U.S. Reciprocal Tariff Rates Unveiled by Trump Administration

The U.S. reciprocal tariff strategy recently outlined by President Donald Trump represents a significant shift in American trade policy aimed at addressing inequities faced by U.S. businesses. By imposing new import duties on over 180 countries and territories, this approach seeks to hold foreign nations accountable for their tariff rates and barriers that allegedly disadvantage American exports. In what has been dubbed the “Trump tariffs,” the intention is to create a more level playing field where the U.S. will charge approximately half of what these nations impose on American goods, while simultaneously combating issues such as currency manipulation. The administration’s decision to adopt these favorable tariff measures aims to reinforce U.S. economic strength amidst increasing globalization. As the situation unfolds, the question remains: will these tariff rates successfully reshape global trade dynamics or will they spur further economic tensions?

The recent announcement of a new tariff framework established by the U.S. government marks a pivotal change in how America handles international trade relations. Often referred to as reciprocal tariffs, this policy aims to ensure fair competition by adjusting the import duties that countries face when trading with the U.S. By analyzing existing trade barriers, the administration hopes to address significant concerns regarding how different countries manipulate currency or apply unfair tariff rates against American products. This strategic shift reflects a broader trend in which nations reassess their trade policies to bolster domestic industries in an increasingly competitive landscape. As these import policies begin to take effect, the implications for global commerce and domestic economies promise to be profound.

Understanding U.S. Reciprocal Tariff Rates

The U.S. reciprocal tariff rates introduced by President Trump represent a significant shift in American trade policy. These rates are designed to counteract the tariffs and trade barriers that over 180 countries impose on the U.S. By establishing reciprocal tariff rates, the administration aims to level the playing field for American businesses that have previously faced higher import duties abroad. This strategic move not only addresses existing trade imbalances but also seeks to stimulate domestic manufacturing by making imported goods more expensive, thereby encouraging consumers to buy American products.

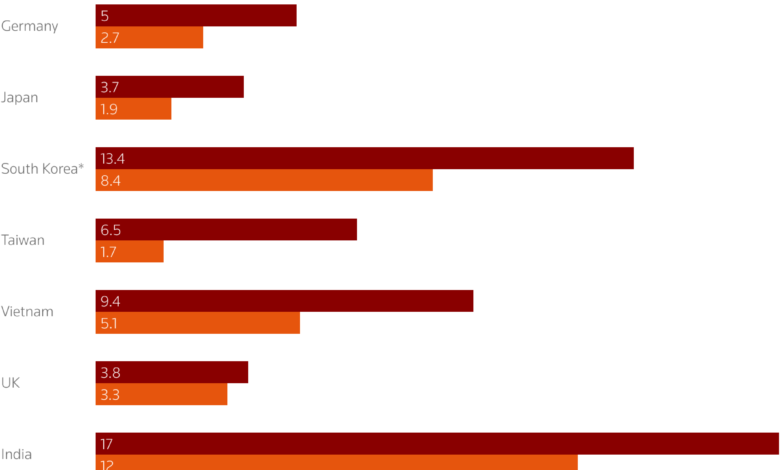

In the Rose Garden announcement, the charts displayed by the Trump administration highlighted the disparity between the tariffs imposed by other nations and the rates applied to U.S. goods. For instance, countries known for currency manipulation and other unfair trade practices will now face increased costs when exporting to the U.S. Such measures are expected to have a profound impact on international trade dynamics, potentially leading to retaliatory actions from affected countries and further complications in global trade relations.

The Impact of Trump Tariffs on International Trade

President Trump’s tariffs are part of a broader trade strategy aimed at reshaping how the United States engages in global commerce. The new import duties will not only affect the countries directly listed but are also part of a larger conversation about America’s role in the world economy. By imposing tariffs, the administration hopes to reduce trade deficits and compel foreign governments to engage in fairer practices, which often includes addressing currency manipulation that disadvantages American exports.

However, the implementation of these tariffs raises concerns among economists and trade experts regarding the potential for trade wars. The aggressive stance taken by the U.S. government could trigger a wave of retaliatory tariffs, putting American exporters at risk. Additionally, the complexity of varying tariff rates—where some nations may face significantly higher rates than others—adds an element of uncertainty to trade agreements and international relations, prompting companies to reassess their supply chains and export strategies.

