Bitcoin Stagnation: Market Flat Amid Geopolitical Tensions

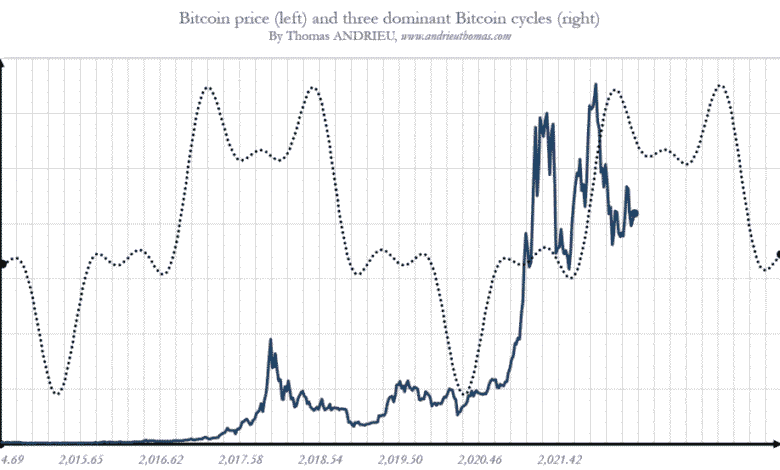

Bitcoin stagnation has raised eyebrows in the financial world, especially as it has remained anchored at approximately $104,000 amid rising geopolitical tensions. The cryptocurrency market has experienced a noticeable lack of movement, mirroring trends seen in the stock market, which is also currently treading water. Investors are keenly observing Bitcoin price fluctuations, but the situation has turned cautious with little indication of a breakout in either direction. This stagnation follows a decline triggered by the escalating Israel-Iran conflict, reflecting broader crypto trading trends that suggest uncertainty in the investment landscape. As Bitcoin news continues to circulate, market participants are left wondering what might move Bitcoin from its current state of limbo and how this will affect the overall cryptocurrency market.

The current lack of activity in Bitcoin, often referred to as its stagnation, highlights a period of consolidation for this leading digital asset. With the cryptocurrency industry experiencing a lull in volatility, many traders are comparing the current market dynamics to those found in traditional financial sectors, where stock valuations are also showing mixed performance. Amid this backdrop of restrained growth, observers are closely examining Bitcoin’s price resilience, while the ripple effects of external factors continue to influence trading behaviors. The broader context suggests an intricate dance between geopolitical events and the sentiments driving crypto investments. As analysts sift through the complex interplay of market forces, the anticipation for renewed momentum remains palpably in the air.

Understanding Bitcoin Stagnation Amid Global Tensions

The recent geopolitical unrest, notably the Israel-Iran conflict, has caused Bitcoin stagnation as it hovers around the $104,000 mark. This lack of volatility in the cryptocurrency market is indicative of broader concerns impacting traders. With uncertainty surrounding global events escalating, investors appear to be adopting a wait-and-see approach regarding Bitcoin price movements. One can see that despite minor fluctuations, the crypto trading trends this week have shown minimal change, leading many analysts to discuss the implications for Bitcoin’s future performance.

Moreover, the interplay between Bitcoin and the stock market is more pronounced during such times of geopolitical uncertainty. As Bitcoin stalled, traditional stock indices showed mixed results, reflecting a broad hesitance among investors to engage in high-risk strategies. As crypto prices fail to rally, analysts are focusing on Bitcoin’s correlation with equity markets and how shifts in investor sentiment might propel changes in the cryptocurrency market. The combination of political unrest and economic caution leaves Bitcoin’s trajectory uncertain, accentuating the need for strategic investment approaches.

Current State of the Cryptocurrency Market

The cryptocurrency market is experiencing a time of notable stagnation, with Bitcoin’s price not reflecting the active trading seen in other assets like stablecoins and major altcoins. As Bitcoin trades sideways, it becomes critical to evaluate its relative performance against the backdrop of vital Bitcoin news and trends. The market capitalization and trading volume provide insights into investor interest and buying pressure, and recent reports indicate a substantial drop in both, signaling a cautious sentiment across the board.

Stablecoins have seen a divergence in performance, with spikes in trading volumes particularly for issuers like Circle, which signals a trend towards safer assets during volatile periods. However, the stagnation of Bitcoin amidst such shifts in the market raises questions about the future of cryptocurrency investments. Investors are increasingly looking for indications that could reverse this stagnation as they weigh the safety of diversified portfolios against the high volatility typically seen in crypto trading trends.

Key Economic Indicators Impacting Bitcoin’s Performance

Analyzing economic indicators is vital to understanding Bitcoin’s stagnation and overall dynamics within the crypto market. With Bitcoin recently experiencing a marginal slip of 0.18%, the prices reflect investor anxiety amid global conflicts. Indicators such as the S&P 500 and Nasdaq metrics provide context, showing that Bitcoin is not immune to the broader economic climate, which is marked by a mix of gains and losses. As uncertainty increases globally, regardless of the usual upward trajectory that Bitcoin is known for, traders are hesitant to commit to investments.

