Tesla’s Stock Performance: Investors Question Elon Musk’s Promises

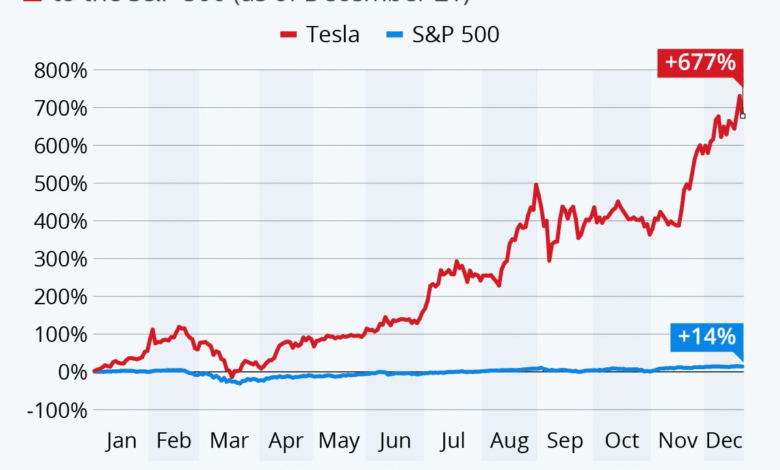

Tesla’s stock performance has recently become a focal point of investor discourse, as disappointing earnings reports have contributed to a more than 20% decline this year, even amidst a booming Nasdaq. With CEO Elon Musk promising a futuristic robotaxi service that aims to redefine urban commuting, there’s an underlying tension given the latest Tesla earnings report revealing shrinking vehicle sales and profits. Investors are showing increased concern regarding the company’s growth trajectory, especially as electric vehicle sales face fierce competition from cheaper alternatives, notably from China. Despite Musk’s assurances about autonomous vehicles generating passive income for owners, skepticism persists about achieving profitable dynamics. As Tesla grapples with these investor concerns and its strategic direction, the question remains: can it recover and thrive in a rapidly evolving market?

The recent fluctuations in Tesla’s equity have sparked significant attention, particularly in light of the company’s latest financial disclosures. Shareholders are apprehensive as the electric vehicle pioneer navigates through challenging market conditions, alongside CEO Elon Musk’s ambitious vision for a robotaxi fleet. As the company falls short of expectations detailed in its earnings report, apprehensions about deteriorating electric vehicle sales and increasing competitive pressures loom large. Investors are particularly tuned in to the dynamics of Tesla’s profitability and the implications of its innovative promises. In this context, the performance of Tesla’s stock is more than just a reflection of its current activities; it encapsulates broader questions about the future of automotive technology and market viability.

Tesla’s Stock Performance Declines Amid Disappointing Earnings

Tesla’s stock has faced a significant decline in 2023, dropping over 20%, as investors grapple with the disappointing earnings report released by the company. The decline is starkly in contrast to the overall bullish trend seen in the Nasdaq, which continues to reach new heights. Analysts highlight that while Tesla’s ambitious goals, particularly around its prospective robotaxi service, show potential for long-term growth, immediate performance metrics fail to instill confidence among investors. With decreased vehicle sales and looming regulatory challenges, the outlook appears grim, and Musk’s optimistic future projections fall on skeptical ears.

The weak earnings report has not only affected Tesla’s stock performance but has also raised substantial investor concerns about the company’s path forward. As traditional sales models falter amid emerging competition from cheaper electric vehicle manufacturers, analysts are emphasizing the need for Tesla to switch its focus to solid financial health in the short term. Investors are anxious to see how Tesla navigates these challenges, particularly as the profitability dynamics struggle to align with Musk’s forward-looking robotaxi vision.

Elon Musk’s Robotaxi Promises: Are They Realistic?

Elon Musk’s promises surrounding Tesla’s robotaxi service have become a focal point of investor interest and skepticism alike. While the prospect of autonomous vehicles operating as a fleet for ride-hailing services is enticing, the reality of its implementation remains unclear. Currently, the robotaxi service is undergoing testing and aims to expand by year-end, but many analysts highlight that these programs are still in their infancy. Musk’s statements during earnings calls, where he touts ambitious timelines, often lead to mixed reactions, especially as the company grapples with regulatory hurdles and technical challenges.

Despite those hurdles, analysts like those at Canaccord Genuity express a longer-term optimism about Tesla’s potential in this realm. However, it is essential for investors to recognize that innovation must be underpinned by solid execution and financial viability. Musk’s optimism regarding the robotaxi service needs to translate into tangible performance improvements soon, as investor patience wears thin amidst discussions of future growth versus immediate profitability.

