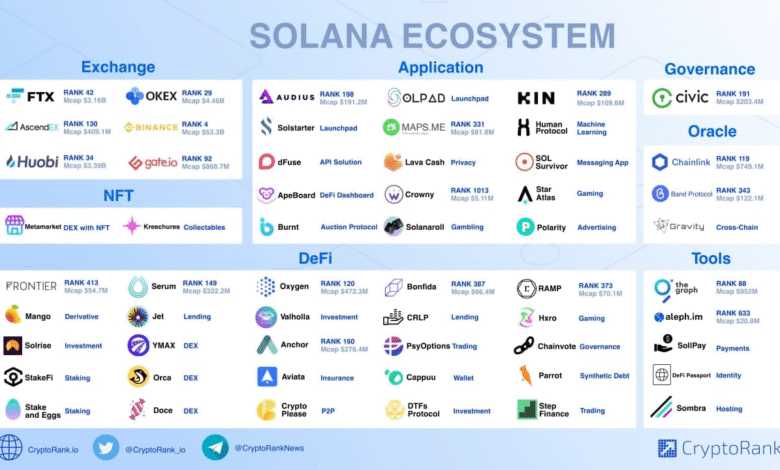

Solana Ecosystem Investment: SOL Strategies Strengthens DEFI

Investing in the Solana ecosystem has become a compelling opportunity as SOL Strategies, a Canadian firm, makes significant strides with its Strategic Ecosystem Reserve. This initiative aims to bolster decentralized finance by strategically investing in impactful projects throughout the Solana landscape. Notably, SOL Strategies has recently acquired Jito tokens, which play a crucial role in the MEV infrastructure, further enhancing the network’s capabilities. By backing innovative technologies and governance models, they are positioning themselves at the forefront of the Solana ecosystem investment movement. As the demand for efficient transaction processing grows, the foresight of SOL Strategies in acquiring vital resources could redefine the future of decentralized finance in this promising sector.

The Solana network presents a thriving landscape for those interested in blockchain investments, as illustrated by recent projects like the Strategic Ecosystem Reserve initiated by SOL Strategies. This reserve focuses on nurturing pivotal decentralized applications, thereby enhancing the overall infrastructure supporting finance within the ecosystem. As the company invests in tokens such as Jito, which addresses Maximum Extractable Value (MEV) needs, it demonstrates a commitment to reinforcing the Solana project’s innovative edge. By leveraging their validator revenues, SOL Strategies is poised to propel not just token acquisitions but also holistic growth and enhancement of the decentralized finance framework. Engaging with such strategic investments means tapping into the vibrant potential that the Solana ecosystem offers to investors now and in the future.

Understanding the Solana Ecosystem Investment

Investing in the Solana ecosystem represents a strategic move for many companies aiming to capitalize on the rapidly expanding decentralized finance (DeFi) market. SOL Strategies, based in Canada, has taken significant steps by directing millions towards Solana (SOL) tokens, fostering the growth of decentralized projects. This focus on ecosystem investment not only signifies confidence in Solana’s potential but also emphasizes the importance of supporting infrastructure critically needed for DeFi functionalities. By establishing a Strategic Ecosystem Reserve, SOL Strategies is laying a robust foundation for enhanced development and sustainability within the Solana landscape.

The aim of the Strategic Ecosystem Reserve is to streamline funding towards promising projects within Solana. By creating a dedicated reserve backed by their validators’ revenue, SOL Strategies ensures that there are reliable financial sources for stimulating growth, innovation, and infrastructure improvements. The evolution of decentralized finance within Solana is pivotal, and with targeted investments, the ecosystem can thrive, attracting users and developers alike to leverage the advantages of blockchain. Such initiatives are crucial in solidifying Solana’s position in the competitive DeFi space.

The Role of Jito Tokens in Solana’s Growth

Jito tokens play a vital role in enhancing the Solana ecosystem, focusing specifically on MEV (Maximum Extractable Value) and the efficiency of staking processes. SOL Strategies’ substantial investment of over $100,000 in 52,181.564 JTO tokens underscores their commitment to not only holding tokens but also strategically uplift the Solana infrastructure. This investment symbolizes an essential step towards optimizing transaction processing for the expanding user base. Jito’s governance structure empowers token holders to influence the future development of the network, ensuring community-led advancements within the ecosystem.

The focus on Jito reflects SOL Strategies’ strategic vision for advancing Solana’s capabilities amid an increasing demand for faster, more efficient DeFi solutions. By supporting Jito, companies can participate in shaping the future of Solana and position themselves at the forefront of blockchain innovation. Furthermore, the collaboration with projects like Jito supports the larger ambition of decentralizing financial services while ensuring security and scalability, which are critical challenges facing blockchain technology today.

Strategic Ecosystem Reserve: A Vision for Innovation

The establishment of the Strategic Ecosystem Reserve signifies a pivotal commitment by SOL Strategies to foster innovation within the Solana ecosystem. This ongoing initiative is designed to create a substantial impact not just through financial input but by strategically acquiring and supporting projects that bolster Solana’s infrastructure. As decentralized finance continues to evolve, allowing for transactions that are not only cost-effective but also secure, enhancing the ecosystem in this manner becomes increasingly critical. The flexibility of the reserve means that as new technological advancements emerge, SOL Strategies will be equipped to adapt its approach accordingly.

