Trump Tariff Decisions: A Response to Market Dynamics

Trump tariff decisions have generated significant buzz as President Donald Trump navigates complex trade dynamics with various global partners. In April 2025, he announced a sweeping 10% import duty that set off a wave of anxiety regarding the potential repercussions for U.S.-China trade relations and broader economic stability. Despite the aggressive stance, Trump’s hesitation to enforce reciprocal tariffs for 90 days was notable—an unexpected move amid escalating market reactions to his economic policies. Market analysts noted a pronounced bond market reaction, with Treasury yields fluctuating in response to the announcement, highlighting the delicate balance between trade policy and economic indicators. The implications of such import tariffs impact consumer prices and inflation, making it essential to closely monitor the evolving landscape of Trump’s economic policy analysis.

The recent tariff strategies employed by the Trump administration have sparked widespread discussion regarding their implications on international trade and domestic economics. These trade measures, particularly concerning duties levied on imports, demonstrate a pivotal shift in how the U.S. engages with trading partners. As uncertainties loom over U.S.-China economic interactions, the administration’s decisions appear even more critical, especially in light of the unpredictable bond market. Furthermore, the impact of these import tariffs is likely to reverberate throughout various sectors, affecting everything from consumer goods pricing to investor confidence. In analyzing Trump’s broader economic strategies, one must consider how such tariffs might reshape future trade agreements and the overall health of the U.S. economy.

Impact of Trump Tariff Decisions on the Bond Market

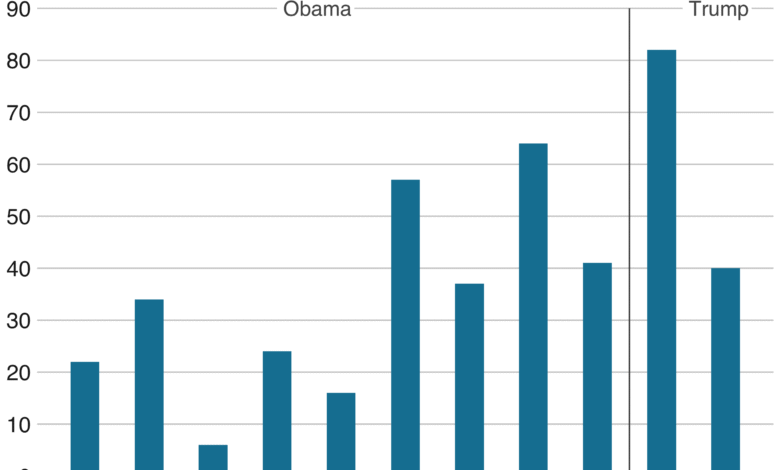

The decision-making process behind President Trump’s tariff policies has significant implications for the bond market. When Trump announced a 10% across-the-board duty on all U.S. imports, it sent shockwaves through financial markets, leading to an aggressive sell-off in bonds. Investors typically react to tariff announcements due to concerns over inflationary pressures and potential economic slowdowns. The spike in Treasury yields following the announcement exemplifies this connection, as prices of long-term securities fell, reflecting a shift in investor sentiment regarding future interest rates and economic policy. This immediate reaction underscores the sensitivity of the bond market to changes in trade policy and highlights the need for careful economic policy analysis.

Despite the volatility in the bond market, Trump has maintained that his tariff decisions were not swayed by these financial fluctuations. He emphasized during interviews that his administration prioritizes long-term strategic negotiations over short-term market reactions. By implementing a 90-day postponement of reciprocal tariffs, Trump aimed to provide room for dialogue with U.S. trading partners while attempting to stabilize market fears. This careful balancing act reflects a broader strategy to influence both domestic economic conditions and international trade relationships, further complicating the bond market dynamics that often hinge on perceived risk factors associated with U.S.-China trade relations.

Analyzing Trump’s Postponement of Tariffs

President Trump’s postponement of reciprocal tariffs showcases a strategic approach to navigating complex trade negotiations. This move comes in response to mounting pressures from financial markets reacting to his previous tariff announcements. Trump’s insistence that market turmoil was not the impetus for his decision reflects a calculated effort to assert control over economic perceptions while addressing pending negotiations with affected countries. This approach illustrates the delicate balance between implementing protective economic measures and mitigating potential adverse impacts on the economy, particularly in the context of U.S.-China trade relations, which remain fraught with challenges.

