Trump Goldman Sachs Tariff Response: A DJ in Economics?

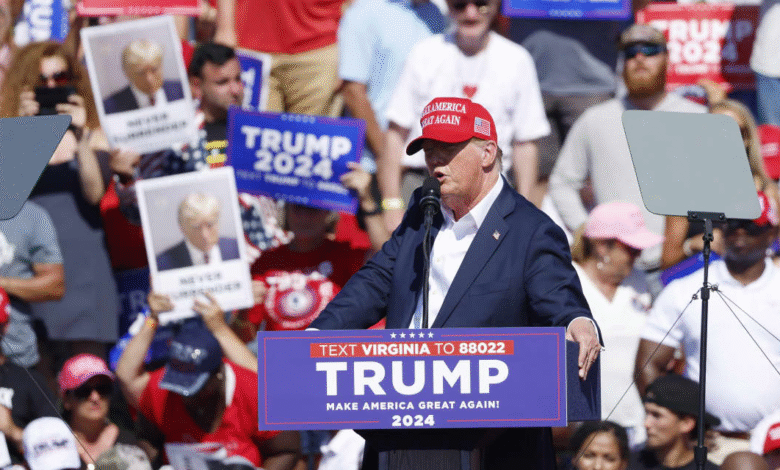

In a bold and contentious statement, President Donald Trump called out Goldman Sachs CEO David Solomon over the bank’s tariff analysis, suggesting he should either consider a new economist or revert to his days as a DJ. This Trump Goldman Sachs Tariff Response came after warnings from Goldman that tariffs imposed by the Trump administration would lead to increased costs for American consumers. While Trump argues that tariff revenues hit nearly $28 billion and insists that tariffs do not fuel inflation, his position starkly contrasts with the warnings from Goldman Sachs’ chief economist, Jan Hatzius. Hatzius highlighted a critical economic impact of tariffs, asserting that by October, consumers could face up to 67% of tariff costs. As Trump continues to defend his tariff policies, the debate intensifies over who truly bears the financial burden—the corporations or the everyday American citizen.

The ongoing discourse surrounding President Donald Trump’s trade measures has sparked significant debate, particularly from influential financial institutions like Goldman Sachs. The recent remarks from Trump regarding his skepticism of economic impacts forecasted by analysts, especially concerning tariff burdens, signal a deeper rift between his administration and financial experts. The Tariff Response from Trump reflects his steadfast belief in the effectiveness of his policies, while detractors highlight the potential consequences for consumers. As the economic landscape shifts under these tariffs, the discussion revolves around whether companies or individuals will face the brunt of rising costs. This complex dynamic underscores the tensions between fiscal policy decisions and their real-world implications.

Trump’s Challenges to Goldman Sachs on Economic Predictions

President Donald Trump has been vocal in his criticisms of economists who forecast negative consequences from his tariffs. His recent remarks directed at Goldman Sachs CEO David Solomon are a prime example, where he questioned the accuracy of the bank’s economic predictions regarding tariff cost impacts on consumers. Trump’s call to Solomon to either replace the bank’s economist, Jan Hatzius, or focus on his alternate career as a DJ highlights his dismissive attitude towards Goldman Sachs’ economic evaluations. This exchange underscores the broader conflict between Trump’s administration and traditional economic thought, particularly concerning tariffs, which are often viewed as inflationary.

In his social media post, Trump contended that the billions generated from tariffs, which reportedly reached around $28 billion by mid-July, do not burden American consumers. Instead, he argues that the primary impact of these tariffs is felt by foreign businesses and governments, which align with his broader strategy of using tariffs as a tool to renegotiate trade deals. Trump’s insistence that tariffs don’t lead to inflation directly contradicts the warnings from Goldman Sachs that U.S. consumers are inevitably going to shoulder a significant portion of the tariff costs. This contentious dialogue raises essential questions about economic policies and their real-world implications.

Economic Impact of Tariffs on American Consumers

The discourse surrounding tariffs has ignited intense debates about their economic implications, particularly for American consumers. Tariffs, as imposed by the Trump administration, are intended to protect domestic industries but come with consequences that can ripple through the economy. Jan Hatzius, Goldman Sachs’ chief economist, predicts that consumers may end up facing up to 67% of the tariffs’ costs if current trends continue. This significant projection could lead to increased prices on goods as companies may choose to pass these costs onto consumers, raising concerns over affordability amidst an already complex economic landscape.

The potential burden on consumers from these tariffs is not just a theoretical exercise; it manifests in rising prices at retail and impacts purchasing power. As tariffs disrupt supply chains and inflate the costs of imported goods, consumers may find themselves navigating a less favorable economic environment. Trump’s assertion that tariffs do not drive inflation challenges established economic principles and predictions, especially as the overall economic health is affected. As American families budget for everyday expenses, the effects of tariff-induced price hikes become increasingly apparent and contentious.