Moreover, this initiative showcases a comprehensive approach that blends strategic investment with community engagement. By actively participating in nurturing key projects, SOL Strategies contributes to the overall health and sustainability of the Solana ecosystem. Investments like those in Jito illustrate a broader trend where fostering the underlying infrastructure becomes just as important as the initial token investments. As SOL Strategies unveils further projects under this reserve, the focus will remain on enhancing the decentralized finance landscape, ensuring that innovations lead the way for future endeavors.

Building the MEV Infrastructure in Solana

Building a robust MEV (Maximum Extractable Value) infrastructure is crucial for the development of decentralized finance on the Solana blockchain. SOL Strategies’ partnership with Jito underlines the importance of investing in such specialized infrastructure that not only aims to optimize transaction processes but also to secure the financial interests of users. As MEV practices come to the forefront of blockchain discussions worldwide, establishing a sound framework allows for better transaction efficiencies and potentially greater rewards for token holders. Therefore, the emphasis on MEV through targeted investments will likely yield dividends for the entire Solana ecosystem.

Moreover, the harmony between Jito’s operational capabilities and SOL Strategies’ long-term vision enhances the overall sustainability of the Solana environment. By focusing on MEV tactics and strategies, user trust and participation can be significantly improved. As the infrastructure evolves, the capability for key financial operations to be conducted seamlessly will attract more developers and users to Solana’s DeFi landscape, essentially bolstering the ecosystem’s overall value. Continuous improvement in MEV practices serves not just immediate financial benefits but also enhances the overall user experience on the Solana platform.

Investment Strategies to Enhance DeFi Opportunities

The investment strategies employed by SOL Strategies highlight the growing demand for opportunities within decentralized finance on the Solana blockchain. By strategically placing funds into promising projects such as Jito, SOL Strategies demonstrates a keen understanding of the necessary elements that can catalyze growth within the ecosystem. This multi-faceted approach, which encompasses both direct token holdings and infrastructural support, is likely to create pathways for innovative solutions in the finance sector, aiming to bridge gaps that currently exist in traditional finance systems.

Investing in decentralized projects allows SOL Strategies to diversify its portfolio while ensuring that the Solana ecosystem is rich with diverse opportunities. This not only mitigates risks associated with volatility but also ensures that they are actively contributing to groundbreaking advancements. As more resources are allocated towards developing DeFi solutions, Solana can maintain its competitive edge in the blockchain space, attracting more investors and users worldwide. The future looks promising as these strategic initiatives unfold, driving the momentum for decentralized finance forward.

SOL: The Backbone of Future Investments

SOL is not merely a token but represents a crucial backbone for future investments within the decentralized finance landscape. By maintaining a portion of SOL in their treasury, SOL Strategies ensures that they have a sustainable asset that will support their ongoing investments and expanding initiatives. This adherence to holding foundational assets reflects long-term strategic planning, recognizing the potential volatility in cryptocurrency markets and seeking to stabilize investments through thoughtful treasury management.

Additionally, keeping SOL as part of their strategy allows SOL Strategies to remain actively involved in the community and progress of the Solana ecosystem. By investing in core projects while holding SOL, they not only align with the technological advancements of the blockchain but also ensure their participation in Solana’s growth narrative. This balance between investment in governance tokens like Jito and holding SOL creates a resilient financial framework that can weather market fluctuations while optimizing for growth.

Decentralized Finance: The Future of Financial Services

The surge in decentralized finance (DeFi) represents a shift towards innovative financial services that prioritize transparency, accessibility, and autonomy. As more applications are built on blockchain technology, companies like SOL Strategies play an essential role in pushing forward potential solutions that can disrupt traditional financial frameworks. With strategic investments in projects within the Solana ecosystem—like that of Jito—SOL Strategies illuminates the path toward creating sustainable and valuable DeFi solutions catering to a global audience.

The transformation promises to redefine financial processes, opening the door for individuals and entities to engage without the limitations imposed by traditional banking systems. As companies continue to invest in decentralized platforms and applications, they contribute to a more inclusive financial system. DeFi’s potential for innovation is limitless, and with active support from forward-thinking companies like SOL Strategies, the groundwork is being laid for a future where financial services are democratized, reflecting the core tenets of blockchain technology.

Community Engagement and Ecosystem Support

Community engagement plays a pivotal role in the growth and sustainability of any blockchain ecosystem, and Solana is no exception. SOL Strategies understands that investing in community-centric projects and initiatives fosters a thriving ecosystem. By supporting governance tokens like Jito, SOL Strategies not only enhances their own investment portfolio but also reinforces community involvement in decision-making processes. This engagement helps build trust among users, encourages new developers to join the ecosystem, and ultimately drives broader adoption.

As decentralized projects evolve, active community support becomes indispensable in guiding the direction of development and ensuring that services meet user expectations. Through consistent investment and interactions within the Solana community, SOL Strategies illustrates the importance of aligning financial interests with those of users. This collaboration between investment firms and community members fosters a robust environment, optimizing the potential for innovative solutions that prioritize user needs while advancing the entire Solana ecosystem.