Tesla Earnings Report Raises Investor Concerns

The recent Tesla earnings report has raised serious red flags for investors who are becoming increasingly wary. The report reflected a worrying trend of decreasing automotive sales, with a noted 16% drop year-over-year in the second quarter. As the company struggles with competition from more affordable electric vehicles, particularly in markets like China, it seems that Tesla’s once-solid market dominance is being challenged. Analysts emphasize the critical necessity for Tesla to improve its profit margins and sales figures before such ambitious plans like the robotaxi service can take precedence.

Additionally, the earnings report has prompted discussions around the potential impact of expiring EV credits and the political landscape in the U.S., where Musk’s controversial persona could be impacting Tesla’s brand reputation. Analysts from firms like Goldman Sachs have critiqued the robotaxi initiative for lacking substantial technical backing. For investors, the focus must shift from Musk’s visionary promises to the tangible realities of growth, profitability, and constant adaptation in a rapidly changing automotive market.

Electric Vehicle Sales Trends Impact Tesla’s Future

As the electric vehicle (EV) market continues to evolve, trends show a noticeable decline in Tesla’s vehicle sales, raising alarms among investors. Reports indicate a significant 16% decrease in sales during the second quarter, triggering questions regarding the sustainability of Tesla’s growth amidst rising competition from other EV manufacturers. The landscape is becoming increasingly crowded, especially as new entrants focus on producing more affordable electric vehicles, drawing consumers away from Tesla’s higher-priced offerings.

Moreover, as regulatory changes unfold and market dynamics shift, Tesla faces unique challenges that require tactical adjustments to its marketing and production strategies. Investors are concerned that without a robust response to these sales trends, Tesla may struggle to maintain its leading position in the market. The success of Tesla’s robotaxi service could potentially provide a new revenue stream, but this is contingent upon overcoming immediate sales hurdles and adapting to the competitive landscape of the EV sector.

Concerns Over Future Profitability for Tesla

In the wake of a disappointing earnings report and declining stock price, investor concerns regarding Tesla’s future profitability have escalated dramatically. With profits narrowing and challenges from competitors mounting, there is an urgent need for the company to correct its profit and loss dynamics. The sentiment among analysts is that while there’s excitement about long-term innovations such as the robotaxi service, immediate financial health remains a pressing concern.

Tesla’s reliance on regulatory credit sales, which are likely to diminish, adds another layer of complexity to its profitability outlook. Regulatory shifts and tariffs could further erode profit margins, emphasizing the importance of transitioning to a business model with sustainable revenue streams. Investors are increasingly vocal about the need for concrete plans that address these factors head-on rather than merely relying on the company’s futuristic promises.

Musk’s Optimism vs. Reality Check for Tesla Shareholders

Elon Musk’s unwavering optimism often contrasts sharply with the realities faced by Tesla shareholders. Musk’s vision of a future dominated by autonomous vehicles and robotaxi services paints an ambitious picture that has traditionally rallied investor support. However, after years of ambitious forecasts that have not materialized as promised, Wall Street has begun to take a more cautious stance. Many investors are asking whether his continued positivity is sufficient to counterbalance the company’s immediate challenges.

This dichotomy between Musk’s forward-thinking promises and the stark reality of Tesla’s current financial performance could lead to increased volatility in Tesla’s stock. The need for a balanced approach that integrates visionary goals with accountable financial performance is crucial if Tesla is to regain investor confidence. Amidst this tension, the analysts stress the necessity for tangible advancements and clear timelines to appease skeptical shareholders.

Market Competition and Tesla’s Position

As Tesla faces increasing competition in the electric vehicle market, its current market position is under significant scrutiny. New competitors are emerging with innovative solutions and attractive pricing strategies, making it essential for Tesla to adapt quickly. With automotive sales already down, the risk of losing market share to more agile competitors looms over the company, causing investor concerns to deepen.

Amidst these competitive pressures, analysts are keenly observing how Tesla plans to maintain its edge. While Tesla’s technological advancements and brand loyalty remain powerful assets, the company must leverage these strengths to combat the growing threats posed by competitors like Ford and new entrants in the EV space. Investors are looking for signs of strategic pivots or partnerships that could help safeguard Tesla’s market position as the competition heats up.

The Importance of Regulatory Approvals for Robotaxi Services

For Tesla’s ambitious robotaxi service to become a reality, securing the necessary regulatory approvals will be paramount. Musk’s assertions regarding the rollout of these autonomous vehicles hinge on navigating a complex landscape of state regulations and safety standards. The recent announcement regarding Tesla’s potential service launch in markets like the San Francisco Bay Area emphasizes the urgency of overcoming these hurdles, as operating without proper authorization is not viable.

Given that Tesla’s robotaxi service intends to operate on public roadways, compliance with the regulatory framework set forth by entities like the California DMV and CPUC is non-negotiable. Investors are anxious to see how the company’s approach to regulatory bodies will evolve in light of these challenges, as success or failure in this area could drastically affect the speed and scale at which Tesla can innovate within the autonomous vehicle sector.

