Trump Tariffs: 40% Duties on Transshipped Goods Imposed

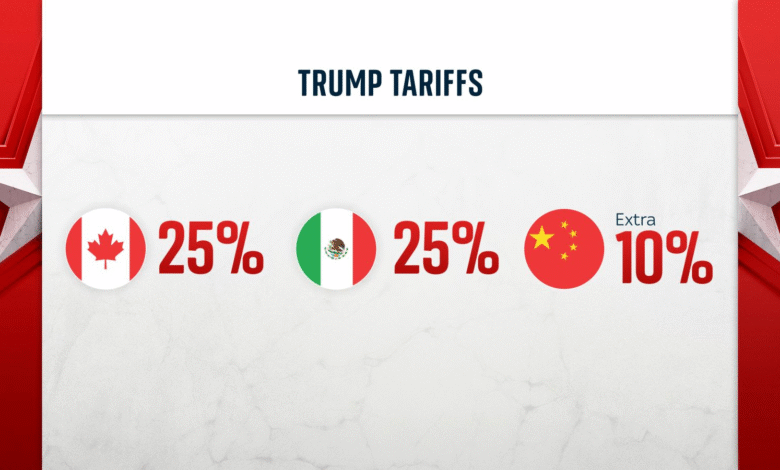

Trump tariffs have taken center stage in international trade discussions as President Donald Trump signed a pivotal executive order adjusting tariff rates on a host of goods. The revised duties, which range from 10% to a staggering 41%, are designed to target countries seeking to evade duties through transshipped goods. Under these new U.S. tariffs, any goods transshipped to avoid taxes will face an additional 40% tariff, emphasizing the administration’s commitment to protecting American interests. As the deadline for these changes looms, trading partners are left scrambling to understand the implications for their exports and ongoing trade agreements. This bold move signifies a crucial shift in the U.S. trade policy landscape, with far-reaching effects on global commerce and international relations.

In recent developments surrounding U.S. trade policy, the administration has announced significant adjustments to the duties levied on imported goods, often referred to as tariff rates. These modifications impact various foreign countries and highlight the ongoing struggle to protect domestic markets from international competition. The latest executive directive imposes higher levies on goods that may have been rerouted through other nations, a strategy intended to thwart circumvention of trade regulations. As negotiations unfold regarding existing trade arrangements, these tariff changes might reshape the landscape for many foreign partners. Such fiscal measures are indicative of a broader trend towards stricter enforcement of trade norms, with a focus on maintaining national economic security.

Understanding Trump’s Latest Tariff Adjustments

In a recent executive order, President Trump has responsibly revised the tariff rates that impact various countries engaged in trade with the United States. The changes show a clear focus on protecting domestic industries by introducing tariffs that range from 10% to 41%. These tariff adjustments are expected to influence market dynamics significantly, especially for imports that had previously skirted around established tariffs through practices like transshipping, which refers to rerouting goods through third countries to avoid higher import duties.

The latest modifications are pivotal as they not only affect current trade relations but also the overall economy. Importers should be wary of the new tariff rates and prepare accordingly for higher costs of imported goods. These tariffs are aimed at ensuring fair competition and may foster more robust domestic industry support. Merchants and businesses involved in importing goods should revisit their supply chain strategies to reflect these tariff changes introduced in this executive order.

Impact of the 40% Duties on Transshipped Goods

The imposition of a 40% duty on all transshipped goods marks a significant shift in U.S. trade policy. This hefty tariff is designed to deter firms from trying to exploit loopholes in trade agreements by rerouting goods through other nations to evade duties. The implications of these tariffs extend beyond immediate financial burdens; they serve as a warning to trading partners about the seriousness with which the U.S. government views trade compliance.

As businesses adjust to these new tariffs, many will have to reassess their logistics and import strategies, potentially leading to increased prices for consumers. This shift could prompt a reevaluation of supplier relationships globally, as companies look for ways to mitigate higher costs associated with tariffs. The market’s response to these duties will be closely monitored by economists, political analysts, and businesses alike to understand their longer-term effects on international trade dynamics.

