Trump Federal Reserve Replacement: Key Announcements Ahead

In a bold move, President Donald Trump is set to announce his picks for key government positions, including the highly anticipated Trump Federal Reserve replacement. This decision comes in response to the recent unexpected resignation of Fed Governor Adriana Kugler and Trump’s dismissal of Bureau of Labor Statistics head Erika McEntarfer. As Trump prepares to name candidates for these influential roles, focus will shift to how their leadership may influence the economy, particularly regarding interest rates policies that impact everything from housing to business investments. With the Trump economy job reports falling short of expectations, Trump emphasizes the need for appointments that align with his vision for economic resurgence. Observers are keenly awaiting news on who might fill these Federal Reserve vacancies, especially in light of Trump’s commitment to reshape the central bank’s approach to monetary policy.

In recent days, President Trump has been gearing up to fill crucial roles at the Federal Reserve and Bureau of Labor Statistics, which have significant implications for U.S. economic management. The vacancies arose due to unexpected resignations and dismissals, prompting Trump to consider new leadership that may align with his fiscal strategies. The anticipated replacements may greatly impact the way interest rates are approached and how job growth is reported, given the criticisms surrounding previous administration’s handling of economic data. As discussions unfold regarding his choices for these pivotal positions, many speculate about the potential shifts in monetary policy and labor statistics that could reshape the economic landscape under Trump. This transition period is closely monitored for how it may reflect on the current state of the economy as well as Trump’s broader economic agenda.

Trump’s Federal Reserve Replacement: What Does It Mean for Interest Rates?

As President Trump prepares to name his replacement on the Federal Reserve, the financial world holds its breath. The decision comes on the heels of Governor Adriana Kugler’s unexpected resignation, which adds an element of urgency to Trump’s search for a candidate who aligns with his vision for monetary policy. One pivotal aspect of this selection is the candidate’s stance on interest rates; Trump has been outspoken about his desire for lower rates, believing that such measures can stimulate the economy further. The Federal Reserve plays a critical role in setting interest rates that influence borrowing costs, consumer spending, and ultimately, job creation in America. This makes the appointments particularly significant considering the ongoing discussions surrounding economic recovery and stability in the face of recent job report disappointments from the Bureau of Labor Statistics (BLS).

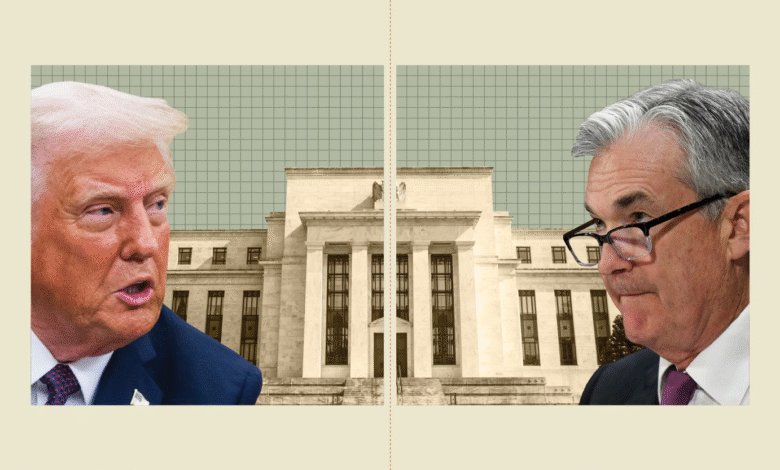

With potential successors like Kevin Warsh and Scott Bessent floating around, it raises questions about whether Trump will choose someone who can break from traditional Fed operations or further perpetuate existing policies. The importance of aligning Fed leadership with Trump’s economic goals is paramount if he aims to maintain momentum in financial markets and his administration’s agenda. Rumblings suggest that many candidates who resonate with Trump’s philosophy could lead to shifts in public policy pertaining to interest rates, particularly if they express skepticism toward established norms upheld by Chair Jerome Powell.

Further complicating the picture is the perception surrounding political influence within the Fed. Trump’s critics argue that his nominees could introduce a bias that undermines the institution’s independence. The central bank’s primary objective is to ensure economic stability without political interference, a principle that has been upheld throughout its history. However, under Trump’s potential appointees, the focus might tilt toward aggressive monetary strategies aimed at achieving immediate economic goals linked to growth, rather than measured approaches that consider inflation and long-term repercussions. Thus, the implications of Trump’s Federal Reserve replacement could be felt widely across financial markets, consumer behavior, and even international economic relations.

The Impact of Trump Appointments on the Bureau of Labor Statistics

The recent dismissal of Erika McEntarfer has put the Bureau of Labor Statistics in the spotlight as President Trump contemplates her replacement. The BLS is responsible for providing essential data on employment figures that inform economic policy-making, job market trends, and business strategies. Trump’s criticism of McEntarfer following a disappointing jobs report indicates his desire for a fresh perspective that would enhance the accuracy and transparency of labor statistics. The upcoming appointment could be pivotal in redefining how job performance and economic health are reported, especially given the recent downward revisions to previous employment figures that sparked significant concerns.

