Crypto Liquidations Exceed $1 Billion as Bitcoin Falls

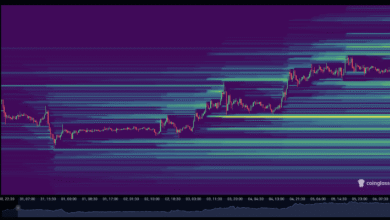

Crypto liquidations have emerged as a crucial topic in the realm of cryptocurrency trading, especially amidst market volatility. Recently, the dramatic drop in Bitcoin prices, which fell over 2.5% to $114,322, sent shockwaves through the crypto market news, resulting in over $1 billion in liquidations of leveraged positions. These sudden downturns in Bitcoin and altcoin values amplify the risk of liquidations, particularly when traders over-leverage themselves, anticipating upward movements. Many altcoins also faced severe losses, with Ethereum dropping by 4.4%, contributing to a wider decline in the total market capitalization, which fell by 6.9% to $3.84 trillion. Understanding the dynamics of crypto liquidations can help investors navigate these turbulent waters and potentially mitigate losses during uncertain trading periods.

The recent phenomenon of forced position closures in the digital asset space has garnered significant attention, particularly following notable price fluctuations in leading cryptocurrencies. The rapid descent in Bitcoin values not only affected its direct holders but also led to a cascading effect on altcoin values and overall market sentiment. These rapid sell-offs, often termed as liquidation events, highlight the high-stakes environment of cryptocurrency investments. As traders react to shifting market conditions, understanding the implications of these events and their direct correlation to broader economic factors becomes imperative. In an era where cryptocurrency trading is increasingly mainstream, grasping the mechanics of liquidations is essential for strategic investment planning.

Understanding Crypto Liquidations in the Current Market Climate

In the dynamic landscape of cryptocurrency trading, liquidations often serve as a stark reminder of the market’s volatility. Recently, over $1 billion in crypto liquidations occurred as Bitcoin (BTC) and various altcoins faced significant downturns. This vast amount represents the forced closure of leveraged positions, primarily long positions, as traders who were betting on price increases found their positions wiped out during the rapid fall in market prices.

The phenomenon of liquidation is critical for market participants to understand, particularly in relation to margin trading. When investors use borrowed funds to trade, the risk of liquidation increases, especially in a fluctuating market such as cryptocurrency. The recent BTC price drop not only triggered extensive liquidations but also highlighted broader market sentiments as traders reacted to negative news, reflecting the state of the crypto market.

Frequently Asked Questions

What causes crypto liquidations during a Bitcoin price drop?

Crypto liquidations often occur during a Bitcoin price drop due to the sudden decline in market value that triggers margin calls on leveraged positions. When Bitcoin experiences significant losses, as seen recently with a drop of over 2.5%, traders holding long positions may be forced to liquidate assets to cover losses, contributing to further market instability.

How do crypto market news events lead to altcoin losses and liquidations?

Crypto market news events, such as changes in federal policies or economic reports, can affect trader sentiment and cause altcoins to experience losses. For instance, when news of increased tariffs impacts Bitcoin, it can lead to a ripple effect across the cryptocurrency market, causing altcoins to plummet and resulting in liquidations for those over-leveraged.

What are the implications of high market capitalization on cryptocurrency trading and liquidations?

High market capitalization in cryptocurrency trading indicates a larger overall value of the crypto assets. However, it can also mean that when the market downturn occurs, as seen with the recent loss of over 6.9% in market cap, the impact is felt more heavily, leading to increased liquidations among both Bitcoin and altcoins.

Why do long positions account for a larger portion of liquidations in cryptocurrency trading?

Long positions account for a larger portion of liquidations in cryptocurrency trading because many traders anticipate rising prices and take leveraged bets. When the market unexpectedly moves against them, such as during a Bitcoin price drop, these long positions are liquidated to prevent further losses, as was seen with $925.6 million in long liquidations recently.

What role does volatility play in crypto liquidations during market downturns?

Volatility is a significant factor that contributes to crypto liquidations during market downturns. Rapid price changes in Bitcoin and altcoins can trigger stop-loss orders, leading traders to liquidate their positions quickly. The recent market activity demonstrates how volatility can create a wave of liquidations, with $1 billion wiped out as prices fell sharply.

How can traders protect themselves from liquidations amid cryptocurrency market fluctuations?

Traders can protect themselves from liquidations amid cryptocurrency market fluctuations by using risk management strategies such as setting stop-loss orders, limiting leverage, and diversifying their portfolios. Staying informed through crypto market news can also help anticipate price movements and mitigate the potential for liquidation.

| Key Point | Details |

|---|---|

| Significant Drop in Bitcoin | Bitcoin fell over 2.5% to $114,322 on July 31. |

| Federal Reserve’s Influence | The drop occurred after the Fed kept interest rates unchanged. |

| Impact of Tariffs | New tariffs on Canada and other countries spooked markets, contributing to Bitcoin’s drop. |

| Market Reaction | The Dow Jones fell by 330 points; Asian markets also opened lower. |

| Altcoin Performance | Ethereum dropped 4.4% to $3,686; XRP fell briefly to $2.93. |

| Overall Market Capitalization | Total crypto market cap fell by 6.9% to $3.84 trillion. |

| Liquidations Overview | Over $1 billion in leveraged positions wiped out, primarily long positions. |

| Long vs Short Liquidations | $925.6 million in long positions liquidated vs $159.3 million in shorts. |

| Liquidation Statistics | BTC liquidations were $142.19 million; ETH was $166.25 million. |

Summary

Crypto liquidations have surged significantly, with over $1 billion wiped from leveraged positions in the market as Bitcoin and altcoins faced a dramatic downturn. Following the Federal Reserve’s decision to maintain interest rates, unexpected tariff announcements severely jolted the crypto market, leading to substantial sell-offs and liquidations. This volatility highlights the interconnectedness of global economic events and market reactions, emphasizing the need for caution among traders in the current crypto landscape.