Top States for Business 2007: Rankings and Insights

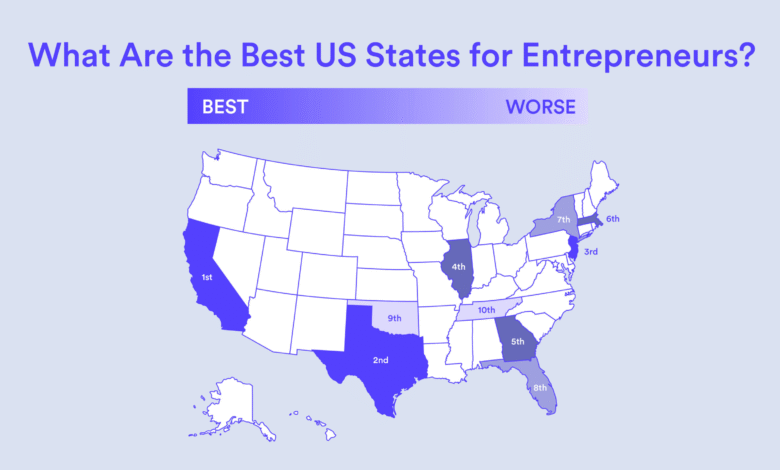

In the competitive landscape of economic growth, the “Top States for Business 2007” report provides insightful rankings of the leading U.S. states based on a comprehensive analysis of various factors that contribute to business success. This authoritative assessment evaluates each state according to crucial metrics, including cost of doing business, workforce quality, and overall economic environment, positioning itself as a valuable resource for entrepreneurs and investors alike. States like Virginia and Texas have emerged as business-friendly states that facilitate economic development and attract investment through their strategic advantages. The rankings shed light on state competitiveness, reflecting how tailored business policies can enhance the quality of life for residents while fostering robust business communities. As such, understanding these rankings is essential for anyone looking to navigate the complex terrain of the U.S. business climate.

In 2007, a detailed analysis spotlighted the most advantageous states for companies aiming to thrive in a dynamic economic environment. This comprehensive evaluation ranks each state based on essential data points that measure various aspects of doing business, including affordability and workforce talent. The states are scored according to their performance across several categories related to economic prosperity and business growth, revealing which areas excel in creating an optimal entrepreneurial landscape. The outcome serves as a critical guide for investors and businesses seeking locations that not only promise high returns but also foster innovation and robust market access. As the business landscape continues to evolve, knowing the top contenders can significantly influence decisions regarding expansion and investment strategies.

Introduction to America’s Top States for Business 2007

In 2007, America’s competitive landscape for businesses was shaped profoundly by a diverse range of factors. Utilizing a comprehensive data analysis framework, all 50 states were scored on 40 distinct measures reflecting their business environment. These measures created a rankings system that gave insights into state competitiveness, highlighting areas such as workforce quality, economic resilience, and business friendliness.

The assessment reflected key priorities for business leaders and investors looking to capitalize on economic development opportunities. The blend of metrics considered in the rankings not only aids businesses in strategic decision-making but also prompts states to enhance areas like education, infrastructure, and access to capital to improve their competitive edge.

Frequently Asked Questions

What are the top states for business in 2007 according to the rankings?

In 2007, the top states for business as per the rankings included Virginia at rank 1, followed by Texas, Utah, Georgia, and North Carolina. These states were recognized for their competitiveness in multiple categories such as cost of doing business and workforce quality.

How was the ranking of top states for business in 2007 determined?

The ranking of top states for business in 2007 was determined using publicly available data across 40 different measures of economic competitiveness. Each state was scored based on its performance in various categories that are crucial for business development.

Why is Virginia ranked as the top state for business in 2007?

Virginia was ranked as the top state for business in 2007 due to its strong performance in several categories, including a favorable cost of doing business, a well-qualified workforce, and overall business friendliness.

What factors contribute to a state’s competitiveness for business?

Factors contributing to a state’s competitiveness for business include the cost of doing business, availability of a skilled workforce, economic stability, educational resources, quality of life, technology and innovation, infrastructure, cost of living, business friendliness, and access to capital.

Which state has the lowest cost of doing business in 2007?

In 2007, Idaho boasted the lowest cost of doing business, ranked at number 1 in that category, making it an attractive option for businesses looking for cost-effective locations.

How do business-friendly states support economic development?

Business-friendly states support economic development by implementing policies that reduce taxes, improve regulatory environments, and invest in infrastructure and workforce development, creating favorable conditions for businesses to thrive.

What role does workforce quality play in the top states for business rankings?

Workforce quality is a critical factor in the top states for business rankings as it directly influences productivity, innovation, and the ability for businesses to attract and retain talent.

What are some challenges faced by states with lower business rankings?

States with lower business rankings may face challenges such as higher costs of doing business, less access to capital, deficiencies in workforce quality, and inadequate infrastructure, which can deter business investment and economic growth.

How does access to capital affect business growth in states?

Access to capital is vital for business growth, as it enables companies to invest in expansion, hire employees, innovate, and navigate economic fluctuations. States that rank higher in access to capital generally experience stronger business and economic performance.

Where can I find comprehensive information on economic development in top states for business in 2007?

Comprehensive information on economic development in the top states for business in 2007 can be found in reports published by economic development organizations, state government websites, and financial analysis reports that provide insights into various business metrics.

| Rank | State | Cost of Doing Business | Workforce | Economy | Education | Quality of Life | Technology & Innovation | Infrastructure | Cost of Living | Business Friendliness | Access to Capital |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | Virginia | 12 | 8 | 3 | 11 | 11 | 14 | 22 | 35 | 4 | 12 |

| 2 | Texas | 27 | 7 | 1 | 31 | 26 | 5 | 5 | 4 | 24 | 3 |

| 3 | Utah | 8 | 5 | 6 | 45 | 2 | 22 | 30 | 24 | 9 | 14 |

| 4 | Georgia | 21 | 2 | 17 | 28 | 36 | 17 | 3 | 9 | 19 | 11 |

| 5 | North Carolina | 22 | 1 | 22 | 30 | 28 | 18 | 21 | 15 | 10 | 9 |

| 6 | Idaho | 1 | 9 | 5 | 46 | 28 | 27 | 26 | 30 | 35 | 37 |

| 7 | Colorado | 26 | 17 | 11 | 34 | 13 | 12 | 41 | 40 | 12 | 7 |

| 8 | Minnesota | 31 | 22 | 34 | 10 | 7 | 13 | 11 | 23 | 15 | 13 |

| 9 | Florida | 43 | 11 | 4 | 37 | 25 | 8 | 1 | 32 | 16 | 15 |

| 10 | Arizona | 23 | 5 | 10 | 43 | 37 | 20 | 6 | 34 | 6 | 20 |

Summary

Top States for Business 2007 highlights how states across America rank based on a set of comprehensive competitiveness metrics. Virginia tops the list, demonstrating a favorable environment for business through low costs of doing business and high workforce rankings. In contrast, states like Texas and Utah also showcase strong economies and innovative environments while maintaining reasonable costs. This report serves as a critical resource for businesses looking to expand or relocate in favor of more conducive economic landscapes.