Tariffs Impact: Steve Eisman’s Concerns for Investors

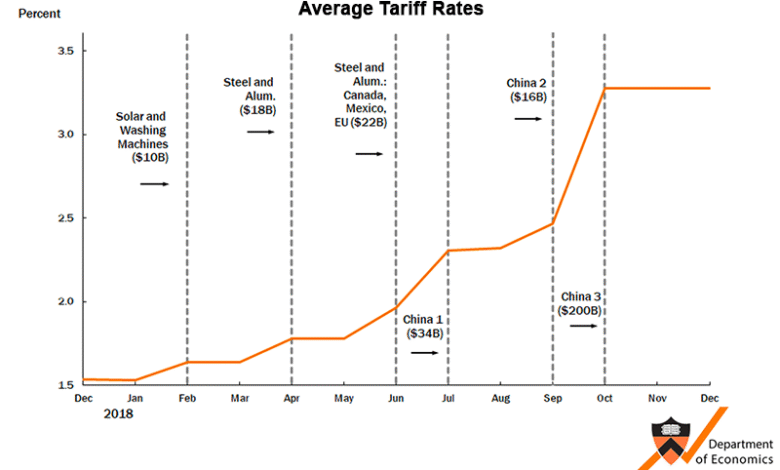

Tariffs impact the delicate balance of global trade, and as investor Steve Eisman recently noted, they are a significant concern in today’s economy. With ongoing trade wars and evolving trade policies, the implications of tariffs could ripple through the markets, affecting both investor sentiment and corporate profitability. The uncertain nature of these tariffs raises alarms, as they threaten market stability and could lead to increased volatility, particularly for sectors reliant on imports. Eisman highlights that while other economic indicators may show resilience, the unpredictable landscape created by tariffs warrants close examination by investors. Thus, understanding the full ramifications of tariffs is crucial for navigating the complexities of the current financial environment.

The effects of imposing taxes on imports, commonly referred to as tariffs, ripple through the economic landscape in profound ways. These trade barriers often alter the dynamics of international commerce and can ignite tensions in trade relations, as seen in recent global disputes. As stakeholders including corporate leaders and investors analyze these changes, the overarching theme remains clear: these tariffs pose risks that could disrupt market equilibrium. In light of the present economic discourse, it becomes essential for investors to consider how fluctuating trade policies can impact sectors they are invested in, especially those that depend on foreign goods. By investigating the intricacies of this issue, one can better grasp how tariffs shape the future of global financial stability.

Understanding Tariffs and Their Economic Impact

Tariffs serve as a critical mechanism in international trade, influencing not only the price of imported goods but also the broader market dynamics. When governments impose tariffs, they raise the cost of foreign products, leading to shifts in consumer behavior and corporate strategies. These adjustments can create ripple effects throughout the economy, affecting everything from market stability to inflation rates. For investors, understanding these economic implications is vital, as they can lead to changes in investment strategies based on market responses to new trade policies.

In particular, the imposition of tariffs can lead to increased costs for companies reliant on imported materials. This situation raises concerns about profit margins and potential price hikes for consumers, generating uncertainty within the marketplace. As Steve Eisman pointed out, the unpredictability surrounding tariffs is a significant risk that investors must acknowledge. The potential for rapid changes in tariffs during trade wars adds another layer of complexity, compelling market participants to remain vigilant and adaptive.

Steve Eisman: Insights on Current Trade Policies

Steve Eisman, a prominent investor known for his insightful analysis, has expressed noteworthy concerns over current trade policies. His experiences during the financial crisis have honed his instincts, making him acutely aware of how such policies can reshape market trajectories. According to Eisman, the government’s shifting approach to tariffs could result in waves of investor panic and increased volatility in stocks related to international trade. As trade wars escalate, companies may find themselves caught off-guard, leading to heightened investor concerns and a cautious approach to market engagement.

Eisman advocates for a thorough examination of how these trade policies affect corporate earnings and the overall economic landscape. By analyzing the connections between tariffs and financial performance, investors can make more informed decisions amidst a climate of uncertainty. This proactive approach can help mitigate risks related to trade tensions and position portfolios favorably, a strategy many investors may need to adopt in light of ongoing tariff-related complexities in today’s market.

