Trump Tariffs Price Impact: Assessing Future Predictions

The impact of Trump tariffs on prices has become a focal point of economic discussions, as many anticipate potential price hikes stemming from these policies. White House economist Stephen Miran, who has been vocal on CNBC about the implications of tariffs, indicated that while higher prices could result, such scenarios are rare, likening them to a meteorite hitting Earth. This analogy underscores the uncertainty around tariff effects on prices, especially in light of the current economic climate. Despite initial concerns and inflation theories, recent reports show a decline in imported goods prices, complicating the narrative around the economic impact of tariffs. As businesses and consumers brace for potential changes, understanding the nuances of Trump’s economic policies and their correlation with inflation and tariffs becomes increasingly important.

The price repercussions of former President Trump’s trade measures have led to considerable debate in economic circles. Many fear that these trade barriers, known as tariffs, could contribute to rising costs for consumers and businesses alike. Economists have cautioned about the potential inflationary pressures that may arise from such protectionist policies, especially as the U.S. navigates its complex trade relationships. Stephen Miran, an influential economist from the White House, has highlighted the unpredictability associated with forecasting tariff-induced price increases. As analysts examine the ongoing economic landscape, they continue to explore how Trump’s tariff strategies might shape future market dynamics.

The Economic Impact of Trump Tariffs on Consumer Prices

The economic impact of Trump tariffs on consumer prices has been a contentious subject among economists and policymakers. While President Trump’s administration has implemented various tariffs with the aim of protecting domestic industries, there remains a significant debate over whether these tariffs will lead to sustained price hikes for consumers. Recently, White House economist Stephen Miran suggested that while higher prices might eventually arise from these tariffs, predicting such outcomes remains speculative. He analogized the occurrence of tariff-related price hikes to rare events, implying that the immediate economic ramifications might not align with populist fears of inflation.

Indeed, many analysts observed that the anticipated price increases resulting from these tariffs have yet to materialize. Miran’s comments on CNBC emphasized data from the Council of Economic Advisers indicating declining prices for imported goods, contrasting with public apprehensions. As businesses adjust and stockpile supplies, the immediate impact of tariffs might be buffered, leading to a complex interplay between tariffs, inflation, and market stability. Ultimately, while fears of rising prices persist, clarity over the economic impact of Trump’s tariffs is still developing.

Anticipating Inflation Amidst Tariff Policies

Inflation and tariffs are intricately linked in economic discussions, particularly under Trump’s administration. Many economists warn that prolonged tariffs might trigger inflationary trends as businesses adjust their pricing strategies to accommodate higher input costs. However, the latest reports have indicated a puzzling decline in imported goods prices, suggesting that inflations fears may be overestimated in the short term. Stephen Miran’s insights shed light on this narrative, where he pointed out that the economy has not yet faced the severe inflationary pressures many had predicted following the imposition of tariffs.

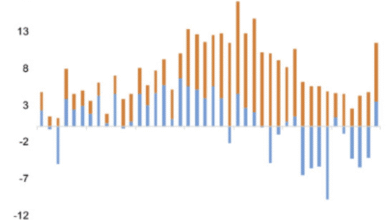

Delayed tariff implementations and the strategic stockpiling of goods by companies have contributed to this anomaly. The lag in economic responses to tariff changes means that immediate effects on consumer prices can be muted. Miran’s observations regarding the Personal Consumption Expenditure Price Index (PCE) and Consumer Price Index (CPI) align with expectations that while some prices may rise, significant inflation across the board is not yet evident. As consumers cope with tariff-induced prices, monitoring these indices will remain crucial in forecasting long-term economic impacts.

Stephen Miran on the Predictions of Tariff Effects

Stephen Miran has been vocal about the challenges in predicting the effects of tariffs on the economy. During recent media appearances, he remarked on the inherent difficulties in forecasting economic outcomes, stating that even with mounting evidence, the correlation between tariffs and price rises remains tenuous. His comment, equating potential tariff impacts to unlikely cosmic events like meteor strikes, highlights skepticism regarding overly dramatic predictions. Instead of panicking about potential inflation, it may be more prudent to rely on data-driven analyses to assess the real implications of Trump’s tariffs.

This cautious approach encourages discussions grounded in empirical evidence rather than speculative alarm. The economic impact of tariffs is nuanced, varying by industry and product, which complicates generalizations. Miran’s insights remind us of the importance of scrutinizing economic data critically, especially when forming forecasts related to Trump’s economic policies. While it’s essential to consider potential tariff-induced price increases, equally important is recognizing the current stability and adaptability within markets.

