Trump Tax Cut Bill: A $2.4 Trillion National Debt Increase

The Trump tax cut bill, often referred to as the “big, beautiful bill,” is set to significantly impact the national debt, with projections indicating an increase of $2.4 trillion over the next decade, according to a precise CBO analysis. This ambitious Republican budget package recently passed through the House, but it now faces considerable hurdles in the Senate, where skepticism from budget-conscious lawmakers is mounting. President Trump has expressed a strong desire to have this bill signed into law before the Fourth of July, emphasizing the urgency of its passage. Critics, including tech entrepreneur Elon Musk, have lambasted the proposal as reckless and potentially disastrous for federal finances, suggesting it may exacerbate existing fiscal challenges. As the political landscape continues to shift, all eyes remain on how this bill will ultimately shape the country’s budget priorities and its long-term economic stability.

In the realm of fiscal policy, the proposed tax reform under President Trump’s administration, widely known as the Trump tax cut initiative, has stirred heated debates across party lines. This Republican-funded budget proposal, characterized by its sweeping cuts and ambitious revenue goals, shines a light on the nation’s escalating national debt, projected to rise by a staggering $2.4 trillion. The bill’s journey, having cleared the House, now faces scrutiny and anticipated conflicts within the Senate, where some legislators have voiced significant budgetary concerns. Additionally, well-known figures, including critics like Elon Musk, have added their voices to the discourse, underscoring the contentious nature of the fiscal strategy. As discussions unfold, the implications of this legislative effort continue to ripple through the political landscape, drawing attention to broader issues surrounding federal spending and economic viability.

The Impact of the Trump Tax Cut Bill on National Debt

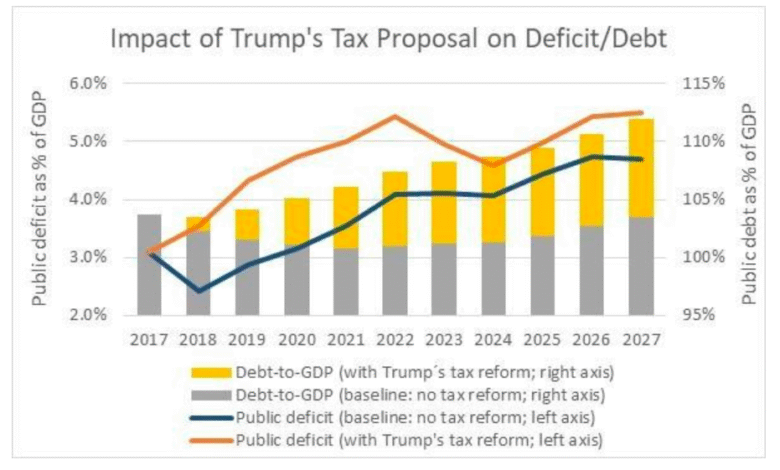

The Trump tax cut bill, often referred to as the “big, beautiful bill,” is projected to significantly increase the national debt, adding approximately $2.4 trillion over the next decade. This staggering figure, according to the Congressional Budget Office analysis, raises serious concerns among fiscal conservatives about the long-term implications for the U.S. economy. The anticipated reduction in federal revenues by $3.7 trillion, coupled with a planned $1.3 trillion in spending cuts, creates a contentious dialogue about fiscal responsibility within the Republican budget package.

As Republican lawmakers rally behind the tax cut bill, they face growing scrutiny regarding its potential impact on the national debt. Critics argue that such tax cuts, while aimed at stimulating economic growth, disproportionately benefit the wealthy and could exacerbate wealth inequality. The broader repercussions of increased national debt, including higher interest rates and reduced governmental spending on essential services, are pressing issues that demand attention as the Senate prepares to review the bill.

Senate Budget Challenges Facing Trump’s Tax Cut Bill

The Republican budget package, while successfully passing through the House, now confronts significant challenges in the Senate, where fiscal conservatism is being put to the test. With some Republican senators openly criticizing the bill for fostering unsustainable deficits, the Senate’s deliberations are under intense scrutiny. Senator Ron Johnson’s opposition, labeling the bill as “grotesque” and “immoral,” illustrates the fractures within the GOP regarding fiscal priorities. As the Senate grapples with the impact of the Trump tax cut bill, balancing party unity with fiscal prudence will be a critical challenge.

Moreover, the Republican party faces external pressures as figures like Elon Musk voice their discontent. Musk’s characterization of the bill as a “disgusting abomination” has resonated with several GOP lawmakers, highlighting a growing disconnect between party leadership and its more fiscally conscious members. These Senate budget challenges necessitate a careful navigation of party dynamics and public opinion, as the clock ticks down to Trump’s desired timeline for signing the tax cut bill into law.

