Tesla Stock Decline Amid Concerns Over Brand Erosion

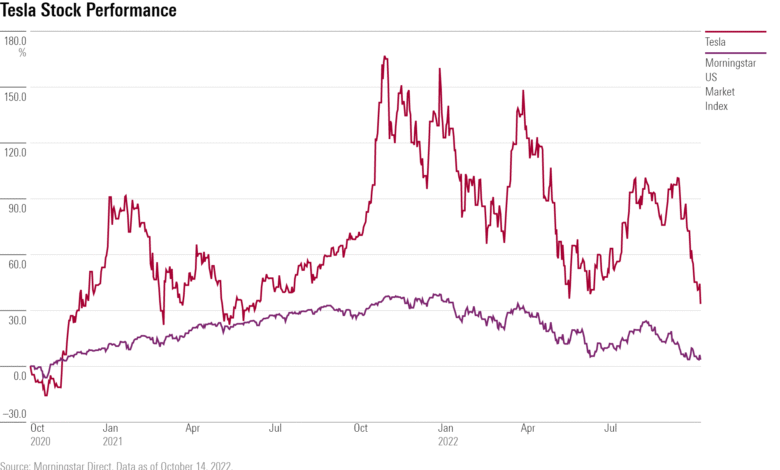

Tesla stock decline has become a topic of significant concern as shares plummeted nearly 6% ahead of the company’s first-quarter earnings report. Closing at $227.50, this drop highlights ongoing issues related to Tesla brand erosion, fueled by CEO Elon Musk’s controversial public engagements and recent challenges in vehicle deliveries. This follows a grim trend for the electric vehicle manufacturer, with the stock down 44% for the year, marking a striking downturn of 12 substantial drops in single trading sessions in 2023 alone. Investors are left anxious, particularly regarding the impact of Musk’s political controversies on the firm’s reputation and performance. As analysts prepare for the earnings call, they will be keenly focused on Tesla share price analysis and predictions concerning future growth amid a shifting market landscape.

The recent downturn in Tesla’s shares reflects broader anxieties among investors and analysts linked to the company’s operational strategies and its charismatic yet polarizing leader. The electric automaker has faced increased scrutiny not just for its dwindling vehicle deliveries, but also for the ramifications of Elon Musk’s external commitments and public persona, which many believe are undermining the Tesla brand. Stock price fluctuations have left stakeholders questioning the sustainability of the company’s growth trajectory, especially in light of the upcoming earnings report. Analysts are analyzing multiple factors—from ongoing controversies surrounding Musk to evolving consumer sentiments—that could shape the future of this iconic brand. Capturing the nuances of investor sentiment and operational performance will be critical as Tesla navigates these turbulent waters.

Tesla Stock Decline: Analyzing Recent Trends

Tesla stock has recently faced a notable decline, plummeting nearly 6% just before the company’s first-quarter earnings report. Closing at $227.50, this drop illustrates a concerning trend that has seen the stock fall nearly 44% since the beginning of the year. Analysts have attributed this decline to various factors, including ongoing brand erosion. Despite previous growth, Tesla’s stock now hovers precariously close to its low for the year, raising questions about its future performance and market positioning.

Furthermore, the volatility of Tesla’s share price analysis has initiated discussions regarding the broader implications for the electric vehicle market. With significant declines observed during 2023, this situation raises concerns about market confidence in Tesla’s strategic direction. The questions surrounding the company’s management and vision during their earnings call are crucial as the brand seeks to regain investor trust amidst warnings of potential margin pressures due to external factors, including tariffs and competition.

Impact of Elon Musk’s Controversies on Tesla’s Brand

Elon Musk’s political affiliations and personal controversies have raised alarms about Tesla brand erosion. Many investors and analysts are questioning the effect of Musk’s actions, particularly his involvement with the Trump administration. As the CEO diverts attention toward controversial political issues, experts predict that brand damage could lead to a permanent decrease in demand for Tesla vehicles. As reports indicate, the market perception of Tesla has shifted significantly, which poses a risk to sales and future growth.

The ongoing scrutiny of Musk’s public persona and decisions, such as his involvement in political maneuvers, threatens Tesla’s reputation, making it less favorable among potential buyers. Surveys have revealed a significant drop in consumer sentiment, with only 27% of respondents considering a Tesla purchase compared to 46% in previous years. This erosion of brand loyalty can be linked directly to negative perceptions surrounding Musk’s visibility in political arenas.

