Bitcoin Price Analysis: Cup and Handle Pattern Insights

Bitcoin price analysis reveals a market that remains tightly consolidated ahead of a potential breakout, with Bitcoin trading between $104,881 and $105,266. Recent patterns indicate that Bitcoin is experiencing a crucial phase, marked by significant levels of support and resistance that could dictate future movements. The formation of a cup and handle pattern on the hourly chart could signal bullish momentum, setting the stage for a promising Bitcoin breakout. As traders engage in Bitcoin trading, understanding these market trends and price predictions becomes essential for making informed decisions. With a robust market capitalization of $2.08 trillion and active buying interest near pivotal levels, Bitcoin’s journey may lead to substantial changes in its overall trajectory.

Analyzing the Bitcoin market landscape reveals key insights for investors and traders alike. This cryptocurrency is navigating a period of consolidation, presenting an intriguing opportunity to explore various trading strategies, such as the popular cup and handle formation. Investors should closely monitor BTC price predictions and market dynamics, as these will inform their approach to Bitcoin positions. The current patterns suggest potential breakout levels that could translate into favorable trading conditions. By staying attuned to Bitcoin market trends, participants can better position themselves for possible upward movements or shifts in market sentiment.

Bitcoin Price Analysis: Current Trends and Predictions

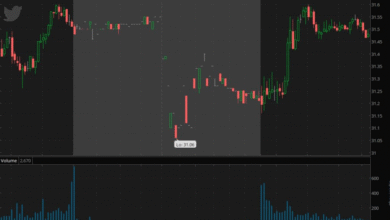

As of the latest market assessment, Bitcoin is fluctuating between $104,881 and $105,266, demonstrating significant trading activity. With a daily intraday range illustrating actions between $103,655 and $105,213, the cryptocurrency is firmly entrenched in a consolidation phase. This period of stability precedes a potential breakout, with current trading volumes pointing towards an active market where traders are keenly eyeing price movements for cues.

Despite the recent peak at nearly $112,000 leading to a double top formation, Bitcoin has managed to sustain its support near the psychologically significant $100,000 mark. For investors focused on Bitcoin trading strategies, identifying whether the coin can reclaim higher levels or if it will succumb to bearish pressures is critical. Current indicators suggest that while there is buying interest re-emerging, ongoing bearish patterns indicate a cautious market sentiment.

Understanding the Cup and Handle Pattern in Bitcoin

The cup and handle pattern is a bullish continuation formation that traders watch for as a sign of potential upward movement. This pattern manifests itself when the price undergoes a rounded bottom (the cup) followed by a consolidation period (the handle). For Bitcoin, technical analysis shows that a handle may be forming, with key support levels identified at $103,500 and $104,200. This primes the market for a breakout above resistance at $105,500.

Should Bitcoin successfully break through this critical resistance marked by the handle, traders could witness a swift ascent towards $106,500 to $107,000. This aligns with BTC price predictions that are bullish in the short term, owing to the heightened buying volumes observed during previous surges. Monitoring these patterns can provide significant insights into potential trading strategies that leverage the momentum of price breakouts.

Key Support and Resistance Levels for Bitcoin Trading

Support and resistance levels play a pivotal role in Bitcoin trading, guiding both bullish and bearish sentiments among investors. Recent analysis indicates vital support at approximately $102,000 and resistance looming near $106,000 to $107,000. Traders using these cues can refine their entry and exit strategies, optimizing their positions based on prevailing market trends and price movements.

The significance of breaking the $105,500 resistance cannot be overstated. A decisive move above this threshold, ideally accompanied by increased trading volume, would symbolize a transition into a bullish trend. Conversely, if Bitcoin fails to maintain levels above $102,000, this could trigger selling pressure, leading to a deeper retracement towards levels near $96,000-$98,000.

Volume Indicators: Analyzing Bitcoin’s Market Strength

Volume is a core aspect of assessing market strength, especially in cryptocurrencies like Bitcoin. The recent surge in trading volumes accompanying movements toward the $105,000 range highlights robust buying behavior and potential bullish setups. High volume often correlates with significant price changes; thus, traders should consider volume trends in conjunction with price patterns to gauge market momentum.

Interestingly, the current oscillators present a multifaceted picture—while the awesome oscillator signals a downward trend, other indicators hint at possible buying opportunities. This divergence underlines the complexity of Bitcoin market dynamics, making it crucial for traders to adopt a comprehensive approach that incorporates both price action and volume trends for effective Bitcoin trading.

Navigating Bitcoin’s Market Sentiment: Bull vs Bear

The ongoing debate between bullish and bearish sentiments within the Bitcoin market informs trading strategies and potential outcomes. Currently, Bitcoin illustrates resilience above $100,000, buoyed by a strong buy-the-dip mentality among traders. However, bearish signals, notably from the awesome oscillator and MACD readings, could create headwinds for those anticipating a quick rally. This dichotomy emphasizes the need for traders to remain vigilant and adaptable.

On the bullish side, there is a clear argument for a price rally back toward $112,000, underpinned by solid technical indicators and diminishing selling pressure. In contrast, should Bitcoin succumb to bearish momentum and breach the pivotal $102,000 support level, traders may need to prepare for a more profound price correction. This ongoing tug-of-war highlights the importance of trader sentiment analysis and timely adjustments in strategies.

The Impact of Market Trends on Bitcoin Breakout Potential

Market trends significantly influence Bitcoin’s breakout potential, with current conditions suggesting a mixture of bullish and bearish forces at play. Recent analysis points to consolidation phases indicative of market indecision, yet historical price movements suggest that continued upward momentum could be facilitated by broader market sentiment shifts. Understanding these dynamics is crucial for anticipating breakout chances in the near term.

