Tax-Efficient Investment Strategies with LCOR ETF

In today’s record-setting market, investors are increasingly exploring tax-efficient investment strategies to minimize their tax liabilities effectively. One notable option is the upcoming Astoria U.S. Enhanced Core Equity ETF, set to launch in October, which leverages a unique exchange strategy under Section 351 of the tax code. This innovative approach can help investors sidestep substantial capital gains taxes that typically arise from heavy concentrations in stocks like Nvidia and Microsoft, which have experienced significant appreciation. By reallocating these positions into the new ETF, investors can avoid the conventional tax consequences associated with selling assets. As many are grappling with large tax bills from their profitable investments in major tech stocks, the search for effective investment tax strategies is more relevant than ever.

As the financial landscape evolves, many investors are seeking ways to optimize their portfolios through smart fiscal planning. Various capital gains tax strategies have emerged, aiming to enhance after-tax returns while complying with regulations. Financial products such as tax-efficient ETFs have gained attention for their potential to streamline returns and reduce tax burdens. The Astoria U.S. Enhanced Core Equity ETF exemplifies this trend, offering an innovative structure to promote efficient investment without triggering unwanted capital gains. Investors are not just looking for profits anymore; they are increasingly focused on how to preserve wealth through intelligent tax management.

Understanding Tax-Efficient Investment Strategies

In today’s fluctuating market, understanding tax-efficient investment strategies is crucial for maximizing returns while minimizing tax liabilities. With rising capital gains taxes, especially for successful tech stocks like Nvidia and Microsoft, investors are increasingly seeking methods to protect and grow their wealth. Tax-efficient strategies can include a variety of approaches, but they primarily focus on reducing the impact of taxes on investment income through careful planning and asset selection.

Among the most effective tactics is the use of tax-efficient ETFs, which aim to deliver returns while minimizing distributions that could trigger capital gains taxes. Investors should be aware of how investments operate within these ETFs, particularly regarding the mechanisms of buybacks and share redemptions, which can lead to lower overall tax burdens. By leveraging the advantages offered by tax-efficient investment vehicles, individual investors can enhance their financial resilience even in a volatile market.

The Role of Section 351 Exchange

The Section 351 exchange is a pivotal component of tax-efficient investment strategies, providing a pathway for investors to transfer appreciated assets into a new investment vehicle without immediately incurring capital gains taxes. This section of the tax code allows for the deferral of tax liability if specific conditions are met, notably the requirement that the exchange be made in exchange for stock in a corporation. This mechanism is particularly beneficial for investors looking to diversify their portfolios and manage their tax liabilities.

By utilizing a Section 351 exchange to invest in offerings like the Astoria U.S. Enhanced Core Equity ETF, investors can effectively reposition their assets while delaying the tax consequences typically associated with selling appreciated securities. This strategic approach not only facilitates a seamless transition into new investment opportunities but also allows the investor to maintain a more favorable tax posture as they pursue growth.

Maximizing Benefits with Tax-Efficient ETFs

Tax-efficient ETFs are becoming increasingly popular among investors seeking to achieve significant growth while minimizing tax-related costs. They are designed to maintain low turnover rates, which direct implications for capital gains distributions. By choosing ETFs like the upcoming Astoria U.S. Enhanced Core Equity ETF (LCOR), investors can take advantage of an investment structure that offers both upside potential and a strategic mitigation of tax impacts.

Furthermore, the inherent design of tax-efficient ETFs can provide investors with a unique opportunity to invest in a diversified portfolio without the constant headache of tax liabilities that often accompany traditional mutual funds. This enhanced efficiency makes them an appealing choice for those looking to optimize their long-term growth strategies while being mindful of their tax obligations.

