Trump Tariffs: Market Slide and EU Retaliation Looms Ahead

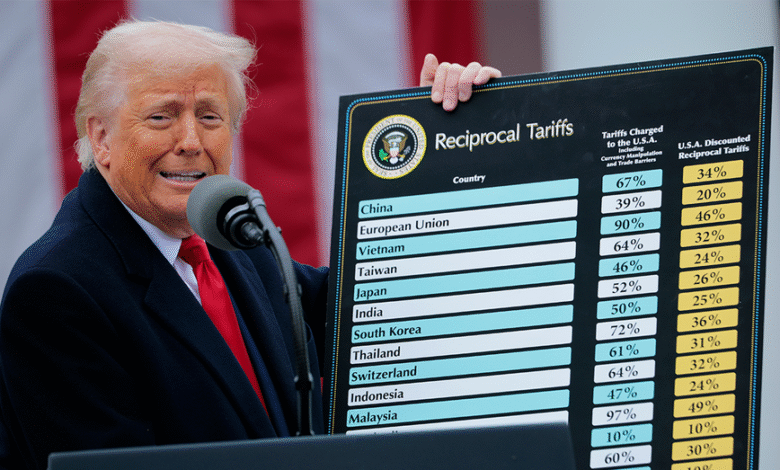

Trump tariffs have recently shaken the U.S. stock market, leading to sharp declines in major indices as investors react to the potential economic fallout. The president’s proposal to impose a 50% tax on imports from the European Union and a 25% tariff on overseas iPhones is intended to both challenge EU trade practices and incentivize local production. The market’s immediate downturn highlights concerns about how these measures could affect consumer prices and companies’ bottom lines, especially as Wall Street grapples with increased uncertainty. Analysts warn that the ramifications of these tariffs may extend beyond immediate economic impacts, potentially leading to retaliatory actions from the EU, which could complicate future trade negotiations. As the threat of rising iPhone prices looms, many are left questioning how these tariffs will ultimately affect everyday Americans and their wallets.

The proposed tariffs by the Trump administration represent a significant shift in U.S. trade policy, igniting fears of escalating tensions between the United States and its European partners. By implementing substantial import taxes on goods like iPhones and targeting the EU, these policies aim to reshape global trade flows and encourage domestic manufacturing. However, this financial maneuvering has prompted a notable reaction on Wall Street, as investors remain wary of price hikes and potential retaliatory tariffs that the EU may impose. Market analysts are closely monitoring the situation, especially since prolonged tariff battles could destabilize the existing landscape of international trade negotiations. As implications for consumer prices and corporate earnings continue to unfold, both investors and consumers are left navigating an increasingly volatile economic environment.

The Impact of Trump’s Tariffs on the EU and iPhone Prices

President Trump’s recent tariff proposal, which includes a hefty 50% tax on imports from the European Union and a 25% tariff on overseas-made iPhones, sends ripples across global markets. This initiative aims not only to pressure the EU during the ongoing trade negotiations but also to stimulate local manufacturing of electronics, such as the iPhone, in the United States. As these tariffs loom, analysts are concerned about the inflationary effects they might have, potentially causing prices of consumer electronics and other imported goods to rise significantly.

The immediate reaction on Wall Street reveals the anxiety these tariffs induce among investors. Major stock indexes, including the Dow Jones and S&P 500, experienced notable declines as fears regarding increased retail prices and reduced consumer spending began to settle in. Companies like Apple may bear the brunt of these tariffs, as higher costs may deter buyers and dampen demand for their products. Consequently, the iPhone, a substantial revenue driver for Apple, could see its prices soar, affecting sales and potentially leading to a decline in share value in a market already jittery from trade negotiations.

Wall Street Reaction and U.S. Stock Market Volatility

The volatility of the U.S. stock market has become increasingly pronounced in light of President Trump’s tariff proposals. Analysts note that Wall Street’s sharp declines reflect deep-seated concerns about the long-term implications of such tariffs on both national and international trade ecosystems. As investors brace for possible retaliatory measures from the EU, such as counter-tariffs, the unpredictability of trade relations generates an atmosphere of uncertainty, leading many traders to reconsider their positions.

