Tesla CEO Pay Package Awarded to Elon Musk: $29 Billion Shares

Tesla CEO pay package has made headlines once again as the company’s board recently approved a staggering interim compensation plan for Elon Musk consisting of 96 million shares, a figure poised to be valued at around $29 billion. This significant decision, which directly reflects on Musk’s immense influence over Tesla’s strategic direction, was publicly recorded in a filing released Monday. Following the approval from Tesla’s board, discussions have sparked among stakeholders regarding the implications of such high executive pay, especially in light of Musk’s past compensation controversies. The latest package is set to vest in two years, but should Musk’s ongoing legal disputes regarding his 2018 compensation plan result unfavorably, he risks forfeiting this new award. Moreover, the backdrop of a recent Tesla stock surge adds another layer to the narrative, raising questions about the sustainability of Musk’s ventures and the expectations surrounding the upcoming Tesla shareholder meeting.

The recent compensation arrangement for the chief executive of Tesla, often referred to as Musk’s salary scheme, highlights the complex dynamics of corporate governance and shareholder sentiment within the electric vehicle powerhouse. This unprecedented package, which includes a massive allocation of shares, underscores both the confidence Tesla’s board has in Musk and the contentious backdrop of his previous compensation battles in Delaware courts. Analysts are now dissecting the potential ramifications of this pay structure amidst a fluctuating stock price and a looming shareholder meeting, where investors will be eager to gain insights into Musk’s strategies and ambitions, especially regarding his new projects and ventures outside Tesla. Musk’s newly approved pay scheme also raises essential questions about the ethical dimensions of executive compensation in the context of shareholder interests and broader market expectations. As Tesla moves further into an increasingly competitive landscape, the implications of Musk’s leadership and financial incentives on the company’s future trajectory remain a critical focal point.

Understanding Tesla CEO Pay Package

Tesla’s recent decision to award CEO Elon Musk an interim pay package consisting of 96 million shares has stirred discussions among investors and financial analysts alike. This substantial package, valued at approximately $29 billion, is contingent on Musk remaining in a leadership position for at least two years. Such a high-stakes compensation plan not only highlights the significant market confidence in Musk’s capabilities but also raises questions about the governance practices of Tesla’s board. The approval of this pay package following the controversies surrounding Musk’s 2018 compensation plan indicates a strategic move by the board to ensure Musk’s continued leadership.

Moreover, this interim pay package reflects Tesla’s ambition and strategic vision. Despite ongoing legal challenges regarding his previous compensation, which was valued at $56 billion upon vesting, Musk’s control over Tesla and its direction appears unquestioned. This dynamic is further intensified by the broader implications for Tesla as it navigates fluctuating stock prices and evolving investor sentiments. The approval of such a package may signal to stakeholders that Tesla is committed to its growth trajectory under Musk’s leadership.

Elon Musk’s Compensation and Market Impact

Following the announcement of his new pay package, Elon Musk’s compensation has become a focal point amidst the backdrop of Tesla’s stock market performance. The recent surge of more than 2% in Tesla’s stock value can be associated with the market’s positive reception of Musk’s interim package. Investors are keenly aware of Musk’s substantial shareholding, which stands at around 13% of Tesla’s outstanding shares. This control is paramount for investor confidence, as it directly ties Musk’s financial success to the company’s overall performance.

However, the discourse surrounding Musk’s compensation is complicated by the legal battles he faces regarding his 2018 pay plan. The ongoing case with the Delaware Supreme Court has the potential to redefine the landscape of executive compensation and corporate governance within tech giants like Tesla. Stakeholders are now watching closely how these issues unfold and how they might influence future decisions about executive pay, particularly in an environment where corporate accountability is increasingly scrutinized.