Future Projections: Tesla’s Growth Strategy

Tesla’s presentation to shareholders outlined a future growth strategy that involves diversifying its focus from just electric vehicles to include AI, robotics, and other related services. This ambitious approach aims to transition Tesla into a multi-faceted leader in emerging technologies, presenting opportunities that could bolster the company’s bottom line in the long-term. However, the lack of concrete guidance on growth metrics has left investors unsure about how swiftly these transitions can occur and what impact they might have on profitability.

Investors are seeking assurance that Tesla will not only innovate but will also execute effectively within its new growth landscape. As other tech companies make leaps in autonomous technology, Tesla must ensure it remains competitive. Balancing innovation across various sectors while maintaining a stronghold in its core automotive business will be critical for Tesla’s sustained growth and investor confidence.

Frequently Asked Questions

What are the current concerns regarding Tesla’s stock performance amidst Elon Musk’s promises for the future?

Tesla’s stock performance has recently been affected by concerns from investors related to CEO Elon Musk’s promises, particularly regarding robotaxi services. After a disappointing earnings report, Tesla’s stock declined over 20% this year, even as the broader market rises. Investors are wary due to falling electric vehicle sales and shrinking profits, which overshadow Musk’s optimistic views on future technologies.

How did Tesla’s earnings report impact its stock performance?

Tesla’s latest earnings report disappointed investors, leading to an 8% drop in its stock price on the day of the announcement. The report showed a 16% year-over-year decline in electric vehicle sales, causing investor concerns around Tesla’s profitability and future growth, thus impacting stock performance negatively.

What does Elon Musk foresee for Tesla’s robotaxi service, and how might it affect stock performance?

Elon Musk envisions Tesla’s robotaxi service as a revolutionary venture that could generate income for owners while they sleep. However, the service is still in limited testing and subject to regulatory approval, raising concerns among investors about its potential impact on the company’s stock performance and timeline for realization.

Why are investors concerned about Tesla’s electric vehicle sales?

Investors are concerned about Tesla’s electric vehicle sales due to recent reports indicating a 16% year-over-year decline in the second quarter. This decline, coupled with anticipated changes in regulatory credit sales, has created uncertainty about Tesla’s revenue growth potential, affecting overall stock performance.

What role does Elon Musk’s optimism play in Tesla’s stock performance?

Elon Musk’s optimism has historically influenced Tesla’s stock performance positively, often driving prices up as he made ambitious future promises. However, after a series of missed deadlines and disappointing earnings, there is growing skepticism among investors, which currently reflects negatively on Tesla’s stock.

How does competition affect Tesla’s stock performance?

The rapid emergence of cheaper electric vehicle competitors, particularly in China, has heightened investor concerns regarding Tesla’s stock performance. As competition increases, analysts worry that Tesla’s market share and profitability will be adversely affected, which is currently reflected in the stock’s downturn.

What changes are expected that might impact Tesla’s profits and stock performance?

Changes such as expiring electric vehicle credits and new tariffs imposed under the current political climate are expected to negatively affect Tesla’s profits. Analysts predict that these shifts could further decline Tesla’s stock performance unless the company can turn around its profit and loss dynamics.

How has the market reacted to Tesla’s future projections versus its current performance?

The market has reacted cautiously to Tesla’s future projections, including the potential of robotaxis and autonomous driving. Despite Musk’s optimistic outlook, the current performance issues, including lackluster sales and profitability, have led to significant declines in stock performance, reflecting investor skepticism.

What is the outlook for Tesla’s stock given the recent earnings report?

The outlook for Tesla’s stock remains uncertain following the recent earnings report, which failed to meet expectations. Analysts suggest that while there are long-term opportunities, immediate challenges such as declining sales and profitability must be addressed to improve investor confidence and stock performance.

| Key Points | Details |

|---|---|

| Tesla’s stock performance | Down 22% for the year, with an 8% drop following the earnings report. |

| Earnings report concerns | Disappointing results led to investor worry, highlighting issues in profit and sales. |

| Future plans | Focus on robotaxis and AI, but immediate P&L concerns remain. |

| Regulatory issues | Testing in Texas with plans to expand, pending necessary approvals. |

| Competitor landscape | Facing challenges from cheaper electric vehicle manufacturers, mainly in China. |

| Investor sentiment | Shifted focus from long-term promises to immediate financial results. |

Summary

Tesla’s stock performance has faced significant challenges in recent months, with a notable decline of 22% this year alone. Investors are growing increasingly wary of CEO Elon Musk’s ambitious promises surrounding future technologies like robotaxis. Although the company is investing heavily in autonomous driving and robotics, immediate profitability and declining sales are causing concern among analysts and shareholders alike. This shift in focus from Musk’s futuristic visions to the current pressing financial metrics illustrates the tension between visionary ambitions and operational realities.