The Role of CBO Analysis in the Trump Tax Cut Debate

The Congressional Budget Office (CBO) analysis of the Trump tax cut bill has become a focal point in the debate surrounding its efficacy and fiscal impact. With projections indicating a $2.4 trillion increment in national debt, supporters of the bill challenge the credibility of the CBO, often questioning its historical accuracy in estimating economic outcomes. This conflict underscores the precarious balance between partisan perspectives and the data-driven insights that organizations like the CBO provide.

Critics of the Trump tax cut bill argue that reliance on CBO estimates ensures a more responsible approach to budgeting. The ongoing debate emphasizes the importance of taking into consideration nonpartisan analyses in creating fiscal policies. As Republican senators prepare to battle in the Senate, the CBO’s findings will serve as a crucial backdrop to discussions about economic viability and governmental spending priorities.

Elon Musk’s Critique of the Republican Budget Package

Elon Musk’s outspoken criticism of the Republican budget package introduces a unique angle into the discussion surrounding the Trump tax cut bill. His condemnation of the bill as a “disgusting abomination” signals a noteworthy point of contention that could influence public perception and potentially sway GOP lawmakers. Musk, having previously held a significant role within the government-defunding movement, taps into broader sentiments shared by some fiscal conservatives who are increasingly wary of excessive government spending.

Musk’s critique also indicates a rising trend among influential figures who challenge the status quo, advocating for fiscal accountability and transparency. As Wisconsin Senator Ron Johnson and other Republican senators align with Musk’s sentiments, this coalition highlights an emerging faction within the party that prioritizes fiscal responsibility over partisan allegiance. The ongoing discourse may well reshape discussions around the tax cut bill, as external pressures mount on Republican leaders to reconsider their stance.

Balancing Tax Cuts and Federal Revenue: A Complicated Equation

The Trump tax cut bill seeks to balance significant tax reductions with an ambitious plan for federal revenues, creating a complex economic equation that many lawmakers find troubling. While the bill aims to reduce taxes significantly, the projected decrease in federal revenues by $3.7 trillion raises serious questions about the sustainability of social programs and economic health. This balance of taxation and revenue generation is central to the narrative as the Senate deliberates the bill.

Critics argue that substantial tax cuts may not lead to the promised economic growth, and instead, contribute to a swelling national debt. This situation compels Republicans to defend their approach while addressing the inevitable backlash regarding economic equity and fiscal integrity. As discussions unfold in the Senate, lawmakers will need to deliver convincing arguments that the benefits of tax cuts outweigh the immediate financial repercussions.

The Implications of Separating the Trump Tax Cut Bill

Amidst rising dissent, some Republican senators, including Ron Johnson, are advocating for a separation of the Trump tax cut bill into distinct parts. This proposal highlights concerns about the path toward securing a more modest approach to tax reforms that could ameliorate overwhelming criticism. Dividing the bill could potentially foster a clearer dialogue around fiscal accountability while allowing lawmakers to deliberate each aspect individually. This restructuring, however, faces immediate pushback from Trump and his allies who favor maintaining the integrity of a single comprehensive package.

The implications of this division reverberate beyond party lines, bringing into question the efficacy of individual tax cuts versus a unified fiscal strategy. Lawmakers will be tasked with weighing the benefits of bipartisan dialogue against the urgency of Trump’s push for a rapid legislative process. As the Senate engages in these discussions, the notion of separating the bill could either alleviate pressures or signal deeper fractures within GOP unity.

Inside the Republican Party’s Battle Over the Budget Package

The turmoil within the Republican Party regarding the budget package reflects broader ideological rifts that could affect Trump’s agenda. While the “big, beautiful bill” aims to enact sweeping tax cuts, internal disagreements about the fiscal consequences and a rising national debt have put Republican unity to the test. Senators are grappling with significant pressures from both party leadership and constituents who demand responsible governance and sustainable fiscal policies.

This battle over the budget package not only threatens the current administration’s legislative goals but also stakes the future of the Republican Party’s identity. Can they unify behind a vision that prioritizes aggressive tax cuts while addressing burgeoning debt, or will ideological differences drive them apart? The critical discussions taking place in the Senate will likely shape the party’s direction for years to come.

Understanding the Broader Economic Impact Beyond Tax Cuts

Beyond the immediate effects of the Trump tax cut bill on federal revenue and the national debt lies a more extensive economic narrative. Experts suggest that widespread tax cuts could potentially trigger increased consumer spending, invigorating economic growth. However, this growth may be overshadowed by concerns regarding the long-term fiscal sustainability of such measures, particularly given the projected $2.4 trillion addition to the national debt as reported by the CBO.