Further analysis of Trump’s economic policy reveals a multifaceted rationale behind tariff adjustments. The goal is not simply to apply tariffs but to leverage them as tools for negotiation. By temporarily delaying the implementation of increased tariffs, Trump signals to markets and international stakeholders that he is willing to engage in constructive dialogue. This strategy aims to achieve desired trade outcomes without inciting unnecessary turmoil within financial markets, particularly the bond market. Ultimately, the administration’s actions reflect a commitment to both domestic economic stability and a recalibrated approach to international trade engagements.

The Broader Economic Implications of Tariff Delays

Tariff delays can have significant implications for the overall economic landscape, as they often influence market confidence and investment decisions. By postponing the reciprocal tariffs, President Trump seeks to mitigate the potential for immediate negative impacts on economic growth, particularly concerning consumer prices and business investments. The uncertainty surrounding import tariffs can lead to a shift in supply chains and business strategies, prompting companies to reconsider their investment decisions based on anticipated costs. Such dynamics underline the critical need for an informed economic policy analysis, allowing stakeholders to navigate the complex ramifications of trade decisions.

Additionally, delays in implementing tariffs can provide time for affected industries to adapt and for negotiations to take place. This flexibility can lead to improved relationships with trading partners, potentially resulting in more favorable trade agreements that benefit the U.S. economy in the long run. However, the initiative also brings about risks; businesses must remain vigilant to changing trade conditions and market responses. While some industry sectors may benefit from tariff delays, others may remain vulnerable to the threat of future tariffs, underscoring the interconnectedness of U.S.-China trade relations and the necessity for a comprehensive understanding of import tariffs’ impacts on various economic sectors.

U.S.-China Trade Relations and Tariff Strategies

The evolving landscape of U.S.-China trade relations remains a pivotal element in shaping tariff strategies under the Trump administration. The complexity of these relations demands careful consideration as tariffs are deployed as both punitive measures and bargaining chips in negotiations. Trump’s stance on tariffs reflects a broader strategic objective of recalibrating the U.S. trade balance with China, aiming to address longstanding concerns about trade deficits and unfair practices. The decision to delay implementing additional tariffs exemplifies the administration’s nuanced approach to dealing with one of the world’s largest economies.

Moreover, ongoing discussions regarding trade policies and tariff implementations can greatly affect public sentiment and investment climate. As tariffs are a central component of economic policy analysis, business leaders are keenly aware of the outcomes of trade negotiations and the potential long-term effects of any new tariff announcements. This approach indicates that Trump is using the leverage of tariffs not merely as a threat but as part of a broader strategy to foster more balanced trade relations that could ultimately lead to mutually beneficial agreements with China and other trading partners.

Consumer Impact of Trump’s Tariff Delays

Consumer reactions to tariff policies can vary significantly, influencing their purchasing power and overall economic sentiment. As President Trump delays reciprocal tariffs, consumers may experience some short-term relief from rising prices, which often accompany aggressive tariffs. During periods of uncertainty, consumers tend to alter their spending habits, particularly with significant consumer goods often affected by tariffs. The administration’s approach to temporarily shelving additional tariffs allows for an assessment of market dynamics, promoting a more favorable environment for consumer spending in the near term.

However, the long-term prospects regarding consumer impact remain contingent upon the outcomes of ongoing trade negotiations. Should these discussions yield favorable results, it could stabilize pricing and strengthen consumer confidence in the economy. Conversely, re-implementing high tariffs could lead to price hikes on everyday goods, thus impacting household budgets. This fluctuation emphasizes the significance of maintaining clear communication on trade policies, ensuring that consumers feel secure in their purchasing decisions, and fostering an environment conducive to economic growth.

Investor Confidence and Market Reactions to Tariff Policies

Investor confidence plays a crucial role in determining the stability of financial markets, particularly in response to tariff announcements and economic policies proposed by the Trump administration. When the announcement of a 10% import duty was made, the initial sell-off in bonds illustrated how sensitive investors are to changes in trade policies. This was followed by a notable rebound in Treasury yields, indicating a shift in market sentiments as investors recalibrated their expectations surrounding future economic conditions. The responsiveness of the bond market to tariff-related announcements highlights the intricate relationship between tariffs, investor confidence, and overall market performance.

Moreover, Trump’s assertion that his tariff decisions are not influenced by market reactions signifies a more strategic approach to managing investor expectations. By holding back on reciprocal tariffs temporarily, Trump aims to not only stabilize the financial markets but also create an environment where investors can feel more secure in their investment choices. This consideration reflects an understanding of the broader economic implications of tariff policies, where maintaining investor confidence is paramount to ensuring robust economic growth while navigating the complexities of U.S.-China trade relations.