Tesla Earnings Report: What to Expect

As Tesla prepares to release its first-quarter earnings report, analysts are zeroing in on key figures like vehicle deliveries and revenue implications. The anticipated revenue of $21.24 billion, while slightly lower than last year, reflects growing concerns about market dynamics. Analysts expect earnings per share to hover around 40 cents, a factor that could heavily influence Tesla’s share price in the upcoming weeks. The results could provide a window into Tesla’s operational health, especially amidst rising competition.

Many expect that this earnings call will not only highlight the current fiscal standing but will also offer insights into the challenges Tesla is facing, particularly regarding self-driving technology and robotaxi advancements. Investors will be paying close attention to any potential comments regarding the strategies Tesla is considering to combat brand erosion and enhance consumer interest, especially in a competitive market environment heavily influenced by international dynamics.

The Role of Vehicle Deliveries in Tesla’s Financial Outlook

Vehicle deliveries play a critical role in Tesla’s financial outlook, with the company reporting a decrease of 13% compared to last year. This dip signifies more than just numbers; it’s a reflection of consumer choice influenced by competition and brand perception. As analysts anticipate a reduction in demand, particularly in key markets such as China, the implications for Tesla’s revenue and market position could be significant.

The pressure on Tesla’s vehicle delivery numbers is further exacerbated by increasing nationalistic sentiments in consumer habits, particularly in China. With domestic brands gaining traction, Tesla may be pivoting its strategies to adapt to these shifts, potentially impacting pricing and overall brand positioning. The balance between maintaining a competitive edge and navigating these nationalistic trends presents a complex challenge for Tesla moving forward.

Consumer Sentiment and Tesla’s Brand Erosion

Consumer sentiment towards Tesla has seen a notable shift, with recent surveys indicating a decrease in brand favorability. Only 27% of surveyed individuals expressed a willingness to consider Tesla as their next vehicle purchase, a stark contrast to figures from just a year prior. This trend is alarming for the brand as it battles to maintain its stronghold in the electric vehicle market while facing substantial competition from domestic automakers.

The ongoing debates surrounding Musk’s political ventures and their fallout have created a hesitancy among consumers. As brand erosion continues, it is essential for Tesla to regain trust and redefine its market strategy. Addressing consumer concerns and enhancing perceptions of the brand will be critical in reversing the ongoing trend and securing a loyal customer base.

Tariffs and Their Impact on Tesla’s Profitability

The implications of tariffs imposed during the Trump administration could drastically affect Tesla’s profitability. Analysts have noted that these tariffs may create additional pressures on profit margins as they could lead to higher operational costs. The expectation of weakening demand in crucial markets alongside potential tariff-induced price adjustments puts Tesla in a precarious position as it looks to stabilize its revenue streams.

Tesla’s ability to navigate these challenges effectively will be a focal point during the upcoming earnings call. Investors will be looking for clarity on how the company intends to mitigate the adverse effects of tariffs while sustaining its growth objectives. Strategic decisions made now will likely have long-lasting impacts on Tesla’s financial health and market positioning.

Future Outlook: Will Tesla Recover?

The future outlook for Tesla remains uncertain as the company grapples with internal and external pressures. Analysts project potential demand destruction that could range between 15% to 20% if current trends continue unchecked. This decline could be further aggravated by increasing competition, particularly in the growing electric vehicle market, prompting Tesla to reassess its strategies in both delivery and product offerings.

In order to initiate a recovery, the company’s leadership must communicate a clear vision during the upcoming earnings call. Investors are eager to understand how Tesla plans to address consumer concerns, enhance brand loyalty, and revitalize its sales strategy amidst evolving market dynamics. The effectiveness of these strategies will determine Tesla’s ability to recover and thrive in the rapidly changing automotive landscape.

Investor Reactions and Market Sentiment

Investor reactions to Tesla’s recent performance have been a mixture of caution and hope. Following the sizable decline in share price and ongoing brand erosion, analysts at Barclays and Oppenheimer have expressed bearish views, downgrading Tesla’s ratings and targets. The skepticism surrounding Tesla’s earnings report could lead to further volatility in its stock analysis, as many remain uneasy about the sustainability of the company given the current climate.

On the flip side, some analysts still harbor optimism for a turnaround, highlighting the potential for Tesla to innovate and adapt in the face of adversity. Whether Elon Musk can refocus attention on the core offerings of the company may significantly influence market sentiment moving forward. The upcoming earnings call will serve as a pivotal moment where investor confidence could either be bolstered or further diminished, depending on the insights provided by Tesla’s leadership.