To comprehend the broader economic impact, discussions must consider the potential for structural deficits and their implications on funding for social initiatives. The economic landscape remains fraught with uncertainty; thus, assessing the multifaceted effects of the Trump tax cut bill will be paramount as the Senate deepens its analysis.

Addressing Bipartisanship in the Face of GOP Opposition

As the Trump tax cut bill faces staunch opposition from within the Republican ranks, the prospect of bipartisan support seems increasingly elusive. Political analysts observe that deep-seated divisions among GOP senators, alongside vocal criticisms from influential figures such as Elon Musk, are creating challenging dynamics for the party as they navigate fiscal policy reform. This situation underscores the importance of collaboration and consensus-building in achieving legislative goals, particularly when addressing complex issues surrounding national debt and budget management.

In this climate, the potential for bipartisan cooperation could offer a pathway forward, especially as some Democrats may be open to discussing tax reforms that promote economic growth without inadvertently exacerbating the national debt. Engaging across party lines to achieve fiscally responsible outcomes remains essential in fostering a government that can effectively manage its resources. The Senate’s ability to bridge these divides will be a crucial test of political will and collaborative governance.

Frequently Asked Questions

What impact will the Trump tax cut bill have on the national debt according to CBO analysis?

The Trump tax cut bill is projected to increase the national debt by $2.4 trillion over the next ten years, as per the Congressional Budget Office (CBO) analysis. This significant increase is primarily due to a reduction in federal revenues expected from the bill.

How does the Trump tax cut bill contribute to the Republican budget package?

The Trump tax cut bill is a core component of the Republican budget package, designed to cut federal spending by $1.3 trillion while reducing federal revenues by $3.7 trillion. This comprehensive approach aims to reshape the financial landscape, although it faces criticism for potentially escalating the national debt.

What challenges is the Trump tax cut bill facing in the Senate?

The Trump tax cut bill is encountering Senate budget challenges, particularly due to resistance from budget hawks concerned about its implications for national debt. Senators like Ron Johnson have voiced strong opposition, calling the bill potentially ‘grotesque’ and unsustainable in its current form.

What criticisms has the Trump tax cut bill received from Elon Musk and other lawmakers?

Elon Musk criticized the Trump tax cut bill, labeling it a ‘disgusting abomination.’ His criticism resonates with some Republican lawmakers, including Rand Paul and Thomas Massie, who share concerns about the bill’s impact on the national debt and overall fiscal responsibility.

What are President Trump’s goals regarding the passage of the tax cut bill?

President Trump aims to have the tax cut bill signed into law by July 4. However, he faces significant hurdles due to ongoing Senate budget challenges and the need for unanimous GOP support to pass the ‘big, beautiful bill’ without Democratic assistance.

How does the Congressional Budget Office’s (CBO) analysis affect perceptions of the Trump tax cut bill?

The CBO’s analysis of the Trump tax cut bill, projecting a $2.4 trillion increase in national debt, has led to criticism from Trump’s allies, who suggest that the CBO has historically provided inaccurate estimates. This battle over credibility reflects broader tensions surrounding fiscal policy and budgetary sustainability.

| Key Point | Details |

|---|---|

| Projected Add to National Debt | The tax cut bill is projected to add $2.4 trillion to the national debt over ten years, according to the Congressional Budget Office. |

| Federal Revenue Reduction | It is expected to reduce federal revenues by $3.7 trillion. |

| Spending Cuts | The spending cuts proposed amount to $1.3 trillion. |

| Senate Challenges | The bill faces opposition in the Senate from budget hawks concerned about rising deficits. |

| Failed Bipartisan Support | Trump insists on passing the bill without Democratic support using the reconciliation process. |

| Criticism from GOP Senators | Senator Ron Johnson labeled the bill as ‘grotesque’ and ‘immoral’. |

| External Pressures | Elon Musk condemned the bill as a ‘disgusting abomination,’ influencing GOP lawmakers. |

| CBO Credibility | Trump’s allies have criticized the credibility of CBO’s estimates. |

Summary

The Trump tax cut bill represents a significant policy initiative aimed at reducing taxes but also raises concerns regarding its impact on the national debt. While projected to infuse money into the economy, the anticipated $2.4 trillion increase in national debt over ten years has garnered criticism from both political allies and opponents. Furthermore, as the bill faces revisions in the Senate and pushback from within the GOP itself, including calls for a more cautious, separated approach to budget management, its future remains uncertain. Trump’s insistence on pushing the legislation forward by July 4 will continue to spur debate on its fiscal responsibility and broader economic implications.