The Role of Tesla’s Board in Executive Compensation

Tesla’s board plays a pivotal role in overseeing executive compensation, particularly in light of the recent turbulence surrounding Elon Musk’s pay packages. The board’s formation of a special committee to approve Musk’s interim pay reflects an effort to mitigate any potential fallout from previous criticisms of their governance practices. This committee, comprising board chair Robyn Denholm and director Kathleen Wilson-Thompson, signifies a step toward transparency and responsible oversight, especially after the court ruling by Chancellor Kathaleen McCormick that deemed Musk’s 2018 pay plan improperly granted.

The implications of the board’s decisions go beyond just Musk’s pay; they set precedents for how executive compensation is structured across the industry. With stakeholders increasingly interested in corporate governance, Tesla’s board must act to balance shareholder interests while ensuring that executive incentive structures foster long-term growth. As Tesla prepares for its upcoming shareholder meeting, these dynamics will likely be at the forefront of discussions among shareholders eager to understand how leadership compensation aligns with overall company performance.

Musk’s New Ventures and Tesla’s Future

Elon Musk’s business ventures continue to evolve alongside Tesla, blending innovation with strategic business decisions. Recently, he launched xAI, a startup focused on artificial intelligence and data infrastructure that aims to complement Tesla’s goals in the EV space. This dual pursuit raises questions about the potential risks and rewards of Musk’s diverse interests, especially as he expresses desires for increased control over Tesla’s strategic direction in AI and robotics integration.

The interconnection between Musk’s new ventures and Tesla’s trajectory could be significant for investors. As Musk explores new technologies and business models, he could bolster Tesla’s competitive edge in a rapidly advancing automotive landscape. However, the challenge remains to maintain transparency with shareholders who are concerned about Musk’s divided attention and its impact on Tesla’s core business focus. Navigating these new ventures while ensuring Tesla continues to lead in electric vehicles will be crucial for sustaining investor confidence.

Shareholder Reactions to Elon Musk’s CEO Role

Elon Musk’s position as CEO has been a lightning rod for debate among Tesla shareholders. Recent controversies, particularly regarding his compensation and legal challenges, have fueled discussions about the sustainability of his leadership. Many shareholders are observing Musk’s active role in new ventures like xAI and his involvement in political activities, which some believe pose distractions from his responsibilities at Tesla. This scrutiny reflects a broader concern about the balance between Musk’s innovative drive and the execution of Tesla’s core strategy.

In anticipation of the upcoming shareholder meeting, tensions may rise as investors seek clarity regarding Musk’s vision for Tesla amidst these distractions. As Musk continues to enhance his portfolio of interests, the obligation to reassure shareholders that Tesla remains a priority will be crucial for maintaining their support. The meeting could become a platform for addressing these concerns, determining how Musk’s leadership will align with Tesla’s future objectives.

Musk’s Political Involvement and Its Impact on Tesla

Elon Musk’s foray into politics, including his involvement with the Trump administration, has generated a significant response among Tesla’s customer base and shareholders. His political activities, particularly his support for a new political party, have resulted in mixed reactions, with some fans rejecting his political stance while others remain loyal to his vision. This dichotomy poses unique challenges for Tesla as it attempts to retain its reputation in an increasingly polarized market.

The tension surrounding Musk’s political involvement has the potential to impact Tesla’s sales performance, especially in key markets like the U.S. and Europe. As the company navigates declining quarterly sales and diminishing EV tax credits, the impact of Musk’s extracurricular engagements becomes ever more pronounced. Thus, the need for Tesla to carefully manage its branding and public relations amidst Musk’s political endeavors is critical for sustaining its market position.

Future Predictions for Tesla Stock Amidst CEO Changes

The unpredictable nature of stock markets makes the future trajectory of Tesla’s stock challenging to forecast, especially given the complexities surrounding Elon Musk’s interim pay package and ongoing legal disputes. Analysts are acutely aware that Musk’s significant stake in Tesla closely ties his financial interests to the company’s performance. As the company approaches key events, such as its annual shareholder meeting, the conversation surrounding potential stock future fluctuations will intensify.

