Trump Nippon Steel US Steel Merger: Boosting Economic Growth

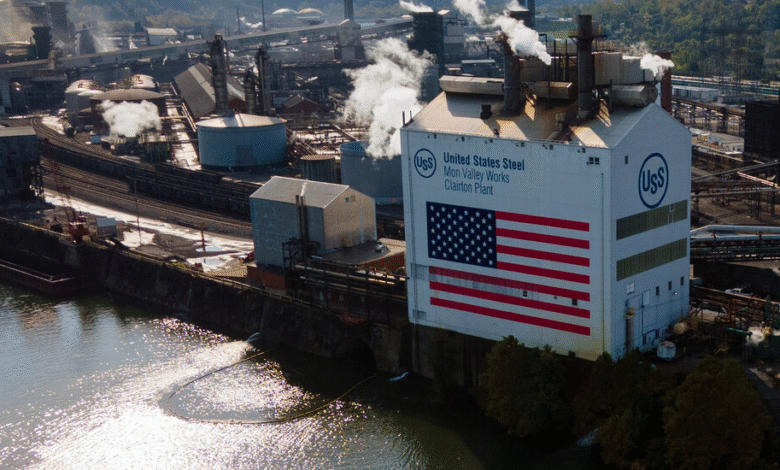

In a bold move that has captured the attention of the steel industry, the Trump Nippon Steel US Steel Merger is set to reshape the landscape of American manufacturing. President Donald Trump has announced a strategic partnership between U.S. Steel and Nippon Steel, projected to inject a staggering $14 billion into the U.S. economy and create approximately 70,000 jobs. This merger not only signals a significant shift in the steel market but also reflects Trump’s ongoing efforts to bolster the American labor force amidst fluctuating global trade dynamics. The partnership has already sparked excitement, with U.S. Steel shares soaring by over 20% following the announcement. As the industry watches closely, the potential economic impact of this steel industry merger may ripple beyond borders, influencing international relationships and job markets in profound ways.

In recent developments, the new collaboration between Nippon Steel and U.S. Steel, as endorsed by President Trump, marks a pivotal moment for the American economy and the domestic steel sector. This forthcoming alliance aims to enhance the steel production capabilities and fortify job opportunities for U.S. workers, deeply influencing the landscape of manufacturing in the country. The anticipated influx of $14 billion in investments underscores Trump’s focus on strengthening the U.S. economy through significant industrial partnerships. Dubbed a strategic merger, this initiative not only seeks to revive the steel industry but also highlights the delicate balance between national interests and foreign investment. With attention fixated on the implications of this partnership, insights into the evolving dynamics of U.S. Steel news continue to emerge.

Trump’s Economic Impact on the Steel Industry

President Donald Trump’s recent approval of the partnership between U.S. Steel and Nippon Steel signals a significant shift in the landscape of the American steel industry. This decision, praised for its potential to inject $14 billion into the U.S. economy, can also be viewed as a strategic maneuver to bolster domestic job creation. By stating that this merger will generate at least 70,000 jobs, Trump highlights an essential component of his broader economic agenda, which focuses on revitalizing American manufacturing and ensuring that domestic industries remain competitive against foreign entities.

Moreover, this partnership reflects Trump’s ongoing commitment to protecting national interests, especially in industries critical to national security. The phased investment over the next 14 months will likely result in enhanced production capacity at U.S. Steel, ultimately benefiting both local economies and the nation as a whole. By keeping U.S. Steel’s headquarters in Pittsburgh, Trump is reinforcing the city’s status as a historical hub of steel production, and ensuring that the strategic sector thrives under American oversight.

Nippon Steel Partnership: Future of U.S. Steel

The innovative partnership between Nippon Steel and U.S. Steel presents a modern solution to the challenges faced by American steel manufacturers. With Nippon Steel’s advanced technology and U.S. Steel’s established market presence, this collaboration is poised to enhance operational efficiencies and drive innovation. As both companies work together, they will likely adopt best practices from each other, further strengthening their production capabilities in a competitive global market.

This strategic alliance comes at a critical time when the steel industry faces numerous pressures, including global competition and fluctuating raw material costs. By pooling resources and sharing technological expertise, Nippon Steel and U.S. Steel aim to navigate these challenges effectively. The merger’s anticipated economic benefits not only promise job creation but also inspire confidence in investors and stakeholders across the steel sector.

