Tariffs Impact on Consumers: Goldman Sachs Stands Firm

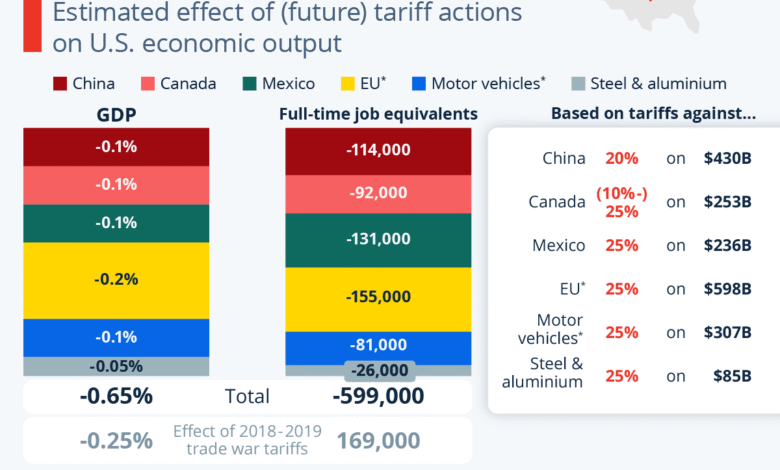

The impact of tariffs on consumers is a pressing concern that has garnered significant attention, especially in the wake of President Trump’s recent criticisms of Goldman Sachs’ analysis. According to the bank’s economist David Mericle, consumers are poised to bear a substantial portion of the costs associated with these tariffs, with projections indicating that by fall, they may absorb nearly two-thirds of the financial burden. This shift in costs could exacerbate inflation forecasts, pushing the consumer price index to alarming levels. The implications of such tariff-led increases could ripple throughout the economy, affecting purchasing power and overall living costs. As we navigate this complex landscape, understanding the extent of tariffs’ impact on consumers becomes increasingly vital for informed financial decisions and economic policies.

In evaluating the repercussions of import taxes, it becomes evident that they alter economic dynamics in ways that directly affect shoppers. Recent estimates suggest that a majority of the tariffs currently levied will ultimately translate into higher prices for everyday goods, with consumers forced to shoulder much of this fiscal burden. Relevant analyses, including those from notable economists, highlight that this scenario may lead to adjustments in the inflation rate, particularly impacting the core components of consumer spending. Moreover, the ongoing debate surrounding these duties underscores the contentious nature of trade policies and their consequences for households. As we delve deeper into the ramifications of such economic measures, it is crucial to recognize how they shape consumer behavior and influence overall market stability.

The Economic Burden of Tariffs on American Consumers

The imposition of tariffs has historically been a contentious issue, often leading to debates about who truly bears the financial burden. Recent predictions by Goldman Sachs indicate that American consumers are likely to shoulder a significant portion of these costs. According to economist David Mericle, as tariffs start to take effect, it is projected that by fall, two-thirds of the additional costs will be passed down to consumers. This stark forecast raises concerns about the overall impact on household budgets and inflation rates.

As costs rise due to tariffs, everyday goods and services may see a price increase, which can strain consumer spending. The ripple effect on the economy could be substantial, as higher prices may lead to a reduction in discretionary spending. This situation can create a cycle of inflation that is hard to break; as consumers tighten their belts in response to rising prices, businesses may face declining sales, creating further economic challenges.

Frequently Asked Questions

What is Goldman Sachs’ analysis of tariffs’ impact on consumers?

Goldman Sachs’ analysis suggests that consumers will eventually bear the bulk of the costs associated with tariffs. Their economist, David Mericle, predicts that by fall, up to two-thirds of the tariffs’ burden will shift to consumers, impacting their finances significantly.

How do tariffs impact consumer price index and inflation forecast?

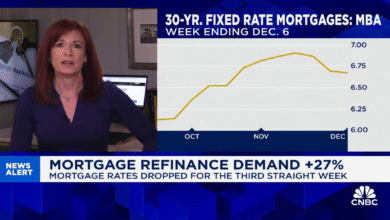

Tariffs can increase consumer prices, thereby influencing the consumer price index (CPI). Goldman Sachs forecasts that the shifting burden of tariffs on consumers could elevate the core PCE inflation measure to 3.2% by year-end, well above the Federal Reserve’s target of 2%.

Why did Trump criticize Goldman Sachs’ economist regarding tariffs impact on consumers?

President Trump criticized Goldman Sachs’ economist David Mericle over his forecast that consumers would shoulder the costs of tariffs. Trump suggested the bank should reconsider its economic predictions, reflecting his administration’s stance on tariff impacts.

What evidence supports the claim that consumers will bear tariffs’ costs?

Goldman Sachs’ research indicates that while initially, exporters and businesses absorbed tariffs, the burden is expected to transition to consumers. This conclusion is backed by analyses showing price increases among companies benefiting from tariff protections against foreign competition.

What is the expected timeline for tariffs’ impact on consumers according to Goldman Sachs?

Goldman Sachs expects that consumers will begin feeling the financial impact of tariffs by fall, with predictions that roughly two-thirds of costs will be passed on to them, affecting overall consumer spending and inflation rates.

How might tariffs influence Federal Reserve’s monetary policy?

While tariffs are expected to influence the consumer price index and inflation, Goldman economist Mericle believes this will be viewed as a one-time price change by the Federal Reserve, potentially leading to monetary policy adjustments, such as interest rate cuts.

What are the implications of tariffs on household budgets according to Goldman Sachs?

The implications of tariffs on household budgets could be significant, as consumers may notice increased prices for goods, resulting in reduced purchasing power and greater strain on their personal finances as companies adjust their pricing strategies to offset tariff costs.

How are consumers expected to react to the rising costs due to tariffs?

As tariffs increase prices, consumers may alter their spending habits, potentially seeking lower-cost alternatives or reducing consumption altogether, which could further influence economic conditions and market dynamics.

What is the relationship between tariffs and the Fed’s inflation targets?

The relationship lies in the fact that increased tariffs can lead to higher consumer prices, which may push inflation rates above the Fed’s 2% target. Goldman Sachs anticipates core PCE inflation could rise as a direct result of these tariffs.

| Key Point | Details |

|---|---|

| Goldman Sachs Prediction | Goldman Sachs economist David Mericle maintains that consumers will eventually bear two-thirds of tariff costs. |

| Impact Timing | The impact on consumers’ finances is expected to be significant by fall 2025. |

| Presidential Critique | President Trump criticized Goldman Sachs for this prediction, suggesting re-evaluating their economic outlook. |

| Rationale Behind Predictions | The analysis suggests businesses will pass tariffs on to consumers, resulting in increased prices. |

| Inflation Impacts | Consumers could see a rise in the core PCE inflation measure to 3.2% by year-end due to tariff costs. |

| Economic Outlook | Mericle believes that the Federal Reserve will respond with interest rate cuts, independent of tariff impacts. |

Summary

Tariffs impact on consumers is becoming a significant concern as economists predict that these tariffs will burden consumers financially. Goldman Sachs has projected that consumers will bear two-thirds of the costs associated with tariffs by the fall of 2025. This shift in the financial responsibility from exporters and businesses to consumers is expected to elevate inflation rates, potentially causing the core PCE inflation measure to rise above the Federal Reserve’s target. The ongoing economic analyses and resulting inflations reflect broader trends where businesses may increase prices due to reduced foreign competition, further emphasizing the financial implications for consumers.