Supply Chain Dynamics and Tariff Responses

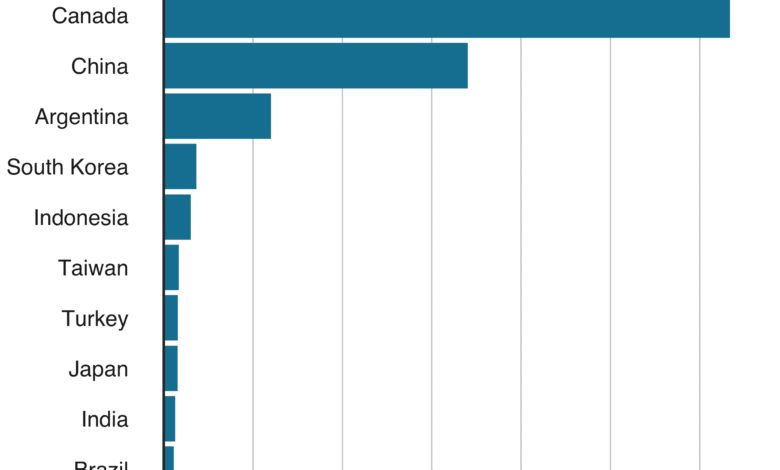

The implementation of tariffs by President Trump has inevitably altered supply chain dynamics, prompting businesses to adapt to new cost structures. In many cases, firms have reacted by diversifying their supply chains or seeking domestic alternatives to mitigate the risks associated with tariff-induced costs. This adaptive behavior serves as a cushion against sudden inflation impacts, allowing companies to maintain price stability while navigating new trade landscapes. Stephen Miran’s discussions on the expected inflation response underscore the resilience of businesses as they strategize around tariffs.

Additionally, the complexity of supply chain relationships means that the immediate effects of tariffs may be delayed. For instance, stockpiling behaviors observed earlier this year indicate that companies foresaw potential price hikes and prepared for them. As these stockpiles deplete, the real impact of Trump tariffs on pricing will come into sharper focus. This dynamic can significantly influence consumer behavior and market strategies, rendering economists’ predictions on immediate inflation further complicated.

The Role of Tariffs in Modern Economic Policies

The role of tariffs in modern economic policies has evolved significantly, culminating in the complex landscape we observe today. Trump’s tariffs were introduced with the rationale of protecting American jobs and industries; however, the implications have extended beyond mere protectionism. By raising the cost of imported goods, tariffs serve as a strategic tool that reshapes domestic markets, influencing everything from consumer spending to manufacturing output. Economists like Miran have shared insights into how these measures interact with existing market structures, informing public discourse on their efficacy.

Despite this intention, the broader economic impact of these tariffs, including potential inflationary effects, has sparked mixed reactions among experts. While some anticipate inevitable price hikes, recent assessments underscore the necessity of a more measured analysis of tariffs’ long-term implications. Miran’s commentary captures the essence of this debate, probing the nuances of tariff-induced price hikes while stressing the importance of relying on empirical data as opposed to speculative forecasts.

Consumer Sentiment and Tariff-induced Pricing

Consumer sentiment plays a critical role in shaping the outcomes of tariffs on pricing strategies. Recent discussions surrounding Trump’s trade policies indicate that public perception of economic conditions can significantly impact spending behavior, affecting how businesses respond to tariffs. When consumers anticipate rising prices due to tariffs, they may alter their purchasing decisions, which can amplify the pricing effects of these policies. The interaction between consumer sentiment and economic realities is essential for understanding the full scope of Trump’s tariffs on the economy.

Moreover, Stephen Miran’s observations about the current market conditions highlight a dissonance between anticipated price increases and actual market responses. For instance, ongoing improvements in the supply chain and adaptive business strategies can help offset potential costs, ultimately influencing consumer prices. As the economic landscape continues to evolve, gauging shifts in consumer sentiment will be paramount in predicting how tariffs affect overall pricing trends in the coming months.

Future Projections: Will Tariffs Lead to Higher Prices?

Looking ahead, the question of whether Trump tariffs will lead to higher prices remains a topic of extensive speculation among economists. Many contend that while the potential is there, various mitigating factors must be considered. Stephen Miran emphasized that historical patterns of economic behavior suggest that immediate effects are not always indicative of long-term outcomes. As companies adjust, the actual response to tariffs may unfold more gradually than anticipated, leading to a re-evaluation of projections regarding inflation.

Additionally, the insights gained from current inflation metrics, such as PCE and CPI, reveal a complex interplay between tariffs and pricing outcomes. By understanding these indicators, analysts can better anticipate future trends and how they may be influenced by policy changes. Ultimately, the discourse surrounding Trump’s economic policies and their ramifications on consumer prices is likely to continue evolving, necessitating adaptive strategies from businesses and careful monitoring of market conditions.

The Long-term Effects of Trump’s Economic Policies

The long-term effects of Trump’s economic policies, especially regarding tariffs, represent an essential area of exploration for economists and investors alike. As market conditions fluctuate, the stability of consumer prices remains under scrutiny. Though short-term price increases have been recorded in some sectors, broader impacts may take time to fully unravel. Economists argue that understanding this timeline is critical in predicting how tariffs will shape future economic landscapes and consumer behavior.