The Relationship Between Trade Wars and Market Stability

Trade wars fundamentally disrupt market stability, creating an environment fraught with uncertainty for businesses and investors alike. These conflicts — characterized by retaliatory tariffs and harsh trade policies — can lead to increased costs for consumers and producers. Consequently, the threat of deteriorating market conditions looms large as participants navigate through an unclear economic landscape. Investors must pay close attention to shifts in trade dynamics, as escalations in tariffs can expect to influence stock prices and sector performance positively or negatively.

Market stability relies heavily on clear communication and predictability in international trade relations. When stakeholders perceive that tariffs will remain volatile due to ongoing trade wars, the resulting hesitation can stall investment and innovation. Investors, both institutional and individual, often reassess their allocations in response to such uncertainties, gravitating towards safer assets or sectors less impacted by foreign tariffs. Thus, understanding the intricate linkage between trade wars and market stability is imperative for stakeholders aiming to safeguard their interests amid shifting economic conditions.

Investor Concerns Amidst Tariff Changes

The recent climate of frequent tariff changes has sparked considerable concern among investors. The unpredictability of these shifts complicates the investment landscape, prompting many to reconsider their strategies. Investors are increasingly wary of companies with high exposure to tariff-related risks, particularly those reliant on international supply chains. As tariffs rise, these companies may face squeezes on their profit margins, which in turn could affect share prices and shareholder returns.

Moreover, as businesses struggle to navigate these economic headwinds, investor sentiment may turn negative, exacerbating market declines. Therefore, staying informed about impending tariff changes and understanding their potential impacts on various sectors is crucial for effective portfolio management. Investors are encouraged to keep abreast of government announcements regarding trade policies and to involve risk assessment strategies that account for tariff-related fluctuations.

The Unpredictability of Tariffs and Investor Strategies

The unpredictability of tariffs necessitates a reassessment of investor strategies in today’s volatile market. As tariffs can be altered swiftly as part of varying trade policies, investors must remain agile in their approach to market positioning. This constant change makes long-term forecasting challenging and requires investors to regularly update their strategies to mitigate risks. By leveraging data analytics and market insights, investors can better gauge when to pivot in response to fluctuating tariff conditions.

To navigate these complexities, investors might benefit from diversifying their portfolios across various sectors less affected by international trade. This strategy includes allocating funds to domestic companies or industries that can thrive despite tariff transformations. Additionally, becoming adept at interpreting policy shifts and market reactions can equip investors with the tools necessary to outmaneuver potential downturns caused by trade-related turmoil and reassure stakeholders about their financial futures.

Forecasting Market Reactions to Trade Policies

As global trade policies continue to evolve, forecasting market reactions becomes increasingly critical for investors. Changes in tariffs can stir immediate market responses, with stocks related to imports and exports often reacting sharply to announcements. Understanding these dynamics allows investors to prepare and position themselves advantageously ahead of expected fluctuations. Predictive analytics and historical patterns can serve as useful tools for anticipating how similar tariff changes have previously influenced market spaces.

Moreover, these forecasts can extend beyond immediate price reactions to encompass longer-term implications. Investors should consider how sustained tariff policies might affect overall market trends, including inflation rates and corporate profitability. By continuously evaluating these factors, they can devise strategies that capture potential opportunities while mitigating risks associated with external economic pressure.

The Impact of Tariffs on Corporate Earnings

Tariffs directly affect corporate earnings by increasing the cost of imported goods, which can lead to higher expenses for businesses. This rise in costs may force companies to either absorb the financial pressure, thereby diminishing profit margins, or pass on the costs to consumers through price hikes. As a result, investors must scrutinize the exposure of their investments to tariffs, especially for those heavily reliant on raw materials sourced from overseas. Understanding this relationship is essential for predicting how changes in tariffs can ripple through financial statements and overall market health.