Strategic Capital Gains Tax Management

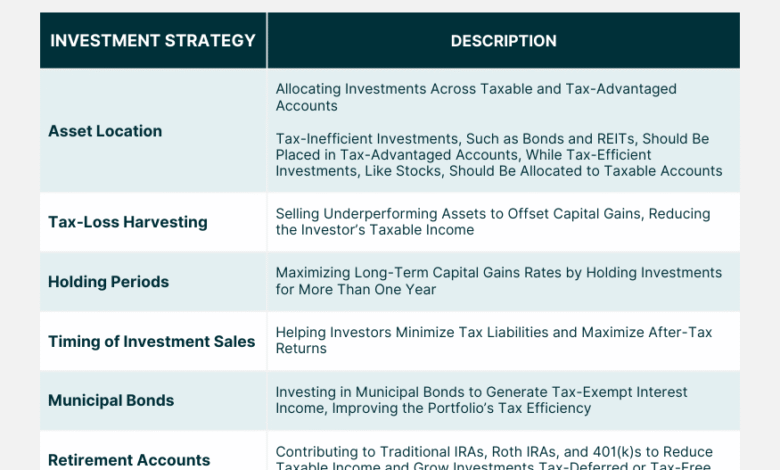

Effective capital gains tax strategies can significantly influence an investor’s net returns, especially in a market characterized by soaring asset prices. Investors must consider various methods to manage gains, including tax-loss harvesting or the strategic timing of sales to align with lower income years. With the right capital gains tax strategies in place, investors can potentially reduce their tax burden and optimize their investment returns.

Moreover, understanding the implications of holding periods and the differences between short-term and long-term capital gains can empower investors to make informed decisions. By focusing on tax-efficient investing, individuals can ensure they’re not only growing their wealth but doing so in a manner that minimizes unnecessary tax exposure.

Benefits of Engaging with Industry Experts

Consulting with industry experts can provide investors with insights into the latest tax-efficient investment strategies and vehicles, including newly launched ETFs like the Astoria U.S. Enhanced Core Equity ETF. With expert guidance, investors can tailor their approaches to align with their specific financial goals while navigating the complexities of tax regulations. Expertise in tax-efficient strategies also includes understanding the intricate guidelines of the IRS and how they affect various investment decisions.

In a world where tax laws continuously evolve, staying current on best practices and investment vehicles can empower investors to maximize their financial outcomes. Engaging with consultants who specialize in tax-efficient investments can help navigate potential pitfalls, ensuring that asset allocation aligns with both growth and tax reduction goals.

Current Trends in Tax-Efficient Investing

The trend toward tax-efficient investing continues to grow, fueled by a market that sees substantial volatility alongside opportunities for significant gains. One clear trend is the increased adoption of tax-efficient ETFs among investors, which are designed to deliver broad market exposure while minimizing capital gains distribution. This shift reflects a growing awareness among investors of the tax implications of their investment choices.

As many investors seek to mitigate their tax liabilities in light of ongoing market fluctuations, products like the Astoria U.S. Enhanced Core Equity ETF are positioning themselves as attractive options. This is particularly relevant for those holding large positions in high-performing stocks who are looking to transition into more diversified, tax-efficient investment strategies.

Impact of Market Conditions on Tax Strategies

Market conditions greatly influence how and when investors should execute their tax strategies. In times of market expansion, where capital gains are prevalent, the pressure on tax liabilities increases, prompting investors to explore tax-efficient options aggressively. Strategies such as reallocating investments through tax-efficient ETFs, using capital losses effectively, or employing a Section 351 exchange become vital during such periods.

Even amid market contractions, understanding tax impacts remains crucial. Investors may reevaluate their holdings and consider tax-loss harvesting to maximize benefits from both rising and falling markets. This dynamic approach allows investors to stay agile and strategically manage their portfolios in response to the unexpected shifts in the market.

The Importance of Portfolio Diversification and Tax Efficiency

Portfolio diversification is foundational to successful investing, not only to spread risk but also to enhance tax efficiency. Through diversification, an investor may mitigate the impact of capital gains taxes by avoiding heavy concentration in one or two high-performing stocks. This strategy can be effectively achieved using tax-efficient ETFs, like the Astoria U.S. Enhanced Core Equity ETF.

Moreover, a well-diversified portfolio that aligns with tax-efficient strategies can protect investors during downturns while allowing them to capitalize on growth opportunities without incurring significant tax burdens. This balance is crucial for long-term financial health and sustainability, making it imperative for investors to incorporate diversification in their tax planning.

