Tokenized Private Credit: The $14 Billion Lending Boom

Tokenized private credit is revolutionizing the financial landscape, standing out as a leading player in the burgeoning real-world asset sector. With active outstanding loans soaring to $13.88 billion, this innovative approach harnesses blockchain lending to transform traditional debt instruments into easily tradable digital tokens. By converting private credit assets into tokenized forms, investors can tap into a market previously dominated by institutional players, thereby broadening access for retail investors. The growth of tokenization in this space not only enhances liquidity but also offers the transparency that modern financiers demand. As tokenized private credit evolves, it stands poised to capture a more significant share of the $1.6 trillion traditional private credit market, highlighting its potential for future expansion and investment opportunities.

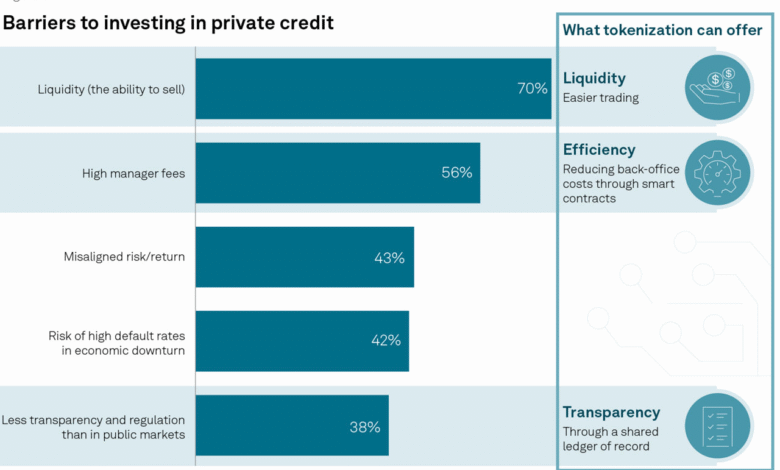

The rise of digitized lending has paved the way for a new financial paradigm, often referred to as tokenized private finance. This mechanism capitalizes on the benefits of blockchain technology to transform conventional loans into digital assets, facilitating easier trade and access for various investors. By utilizing smart contracts tied to these digital representations of debt, the process becomes more efficient and transparent, addressing many limitations faced by traditional lending avenues. The tokenization trend is gaining traction, with an increasing number of platforms entering the private credit arena, showcasing the immense potential that exists within this evolving market. As the understanding and adaptation of real-world assets through digital tokens continue to grow, the implications for market dynamics and investment strategies are substantial.

Understanding Tokenized Private Credit

Tokenized private credit represents a transformative shift in how lenders and investors engage with debt instruments. By converting traditional loans into digital tokens on a blockchain, this innovative approach allows for increased accessibility and transparency in the credit market. The underlying assets, often generated by non-bank lenders, are broken down into fractional ownership stakes, making it possible for retail investors to participate in areas that were previously limited to institutional players. This democratization of private credit not only opens up new avenues for investment but also contributes to the overall liquidity of financial assets.

The incorporation of smart contracts within tokenized private credit systems further enhances the operational efficiency of these loans. Automated processes streamline the management of loan agreements, reducing the complexities and long timelines typically associated with traditional private lending. Additionally, blockchain’s inherent transparency ensures that all transactions and asset performance metrics are recorded and accessible in real-time, thereby minimizing the risk of fraud and providing investors with greater confidence in their investments.

Frequently Asked Questions

What is tokenized private credit and how does it relate to blockchain lending?

Tokenized private credit refers to the process of converting traditional private credit assets, such as loans issued by non-bank lenders, into digital tokens that exist on a blockchain. This innovation falls under the broader category of blockchain lending, enabling digital ownership and trading of credit assets, thus improving liquidity and accessibility for investors.

How has the tokenization growth impacted the private credit market?

The tokenization growth in the private credit market is significant, with active tokenized loans reaching $13.88 billion. This rapid expansion indicates a shift from traditional lending, as tokenized private credit begins to provide broader access and automated processes through smart contracts, enhancing the overall efficiency of the market.

What are the main advantages of tokenized private credit compared to traditional lending?

Tokenized private credit offers several advantages over traditional lending, including enhanced liquidity through fractional ownership, lower administrative costs due to smart contract automation, and increased transparency via on-chain data that enables better tracking of asset performance.

Which blockchain protocols are leading in the tokenized private credit market?

As of now, Figure leads the tokenized private credit market with $12.78 billion in originated loans, accounting for 92% of the sector. Other notable players include Tradable, Maple Finance, and TrueFi. These protocols operate on various blockchain networks, reflecting the technological advancement and diverse strategies within the tokenized private credit space.

How can retail investors participate in the tokenized private credit market?

Retail investors can participate in the tokenized private credit market through platforms that facilitate blockchain lending by allowing fractional ownership of loans represented by digital tokens. This opens opportunities for individuals to invest in private credit assets, which were traditionally limited to institutional investors.

What is the future potential of tokenized private credit in relation to real-world assets?

With tokenized private credit representing less than 1% of the $1.6 trillion traditional private credit market, there is substantial potential for growth. As the tokenization of real-world assets continues to gain traction, more investors may be drawn to the enhanced liquidity and access provided by blockchain technologies.

What challenges exist within the tokenized private credit space?

Despite its rapid growth, tokenized private credit faces challenges such as regulatory uncertainty, the need for widespread adoption of blockchain technologies, and competition from traditional lending systems. Addressing these obstacles will be crucial for the future success and expansion of this innovative segment.

How does tokenization improve transparency in private credit lending?

Tokenization enhances transparency in private credit lending by utilizing blockchain technology, which records every transaction immutably on a distributed ledger. This on-chain data allows for real-time monitoring of asset performance and provides clear visibility into the underlying financial transactions, thereby minimizing risks associated with traditional lending.

| Key Points | Details |

|---|---|

| Market Size | Tokenized private credit has reached an outstanding loan amount of $13.88 billion, surpassing tokenized U.S. Treasuries at $7.38 billion. |

| Definition | Tokenized private credit converts traditional loans or debt instruments into digital tokens on a blockchain. |

| Market Leader | Figure is the market leader with $12.78 billion in loans, accounting for 92% of the sector. |

| Other Major Players | Other significant protocols include Tradable, Maple Finance, and TrueFi with respective loans of $4.72 billion, $3.38 billion, and $1.72 billion. |

| Technological Infrastructure | Protocols use various blockchain networks, enhancing the sector’s technological maturity. |

| Advantages | Tokenization expands access to retail investors and improves liquidity of private credit assets. |

| Growth Potential | Although growing rapidly, tokenized credit is still less than 1% of the $1.6 trillion traditional private credit market. |

Summary

Tokenized Private Credit represents a significant and rapidly growing segment in the financial services landscape, with outstanding loans currently at $13.88 billion. This financial innovation has transformed traditional credit assets into blockchain-based tokens, facilitating more accessible and liquid investment opportunities. As this market continues to evolve, its potential to disrupt the conventional private credit sector is substantial, signaling a trend towards broader adoption and integration into mainstream finance.