Moreover, the earnings reports of companies following tariff adjustments can reveal insights into how effectively management navigates these challenges. Investors should look for indications of strategic shifts, such as diversification of suppliers or cost-cutting measures, that could mitigate tariff impacts. Ultimately, analyzing corporate responses to tariff changes will provide a clearer picture of potential earnings growth or decline, guiding investment decisions in a turbulent economic environment.

Adapting to Changing Trade Policies

As the landscape of global trade continuously shifts, adapting to changing trade policies becomes imperative for both investors and corporations. The ability to pivot in response to new tariffs is crucial for maintaining competitive advantages and ensuring financial viability. Corporations that proactively reassess their supply chains and consider alternative sourcing strategies will likely fare better against tariff-induced pressures. This adaptability is equally important for investors, who must evolve their portfolios in alignment with the unfolding economic climate.

In cultivating resilience, businesses and investors alike should engage in scenario planning and risk assessment exercises. By exploring various contingent plans regarding different tariff outcomes, stakeholders can prepare for potential disruptions in the market. Thus, fostering a culture of flexibility and foresight within investment strategies allows for a more robust response to the unpredictable nature of trade policies and tariffs, ensuring long-term growth and stability.

The Future of Trade and Tariff Management

Looking forward, the future of trade and tariff management is likely to be characterized by greater complexity and ongoing contention among nations. As trade policies evolve, the importance of effective tariff management will become ever more pronounced. Investors should closely monitor government negotiations and developments that could herald significant changes to how tariffs are levied. Being ahead of market shifts in trade policies can empower investors to seize opportunities for growth during transitional periods.

Additionally, a focus on international collaboration and diplomacy may pave the way for more stable trade relations, potentially reducing the volatility associated with tariffs. The evolution of trade agreements and their implementation will play a critical role in shaping market outcomes. Investors should be prepared to adapt to these changes, aligning their strategies with broader geopolitical trends that influence global trade flows and economic conditions.

Frequently Asked Questions

What is the impact of tariffs on market stability according to Steve Eisman?

Steve Eisman warns that tariffs can create significant instability in the market. He believes that rising tariffs and ongoing trade wars undermine investor confidence and can lead to increased volatility in stock prices, particularly for companies reliant on imported goods.

How do current trade policies affect investor concerns regarding tariffs?

Current trade policies, particularly those involving tariffs, create heightened investor concerns. Investors are apprehensive that changes in tariffs could lead to unpredictable earnings for companies, thus affecting overall market performance.

Why are tariffs considered a critical issue in today’s trade wars?

Tariffs are at the center of today’s trade wars as they directly affect the cost of goods and companies’ profit margins. This uncertainty can hinder investment decisions and market health, making tariffs a pivotal issue for investors like Steve Eisman.

What should investors watch regarding tariffs and their economic impact?

Investors should closely monitor the evolving situation surrounding tariffs, as their impact on trade policies can lead to substantial shifts in market stability. Analyzing how tariff changes influence both domestic and international markets is crucial for anticipating market movements.

What are the broader implications of tariffs on company earnings?

Tariffs can have broad implications for company earnings, as increased costs from tariffs may squeeze profit margins and lead to lower earnings projections. Companies that rely heavily on imports are particularly vulnerable, making the tariff situation critical for investors.

| Key Point | Details |

|---|---|

| Eisman’s Concern | Steve Eisman focuses on tariffs as the main concern affecting the market. |

| Impact on Company Earnings | Changes in tariffs could significantly alter earnings for companies involved in international trade. |

| Trade Wars | Ongoing trade wars introduce uncertainty that can negatively impact market stability. |

| Economic Indicators | While economic indicators appear strong, tariffs add a layer of unpredictability. |

| Investor Advice | Investors should monitor tariff developments closely due to their potential to increase market volatility. |

Summary

Tariffs impact the market significantly, as highlighted by Steve Eisman, who sees them as a primary concern in current economic discussions. The unpredictability surrounding tariffs and trade policies has the potential to affect company earnings and result in increased volatility across various market sectors. Investors should be aware of the implications that changing tariffs can have on their investments, especially in industries that rely heavily on international goods.