Understanding the Steel Industry Merger Importance

The merger between U.S. Steel and Nippon Steel is poised to reshape the dynamics of the steel industry significantly. In an era where mergers and partnerships can define market trajectories, this particular union emphasizes the importance of collaboration in facing industry-wide challenges. Furthermore, it underscores the potential for international firms to work alongside American companies to create competitive advantages that may not have been possible independently.

Moreover, industry experts argue that the benefit of this merger extends beyond mere financial gains. It represents a strategic alignment aimed at enhancing the reliability of supply chains crucial for the steel production process. By blending resources and expertise, the partnership mitigates risks associated with global supply chain uncertainties, ensuring that both companies can deliver high-quality products to their customers and maintain a solid footing in the ever-evolving market landscape.

Impact on US Economy Jobs and Growth

The announcement of the partnership between U.S. Steel and Nippon Steel signals a renewed focus on job creation within the U.S. economy. With projections estimating the creation of 70,000 jobs, this partnership not only promises to provide immediate employment opportunities but also serves as a stabilizing force for vulnerable sectors. These new positions are vital for bolstering local economies, especially in regions like Pittsburgh, which relies heavily on the steel industry.

As job opportunities expand, they can potentially lead to increased consumer spending, fostering further economic growth. The ripple effects of such a substantial injection into the job market may enhance worker confidence and stimulate demand across various sectors. This synergy between new jobs and economic growth might also attract further investments into the region, creating a positive feedback loop that reinforces strong economic foundations across the U.S.

The Controversy Behind Steel Partnerships

Despite the anticipated benefits of the U.S. Steel and Nippon Steel partnership, it is essential to understand the controversies that surround such mergers. Previously, President Joe Biden had blocked Nippon Steel’s attempt to acquire U.S. Steel, citing national security concerns. This decision illustrated the complexities of foreign investments in key American industries, particularly those that hold significance for national infrastructure and defense.

Critics argue that allowing foreign entities to take significant stakes in American companies could jeopardize supply chains and stability in the market. As the steel industry continues to evolve, striking a balance between attracting foreign investment and ensuring national security will be paramount. The ongoing debates highlight the broader implications of these partnerships and the governance required to oversee such significant economic decisions.

Investments and Innovations in Steel Production

The partnership between U.S. Steel and Nippon Steel is expected not only to enhance job creation but also to prioritize investments in innovative technologies that can revolutionize steel production. As both companies look to modernize their operations, they must consider embracing advanced manufacturing practices, including automation and sustainable methods. These innovations are critical in making the steel industry more competitive and environmentally friendly.

By investing in research and development, U.S. Steel and Nippon Steel can work on improving production efficiency and reducing overall emissions, responding to growing environmental concerns. Such advancements will not only benefit the companies involved but also contribute positively to the U.S. economy’s sustainability goals, aligning with broader interests for an eco-conscious industrial approach that meets both regulatory requirements and societal expectations.

Long-Term Outlook for the Steel Industry

The long-term outlook for the steel industry, following the announcement of the U.S. Steel and Nippon Steel partnership, appears promising. With a significant investment commitment from Nippon Steel, the steel sector is likely to experience robust growth fueled by the merging of innovative technologies and expertise. As the global market continues to shift, maintaining a strong domestic steel production capability will be crucial for the U.S. economy.

This partnership not only points to stabilization in the steel market but also signals potential for leadership in the global arena. Establishing a powerful alliance can help safeguard American steel interests while also serving as a precedent for future partnerships in other industries that could enhance U.S. economic resilience in decades to come.

Implications for Future U.S.-Japan Relations

The merger between U.S. Steel and Nippon Steel could have far-reaching implications for U.S.-Japan relations. The partnership exemplifies a collaborative approach towards economic growth and mutual benefits between the two nations. As trade relationships evolve, this merger might set a precedent for future cross-border partnerships that could further strengthen bilateral ties and economic collaborations.

Additionally, successful cooperation in significant sectors such as steel can pave the way for dialogue in other industries. By demonstrating how joint ventures can yield symbiotic benefits while promoting both economic growth and security, U.S.-Japan relations may experience newfound momentum that leads to more comprehensive agreements and initiatives aimed at boosting trade and investment.