Amidst this chaos, sectors reliant on foreign supply chains, including technology and automotive industries, have to navigate an ever-changing landscape. With fears of an impending trade war, the stock market’s stability remains in jeopardy, and further declines could result in a prolonged downturn. Trade negotiations between the U.S. and EU are at a standstill, and any movement—or lack thereof—will have a profound impact on market dynamics as investors react to every new development.

Furthermore, analysts warn that continued uncertainty could lead to a broader economic slowdown, ultimately affecting household budgets and consumer confidence. The pricing pressure due to tariffs could adversely influence consumer spending, a critical contributor to economic growth.

Economic Predictions Amid Trade Negotiations

As trade negotiations stagnate, economists express increasing concern over the potential economic ramifications stemming from Trump’s proposed tariffs. The 50% tax on European imports and 25% tariff on iPhones are expected to cause upstream changes across multiple sectors, which may result in inflationary pressures for consumers. Many households may feel the pinch as these tariffs translate into higher prices for everyday goods and services, potentially slowing consumer spending and economic expansion.

Furthermore, the correlation between stock market performance and consumer behavior cannot be understated. As investors react to the initial shock of proposed tariffs, consumer attitudes could shift, leading to diminished confidence in their purchasing power. If consumers perceive a future with higher prices, they may become more conservative in their spending habits, impacting overall economic growth.

The Role of Trade Policies in Global Economics

Trade policies play a pivotal role in shaping the global economy, as they determine the flow of goods and resources between nations. Trump’s tariff strategy, particularly in targeting goods from the EU, underscores a heightened focus on trade sovereignty, but it also risks alienating key economic partners. This potential for conflict in trade relations can lead to uncertainty that weighs heavily on international markets.

As tariffs reshape the landscape of global trade, the repercussions are not limited to the U.S. alone. International relationships hinge on these developments, with countries closely monitoring the effects of renewed tariffs. Should tensions escalate, cascading effects could emerge, disrupting trade flows and altering market strategies worldwide.

Consumer Concerns Over Rising Prices

Consumers are likely to feel the brunt of Trump’s tariffs, particularly as they target fundamental goods such as electronics. With a 25% tariff on overseas iPhones, consumers could face significantly higher prices. This change not only affects technology enthusiasts but the average consumer who relies on these devices for communication and productivity. As investors watch Apple’s stock dip, everyday buyers may find that their next iPhone purchase could stretch their budgets.

In light of these tariffs, businesses that import goods may have to pass on the increased costs to consumers, leading to a general rise in the cost of living. This could exacerbate issues surrounding affordability, particularly for middle and lower-income families, ultimately shaping consumer sentiment and spending habits as they react to the changing economic landscape.

Potential EU Countermeasures Against U.S. Tariffs

The implementation of Trump’s proposed tariffs has sparked fears of retaliation from the European Union. The EU has historically responded decisively to trade-related aggressions, and many experts predict that retaliatory tariffs could materialize swiftly. Such actions may include taxing American products, effectively escalating the trade equation into a ‘tit-for-tat’ situation that could hinder economic cooperation and impact global supply chains.

If the EU’s countermeasures come into play, the economic ramifications could be extensive. U.S. exports might suffer from decreased demand, leading to job losses and reduced production in impacted industries. This mutual aggression may derail ongoing trade negotiations and increase uncertainty among consumers and businesses on both sides of the Atlantic, creating a challenging atmosphere for global trade.

Trade War Fears and Their Economic Consequences

The looming possibility of a trade war between the U.S. and the EU has raised alarms across financial markets globally. Investors are acutely aware that trade wars can lead to economic downturns, as seen in past conflicts. As tariffs threaten to disrupt established trade agreements, markets may react to signs of escalation with increased volatility, affecting both investor confidence and consumer spending.

Economic forecasts increasingly reflect a cautious sentiment due to these fears, suggesting that businesses might delay investments in response to an uncertain trade landscape. In this environment, companies may curtail hiring or expansion plans, leading to broader implications for economic growth if both consumer and business confidence erodes under the weight of potential trade barriers.