The Future of Blockchain: Integration and Expansion

The future of blockchain technology lies in its ability to integrate across various sectors, propelling the technology into mainstream adoption. As societies recognize the value of decentralized solutions provided by platforms like Solana, the drive for integration becomes even stronger. SOL Strategies, through its investments in the Strategic Ecosystem Reserve, signals a commitment to not only support but accelerate the expansion of blockchain applications in everyday use. By funding innovative projects, they contribute to building a future where blockchain is seamlessly integrated within existing systems.

Furthermore, as decentralized finance evolves, the potential for scalability and interoperability across various blockchain networks will be crucial. SOL Strategies is at the forefront of these initiatives, recognizing that the success of blockchain hinges upon its ability to collaborate and grow beyond its current boundaries. As more companies engage with Solana’s offerings, the future is poised for an expansive and interconnected blockchain landscape that aligns well with SOL Strategies’ vision of innovation and sustainability.

Frequently Asked Questions

What is the purpose of the Strategic Ecosystem Reserve in the Solana ecosystem investment strategy?

The Strategic Ecosystem Reserve aims to strengthen the Solana ecosystem by investing in decentralized projects, particularly those that enhance decentralized finance infrastructure. It is financially backed by a portion of the revenues from SOL Strategies’ validators, allowing for strategic acquisitions that support the growth of the Solana ecosystem.

How does SOL Strategies plan to invest in decentralized finance within the Solana ecosystem?

SOL Strategies plans to invest in decentralized finance within the Solana ecosystem by using the Strategic Ecosystem Reserve to support vital projects. These investments will focus on developing key infrastructure components and acquiring projects that align with the goals of enhancing transaction processing and overall ecosystem resilience.

Why has SOL Strategies chosen to invest in Jito tokens as part of their Solana ecosystem investment?

SOL Strategies has chosen to invest in Jito tokens, which focus on MEV infrastructure, because they provide a critical component for improving staking and transaction efficiency in the Solana ecosystem. This investment will help to bolster the infrastructure necessary for seamless decentralized financial operations on Solana.

What are the benefits of the investment in Jito for the Solana ecosystem?

The investment in Jito provides significant benefits to the Solana ecosystem by enhancing Maximum Extractable Value (MEV) capabilities, thus improving transaction processing efficiency and staking infrastructure. This investment is designed to facilitate better performance and scalability for decentralized applications, ultimately benefiting Solana users.

How does SOL Strategies ensure the growth of the Solana ecosystem through its investments?

SOL Strategies ensures the growth of the Solana ecosystem through its Strategic Ecosystem Reserve, which dynamically invests in key projects that support decentralized finance. By strategically acquiring project tokens and infrastructure, SOL Strategies contributes to a more robust ecosystem that can evolve alongside emerging opportunities.

What role do validators play in the funding of the Strategic Ecosystem Reserve for Solana?

Validators play a crucial role in funding the Strategic Ecosystem Reserve by generating revenue that is partially allocated to invest in decentralized projects within the Solana ecosystem. This model allows SOL Strategies to focus on acquiring and supporting innovations that strengthen the overall framework of decentralized finance.

How can investors benefit from following the developments within the Solana ecosystem investment initiatives?

Investors can benefit from following developments within the Solana ecosystem investment initiatives, such as those by SOL Strategies, by gaining insights into emerging trends and strategic projects. Understanding how investments in tokens like Jito and infrastructure enhancements promote overall ecosystem growth can provide valuable information that aids in making informed investment decisions.

What makes the investment strategy of SOL Strategies unique in the Solana ecosystem?

The investment strategy of SOL Strategies is unique in the Solana ecosystem because it combines active investment in key projects with the backing of validator revenue, ensuring a sustainable approach to ecosystem development. This dual focus not only supports infrastructure improvements but also allows for a strategic acquisition of assets that can yield long-term benefits for the entire Solana community.

| Key Points | Details |

|---|---|

| Company | SOL Strategies, a Canada-based firm investing in the Solana network. |

| Project Focus | Development of a Strategic Ecosystem Reserve to strengthen Solana. |

| Investment Strategy | Investing in decentralized projects to enhance the infrastructure of decentralized finance. |

| Funding Source | Financially backed by revenue generated from the company’s validators. |

| First Major Investment | Investment in Jito governance token, focusing on MEV and staking infrastructure. |

| Investment Amount | 52,181.564 JTO tokens, valued at over $100,000. |

| CEO Statement | Leah Wald emphasizes investment in vital infrastructure to enhance transaction processing. |

| Project Dynamics | Characterized as a dynamic initiative, expanding support for significant projects. |

Summary

Solana ecosystem investment is being strategically bolstered through a new initiative by SOL Strategies aimed at strengthening decentralized finance infrastructure. By investing in projects like Jito and utilizing revenue from their validators, SOL Strategies is set to enhance the ecosystem, showcasing innovation and adaptability in the rapidly evolving crypto space. This approach not only aids existing users but also paves the way for future growth in the Solana community.