Analyzing the Role of Tariff Rates in Domestic Economy

Tariff rates directly influence the pricing of imported goods and can lead to shifts in consumer behavior. As the reciprocal tariffs take effect, American consumers may see higher prices on foreign products, which could result in a surge of demand for domestic alternatives. This scenario presents an opportunity for U.S. manufacturers to expand their market share and increase production capacity. The strategic implementation of tariffs, particularly when targeted against countries that employ currency manipulation and other unfair trade tactics, can potentially bolster the American economy.

Moreover, fluctuations in tariff rates often unveil the intricate relationship between international trade policies and local economies. Small businesses, in particular, may feel the impact of these changes more acutely, as they struggle to compete against larger firms with more leverage in foreign markets. As tariffs rise, it becomes essential to monitor the economic indicators closely, particularly in sectors heavily reliant on imports. Policymakers must balance the need for protective measures with the realization that too many barriers can lead to international isolation.

The Consequences of Currency Manipulation on Trade Policy

Currency manipulation remains one of the most contentious issues in international trade, with significant implications for U.S. trade policy. Some countries engage in practices that artificially lower the value of their currency to make their exports cheaper and more attractive to foreign buyers. This practice creates an uneven playing field, leading to calls for reciprocal tariffs to counteract the effects of such manipulation. The administration’s response to these unfair practices is encapsulated in the recent announcement of tariff rates, which aim to penalize countries that manipulate their currencies.

By designing tariffs with a focus on currency manipulation, the U.S. hopes to encourage other nations to adopt more transparent monetary policies. This could lead to a more balanced trading environment where American products can compete effectively on a global scale. Implementing measures that address currency issues not only serves to protect American industries but also seeks to foster fairer trade relations, which can eventually contribute to a stronger international economic system.

Trade Barriers and Their Effect on U.S. Exports

Trade barriers, which encompass tariffs, quotas, and other restrictive regulations, play a critical role in shaping U.S. exports. The introduction of reciprocal tariffs highlights the administration’s focus on combating foreign trade barriers that hinder American goods from entering international markets. By matching or exceeding the barriers imposed by other countries, the U.S. seeks to encourage nations to reevaluate their own policies and reduce their barriers to American products.

As American businesses navigate these new tariffs, understanding the landscape of global trade will be crucial. The announced rates serve as a reminder of the potentially punitive measures that may arise from aggressive trade policies. Companies will need to adapt quickly, lobbying for access to foreign markets while adjusting to the new costs associated with exports. Overall, crippling trade barriers not only affect bilateral trade relationships but also have the potential to influence global supply chains and economic growth.

Navigating the Complexities of Import Duties

Import duties are a cornerstone of trade policy, affecting everything from pricing strategies to market accessibility. The U.S. reciprocal tariff rates signify that American imports will now face additional scrutiny as the nation attempts to redefine its trading relationships. Companies will need to navigate the complexities of these new import duties as they plan their strategies for international trade. Understanding the nuances of tariff rates and their implications for cost structures will be essential for maintaining competitiveness in the global market.

In this evolving landscape, businesses will likely reassess their supply chains to avoid the pitfalls of high import duties. Firms may seek alternative sources of goods or reevaluate their pricing structures to accommodate the added costs. Importantly, the ripple effect of these duties extends beyond individual companies; it impacts consumers, domestic production, and the overall economy. As import duties continue to shift, agility and adaptability will be key traits for businesses looking to thrive in a complex and uncertain trade environment.

Future Implications of Tariffs on Global Relations

The introduction of reciprocal tariffs under the Trump administration marks a pivotal moment in global trade relations. As nations react to the U.S. policy shift, the potential for both cooperation and conflict increases. Tariffs can serve as a negotiation tool; however, they can also provoke retaliatory measures that escalate into trade wars. The long-term implications of these tariffs on diplomatic relationships cannot be underestimated as they may reshape alliances and trade partnerships.

As the global landscape evolves, the administration will need to carefully monitor the outcomes of these tariffs and adjust its trade policy accordingly. This delicate balancing act requires an understanding of international economics and the political will to make concessions when necessary. Ultimately, the capacity to navigate the ramifications of tariff practices will define future U.S. trade engagements and reinforce its position within the global economy.

Balancing Trade Deficits through Strategic Tariffs

One of the primary goals of imposing new tariffs is to address and reduce the U.S. trade deficit. By raising import costs for foreign goods, the administration is attempting to encourage domestic production and consumption. Implementing strategic tariffs that target countries with significant trade imbalances can help to mitigate the outflow of capital from the U.S., reinvesting those resources back into the American economy.

