U.S. and Germany Trade Relations: Trust Still Intact

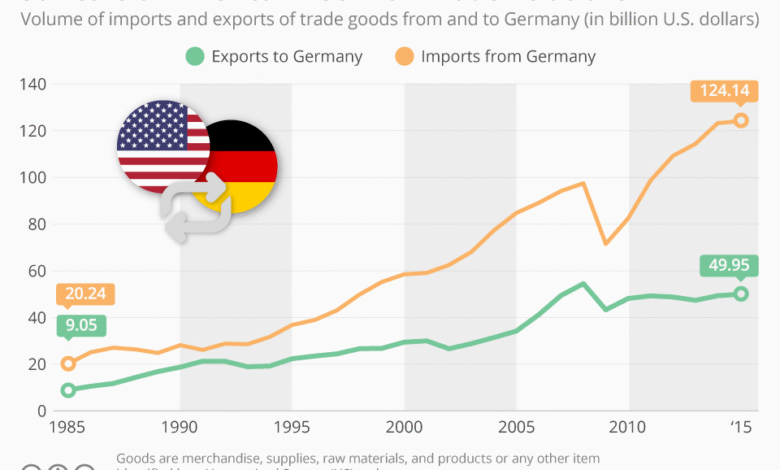

U.S. and Germany trade relations continue to navigate a complex landscape shaped by historical partnerships and modern challenges. The trust between these two economic powerhouses has remained resilient, mirroring decades of collaboration despite recent turbulence from tariff disputes, notably under the Trump administration. German finance minister Joerg Kukies recently emphasized the importance of a zero-for-zero tariff agreement as a means to foster goodwill and reconciliation between the nations. With the German economy heavily reliant on trade, especially with the U.S. as its most significant trading partner, the implications of current trade policies on both sides are substantial. As discussions progress, the focus is on preserving the transatlantic partnership while addressing the impacts of various tariffs and trade policies.

Examining the economic interplay between the United States and Germany reveals a nuanced relationship marked by tradition and adaptation. Recent dialogue highlights a desire for a balanced approach to tariffs, especially as German officials advocate for a solution that minimizes duties on imported goods. Amidst shifting trade dynamics, the implications of recent U.S. tariffs on Germany’s economic forecasts have been significant, driving discussions about collaborative policies. The commitment to a constructive transatlantic partnership underscores both nations’ expectations of a mutually beneficial trading environment. Ultimately, finding common ground regarding trade policies is essential for both countries to thrive in an increasingly interconnected global economy.

U.S. and Germany Trade Relations: A Trust That Remains

The relationship between the United States and Germany has historically been a pillar of stability in global trade. Despite the tensions created by President Trump’s tariffs, the acting German finance minister, Joerg Kukies, emphasizes that the fundamental trust within the transatlantic partnership remains robust. He noted that this partnership has developed over decades, which brings forth a certain resilience to external pressures, suggesting that neither side is ready to sever ties based solely on tariff disputes. This ongoing dialogue is crucial as both nations navigate their trade policies, which influences economic stability on both sides of the Atlantic.

Moreover, Joerg Kukies articulated a strong preference for a zero-for-zero tariff agreement, which would eliminate tariffs on both sides and foster a more open trading environment. Such an agreement could rejuvenate the struggling German economy, which has been negatively impacted by the current tariffs. By reducing or eliminating these trade barriers, both economies stand to benefit, creating a more favorable climate for industries across both nations.

Frequently Asked Questions

How do the Trump tariffs impact U.S. and Germany trade relations?

The Trump tariffs have created tensions in U.S. and Germany trade relations by imposing significant duties on German imports, affecting Germany’s economy, which heavily relies on trade with the U.S. Tariffs are seen as detrimental to both countries’ economic interests, making it challenging to negotiate favorable trade policies.

What is a zero-for-zero tariff agreement in the context of U.S. and Germany trade relations?

A zero-for-zero tariff agreement refers to a mutual understanding where both the U.S. and Germany would eliminate tariffs on specific goods, promoting free trade and reducing economic friction. This solution is favored by German officials, including finance minister Joerg Kukies, as it would enhance the transatlantic partnership without the burden of tariffs.

What role does the transatlantic partnership play in U.S. and Germany trade relations?

The transatlantic partnership is a long-standing economic and political alliance between the U.S. and Europe, including Germany. It plays a crucial role in U.S. and Germany trade relations by fostering collaboration on trade policies, addressing tariff issues, and navigating challenges posed by current U.S. administration’s trade strategies.

How has the German economy adjusted due to U.S. trade policies?

The German economy has faced challenges due to U.S. trade policies, particularly the Trump tariffs, which have led to revised growth forecasts and concerns about economic stagnation. These policies have caused uncertainty in trade relations, impacting Germany’s overall economic performance as the country relies significantly on exports to the U.S.

What are the prospects for future U.S. and Germany trade negotiations?

Future U.S. and Germany trade negotiations hold potential for positive outcomes as both sides express interest in discussions. Despite current tariff tensions, officials indicate a willingness to explore agreements like a zero-for-zero tariff solution, emphasizing the importance of understanding each other’s perspectives to achieve beneficial trade relations.

How might a zero-for-zero tariff solution benefit both the U.S. and Germany?

A zero-for-zero tariff solution could benefit both the U.S. and Germany by eliminating tariffs on various goods, promoting increased trade flow, enhancing economic ties, and potentially leading to job creation and economic growth in both countries. Such an agreement could also stabilize the transatlantic partnership amid current trade tensions.

| Key Points |

|---|

| Trust between the U.S. and Germany remains intact despite Trump’s tariffs, as stated by German finance minister Joerg Kukies. |

| Kukies mentions that breaking trust would require more significant actions as the transatlantic partnership is long-standing. |

| His preferred solution to the tariff issue is a zero-for-zero tariff agreement between the U.S. and EU. |

| Trump has rejected the EU’s proposal for zero duties on industrial goods, complicating negotiations. |

| Germany faces a 10% tariff currently; the German economy is heavily reliant on trade with the U.S. |

| The German government has recently lowered its growth forecasts due to the impact of U.S. trade policies. |

| Despite current struggles, there may be investment boosts from a major fiscal package including infrastructure funding. |

Summary

U.S. and Germany trade relations are characterized by a complex balance of trust and tension, particularly influenced by tariff policies from both sides. German finance minister Joerg Kukies has emphasized that the longstanding partnership between the U.S. and Germany remains strong, despite aggressive tariff measures under President Trump’s administration. Aiming for collaborative resolutions, Kukies advocates for a zero-for-zero tariff agreement, although such proposals have faced rejection from the U.S. Current trade tariffs pose significant challenges for the German economy, which is particularly vulnerable given its dependency on trade with the U.S. Nonetheless, upcoming fiscal initiatives could provide avenues for recovery and economic stability.