Moreover, the emphasis on adapting to new policies will be pivotal as businesses adjust their strategies over time. The proactive measures taken to stockpile goods or shift supply chains in response to tariffs may soften the impact of any potential price hikes, shaping a more nuanced perception of Trump’s tariffs. Continued analysis of these policies will be necessary to decipher their ultimate impact on inflation and economic growth.

Navigating Tariffs and Consumer Price Expectations

Navigating the complexities surrounding tariffs and consumer price expectations demands an adaptive approach from both businesses and policymakers. The uncertainty of economic responses to Trump tariffs necessitates close monitoring of consumer sentiment and market reactions. As discussions around prices evolve, it’s crucial for businesses to communicate transparently with consumers, helping to manage expectations and mitigate potential backlash. Stephen Miran’s insights highlight the importance of maintaining an informed perspective in the face of rapidly shifting economic landscapes.

Furthermore, ongoing evaluations of inflation rates and their correlation with tariffs will play an integral role in shaping future pricing strategies. Businesses will need to stay attuned to market trends, ensuring they are prepared to respond effectively as price dynamics shift. The capacity to navigate this landscape will ultimately determine how tariffs impact consumer prices in the months and years ahead.

Frequently Asked Questions

What is the impact of Trump tariffs on prices according to economists?

Economists, including White House adviser Stephen Miran, have indicated that while Trump’s tariffs could potentially lead to higher prices, actual evidence of a widespread price increase has not yet manifested. Factors like delayed tariff implementation and stockpiling have contributed to the current stability in prices despite initial concerns.

How might the economic impact of tariffs affect consumers in the future?

The economic impact of tariffs, particularly under Trump’s administration, raises concerns about future price hikes for consumers. However, as Stephen Miran noted, the anticipated inflation tied to these tariffs has not materialized so far. Predictions remain speculative, indicating that while price increases are possible, they have yet to occur substantially.

What does Stephen Miran say about inflation and tariffs related to Trump’s policies?

Stephen Miran stated that although inflation linked to Trump’s tariffs is a concern, the actual data shows a decline in imported goods prices from March onward. He emphasized that predicting inflation due to tariffs is challenging and currently, there is no solid evidence to support claims of imminent price increases.

Are predictions about Trump’s tariffs leading to price increases justified?

Predictions about Trump’s tariffs leading to price increases are difficult to justify at this moment. Miran highlighted the rarity of such events, comparing them to meteor strikes, and noted that tariffs have yet to cause significant inflation as seen in recent reports on import price trends.

What has been the trend in prices since the imposition of Trump’s tariffs?

Since the imposition of Trump’s tariffs, reports suggest mixed results; while some individual goods’ prices have increased, overall price indices like the Consumer Price Index have shown little to no significant change. Miran pointed out that import prices decreased in the months following the tariffs, contrary to initial worries about inflation.

How have companies responded to the possibility of Trump tariffs affecting prices?

In anticipation of potential price hikes due to Trump’s tariffs, many companies engaged in stockpiling strategies earlier in the year. This maneuver may have buffered immediate price increases, contributing to the current lack of observable inflation despite ongoing tariff discussions.

What inflation metrics did the White House report analyze regarding Trump’s economic policies?

The White House report analyzed two key inflation metrics: the Personal Consumption Expenditure Price Index (PCE) and the Consumer Price Index (CPI). The findings revealed that prices for imported goods had declined, while overall prices remained relatively stable, indicating that Trump’s tariffs have not yet significantly impacted inflation.

What factors contribute to the uncertainty surrounding Trump’s tariffs and their price impact?

Several factors contribute to the uncertainty regarding the price impact of Trump’s tariffs: the delayed implementation of tariff rates, existing stockpiling by businesses, and the unpredictability of economic reactions. Economists like Stephen Miran stress that these variables make it difficult to project future price movements related to tariffs.

| Key Point | Details |

|---|---|

| Statement on Price Impact | Stephen Miran claims that Trump’s tariffs could increase prices, but considers it highly improbable. |

| Comparison to Rare Events | Miran likens the tariff impact on prices to rare events like meteor strikes, suggesting no notable evidence so far. |

| Current Price Trends | A report indicated declining prices for imports between December and May despite tariff fears. |

| Delays in Tariff Implementation | Trump has delayed his most severe tariffs and postponed deadlines for negotiations. |

| Inflation Metrics | Analysis of the PCE and CPI shows imported goods prices declining or stable overall. |

| Future Expectations | Many economists anticipate future price hikes, but Miran emphasizes the lack of current evidence for such increases. |

Summary

The Trump tariffs price impact remains a contentious topic as economists weigh in on potential consequences. Despite Stephen Miran’s assurances that significant price increases are improbable, many experts are preparing for possible hikes in the future. Currently, data suggests a decline in the prices of imported goods, and delays in tariff implementation are also mitigating immediate effects. However, the ongoing discussion about the tariffs indicates that stakeholders should stay alert as the market adjusts.