Exploring U.S. Tariffs in the Context of Trade Agreements

U.S. tariffs are intricately linked to international trade agreements that the nation enters into with various countries. With newly adjusted rates coming into effect, understanding these agreements is crucial for stakeholders. Many countries nearing finalizing comprehensive trade and security agreements with the U.S. may find themselves in a favorable position, as they can benefit from modified tariff rates while negotiations are still active.

Trade agreements often dictate the terms of tariff imposition and can lead to reduced duties for countries participating in these arrangements. The tension between imposing tariffs and fostering strong trade relationships poses a complex challenge for policymakers. As President Trump navigates this landscape, the impact of such strategic tariff adjustments will be at the forefront of discussions surrounding U.S. economic interests and international relations.

The Role of Executive Orders in Shaping Trade Policy

Executive orders have long been a tool used by U.S. Presidents to expedite modifications in policy without going through Congress. The recent executive order signed by President Trump exemplifies this direct approach to altering the tariff landscape. By bypassing the legislative process, the administration demonstrates its commitment to an assertive trade policy that reflects the current administration’s priorities.

Such rapid changes can provide immediate relief in addressing perceived trade imbalances but can also generate criticism regarding their long-term sustainability. Executive orders can lead to instability in trade policies, forcing businesses to adapt quickly to shifting regulations, which may, in turn, lead to increased costs and uncertainty in the market.

Consequences of Tariff Rate Changes on Domestic Economy

The recent changes in tariff rates initiated by President Trump’s executive order are poised to have profound implications for the U.S. economy. For domestic manufacturers, increased tariffs on imported goods can provide a protective buffer against foreign competition, allowing local businesses to thrive. However, the downside of this protectionist approach can lead to higher prices for consumers, creating a potential backlash.

As the manufacturing sector benefits from reduced competition, consumers may see increases in the prices of everyday goods, particularly those heavily reliant on imports. This cycle highlights the need for a careful balance between the protection of domestic industries and the need to maintain reasonable prices for consumers, as economic ramifications unfold.

The Strategic Importance of Tariffs in U.S. Foreign Policy

Tariffs are not just an economic tool; they play a crucial role in U.S. foreign policy as well. By adjusting tariff rates, the U.S. government can signal to trading partners its stance on various geopolitical issues. The recent tariff changes can be seen as a strategic move to leverage negotiations before completing trade agreements or addressing compliance issues with existing agreements.

Through these tariff adjustments, the U.S. aims to not only protect its economic interests but also to assert its influence on the global stage. The interconnected nature of trade and diplomacy means that these decisions can impact alliances and international relations, making them a vital component of broader U.S. foreign policy.

Analyzing Trade Partner Reactions to New Tariffs

In response to the latest changes in U.S. tariffs, trading partners are likely evaluating their own positions strategically. Countries affected by the updated tariff rates may seek diplomatic avenues to renegotiate terms or adapt their trade practices. This is particularly significant for nations heavily dependent on exports to the U.S., where recalibrating trade relationships can be essential for economic stability.

Responses from trading partners can also influence the domestic economic landscape, as retaliatory measures may be put in place, leading to a tit-for-tat scenario that can escalate tensions and uncertainty in global markets. Therefore, the international trade community is watching closely to gauge the reactions and potential shifts in trade strategies in light of these new U.S. tariffs.

The Role of Compliance in Future Tariff Adjustments

As the U.S. implements new tariffs, compliance from trading partners becomes increasingly critical. The recent adjustments underscore the administration’s emphasis on ensuring that goods entering the U.S. comply with established trade laws. The administration is likely to prioritize negotiations that stress adherence to trade agreements and compliance requirements.

Future tariff adjustments may hinge on the performance of countries in complying with these guidelines, which emphasizes the need for transparency and cooperation in international trade relationships. Ongoing compliance will be essential in determining how future tariffs evolve and whether trading partners can avoid excessive duties that disrupt economic relationships.

