Trump Tariffs and Trade Uncertainty: Market Reactions Explored

As the world grapples with the extent of Trump tariffs and trade uncertainty, the financial markets remain on high alert. The ongoing trade war between the U.S. and China continues to cast a long shadow over investor confidence, leading to fluctuating equities and an unpredictable crypto landscape. Recent developments indicate that Trump has initiated discourse with China, but markets are still jittery amid fears of potential fallout from steep import duties. Critics argue these tariffs could disrupt the economy, leading to higher consumer prices and reduced household incomes, while supporters tout their benefits for U.S. manufacturing and jobs. As this trade saga unfolds, the ramifications on various assets—like gold, often sought as a safe haven during turmoil—continue to keep investors vigilant, alongside the unique digital asset bitcoin, whose price dynamics are closely tied to these geopolitical tensions.

The conversation surrounding tariffs imposed during Trump’s administration reflects broader themes of trade volatility and economic unpredictability. As policymakers grapple with the implications of an escalating trade standoff with major partners such as China, market participants watch closely. Uncertainty looms large as businesses and consumers consider the impact of these duties on their financial outlooks, prompting many to explore alternatives like commodities or cryptocurrencies. This precarious situation has intensified discussions about the influence of tariffs on market sentiment, especially concerning traditional investments and the role of gold as an asset class favored during times of instability. Moreover, with digital currencies like bitcoin often acting as a barometer for investor sentiment amidst these fluctuations, the intersection of tariffs, market performance, and asset diversification becomes increasingly critical.

The Impact of Trump Tariffs on Global Markets

The tariffs imposed by President Trump have sent shockwaves through the global market landscape, markedly influencing the dynamics of trade and investment. As the U.S. and China continue to engage in tit-for-tat tariff impositions, major U.S. indexes have experienced volatility, demonstrating how sensitive the markets are to trade policy changes. Investors must navigate this uncertainty carefully, as the rising costs of imported goods due to heavy tariffs can lead to higher prices for consumers and disrupt established supply chains. Furthermore, this trade war has sparked fears of a broader economic slowdown, as companies adjust their strategies in response to increased costs, which in turn diminishes consumer confidence.

Beyond immediate market reactions, the long-term implications of these tariffs could reshape investment strategies. The market participants are beginning to consider alternative avenues, including domestic production and investments in commodities like gold—considered a safe haven during tumultuous financial periods. As analysts evaluate the ongoing situation, understanding the impact of tariffs on market behavior becomes essential for informed decision-making. Observers suggest that the oscillation of the stock market in response to Trump tariffs serves as a litmus test for broader economic sentiments, as fears of inflation loom large and global fiscal policies adapt to these trade realities.

Navigating Trade Uncertainty Amid U.S.-China Negotiations

Trade uncertainty remains a significant concern for investors focused on the ongoing U.S.-China negotiations. President Trump’s remarks about engaging in discussions with China are layered with both hope and apprehension. While on one hand, dialogue could lead to a resolution that restores market confidence, on the other hand, prolonged negotiations may exacerbate existing uncertainties, causing fluctuations across both traditional and crypto markets. As both nations impose tariffs, the effects ripple through sectors, with some industries facing steep challenges while others may find unexpected opportunities in a reconfigured global trading environment.

Additionally, the impact of these negotiations extends to the cryptocurrency market, framed by emerging investor behavior amid geopolitical instability. As traditional markets experience volatility, many investors are speculating that digital assets like Bitcoin will serve as an alternative investment, providing a hedge against the unpredictability introduced by these trade tensions. This duality highlights the relationship between tariffs, trade negotiations, and market strategies, where uncertainty could drive many investors towards cryptocurrencies and precious metals as safer investment options.

How Tariffs Influence Bitcoin and Cryptocurrency Markets

The relationship between Trump tariffs and the cryptocurrency market is becoming increasingly relevant amid trade uncertainties. As traditional markets react to the complexities of tariffs, Bitcoin has emerged as a potential refuge for investors looking to withstand economic turbulence. The decentralized nature of Bitcoin allows it to sidestep many of the fiscal constraints that traditional assets face, especially when tariffs begin to impact the bottom line for businesses. As such, Bitcoin’s price action has shown resilience, even as stock markets experience downturns, indicating a possible shift in how digital assets are viewed during economic uncertainties.

Moreover, the fluctuations in Bitcoin prices against the backdrop of U.S.-China trade tensions suggest a new investor psychology; one that leans towards cryptocurrencies as alternatives to secure wealth against inflationary pressures prompted by tariffs. As traditional safe havens like gold have gained attention, Bitcoin’s emergence as a competing asset class underscores the evolving landscape of what constitutes a ‘safe haven’ in a world marked by tariff-induced economic volatility.

Gold as a Safe Haven Amidst Trade Wars

Gold has long been considered a reliable safe-haven asset during periods of economic uncertainty, and the ongoing U.S.-China trade war is no exception. As Trump’s tariffs drive fear into the hearts of investors worried about the immediate and long-term economic consequences, many are turning towards gold to protect their wealth. The recent uptick in gold prices reflects a collective pivot by investors seeking stability amidst market disruptions, indicating that traditional hedges remain pertinent even in modern trading climates influenced by cryptocurrency dynamics.