Investment Tax Strategies: Future Outlook

Looking ahead, the landscape for investment tax strategies is likely to become more intricate as tax legislation evolves. Investors will need to stay well-informed about changes in tax law and how these shifts affect their investment strategies, especially related to capital gains tax implications. Opportunities for tax-efficient investing, particularly through innovative products like tax-efficient ETFs, will undoubtedly play a significant role in helping investors navigate this landscape.

The future of investment tax strategies will likely see a focus on not only maximizing growth but also understanding the long-term implications of tax liabilities. Emphasizing tax-efficient investment strategies, including the use of ETFs, will be essential in equipping investors to meet their financial objectives in an environment characterized by complexity and change.

Frequently Asked Questions

What are tax-efficient investment strategies and why are they important?

Tax-efficient investment strategies are methods that minimize tax liabilities for investors, enhancing after-tax returns. These strategies are crucial as they help preserve capital by reducing the total taxes owed on investment gains, especially relevant in a market with significant capital gains.

How does the Astoria U.S. Enhanced Core Equity ETF utilize tax-efficient strategies?

The Astoria U.S. Enhanced Core Equity ETF (LCOR) employs tax-efficient strategies by leveraging Section 351 of the tax code, allowing investors to transfer appreciated assets into the ETF without triggering immediate capital gains taxes.

What is a Section 351 exchange and how does it relate to tax-efficient ETFs?

A Section 351 exchange enables investors to transfer appreciated securities into a corporation or ETF like LCOR without realizing capital gains. This tax-efficient strategy helps prevent an immediate tax liability, making it an appealing option for investors looking to optimize their tax situation.

What are capital gains tax strategies that investors should consider?

Capital gains tax strategies include tax-loss harvesting, utilizing tax-efficient ETFs like LCOR, and long-term holding of investments to benefit from lower tax rates. These strategies aim to minimize tax impact while maximizing investment returns.

Are tax-efficient ETFs like LCOR suitable for all investors?

While tax-efficient ETFs such as LCOR can benefit many investors by reducing tax liabilities, they are particularly suitable for those with substantial gains in concentrated stock positions, as they provide a way to reallocate investments with minimized tax consequences.

What investment tax strategies can help reduce overall taxes on a portfolio?

Investment tax strategies include investing in tax-efficient ETFs, utilizing tax-advantaged accounts, implementing tax-loss harvesting, and placing high-yield investments in tax-deferred accounts. These approaches aim to lower the overall tax burden on portfolios.

Why is tax efficiency increasingly relevant for investors today?

Tax efficiency is increasingly relevant as many investors face higher capital gains taxes from profitable investments, especially in a booming market with significant appreciation in tech stocks. Strategies like those offered by the Astoria U.S. Enhanced Core Equity ETF are timely solutions to managing tax liabilities.

| Key Point | Details |

|---|---|

| Tax-Efficient Investment Strategies | Investors are looking for ways to minimize tax liabilities amid a record-setting market. |

| Astoria U.S. Enhanced Core Equity ETF (LCOR) | LCOR aims for tax efficiency through a unique exchange strategy under Section 351 of the tax code. |

| Capital Gains Tax | This strategy helps avoid substantial capital gains taxes from heavy concentration in high-performing stocks. |

| Focus on Major Tech Stocks | Stocks like Nvidia and Microsoft have seen significant appreciation, prompting tax concerns. |

| Reallocation Benefits | Investors can reallocate positions into the new ETF without typical selling tax consequences. |

| Industry Response | Experts believe this approach is essential for those facing large tax bills from profitable tech investments. |

| Growing Interest | There is increasing demand for tax-efficient strategies to help manage tax burdens effectively. |

Summary

Tax-efficient investment strategies are crucial for investors aiming to reduce their tax liabilities as market conditions evolve. The introduction of the Astoria U.S. Enhanced Core Equity ETF (LCOR) exemplifies a forward-thinking approach to achieving tax efficiency through innovative methods aligned with the tax code. By leveraging Section 351, investors can navigate the complexities of capital gains tax, particularly concerning lucrative tech stocks like Nvidia and Microsoft. As the market continues to rise, it is evident that strategies like LCOR are not just beneficial but necessary for investors looking to effectively manage their tax burdens in an increasingly profitable environment.