Key Takeaways from Recent Tariff Proposals

Trump’s latest tariff proposals highlight the administration’s commitment to altering trade dynamics significantly. As the deadline approaches for the 50% tariffs on EU imports and the iPhone tax, stakeholders are watching closely. The measures appear aimed at rebalancing trade relationships, but economists caution against the risks involved. The tariffs could induce inflation, which may strain consumers and ripple through the larger economy.

Investors and market analysts emphasize the importance of monitoring trade negotiations closely. As the U.S. and EU navigate these turbulent waters, financial sectors may undergo substantial shifts reflective of consumers’ and businesses’ adaptive strategies to tariffs. In assessing the long-term implications, it’s crucial to grasp how these tariffs will interlink with global economic trends.

Future of U.S.-EU Trade Relations

As trade tensions escalate, the future of U.S.-EU relations remains uncertain. The outcome of ongoing negotiations could dictate the trajectory of interactions between these economic powers, influencing everything from tariffs to shared policies regarding trade and commerce. Given the current proposed tariffs, analysts advocate for a diplomatic approach to de-escalate tensions that avoids prolonged economic instability.

Furthermore, the evolving nature of global markets demands flexibility from both sides as they navigate these challenges. Success in trade negotiations may lead to more favorable conditions for economic cooperation, while continued tariff escalation might plunge both economies into a period of heightened volatility and economic uncertainty. All eyes remain on the diplomatic fronts as stakeholders await clarity on the future of trade.

Frequently Asked Questions

What are Trump tariffs and how do they affect EU imports?

Trump tariffs refer to the import taxes imposed by President Donald Trump on various goods from other countries, primarily targeting the European Union (EU) with a proposed 50% tax. These tariffs aim to challenge trade imbalances and exert pressure during trade negotiations, causing potential price increases for consumers in the U.S.

How will Trump tariffs influence iPhone prices in the United States?

The proposed 25% tariff on iPhones made overseas may lead to higher retail prices for consumers in the U.S. Apple could pass on the additional costs to customers, weakening demand for the product and impacting sales as the company navigates the ramifications of these Trump tariffs.

What was Wall Street’s reaction to Trump tariffs on EU and iPhone imports?

Wall Street reacted swiftly to the announcement of Trump tariffs, with major indexes like the Dow Jones, S&P 500, and Nasdaq experiencing significant declines. This reaction highlights investor concerns about the broader consequences of trade tensions and potential economic impacts on the U.S. stock market.

What impact do Trump tariffs have on U.S. stock market performance?

Trump tariffs have been linked to volatility in the U.S. stock market, as seen after his recent proposals targeting the EU and tech imports. Investors fear that increased tariffs could lead to higher consumer prices and slower economic growth, resulting in declines across major stock indexes.

Are Trump tariffs part of broader trade negotiations with the EU?

Yes, Trump tariffs are part of ongoing trade negotiations with the EU, with the administration using tariffs as a strategic tool to push for concessions. While intended to bolster U.S. industries, the lack of agreement in trade talks raises concerns about escalating tensions and further tariffs.

| Key Point | Details |

|---|---|

| Trump’s Tariff Proposal | 50% tax on imports from the EU and 25% tariff on overseas iPhones, effective June 1. |

| Market Reaction | Major U.S. stock indexes dropped significantly, with the Dow Jones, S&P 500, and Nasdaq all experiencing losses. |

| Impact on Companies | Apple shares fell as investors feared higher prices for iPhones might reduce demand, affecting overall consumer spending. |

| Economic Concerns | Economists warn that tariffs could raise consumer prices and slow economic growth, adding strain on household budgets. |

| Potential EU Response | The European Union may retaliate with its own tariffs, increasing tensions and complicating trade negotiations. |

| Future Outlook | Continued discussion between U.S. and EU officials, but no resolution in sight may prolong market volatility. |

Summary

Trump tariffs have significantly impacted the financial markets and international trade relations. The proposed 50% tax on EU imports and 25% tariff on iPhones raises concerns among companies and consumers alike, signaling potential price increases and slower economic growth. As the EU prepares to retaliate, the future of these trade negotiations remains uncertain, indicating more challenges for both investors and consumers.