In addition to traditional investment strategies, gold’s position as a safe haven is sometimes viewed in direct contrast to the cryptocurrency market, particularly Bitcoin. While gold’s value is historically grounded in tangible assets, Bitcoin offers a new frontier for investors looking for non-correlated assets during turbulent economic times. This juxtaposition of gold and Bitcoin highlights the diverse range of options available to investors in navigating the uncertain waters of a trade war. As tariffs continue to shape market trends, understanding the interplay between these two asset classes will be crucial for investors.

Market Reactions to Trump’s Tariffs Announcements

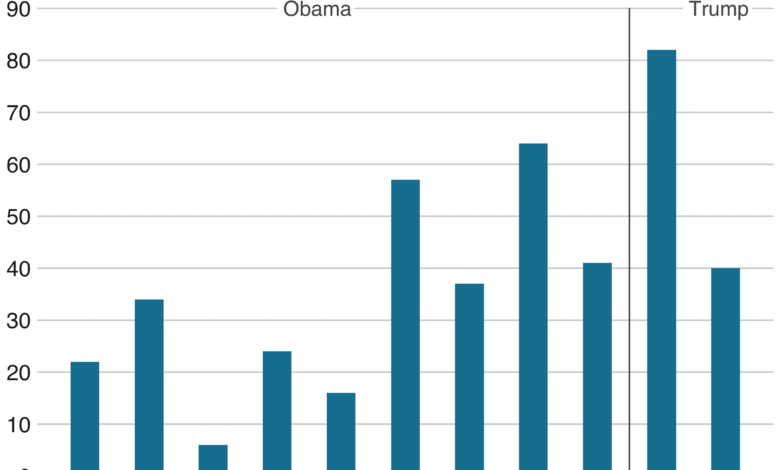

Market reactions to any announcements from President Trump regarding tariffs have been fast and dramatic. For instance, the divergence seen in the major U.S. indexes following Trump’s assertions about engaging with China showcases the markets’ sensitivity to trade policy signals. Each statement made by the administration can lead to rapid adjustments in investor sentiment, often reflected through the fluctuating values in equities and cryptocurrencies alike. This volatility calls for a comprehensive understanding of how trade announcements resonate throughout various sectors of the economy.

Additionally, the ongoing roller coaster of stock performance emphasizes the need for investors to remain vigilant as they respond to news and speculation. With the potential for escalation in the trade war having been articulated by both sides, the unpredictability prompts many to adopt diversified portfolios. The juxtaposition of gains in cryptocurrencies, like Bitcoin, with losses in traditional indexes further illustrates the market’s reaction to tariffs. In this climate, strategic investing will require a rigorous analysis of how tariffs influence both domestic and global markets.

The Broader Economic Implications of Trump’s Tariffs

The broader economic implications of President Trump’s tariffs extend far beyond immediate market reactions and investor attitudes. Economists warn that by imposing steep tariffs, the U.S. risks economic retaliation that could heighten inflation and impact consumer spending patterns. For instance, the price hike on imported goods leads to increased costs for businesses that rely on foreign materials, and these costs may ultimately be passed down to consumers, reducing overall purchasing power. This upward pressure on prices could constrain economic growth and significantly diminish household incomes.

Moreover, the trade war’s repercussions might also aggravate global supply chain dynamics, prompting companies to reconsider their manufacturing and sourcing strategies. As firms grapple with potential disruptions, the costs tied to tariffs necessitate a reevaluation of operational frameworks, which could lead to job losses in certain sectors and a shift towards more localized production. Understanding these interlinked economic implications is crucial for stakeholders looking to navigate the complexities introduced by the U.S.-China trade conflict.

Investor Sentiment and the Future of Tariffs

Investor sentiment regarding tariffs is a complex landscape shaped by a myriad of factors, including anticipated outcomes of negotiations and economic forecasts. As President Trump announces ongoing talks with China, market players are left analyzing the potential for compromise—hoping that these discussions will culminate in reduced tariffs that could restore confidence across global markets. However, as talks progress slowly, the lingering uncertainties continue to gnaw at the investor psyche, prompting cautious strategies bolstered by diversified assets.

Furthermore, this sentiment is mirrored in the volatility observed in the cryptocurrency market, as investor choices gravitate towards less traditional assets during periods of heightened uncertainty. As Bitcoin rises and falls in accordance with investor sentiment toward tariffs and trade negotiations, the interconnectedness of financial markets becomes increasingly apparent. Maintaining awareness of how tariffs impact broader economic narratives will be crucial for investors as they develop strategies for the future.