Potential Changes to Tariff Rates Over Time

The economic landscape is always shifting, and as such, tariff rates are not set in stone. As market conditions, global trade dynamics, and diplomatic relations fluctuate, the U.S. may continue to adjust tariff rates in response to new information or changing circumstances. The flexibility in tariff policy allows for adaptation to economic pressures and competitive landscapes.

Potential changes to tariffs could manifest as reductions or increases, depending on the situations surrounding trade negotiations and compliance among trading nations. This ongoing evaluation is crucial for businesses and stakeholders to remain informed, as any sudden shifts in tariff rates can significantly impact operational costs and pricing strategies.

Frequently Asked Questions

What are the implications of the Trump tariffs on transshipped goods?

The Trump tariffs imposed an additional 40% duty on all goods classified as transshipped to avoid existing tariffs. This move aims to discourage countries from rerouting products through third-party nations to escape higher tariff rates. As such, importers must ensure compliance with U.S. tariffs to avoid hefty penalties, significantly impacting global trade dynamics.

How do the updated Trump tariff rates affect trade agreements with the U.S.?

The updated Trump tariff rates, which range from 10% to 41%, will be applied to countries not adhering to new trade agreements. However, nations nearing trade and security agreements with the U.S. may receive temporary relief from these increased tariffs until negotiations are complete. This strategy is part of Trump’s broader effort to leverage tariffs as a tool during discussions.

What role does the executive order play in setting new Trump tariff rates?

The executive order signed by President Trump modifies existing tariff rates, establishing new duties on imports based on reciprocity principles. This order outlines specific tariffs for various countries and introduces additional fees for transshipped goods, effectively reshaping the landscape of U.S. trade policy.

How do the Trump tariffs influence the import market for U.S. businesses?

The Trump tariffs are designed to adjust the competitiveness of imported goods, likely making foreign products more expensive for U.S. consumers and businesses. This could lead to increased prices on imported goods, potentially driving consumers toward domestically produced alternatives, thereby impacting the import market significantly.

What happens if goods are labeled as transshipped under the Trump tariffs?

Goods identified as transshipped—that is, products rerouted through other countries to bypass tariffs—will face an additional 40% duty under the Trump tariffs. This enforcement mechanism is intended to discourage such practices and ensure that all imported goods comply with U.S. tariff regulations.

Will the Trump tariffs affect American consumers directly?

Yes, the Trump tariffs may lead to higher prices for consumers as companies may pass on the increased costs of imported goods due to higher tariff rates. This adjustment could influence the purchasing habits of consumers as they seek affordable alternatives.

What are reciprocal tariffs in the context of the Trump tariffs?

Reciprocal tariffs, as outlined in the Trump tariffs, refer to duties applied to imports based on the tariffs imposed by other countries on U.S. goods. The adjustment made in the latest executive order seeks to ensure that U.S. tariffs align with the trade practices of international partners, promoting fairness in trade.

| Key Point | Details |

|---|---|

| Executive Order Issued | President Trump signed an executive order altering tariff rates. |

| Tariff Rates Adjusted | Tariffs now range from 10% to 41% on various countries. |

| Transshipped Goods Tariff | A 40% additional tariff is imposed on all goods transshipped to bypass duties. |

| Countries Affected | Countries not on the list will face an extra 10% duty. |

| Timing of New Rates | New tariff rates take effect 7 days after the order is signed. |

| Canada Tariff Increase | Tariffs on Canadian exports raised to 35%, excluding USMCA goods. |

Summary

Trump tariffs have seen a significant adjustment following a recent executive order released by President Donald Trump. The changes entail a range of duties that could affect international trade dynamics and economic relations. With tariffs increasing up to 41% for various countries and a strict 40% on goods identified as transshipped, these measures highlight the administration’s intensified trade policies. The aim appears to be enforcing stricter compliance and protecting U.S. industries while navigating existing trade agreements.