Additionally, other critical indicators such as trading volume and open interest in futures markets have shown declines, highlighting a significant pullback in speculative enthusiasm. As Bitcoin’s trading volume decreased by 14.60%, this illustrates how external factors impact crypto trading trends, inviting discussions on market stability and potential recovery points. Investors are now more than ever watching economic signals closely that could lead to a resurgence in trading activity or further consolidation for Bitcoin.

Bitcoin vs. Traditional Markets: A Comparative Analysis

The ongoing stagnation of Bitcoin has sparked discussions about its relationship with traditional financial markets. Bitcoin’s recent performance, characterized by minimal movement and a hovering price around $104,000, poses questions about its role as a safe haven during stock market fluctuations. Analyzing the behavior of traditional indices helps in understanding how global events correlate with Bitcoin’s movements, indicating that it often follows similar trends. This relation can be informative for investors hoping to decode Bitcoin price future movements amidst significant macroeconomic shifts.

Moreover, Bitcoin’s appeal as a unique asset class is continually being tested by external pressures from stocks and other investments. The contrasting movements within the stock market—evident through the slight rises and falls seen in indices such as the S&P 500 and Nasdaq—highlight a critical juncture for Bitcoin. Investors are scrutinizing these correlations, and as traders witness Bitcoin stay stagnant while stocks experience volatility, it raises the importance of realigning investment strategies according to market realities.

Market Sentiment and Its Influence on Bitcoin Prices

Market sentiment plays a crucial role in shaping Bitcoin’s price movements, especially during periods of stagnation. With Bitcoin remaining stagnant at $104,000, investor sentiment appears cautious, influenced heavily by the tense geopolitical climate in the Middle East. This war scenario often leads to increased uncertainty in traditional financial markets and, by extension, the crypto market. The anxiety among investors to pull back can directly affect Bitcoin’s liquidity and stability, prompting discussions on market resilience.

Furthermore, as Bitcoin’s price remains flat, sentiment data is vital in assessing potential market shifts. Many investors are looking for signs of recovery or a downturn, analyzing Bitcoin news to anticipate any shifts in trading behavior. Negative sentiment not only leads to a decrease in trading volumes but also affects market participation rates, reinforcing the cyclical nature of price movements within the cryptocurrency landscape. As sentiment evolves, so too will Bitcoin’s performance, necessitating consistent observation by traders.

A Look at Trading Trends: Speculation in Bitcoin Markets

In the face of Bitcoin stagnation, speculation within trading trends takes on increased importance. The current lull in trading volume, down 14.60%, indicates a divergence from the speculative excitement often associated with Bitcoin. Traders typically seek profit opportunities in fluctuating prices, but when stagnation prevails, interest wanes. This dynamic creates an environment where support and resistance levels become increasingly vital to track as the market grapples with external economic pressures.

Despite this stagnation, recent spikes in some coins could point to a potential shift in trading trends, with investors seeking alternatives while Bitcoin remains flat. Analysts emphasize keeping an eye on social media trends and trading volume shifts, noting these factors can influence Bitcoin’s trajectory. Speculation often reacts quickly to changing market sentiments, and identifying these trends can mean the difference between loss and profit in the complex cryptocurrency landscape.

The Impact of Geopolitical Events on Bitcoin Investments

Geopolitical events notably affect Bitcoin investments, especially evident during the Israel-Iran conflict, which has led to significant market stagnation. As Bitcoin’s price hovers at around $104,000, investors are sharply focused on how external conflicts influence their trading strategies. Recent escalations in military tensions often correlate with volatility in financial markets, driving caution among crypto traders. The immediate effect is a hesitancy to invest heavily in Bitcoin, highlighting its sensitivity to worldly happenings.

Furthermore, the impact of such events on Bitcoin trading reflects a broader concern among cryptocurrency holders, who often associate drops in price with geopolitical unrest. Analysts suggest that understanding these correlations is crucial for future Bitcoin price predictions, encouraging investors to stay informed about international events that could lead to market shifts. As the situation develops, maintaining awareness of the intertwined nature of global conflicts and Bitcoin performance will be crucial for making informed trading decisions.

Future Projections for Bitcoin: What Analysts Are Saying

Looking ahead, analysts are divided regarding the future projections for Bitcoin, especially in light of its current stagnation. The consensus is that while immediate trading patterns are slow, long-term projections remain cautiously optimistic. With Bitcoin price currently around $104,000, various analysts speculate that it could rebound strongly once investor confidence is restored. Nonetheless, this depends heavily on macroeconomic conditions and external political environments that could shift dramatically at any moment.