Trump Versus Goldman Sachs: A Broader Economic Debate

The exchange between President Trump and Goldman Sachs raises critical questions about the reliability of economic forecasting and the role of major financial institutions in shaping public policy. Trump’s remarks suggest a significant distrust in traditional economic analyses, especially those predicting dire outcomes from his tariff policies. This skepticism points to a broader phenomenon where political leaders may challenge the narratives constructed by economists, creating divisions between economic theory and political rhetoric. Trump’s suggestion to David Solomon to either hire a more accurate economist or return to his DJ career only serves to emphasize this disconnect.

In this contentious environment, the discourse surrounding tariffs becomes a microcosm of the larger conflict between conventional economic wisdom and populist political strategies. As numerous economists, including those at Goldman Sachs, raise alarms over the long-term implications of high tariffs on economic stability, Trump maintains his position that the immediate benefits outweigh potential future costs. Such ideological clashes can lead to policymaking that strays from empirical evidence, sparking further debate on the sustainability of tariffs and their efficacy in achieving desired economic outcomes.

Assessing the Cost of Trump’s Tariffs for Consumers

The discussion of tariffs often brings to light the immediate and long-term costs that American consumers might face. Trump’s tariffs have been designed primarily as a strategy to negotiate trade terms with other nations, but they inadvertently create complexities for the everyday consumer. Increased prices for imported goods can distort spending patterns, pushing consumers to either cut back on purchases or shift to less desirable alternatives. This, in turn, can stifle overall economic growth if spending slows down significantly.

As projections indicate that consumers may end up covering a substantial share of tariff costs—potentially as much as 67%—the implications for consumer purchasing power become increasingly urgent. Many households may find their budgets stretched thinner, leading to discontent that can manifest in various economic sectors. Understanding the true economic impact of tariffs necessitates a careful analysis of consumer behavior and market dynamics, highlighting the balance between protecting domestic industries and ensuring a stable, accessible environment for consumers.

The Role of Economists in Tariff Debates

Economists play a critical role in informing the public and policymakers about the potential repercussions of tariffs. The predictions made by experts like Jan Hatzius of Goldman Sachs offer insights into how tariffs might affect both companies and consumers. However, Trump’s challenge to Solomon highlights a growing skepticism toward conventional economic wisdom within the political sphere. As economists analyze data and trends to create forecasts, they face the difficult task of communicating complex ideas in a way that resonates with a broader audience.

The confrontation between Trump and Goldman Sachs illustrates a larger trend of politicizing economic forecasts. When presidents or political figures disregard expert opinions, it can lead to misguided policies based on populism rather than sound economic reasoning. Understanding the context in which economists operate—often influenced by shifting political landscapes—can help to contextualize the debates surrounding tariffs and their anticipated impacts on the economy. Engaging with these experts becomes vital in crafting policies that are beneficial for the economy as a whole.

Consumer Sentiments on Tariffs: A Growing Concern

As concerns grow regarding the financial ramifications of President Trump’s tariffs, consumer sentiment is evidently shifting. With rising prices and the possibility of increased living costs, many Americans are voicing their frustrations. This shift in consumer confidence can have larger implications for the economy, including changes in spending behavior and the overall stability of financial markets. As consumers begin to feel the pinch from tariffs, they may be less inclined to support policies seen as detrimental to their financial well-being.

Consumer sentiment is also closely tied to perceived economic health. If consumers believe that tariffs are leading to higher prices without tangible benefits, their trust in government policy could wane. Maintaining consumer confidence is paramount for economic growth, and any policy that disrupts this trust may lead to unforeseen consequences. As the situation evolves, the impacts of tariffs will continue to reverberate across consumer attitudes, influencing future financial decisions and political support.

Tariff Revenue: A Double-Edged Sword

While the tariff revenues generated may seem beneficial to the federal budget—reportedly reaching nearly $28 billion—this figure belied the complexities of the overall economic scenario. These revenues could present an illusion of success while ignoring the potential fallout for consumers and businesses alike. Critics argue that relying on tariff revenues as a fiscal tool could lead to adverse economic impacts, particularly if domestic businesses struggle to compete under inflated costs due to tariffs.

The prospect of utilizing tariff income to fund government initiatives creates a paradox; as funds increase through tariffs, the burden on consumers may hinder economic activity. Balancing the positive influx of funds against the costs passed down to consumers is essential for understanding the broader implications of such policies. As seen in the case of Trump’s administration, discussions around tariff revenues must consider their broader impacts on the economy—to ensure sustainability over short-term fiscal gains.

Implications of Trump’s Tariff Policies for Global Trade

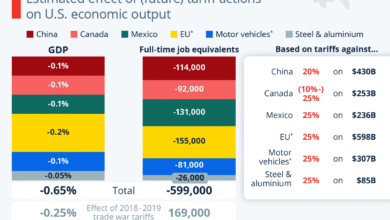

Trump’s administration has taken decisive actions in the realm of international trade, particularly through the implementation of tariffs on a variety of goods. These policies are not simply national in scope; they reverberate through global supply chains and impact international trade relationships. As nations respond to the imposition of tariffs, we witness a shift in trade paradigms that could redefine commerce on a global scale—leading to retaliatory tariffs and trade disputes that complicate international dynamics.