However, it is crucial to understand that tariffs are a double-edged sword; while they may reduce trade deficits in the short term, they could also provoke retaliation from trading partners that may harm U.S. exports. As tariffs disrupt established trade flows, policymakers must weigh their potential benefits against the risks of escalating tensions with key allies and major economies. Finding a solution that balances the need for trade fairness with the avoidance of trade conflicts is essential for maintaining healthy economic relationships globally.

Evaluating the Effectiveness of Trump’s Trade Policy

The effectiveness of President Trump’s trade policy will ultimately be judged by its impact on the U.S. economy and its ability to foster long-term stability. The reciprocal tariffs, particularly as they relate to import duties and allegations of currency manipulation, suggest a hardline approach to renegotiating trade agreements. The challenge lies in measuring actual outcomes against the promised benefits; while some businesses may thrive under reduced competition, others may face increased costs and potential market isolation.

Moreover, the ongoing analysis of tariff rates is critical for understanding their impact on both domestic and international commerce. If the tariffs succeed in incentivizing countries to rethink their trade barriers, the long-term effects could lead to a more equitable global trading system. However, the potential for unintended consequences—such as increased prices for consumers or strained international relations—must not be overlooked in the assessment of this ambitious trade policy.

Frequently Asked Questions

What are U.S. reciprocal tariff rates and how do they relate to Trump tariffs?

U.S. reciprocal tariff rates are import duties imposed by the U.S. government on foreign goods, designed to mirror the tariffs that other countries charge the U.S. under trade policy. Announced by President Trump, these tariffs aim to counteract unfair trade practices and currency manipulation by more than 180 countries, ensuring that U.S. exporters are treated fairly.

How do U.S. reciprocal tariffs affect international trade?

U.S. reciprocal tariffs can significantly impact international trade by raising costs for imports and potentially leading to trade disputes. As the U.S. implements these tariffs, other countries may respond with their own tariffs, resulting in escalated trade tensions that can affect global markets and relationships.

What role do import duties play in the U.S. trade policy?

Import duties, including those under U.S. reciprocal tariff schemes, play a crucial role in U.S. trade policy by protecting domestic industries from foreign competition. These duties are intended to discourage imports from countries that impose higher tariffs, thus promoting fair trade practices and addressing issues like currency manipulation.

How are the tariff rates for U.S. reciprocal tariffs determined?

The tariff rates for U.S. reciprocal tariffs are determined by analyzing the tariffs imposed by other countries on U.S. goods. As stated by President Trump, these rates aim to be approximately half of what other countries charge the U.S., as part of a strategy to provide a fairer trading environment.

What is the impact of Trump tariffs on U.S. consumers?

Trump tariffs, including the newly announced U.S. reciprocal tariffs, can lead to higher prices for consumers as the cost of imported goods increases. This inflationary effect may particularly impact products that are heavily imported from countries subject to these tariffs, potentially limiting consumer choice and increasing living costs.

Are U.S. reciprocal tariffs permanent or temporary measures?

U.S. reciprocal tariffs are not necessarily permanent and may evolve based on negotiations and trade agreements with affected countries. The Trump administration indicated that the tariffs could be adjusted in response to changes in foreign trade practices and tariff rates.

What are the criticisms surrounding U.S. reciprocal tariff policies?

Critics argue that U.S. reciprocal tariffs can lead to trade wars, which may hurt U.S. businesses reliant on international markets. Additionally, they contend that such tariffs can disproportionately affect low-income consumers due to rising prices and limited availability of imports.

How can businesses prepare for U.S. reciprocal tariff changes?

Businesses can prepare for U.S. reciprocal tariff changes by closely monitoring trade policies, adjusting their supply chains to minimize reliance on heavily taxed imports, and seeking alternative markets to mitigate the risks associated with increased import duties.

| Country/Territory | Claimed Tariff Rate on U.S. | New U.S. Reciprocal Tariff Rate |

|---|---|---|

| China | 20% | 54% (20% existing + 34% new) |

| European Union | Varied | Approx. Half of Claimed Rate |

| Other Countries | Varied | Approx. Half of Claimed Rate |

Summary

The U.S. reciprocal tariff policy, as unveiled by President Trump, aims to impose tariffs on over 180 countries and territories, reflecting the administration’s response to perceived trade imbalances. This strategy advocates for tariffs that are approximately half of what those countries reportedly charge the U.S., while maintaining existing tariffs on nations like China. By establishing a baseline of 10% for all imports, the U.S. government seeks to level the playing field in international trade, ensuring that American interests are prioritized against unfair trade practices.