Moreover, the interactions between the Trump administration and the BLS raise questions about the potential for politicization of economic data. Critics argue that frequent changes in leadership at the BLS could undermine public trust in labor statistics, an essential tool used by economists and policymakers alike. Trump’s role in choosing a new BLS head will undoubtedly focus on aligning the agency’s data reporting with his economic message, particularly as he advances his agenda in response to subpar job counts that have drawn him public critique. The selection process, therefore, will not just influence the agency’s operational approach, but could also set the tone for future administrative accountability regarding job growth and economic indicators who support the current political narrative.

By appointing someone who aligns closely with his views on labor market dynamics, Trump might maneuver to reflect a more favorable narrative for his presidency. However, such a strategy could backfire if the new appointee fails to deliver credible and reliable data that can withstand scrutiny from economists and market analysts. Therefore, as Trump looks ahead to selecting a new BLS leader, the implications span well beyond administrative appointments; they reach into how the labor market will be perceived by the public and international observers who rely on these statistics for informed decisions. Ultimately, this critical appointment could reshape engagement with labor data, influencing everything from fiscal policy to investor confidence in the Trump economy.

Frequently Asked Questions

How will the Trump Federal Reserve replacement affect interest rate policies?

The upcoming Trump Federal Reserve replacement, following Governor Adriana Kugler’s resignation, is expected to influence interest rate policies significantly. President Trump has indicated that he will appoint nominees who are more inclined to lower interest rates, potentially altering the central bank’s approach to monetary policy.

What are the implications of the Trump appoints Fed chair for the economy?

When President Trump appoints a new Fed chair, it could lead to changes in economic strategies that affect inflation and employment rates. A Trump-appointed chair aligns with lower interest rate policies, which may stimulate economic growth by encouraging borrowing and investing.

What role does the Bureau of Labor Statistics play in relation to the Trump Federal Reserve replacement?

The Bureau of Labor Statistics (BLS) provides essential job report data that influences Federal Reserve decisions on interest rates and monetary policy. With Trump’s dismissal of BLS head Erika McEntarfer following disappointing job reports, this could affect how labor market data is perceived and used to guide future Trump Federal Reserve replacement candidates.

What factors will Trump consider for his Federal Reserve vacancies?

President Trump will evaluate candidates for the Federal Reserve vacancies based on their willingness to support lower interest rates and their alignment with his economic vision. Potential nominees like Kevin Warsh and Scott Bessent are under consideration for their perceived fit in promoting a Trump-style economic approach.

How does Trump’s intervention at the BLS impact Federal Reserve job reports?

Trump’s intervention at the Bureau of Labor Statistics, especially after recent job report discrepancies, raises concerns about the integrity of economic data. This ultimately affects Federal Reserve decision-making as accurate job reports are crucial for assessing the economy and determining interest rates.

What has been the reaction to the Trump Federal Reserve replacement announcements?

The announcements regarding the Trump Federal Reserve replacements have prompted mixed reactions, with concerns about potential politicization of the Fed and economic data. Financial analysts worry that overly partisan appointments could compromise the Federal Reserve’s independence and the reliability of job reports from the BLS.

What is the significance of the Trump economy job reports in light of the Fed vacancy?

The Trump economy job reports are particularly significant following the Fed vacancy, as they provide data that the new chair will rely on for monetary policy decisions. The accuracy and reliability of these reports are crucial for setting interest rates that influence economic conditions.

How might Trump’s approach to Federal Reserve vacancies change under the new appointees?

Trump’s approach to Federal Reserve vacancies is likely to skew towards candidates who are aligned with his economic policies, notably those favoring lower interest rates. This shift may lead to a reevaluation of monetary strategies and a more aggressive stance on economic stimulation under the new appointees.

| Key Points |

|---|

| President Trump plans to announce replacements for the Federal Reserve and Bureau of Labor Statistics. |

| Vacancies arose from the resignation of Fed Governor Adriana Kugler and dismissal of BLS Commissioner Erika McEntarfer. |

| Trump is considering several candidates for the Fed position and intends to act soon on McEntarfer’s replacement. |

| Kugler’s unexpected resignation was effective August 8, prior to the end of her term in January. |

| Kugler supported Fed Chair Jerome Powell’s policies but left amid Trump’s ongoing criticisms of the Fed. |

| Potential successors for the Fed role include Kevin Warsh and Scott Bessent, among others. |

| McEntarfer’s dismissal follows disappointing job report data, with claims of miscalculations in employment figures by Trump. |

| Concerns arise over politicization of labor statistics and the implications for economic policy decision-making. |

Summary

The upcoming Trump Federal Reserve replacement marks a pivotal moment as President Trump seeks to reshape key economic institutions. With the resignation of Fed Governor Adriana Kugler and the dismissal of BLS Commissioner Erika McEntarfer, Trump aims to appoint candidates who align with his vision for economic policy, particularly concerning interest rates. This strategic decision could influence monetary policy and economic statistics, casting a spotlight on the integrity of data collection and its implications for future economic growth.