The implications of such tariffs extend beyond immediate financial concerns, potentially altering the landscape of global trade and international cooperation. Countries that find themselves affected by U.S. tariffs may seek alternative markets or foster new trade agreements, reshaping long-held alliances. Understanding the broader effects of Trump’s tariff policies necessitates examining their global repercussions—not just their perceived benefits domestically. As the global economy thrives on interconnectedness, the actions taken by one nation can trigger a cascade of economic consequences worldwide.

Future of Tariff Policies in American Economic Strategy

As we look ahead, the future of tariff policies within American economic strategy remains uncertain, especially in the light of shifting political tides. Trump’s tariffs have ignited powerful debates about protectionism versus free trade, and the outcomes of these discussions will shape economic policies moving forward. Key considerations will revolve around how tariffs are crafted, the industries affected, and ultimately the ease of trade with global partners.

The ongoing examination of tariffs will necessitate assessments of whether these policies yield more benefits than harm over time, particularly for consumers. As economists and policymakers work to navigate this territory, understanding the intersection between economic theory and practical implementation will be crucial. Future economic strategy will likely need to incorporate a balance that safeguards American interests while promoting consumer welfare and robust international trade relationships.

Frequently Asked Questions

What was Donald Trump’s response to Goldman Sachs regarding tariff concerns?

In response to warnings from Goldman Sachs economist Jan Hatzius about tariff costs for consumers, President Donald Trump suggested that Goldman Sachs CEO David Solomon should either replace Hatzius or focus more on his DJ career. Trump dismissed concerns about inflation from tariffs and claimed that the revenues from these tariffs are beneficial.

How do Donald Trump’s tariffs impact consumers according to Goldman Sachs?

Goldman Sachs economist Jan Hatzius has warned that the economic impact of tariffs will largely be shouldered by U.S. consumers, predicting that by October, they could bear up to 67% of the tariff costs. This contradicts Trump’s assertion that tariffs mainly affect companies and foreign governments.

What is the economic impact of tariffs according to Trump’s statements?

President Trump argues that tariffs, which have generated over $28 billion in revenue, do not lead to inflation and primarily impact foreign governments and companies. He challenges the economic forecasts from Goldman Sachs, emphasizing that the actual burden of tariffs on consumers is overstated.

Who is David Solomon and what did Trump say about him?

David Solomon is the CEO of Goldman Sachs. In reaction to the firm’s economic analysis regarding consumer costs from tariffs, Trump humorously suggested that Solomon should either find a new economist for the bank or concentrate on his side career as a DJ.

What concerns did Goldman Sachs express about Trump’s tariffs?

Goldman Sachs, represented by chief economist Jan Hatzius, expressed concerns that Donald Trump’s tariffs would increase costs for American consumers, potentially leading to significant financial burdens, contrary to Trump’s claims regarding the non-inflationary effects of tariffs.

How did Trump justify his stance on tariffs and their effects?

Trump justified his stance by arguing that tariff revenues do not negatively impact inflation and that consumers would not bear the brunt of cost increases, a view that contrasts sharply with the warnings from Goldman Sachs.

What are the current projections on tariff costs for consumers as indicated by Goldman Sachs?

Goldman Sachs has projected that if current trends continue, U.S. consumers might end up covering approximately 67% of the costs associated with Donald Trump’s tariffs by October, highlighting the potential economic impact of these tariffs.

| Key Point | Details |

|---|---|

| Trump’s Statement | Trump suggested Goldman Sachs CEO David Solomon should replace their economist or focus on his DJ career. |

| Tariff Revenue | By July, tariff revenues reached $28 billion, according to Trump. |

| Economic Impact | Trump argued that tariffs do not lead to inflation contrary to warnings by Goldman Sachs’s economist. |

| Goldman’s Warning | Goldman Sachs’ chief economist, Jan Hatzius, warned consumers could bear 67% of tariff costs by October. |

| Response from Goldman Sachs | A Goldman spokesperson did not respond to Trump’s comments. |

Summary

Trump Goldman Sachs Tariff Response highlights a tension between President Trump’s economic perspectives and those of Goldman Sachs. In his critical remarks about Goldman Sachs CEO David Solomon, Trump dismissed concerns about consumer burden from tariffs, asserting that the effects are primarily felt by companies and foreign entities. He challenged the validity of the warnings given by Goldman Sachs’s economist, Jan Hatzius, who projected significant costs for consumers as a result of these tariffs. As tariff revenues soar, Trump’s commentary suggests a firm stance on his tariff policies, aiming to downplay fears of inflation and consumer impact.