold might prove most beneficial. Crypto investment strategies vary widely, but one increasingly popular method involves partial liquidation. By selling a portion of Bitcoin to invest in gold, investors can stabilize their portfolios and take advantage of both assets. This strategy not only protects against market volatility but also allows for participation in potential gains from Bitcoin’s inevitable recovery.

Furthermore, diversifying to include both assets in a portfolio exemplifies a robust investment strategy. Investors can benefit from gold’s stability while still reaping the rewards of Bitcoin’s growth potential. As the markets evolve, maintaining exposure to both assets creates a shield against adverse market conditions, fostering a balanced yet dynamic investment framework.

The Role of Economic Policies in Crypto and Gold Investment

Economic policies significantly affect investment choices, particularly in the realms of Bitcoin and gold. Current U.S. practices surrounding interest rates and tariffs impact the behavior of investors across asset classes. As uncertainties loom regarding future Federal Reserve decisions, both gold and Bitcoin present unique responses; while Bitcoin may yield high returns during loose monetary policies, gold often excels in tightening conditions, as it serves as an inflation hedge.

Investors need to stay informed on how geopolitical tensions and economic policies may shift market dynamics. Awareness of the implications of government decisions on cryptocurrencies and precious metals is essential for prudent investing. For those holding both Bitcoin and gold, understanding this relationship can help hone a strategic investment approach that capitalizes on prevailing economic conditions.

Long-Term Perspectives: Holding vs. Selling

Considering the long-term outlook, strong arguments exist for both sides regarding holding Bitcoin versus selling for gold. While short-term drops may entice hasty decisions, the historical performance of Bitcoin suggests that it can lead to exceptional returns in the grand scheme. Those who can endure market volatility and philosophically embrace the cyclical nature of cryptocurrencies may find solace in retaining their Bitcoin investments for potential future gains.

Conversely, establishing a gold position in one’s portfolio offers security and stability. For investors with a lower risk appetite or those near retirement, reallocating a fraction of their Bitcoin earnings into gold might provide peace of mind, ensuring that their portfolio remains somewhat insulated against unprecedented market crashes.

Conclusion: A Balanced Investment Portfolio for 2025

Ultimately, the landscape of investing in 2025 will necessitate a multifaceted approach that incorporates both Bitcoin and gold. Investors that strategically allocate resources to diversify their portfolios not only hedge against risk but position themselves for potential profits from both asset classes. Understanding the unique characteristics and market behaviors associated with each will guide prudent decisions.

As Bitcoin and gold continue to thrive amidst changing global economic conditions, embracing a dual-investment strategy may prove to be the most prudent path forward. With trends evolving, staying adaptable to market conditions requires investors to constantly re-evaluate their positions and growth strategies. Thus, whether to buy, sell, or hold becomes a dance of careful consideration, informed by thorough market analysis.

Frequently Asked Questions

How does the Bitcoin price compare to the recent Gold price rally?

The Bitcoin price has significantly decreased, falling below the six-figure mark, while the gold price has skyrocketed, reaching new all-time highs of nearly $3,004 per ounce. This stark contrast shows that gold is currently experiencing a strong price rally, driven by geopolitical tensions and inflation fears, unlike the declining trend in Bitcoin prices.

Should I consider selling Bitcoin for Gold given the current market trends?

Considering the current market trends, with gold prices surging and Bitcoin facing decline, some investors might contemplate selling Bitcoin for gold. However, it’s crucial to evaluate your investment strategy and risk tolerance. While gold serves as a ‘safe haven,’ Bitcoin still offers potential for high returns, making a diversified approach more beneficial.

What are the investing strategies comparing Bitcoin and Gold?

Investing strategies for Bitcoin generally involve high risk and potential rapid returns, suitable for those seeking aggressive growth. In contrast, investing in gold focuses on stability and wealth preservation, especially during economic uncertainties. A balanced portfolio including both Bitcoin and gold can leverage the high return potential of crypto while maintaining the safety of precious metals.

How has Donald Trump’s policies affected Bitcoin and Gold prices?

Donald Trump’s tariffs and trade policies have negatively impacted Bitcoin prices by increasing market uncertainty and potentially tightening monetary policy. Conversely, these same policies have bolstered gold prices, as investors flock to gold as a reliable asset during crises, benefiting from its historical role as a hedge against inflation.

Is holding onto Bitcoin a wise investment choice compared to Gold?

Holding onto Bitcoin can be wise for long-term investors as Bitcoin remains in a bullish cycle despite current corrections. While gold provides stability and crisis resistance, Bitcoin’s potential for substantial returns during bullish phases often outweighs the slower growth of gold investments, particularly for risk-tolerant investors.

What benefits do I gain from investing in both Bitcoin and Gold?

Investing in both Bitcoin and gold allows you to benefit from the high volatility and return potential of Bitcoin, while diversifying risk with the stable nature of gold. This balanced approach can position your portfolio for growth while shielding it from market downturns, contributing to a more robust long-term investment strategy.

How have central banks influenced Gold prices and its comparison with Bitcoin?

Central banks, particularly in countries like China and India, have significantly increased their gold reserves, driving up demand and prices. This institutional backing contrasts sharply with Bitcoin, which, despite its popularity among retail investors, does not benefit from similar levels of institutional support, making gold a more stable investment in uncertain economic climates.

What are the risks and rewards of investing in Bitcoin versus Gold?

Investing in Bitcoin carries high rewards potential but comes with significant risks due to its volatility. Conversely, investing in gold is generally safer with lower but more stable returns, particularly during inflationary periods. Understanding these dynamics can help investors choose the right balance based on their financial goals and risk tolerance.

How can I optimize my portfolio between Bitcoin and Gold for 2025?

To optimize your portfolio for 2025, consider allocating a portion of your investments to both Bitcoin and gold. This strategy allows you to secure gains from Bitcoin’s growth while also benefiting from gold’s stability. Regularly evaluate market conditions and adjust your holdings to maintain a suitable risk level aligned with your investment objectives.

| Aspect | Bitcoin | Gold |

|---|---|---|

| Current Market Performance | Significantly decreased below $100,000 since the high at Trump’s inauguration. | Soared to over $3,000, continuing a strong upward trend. |

| Investor Sentiment | Disappointed due to Trump’s approach and market volatility; many investors may feel inclined to sell. | Seen as a safer haven amid global uncertainties; demand is high among central banks and attracting investors. |

| Influence of Economic Policies | Current U.S. administration’s tariffs and inflation concerns are viewed unfavorably for crypto investments. | Could benefit from inflation fears and trade conflicts, enhancing gold’s appeal as a safe haven. |

| Investment Strategy | Consider holding for potential long-term gains while being cautious of current downturns. | Considered a more stable investment with lower volatility; good for portfolio diversification. |

Summary

In the discussion of Bitcoin vs Gold, it is clear that both assets have distinct advantages depending on current market conditions. Bitcoin has faced significant volatility and drops recently, leading some investors to reconsider their positions. Conversely, Gold’s price rally suggests stability and security amidst economic uncertainties. While Bitcoin may provide higher short-term returns, Gold remains a crucial hedge against inflation and geopolitical tensions. Thus, a diversified investment strategy incorporating both assets may offer the best approach for navigating today’s financial landscape.