Market responses have often hinged on Musk’s leadership style and public persona, which contribute substantially to Tesla’s brand identity. The continuing legal challenges and Musk’s ambitious statements regarding new ventures may create both volatility and opportunity for investors. Observing how these factors unfold in the coming quarters will provide insight into not only Tesla’s stock but also the broader trends within the automotive and tech industries as they transition towards greater innovation.

Legal Challenges and Their Implications for Tesla Shareholders

The legal disputes facing Elon Musk regarding his past compensation package have considerable implications for Tesla shareholders. The ruling in the case of Tornetta v. Musk raises critical questions about corporate governance at Tesla and may influence how shareholder compensation packages are structured in the future. Investors are closely monitoring the situation, as favorable outcomes for Musk could ease tensions and stabilize executive pay structures.

Conversely, should the Delaware Supreme Court decision backfire against Musk, it could lead to significant reputational damage, impacting shareholder confidence. The potential for future legal battles can create uncertainty in the market, especially for investors looking to understand the long-term viability of Tesla under Musk’s leadership. As Tesla navigates these turbulent waters, it will be vital for the company to reassure its shareholders about its path forward, mitigating the impact of ongoing legal challenges.

Tesla’s Growth Strategy Amidst Market Challenges

Tesla’s growth strategy remains paramount as the company navigates a myriad of market challenges. With automotive revenues experiencing a decline, the need for an adaptive and forward-thinking approach has never been clearer. Elon Musk’s leadership is integral to this strategy, reflected in the ambitious goals set forth at the most recent shareholder meeting. Adapting to market conditions while leveraging Musk’s innovative spirit and ideas will be critical for Tesla’s resilience.

As the electric vehicle market becomes increasingly competitive, maintaining Tesla’s position as a market leader will require continuous innovation and effective management. Given Musk’s recent comments on the prospect of rough quarters ahead, shareholders are rightfully anxious about the road ahead. However, with Musk at the helm and an inherent flexibility in Tesla’s operational structure, there remains the potential for significant recovery and growth in the years to come.

Frequently Asked Questions

What is included in Elon Musk’s new Tesla CEO pay package?

The new Tesla CEO pay package for Elon Musk includes an interim award of 96 million shares, which is valued at approximately $29 billion. These shares are set to vest in two years, contingent upon Musk remaining in his role as CEO or taking on another key executive position. If ongoing legal disputes regarding Mustang’s previous 2018 compensation conclude favorably for him, the award may be forfeited.

How has Tesla’s board approved Elon Musk’s compensation package?

Elon Musk’s interim compensation package was approved by a special committee of the Tesla board, specifically comprising board chair Robyn Denholm and director Kathleen Wilson-Thompson. This decision followed a court ruling indicating earlier compensation plans were improperly granted due to a lack of essential shareholder information.

What has been the reaction of investors to the Tesla stock surge following Musk’s compensation news?

Following the announcement of Elon Musk’s new pay package, Tesla’s stock surged over 2%. This reaction indicates investor interest and confidence in Tesla amid news of Musk’s significant compensation structure, even as legal issues surrounding his 2018 compensation continue.

What are the implications of Tesla shareholder meetings on Musk’s new compensation plan?

The upcoming Tesla shareholder meeting in November is crucial as it provides a platform for discussions on CEO Elon Musk’s compensation plan, especially in light of the legal challenges related to his previous pay package from 2018. Shareholders will likely address concerns about Musk’s control over Tesla and the company’s direction.

What risks does Elon Musk’s new compensation package present to Tesla shareholders?

Elon Musk’s new compensation package may present risks to Tesla shareholders, particularly if legal disputes about Musk’s 2018 compensation escalate. Additionally, with Musk pursuing new ventures and expressing discomfort with his level of voting control, shareholders might worry about his focus on Tesla’s core operations and future performance.

How does Elon Musk’s control in Tesla relate to his AI and robotics ventures?