Regulatory Considerations for Steel Industry Mergers

The partnership between U.S. Steel and Nippon Steel will require navigating numerous regulatory considerations to ensure compliance within U.S. laws. As the Committee on Foreign Investment reviews this agreement, it will be crucial for both companies to address any potential concerns related to national security and supply chain stability. Maintaining transparency and adhering to U.S. regulations will be key factors in achieving a successful partnership that withstands scrutiny.

Regulatory bodies will closely monitor the merger’s alignment with national interests, particularly in terms of job preservation and economic growth. Ensuring that the merger does not compromise the integrity of domestic production will be a priority as various stakeholders assess its long-term implications for the U.S. steel industry and economy.

Frequently Asked Questions

What is the Trump Nippon Steel US Steel merger about?

The Trump Nippon Steel US Steel merger refers to President Donald Trump’s approved partnership between U.S. Steel and Nippon Steel. This strategic alliance aims to strengthen the steel industry and is projected to contribute $14 billion to the U.S. economy and create at least 70,000 jobs.

How will the Trump Nippon Steel US Steel merger impact the US economy?

The Trump Nippon Steel US Steel merger is expected to significantly impact the US economy by injecting $14 billion and creating numerous jobs in the steel industry. This partnership is anticipated to bolster local economies, particularly in Pittsburgh, where U.S. Steel’s headquarters is located.

What are the key benefits of the Nippon Steel partnership with US Steel under Trump’s approval?

The key benefits of the Nippon Steel partnership with US Steel include job creation, with an estimation of at least 70,000 new jobs, and a major economic boost of $14 billion to the U.S. economy. This merger is viewed as a strategic move to enhance competitiveness in the steel industry.

What are the potential risks associated with the Trump Nippon Steel US Steel merger?

Potential risks associated with the Trump Nippon Steel US Steel merger include national security concerns previously raised during an attempted acquisition. The merger could also affect domestic supply chains and international trade relations, necessitating careful regulatory oversight.

What does the Trump announcement on the Nippon Steel US Steel merger mean for US Steel’s headquarters?

According to Trump’s announcement, U.S. Steel’s headquarters will remain in Pittsburgh, ensuring that the city’s economy continues to benefit from the steel industry. This stability is critical for the local workforce and community.

How did the stock market react to the Trump Nippon Steel US Steel merger announcement?

Following President Trump’s announcement of the Nippon Steel US Steel merger, U.S. Steel shares experienced a significant increase, rising by more than 20% to close at $52.01 per share, reflecting positive investor sentiment about the merger.

What led to the Trump Nippon Steel US Steel merger discussion?

The Trump Nippon Steel US Steel merger discussions emerged after President Biden previously blocked a direct acquisition attempt by Nippon Steel due to national security concerns. Trump initiated a review of this decision, paving the way for a partnership instead of a full acquisition.

When are the investments from the Trump Nippon Steel US Steel merger expected to occur?

The investments from the Trump Nippon Steel US Steel merger are expected to begin in the next 14 months, as outlined by President Trump. This timeline indicates a commitment to rapid economic development within the steel industry.

| Key Point | Details |

|---|---|

| Partnership Announcement | Trump announces that U.S. Steel and Nippon Steel will form a partnership. |

| Economic Contribution | The partnership is expected to contribute $14 billion to the U.S. economy. |

| Job Creation | At least 70,000 jobs will be created as a result of this partnership. |

| Company Location | U.S. Steel’s headquarters will remain in Pittsburgh. |

| Stock Market Reaction | U.S. Steel shares rose by over 20% after the announcement, closing at $52.01. |

| Previous Acquisition Block | Biden previously blocked Nippon Steel’s acquisition attempt citing national security. |

| Review of Acquisition | Trump ordered a review of the acquisition to reassess its implications. |

| Upcoming Rally | Trump plans to hold a rally at U.S. Steel in Pittsburgh on May 30. |

Summary

The Trump Nippon Steel US Steel Merger represents a significant milestone in the U.S. steel industry, as it aims to create a robust partnership between two leading steel producers. With an anticipated contribution of $14 billion to the U.S. economy and the creation of at least 70,000 jobs, this merger reflects a strategic push towards economic recovery and job growth. Trump’s announcement has stirred market enthusiasm, evidenced by the increase in U.S. Steel shares, signaling positive investor sentiment about the expected benefits of this partnership. Additionally, the decision to maintain the corporate headquarters in Pittsburgh underscores a commitment to preserving local jobs while adapting to changing market conditions. Overall, this merger has the potential to reshape the steel landscape of the United States.