Additionally, keeping an eye on external factors such as regulatory news or macroeconomic trends can provide a clearer picture of potential breakout scenarios for Bitcoin. As traders analyze chart patterns and historical data, identifying key market trends will be essential in predicting both potential surges as well as retracement periods, thereby refining trading approaches to leverage such opportunities.

Psychological Levels in Bitcoin Trading Strategies

Psychological levels in Bitcoin trading play an essential role in determining market sentiment and price action. The $100,000 mark is a prime example of such a level, serving as both support and pivotal points for traders. This psychological barrier can influence buying and selling activity, making it a critical consideration for traders implementing their strategies.

Additionally, other key psychological levels, such as $105,000 and $107,000, emerge frequently during trading sessions. These levels can act as magnets for price action, dictating how traders approach their positions. Understanding these psychological intricacies can lead to more informed decision-making in Bitcoin trading, enhancing one’s ability to respond to fluctuations and capitalize on market movements.

Technical Indicators: Assessing Bitcoin’s Price Movements

Technical indicators serve as essential tools for traders analyzing Bitcoin’s price movements. Among these, the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) provide crucial insights into market trends. Presently, Bitcoin’s RSI stays balanced at 52, signaling potential neutrality, while the MACD indicates a lean toward bearishness. These indicators equip traders with information to make informed decisions regarding entry and exit points.

Furthermore, combining multiple indicators, such as oscillators and moving averages, can enhance a trader’s ability to interpret Bitcoin’s price activity. As the market oscillates and crosses between buy and sell signals, a nuanced understanding of these technical indicators aids in refining Bitcoin trading tactics amidst prevalent market volatility.

Future Bitcoin Price Predictions: What to Expect

As traders look ahead, future Bitcoin price predictions are crucial for strategic planning. Current market indicators suggest possible bullish price movements if Bitcoin successfully breaks through resistance levels around $105,500. Positive momentum could steer Bitcoin toward new highs, reaffirming bullish sentiment and invigorating BTC price predictions for the coming weeks.

Conversely, traders must also prepare for various scenarios, including potential retracement toward lower levels. If the $102,000 support fails, it could trigger significant market shifts, steering predictions towards more pessimistic outlooks. By monitoring key price levels and adjusting strategies accordingly, traders can navigate the complexities of Bitcoin’s future, ensuring readiness for both upward and downward price movements.

Frequently Asked Questions

What does Bitcoin price analysis say about the cup and handle pattern?

Bitcoin price analysis indicates that the formation of a cup and handle pattern suggests a bullish trend may be on the horizon. Currently, Bitcoin is consolidating around the $105,000 range, and a breakout above $105,500 could trigger substantial upward movement toward $106,500-$107,000.

How do market trends impact Bitcoin trading strategies?

Understanding Bitcoin market trends is essential for effective trading strategies. The current consolidation phase after the recent peak near $112,000 implies traders should watch for potential breakouts or breakdowns. A strong support level is identified around $102,000, making it a key area for decision-making in BTC price prediction.

What are the key levels to watch for in Bitcoin breakout scenarios?

In Bitcoin breakout scenarios, critical levels include $105,500 as a resistance point. A successful breach above this level, supported by high volume, could lead to a rally toward $107,000. Conversely, a decline below $102,000 may signal a deeper retracement, emphasizing the importance of monitoring price actions closely.

How does the Cup and Handle pattern work in Bitcoin price analysis?

The Cup and Handle pattern in Bitcoin price analysis highlights a specific formation where prices consolidate, forming a rounded bottom followed by a handle. This pattern suggests potential bullish momentum, and a breakout from the handle, typically above $105,500, could confirm the setup and stimulate further price increases.

What indicators are significant for Bitcoin price prediction?

For accurate Bitcoin price prediction, traders should consider various indicators such as the RSI, MACD, and volume trends. Currently, the RSI is at 52, signaling neutral momentum, while the MACD shows bearish signals. These indicators, alongside identified support levels, provide crucial data for evaluating potential price movements.

How does Bitcoin trading volume affect price direction?

Bitcoin trading volume is a crucial factor that influences price direction. A notable increase in volume during a breakout above $105,500 would validate the bullish trend, while declining volume may indicate indecision or weakness in selling pressure during consolidation phases.

Why is the $100,000 psychological level important in Bitcoin price analysis?

The $100,000 psychological level acts as a significant support zone in Bitcoin price analysis. Holding above this level demonstrates resilience in the market, while breaking below could lead to increased selling pressure and potential deep retracement towards $96,000-$98,000.

What does it mean if the Bitcoin price is consolidating around current levels?

When Bitcoin price is consolidating around current levels, it indicates a period of indecision in the market where bulls and bears are contesting control. This phase often precedes significant price movements, and traders use technical patterns, like the cup and handle, to predict potential breakout opportunities.

| Aspect | Details |

|---|---|

| Current Price Range | $104,881 – $105,266 |

| Market Capitalization | $2.08 trillion |

| 24-Hour Trading Volume | $24.93 billion |

| Price Range in 24 Hours | $103,655 – $105,213 |

| Current Market Sentiment | Mixed, with bearish engulfing patterns |

| Key Support Area | $102,000 |

| Immediate Resistance Level | $105,500 |

| Potential Price Targets | $106,500 – $107,000 |

Summary

Bitcoin price analysis indicates that the cryptocurrency is currently testing key support levels while navigating through a consolidation phase. The potential cup and handle pattern signifies bullish sentiment may emerge, especially if Bitcoin breaks above $105,500 with adequate volume. As market dynamics evolve, traders should monitor both the technical indicators and support zones closely to make informed decisions regarding potential price movements.