Musk’s control over Tesla, where he holds about 13% of outstanding shares, is intertwined with his plans to develop AI and robotics products. He has expressed a need for greater voting control to ensure Tesla leads in these innovative sectors, which could impact strategic decisions and shareholder confidence.

How did legal issues affect Musk’s previous compensation plan and Tesla’s stock?

Legal challenges against Elon Musk’s previous compensation plan from 2018 have called its validity into question, impacting Tesla’s stock performance. A court ruling found that the board had not adequately informed shareholders, leading to increased scrutiny and potential volatility in stock prices as the situation develops.

What does Elon Musk’s new interim pay structure mean for future Tesla leadership prospects?

Elon Musk’s interim pay structure, which includes a significant share award, may signal his long-term commitment to Tesla’s leadership. However, as Musk also explores other ventures and has indicated a desire for more control, it raises questions about the stability and direction of Tesla’s future leadership.

| Key Points | |

|---|---|

| CEO Elon Musk awarded 96 million shares as an interim pay package valued at approximately $29 billion. | Shares will vest in two years, contingent on Musk’s role as CEO or another key position. |

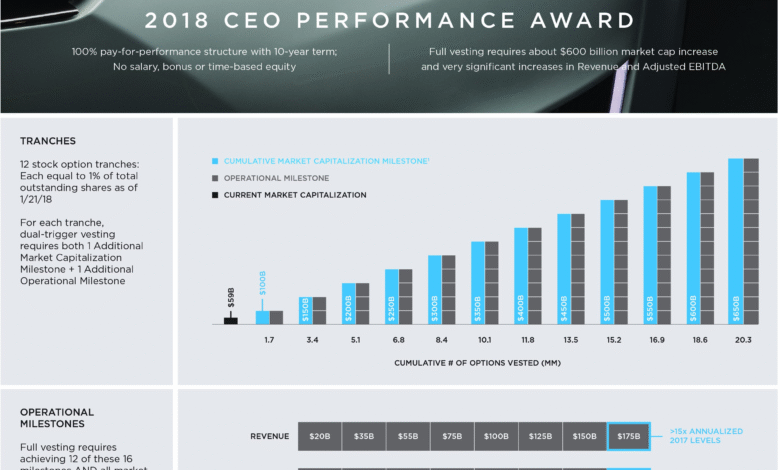

| Award forfeiture possible if legal dispute over Musk’s 2018 compensation is decided in his favor. | Original 2018 package was valued at $56 billion at vesting time. |

| Musk’s 2018 compensation plan was ruled improperly granted by Delaware’s Chancellor. | Tesla is appealing this ruling to the Delaware Supreme Court. |

| Musk holds approximately 13% of Tesla’s outstanding shares. | Recent threats to develop AI outside Tesla unless control is increased. |

| Public records show Musk established AI company ‘xAI’ in 2023 without shareholder notice. | xAI is focused on AI products and data infrastructure, integrating AI into Tesla’s operations. |

| Musk’s pay plan approved by a special committee of Tesla’s board. | Plan allows Musk to pursue new ventures and political activities without restriction. |

| Musk’s political involvement has impacted Tesla’s brand reputation and sales negatively. | Recent disappointing earnings report with sales decline and revenue drop noted. |

| Next annual shareholder meeting scheduled for November. | Musk indicates potential ‘rough quarters’ ahead due to loss of EV tax credits. |

Summary

The Tesla CEO pay package awarded to Elon Musk has garnered attention due to its size and the accompanying legal implications. Musk’s interim pay package consists of 96 million shares, potentially valuing at $29 billion, but it is intertwined with legal disputes relating to previous compensation plans. As Tesla continues to navigate challenges both financially and in terms of corporate governance, including Musk’s significant involvement in political and AI initiatives outside the company, the outcomes of these situations may have lasting impacts on Tesla’s future and Musk’s influence as CEO.