Strategic Innovations: Tesla’s Path Forward

As Tesla navigates through tumultuous waters, strategic innovation remains central to its path forward. The company has been investing heavily in its Full Self-Driving technology and plans for a long-delayed robotaxi service. However, as analysts have pointed out, the path to market leadership in autonomous driving technology is fraught with challenges, particularly as competitors ramp up their capabilities.

While technological advancements are essential, Tesla must also focus on rebuilding its brand perception and addressing consumer sentiment. By prioritizing innovation and maintaining transparency with consumers and investors, Tesla can strive for a recovery trajectory. The results of its forthcoming earnings call could provide important insights into how the company plans to address these strategic priorities amid an evolving competitive landscape.

Frequently Asked Questions

What factors are contributing to the Tesla stock decline?

The Tesla stock decline can be attributed to several factors, including concerns about ongoing brand erosion, decreased vehicle deliveries, and the impact of Elon Musk’s political controversies. Analysts are worried about how these issues may affect the company’s future performance and consumer sentiment.

How does the Tesla earnings report affect the stock decline?

The Tesla earnings report is crucial as it reflects the company’s financial health and operational challenges. A modest revenue forecast of $21.24 billion and a drop in vehicle deliveries by 13% is leading to investor concern, contributing to the current stock decline.

Is brand erosion impacting Tesla stock performance?

Yes, ongoing brand erosion is significantly impacting Tesla stock performance. A survey indicated that only 27% of respondents would consider buying a Tesla, a steep decline from previous years, suggesting that consumer attitudes are shifting negatively.

What role do Elon Musk’s controversies play in Tesla stock decline?

Elon Musk’s controversies, especially related to his political involvement and public statements, are causing significant backlash. These controversies are perceived as damaging to the Tesla brand, thereby affecting investor confidence and contributing to the stock decline.

Could Tesla vehicle deliveries impact share price analysis?

Absolutely, Tesla vehicle deliveries are a key metric for the company’s performance. The recent report of 336,681 deliveries marks a 13% decrease from the previous year, which raises concerns about demand and profitability, thereby negatively influencing share price analysis.

How are analysts viewing the future of Tesla amid the stock decline?

Analysts are expressing caution regarding Tesla’s future, citing potential demand weakness, especially in China, and the financial implications of Trump tariffs. Predictions of a 15% to 20% reduction in demand due to brand damage further alarm investors amid the ongoing stock decline.

What are the implications of Tesla’s declining stock on investor sentiment?

The declining Tesla stock affects investor sentiment by fostering uncertainty about the company’s growth and stability. Continuous declines, coupled with worsening consumer perception, may lead to increased skepticism and reluctance among investors.

What strategies could Tesla employ to combat stock decline?

To combat stock decline, Tesla may need to strengthen its brand image, reassure investors with positive updates on product developments, such as the Full Self-Driving technology, and focus on improving customer satisfaction to regain consumer trust.

| Key Points | Details |

|---|---|

| Tesla Stock Performance | Tesla shares fell nearly 6% to close at $227.50, remaining near its yearly lows, marking a 44% decline this year. |

| Earnings Report Expectations | Investors are awaiting the first quarter earnings report, with revenue expectations at $21.24 billion and an anticipated earnings per share of 40 cents. |

| Brand Erosion Concerns | Analysts highlight ongoing brand erosion in the U.S. and Europe that might impact Tesla’s sales and point to potential demand weakness in China. |

| CEO Elon Musk’s Distractions | Musk’s involvement in politics is drawing scrutiny, with some investors concerned about its impact on the company’s brand and sales. |

| Consumer Sentiment | A recent survey indicates only 27% of U.S. consumers are considering buying a Tesla, down from 46% in January 2022. |

| Analyst Ratings | Barclays has reduced its price target for Tesla to $275, maintaining a sell-equivalent rating due to weak fundamentals. |

| Potential Future Actions | Investors are eager to hear Musk’s strategy for reclaiming market position and strengthening the brand image during the upcoming earnings call. |

Summary

The Tesla stock decline is a pressing concern as the company’s shares have significantly dropped due to various factors, including weak consumer sentiment, brand erosion, and CEO Elon Musk’s controversial political involvements. With a 44% decrease this year and ongoing worries about demand particularly in international markets, Tesla faces critical challenges as it approaches its first-quarter earnings report. Investors will be keenly watching for Musk’s outline of strategies to recover from these setbacks and restore investor confidence.