The Role of Economic Policy Analysis in Tariff Decisions

Economic policy analysis plays an essential role in shaping tariff decisions, especially those made under the Trump administration. By examining data on trade balances, market reactions, and the potential implications of tariffs on both domestic and global markets, analysts can provide insights that are critical for informed decision-making. Trump’s administration has faced scrutiny regarding its tariff strategies, necessitating a robust economic policy analysis to ensure that decisions align with long-term economic objectives. This analysis not only quantifies the potential impacts of tariffs but also evaluates how they can be used effectively to achieve desired outcomes.

Furthermore, the complexity of global trade dynamics necessitates continuous monitoring and adaptation based on economic indicators and market feedback. Effective economic policy analysis can lead to a better understanding of how tariffs influence trade relations, inflation rates, and market volatility. By engaging in sustained analysis, the administration can proactively navigate the challenges presented by tariffs, ensuring that policies are responsive to both macroeconomic conditions and stakeholder interests. As such, ongoing research and analysis will be vital in optimizing tariff strategy and mitigating risks associated with U.S.-China trade relations.

Future Prospects of Tariffs Under Trump’s Administration

Looking ahead, the future of tariffs under President Trump’s administration remains uncertain, with several factors influencing potential policy shifts. The administration’s willingness to negotiate and delay reciprocal tariffs can signal a more collaborative approach to international trade. As discussions with global trading partners evolve, the potential for new agreements may reshape the landscape of tariff implementation, ultimately impacting U.S.-China trade relations. Should negotiations yield positive outcomes, it could pave the way for revised tariff structures that foster enhanced economic collaboration rather than confrontational policies.

However, Trump has also indicated his willingness to maintain high tariffs if necessary, aiming for a trade environment that promotes U.S. economic interests. The prospects of maintaining tariffs or adjusting them will likely remain responsive to economic conditions, investor sentiments, and the outcomes of ongoing trade discussions. As domestic economic stability is prioritized, the administration faces the challenge of balancing aggressive tariff strategies with the need for constructive trade relationships. Collective insights and analyses will be critical in navigating these complexities, ensuring that U.S. economic and trade objectives remain aligned.

Frequently Asked Questions

What are the implications of Trump tariff decisions on US-China trade relations?

Trump tariff decisions have significantly impacted US-China trade relations, increasing tensions and leading to retaliatory tariffs from China. These tariffs are designed to protect American industries but have also raised concerns about inflation and disruptions in trade agreements.

How did the bond market react to Trump’s tariff delays?

The bond market reacted negatively to Trump’s tariff delays, with Treasury yields initially dropping as investors grappled with uncertainty regarding future tariffs and economic stability. However, after Trump’s comments and the announcement of a 90-day postponement, yields rebounded sharply, indicating volatility in market sentiment.

What is the impact of Trump’s import tariffs on the U.S. economy?

Trump’s import tariffs are intended to bolster American manufacturing by making foreign goods more expensive, but they can also lead to higher consumer prices and potential inflation, affecting the overall economic landscape in the U.S.

Why did Trump postpone reciprocal tariffs?

Trump postponed reciprocal tariffs by 90 days to allow for further negotiations with trading partners. He stated this decision was not influenced by the bond market’s performance but was based on his desire to achieve favorable trade terms.

What analysis is available on the economic policy behind Trump’s tariff decisions?

Economic policy analysis of Trump’s tariff decisions highlights the tension between protecting domestic industries and the risk of escalating trade wars. Experts argue that while tariffs may provide short-term benefits, they could harm long-term economic growth if retaliatory actions are taken by affected nations.

What challenges have arisen from Trump’s announcement of a 10% across-the-board duty on U.S. imports?

The announcement of a 10% across-the-board duty on U.S. imports has led to market volatility, fears of inflation, and uncertainties in trade relations. This aggressive tariff strategy has raised questions about potential recession risks and disruption of established international trade agreements.

| Key Point | Details |

|---|---|

| Trump’s Denial | Trump denied that market sell-off influenced his tariff decisions. |

| Market Reaction | Announcement of a 10% duty led to negative market reactions. |

| Tariffs Postponed | Trump postponed reciprocal tariffs by 90 days for negotiations. |

| Confidence in Economy | Trump expressed confidence in the U.S. economy despite market concerns. |

| Future Tariff Vision | Trump indicated a vision for tariffs potentially remaining high for future stability. |

Summary

Trump tariff decisions have sparked significant debate regarding their impact on the U.S. economy and global trade relations. Despite market sell-offs, Trump asserted his focus on long-term economic stability and negotiations with trading partners, believing that higher tariffs could lead to a ‘total victory’ in the future.