Furthermore, technological advancements and regulatory changes could also play pivotal roles in accelerating Bitcoin’s recovery from stagnation. As institutional interest continues to rise, analysts posit that the entry of new capital could lead to price surges, ultimately breaking the current flat phase. Staying apprised of Bitcoin news and market dynamics will be key for traders looking to position themselves ahead of potential profitable moves as volatility resumes.

Navigating Bitcoin: Strategies During Market Stagnation

Navigating Bitcoin during periods of stagnation requires strategic planning from investors. As the cryptocurrency trades flat at approximately $104,000, traders need to consider diversifying their portfolios to mitigate risks associated with Bitcoin price volatility. Techniques such as dollar-cost averaging may provide investors a way to gradually accumulate Bitcoin while the market remains uncertain. Research into crypto trading trends can help identify when to engage, allowing for a more calculated approach to Bitcoin investments.

Moreover, investing in alternative cryptocurrencies or even traditional assets could provide the necessary balance during stagnant times. As Bitcoin’s performance is closely watched, coupled with mixed stock market outcomes, exploring varied asset classes could buffer against potential downturns. Successful navigation of this stagnation phase will ultimately depend on a trader’s ability to stay adaptable and informed, ensuring that their strategies align with changing market landscapes.

Frequently Asked Questions

What is causing the Bitcoin stagnation observed in recent weeks?

Bitcoin stagnation has been largely attributed to ongoing geopolitical tensions, specifically the Israel-Iran conflict. Since the conflict escalated, Bitcoin’s price has hovered around $104,000 with minimal movement, reflecting investor caution amid broader market instability.

How does the broader cryptocurrency market relate to Bitcoin stagnation?

The broader cryptocurrency market is experiencing stagnation, similar to Bitcoin, with only slight fluctuations. The market saw a 0.09% decline recently, indicating that Bitcoin’s stagnant position is paralleled by other cryptocurrencies, which are also exhibiting limited trading activity.

What impact does the stock market have on Bitcoin price stagnation?

The stock market’s mixed results can influence Bitcoin price stagnation. Recent data showed minor declines in the S&P 500 and Dow, which often correlate with moves in the cryptocurrency market, including Bitcoin. This can lead to investor hesitancy, affecting overall crypto trading trends.

Are there any factors that could break the Bitcoin stagnation?

Potential factors that could break Bitcoin stagnation include significant geopolitical developments, changes in regulatory policies like the recent passage of the GENIUS Act, or a substantial shift in market sentiment that could spur crypto trading trends and boost activity.

How does Bitcoin’s trading volume reflect current market conditions during this stagnation?

Bitcoin’s trading volume has dropped by 14.60% during this period of stagnation, which indicates reduced investor participation and concerns regarding market volatility. Lower trading volumes often accompany stagnant price movements, as seen with Bitcoin’s constant hovering around the $104,000 mark.

What role do geopolitical conflicts play in Bitcoin price movements?

Geopolitical conflicts, such as the recent Israel-Iran situation, can significantly impact Bitcoin price movements. These conflicts often lead to market uncertainty, causing traders to slow their activities and contributing to overall Bitcoin stagnation.

What does the recent Bitcoin price stability indicate about investor sentiment?

The recent Bitcoin price stability around $104,000 suggests a cautious investor sentiment. While traders remain wary due to geopolitical events, the lack of significant price changes indicates that many are waiting for clearer market signals before making moves.

How might Bitcoin stagnation affect long-term crypto investments?

Bitcoin stagnation can lead to short-term uncertainty for investors, but it may also present opportunities for long-term holders. As market conditions stabilize, those who maintain their positions during this lull may benefit when prices begin to rise again.

| Market Metrics | Current Status | Recent Changes | Market Dynamics |

|---|---|---|---|

| Bitcoin | $104,116.58 | -0.18% (daily) | BTC dominance up 0.06% to 64.90%. |

| Trading Volume | $40.43 billion | -14.60% (weekly) | Diminished participation amid geopolitical tensions. |

| Futures Open Interest | $69.15 billion | -0.13% | Speculative positioning shows pullback. |

| Stability in Other Assets | Mixed results in stocks | S&P 500 down 0.03%, Nasdaq up 0.13% | Circle (33.82%) and Coinbase (16.32%) saw price increases. |

Summary

Bitcoin stagnation has become a notable trend amidst the ongoing geopolitical tensions, particularly with the ongoing Israel-Iran conflict. Since the onset of hostilities, Bitcoin has struggled to break free from its range, indicating investor caution. With price movements largely hovering around $104,000 and negligible trading volume, it appears that market participants are waiting for clearer signals before making significant moves. The stability in the broader market, alongside mixed performances in other crypto assets, further emphasizes the stagnation of Bitcoin in the current economic landscape.