The Role of Tariffs in Economic Policy

Tariffs are a critical component of economic policy, particularly in the context of trade negotiations between major economies such as the U.S. and China. President Trump’s approach to tariffs signifies a shift towards protectionist measures intended to bolster domestic industries and safeguard jobs. However, the broader implications of such policies can lead to complex interdependencies that may not align with immediate economic benefits. Critics of tariffs argue that while they may offer short-term relief to specific sectors, they can also spark retaliation and create barriers that hinder overall trade agreements.

In an interconnected global economy, the role of tariffs transcends national borders, influencing various aspects of international relations and trade dynamics. As international partners reassess their own tariff structures in response to the U.S. stance, the ripple effect can reshape global supply chains and manufacturing frameworks. Understanding the nuanced implications of tariffs is essential for policymakers and investors alike, as they seek to balance the need for economic growth with the realities of protective trade measures.

Trump’s Tariffs and Future Economic Growth

The potential long-term effects of Trump’s tariffs on future economic growth remain a contentious point of debate among economists and market analysts. While tariffs may provide temporary benefits to domestic industries by reducing competition from foreign goods, many argue that they can ultimately stifle innovation and economic expansion. As businesses face increased costs from tariffs, investment in research, development, and new technologies may take a backseat, impacting the U.S. economy’s long-term competitiveness. The dichotomy of short-term gains versus long-term economic health poses significant challenges for policymakers.

Moreover, the cloud of tariffs casts shadows over expected GDP growth, as market participants grapple with the implications of ongoing trade tensions. The resulting uncertainty can lead to reduced consumer spending, as higher prices weigh on household budgets. Thus, the trade war’s outcome may hinge not just on domestic considerations, but also on international market responses and cooperation. Keeping a keen eye on these dynamics will be essential as businesses and investors strategize for sustainable growth amidst an evolving economic landscape.

Frequently Asked Questions

How are Trump tariffs affecting trade uncertainty with China?

Trump tariffs significantly heighten trade uncertainty between the U.S. and China by imposing steep duties on each other’s goods, leading to unpredictable market reactions and investor sentiment.

What impact do Trump tariffs have on markets?

The impact of Trump tariffs on markets is profound; they create volatility, causing major indexes to fluctuate, as seen recently with the S&P 500 and Dow Jones reactions amidst ongoing U.S.-China trade tensions.

How does the US-China trade war influence the price of bitcoin?

The US-China trade war and Trump tariffs create a feeling of uncertainty that can influence bitcoin price, as some investors view bitcoin as a safe asset during turbulent economic times, leading to its steady performance despite broader market fluctuations.

Is gold considered a safe haven during Trump tariffs and trade uncertainty?

Yes, gold is regarded as a safe haven during periods of trade uncertainty such as those created by Trump tariffs, as its price tends to rise when investors seek stability amid economic instability.

What are the potential job impacts of Trump tariffs during the US-China trade war?

Critics of Trump tariffs argue that they could lead to job losses due to increased costs for businesses that may result in wage reductions or layoffs, inherently threatening economic stability amid the US-China trade war.

How do Trump tariffs affect consumer prices and spending?

The effect of Trump tariffs on consumer prices can lead to increases, as businesses often pass on higher costs to consumers, which may subsequently reduce household spending and overall economic growth.

What negotiations is Trump pursuing with China regarding tariffs?

Trump has stated that the U.S. is engaged in discussions with China concerning tariffs, indicating a desire for dialogue to potentially resolve ongoing trade tensions and reduce uncertainty in the market.

Can Trump’s tariffs influence gold prices and investment behavior?

Yes, Trump’s tariffs can influence gold prices as economic uncertainty often drives investors towards gold, a traditional safe haven, leading to its appreciation amid trade conflicts.

What is the relationship between the US-China trade war and the performance of small-cap stocks?

Small-cap stocks, such as those in the Russell 2000, may react differently to the US-China trade war, sometimes showing resilience or gains as investors look for domestic growth opportunities despite broader market challenges posed by Trump tariffs.

Why do some business leaders criticize Trump tariffs during trade negotiations?

Some business leaders criticize Trump tariffs because they believe they undermine free trade principles, increase operational costs, and create an unstable business environment, which can harm both businesses and consumers.

| Key Points |

|---|

| Trump’s remarks on trade talks with China and their implications for markets. |

| Equity markets had mixed performance, reflecting investor uncertainty over tariffs. |

| Trump’s position is that tariffs protect U.S. jobs and boost manufacturing, |

| Concerns exist over the economic impact of tariffs on consumers and businesses. |

| Rising gold prices show a shift towards safe havens amid trade uncertainties. |

| Bitcoin remains stable, suggesting investor caution in traditional markets. |

Summary

Trump tariffs and trade uncertainty have become a focal point for investors as the U.S. engages in negotiations with China. Recent statements from President Trump indicate ongoing dialogues aimed at resolving the tariff standoff, although market reactions remain mixed. While some view tariffs as detrimental to economic stability, fearing increased costs for businesses and consumers, Trump argues they are essential for protecting U.S. jobs and encouraging local manufacturing. The volatility in both equity and cryptocurrency markets underscores the widespread apprehension regarding the long-term impact of these trade policies.