Trump Zervos Fed Chair Odds Surge on Kalshi Prediction Market

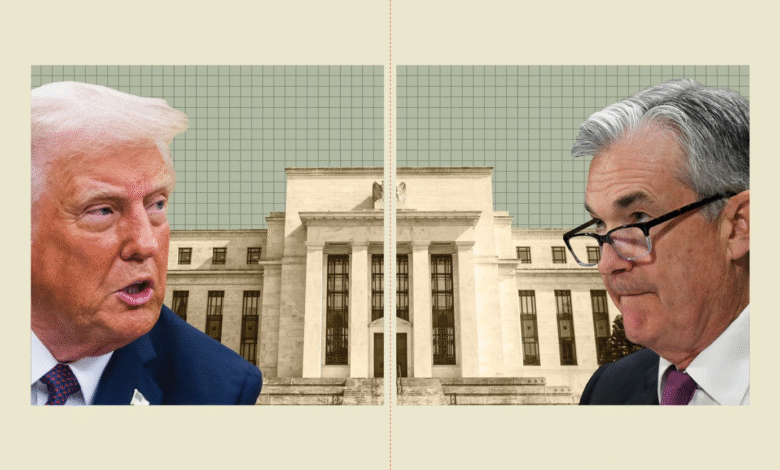

The odds of Trump tapping David Zervos for Fed Chair have surged dramatically following a recent CNBC report, igniting interest in the prediction market Kalshi. Many users are now betting on Zervos, the Chief Market Strategist at Jefferies, as he emerges as a strong contender among the potential Fed chair candidates. This speculation comes amid Trump’s evaluation of 11 possible nominees to replace Jerome Powell, whose term will conclude soon. With Zervos’ odds rising to 17%, closely trailing behind favored candidates, the landscape of Federal Reserve news is heating up. Investors and market analysts alike are keenly observing how Trump’s nominations might reshape monetary policy in the coming months.

The speculation surrounding David Zervos as a leading candidate for the position of Federal Reserve Chair has gained traction, especially in light of recent developments reported by CNBC. Known for his strategic insights as the Chief Market Strategist at Jefferies, Zervos is one of several candidates under consideration by Trump to succeed Jerome Powell. The betting activities on the Kalshi market reveal heightened confidence in his potential nomination, reflecting the shifting dynamics among preferred candidates for the Federal Reserve’s pivotal role. As the Trump administration mulls over various nominations, including notable figures in the financial world, the conversation about the future direction of U.S. monetary policy is becoming increasingly prominent.

The Rising Odds of David Zervos as Fed Chair

As reported by CNBC, the belief that David Zervos might be the next chair of the Federal Reserve is gaining traction among users of the Kalshi market. Currently serving as Chief Market Strategist at Jefferies, Zervos has seen his odds increase significantly after President Trump disclosed that he is evaluating a list of 11 potential candidates to replace Jerome Powell. This news is crucial, especially considering Powell’s term concludes in May 2026, creating a competitive landscape for candidates vying for this influential position.

The betting odds on Kalshi indicate that Zervos’s chances have risen to 15%, a notable increase as compared to his rivals. These shifting dynamics highlight the growing confidence among traders and analysts that Zervos could align with Trump’s vision for monetary policy, particularly given the latter’s criticism of the current Fed for not implementing aggressive interest rate cuts. The movement in these odds demonstrates how political strategies and upcoming decisions can directly influence financial markets.

Trump Zervos Fed Chair Odds: A Competitive Landscape

The latest figures from the Kalshi market reveal an intense competition among potential candidates for the Federal Reserve chair position. As of now, Chris Waller leads with an impressive 31% odds, followed closely by Kevin Hassett at 20% and David Zervos, who has recently surpassed Kevin Warsh’s odds to settle at 17%. This positioning shows how Trump’s expectations and previous endorsements can sway market perceptions and investors’ confidence in certain candidates.

The emergence of Zervos in the mix is intriguing, as he not only embodies the economic philosophy Trump seems to favor but also represents a shift in the Fed chair candidates narrative. As Powell is often viewed as too cautious, candidates like Zervos and Hassett are being examined for their potential to push for a more aggressive stance on interest rates. It’s clear that as the nomination process unfolds, the Kalshi platform will remain a focal point for gauging the fluctuating sentiments surrounding Fed chair nominations.

The Role of Kalshi in Predicting Fed Chair Outcomes

Kalshi has emerged as a significant player in predicting political and economic outcomes, particularly in the context of the Fed chair candidates. The prediction market allows users to bet on various outcomes related to national interest, providing a unique insight into public sentiment regarding potential nominees. With David Zervos gaining traction, Kalshi is becoming a barometer for political analysts and those interested in Federal Reserve news, which ultimately affects financial markets globally.

By leveraging Kalshi for prediction purposes, traders and investors can harness the collective wisdom of market participants. This platform is uniquely positioned to reflect the evolving landscape of the Fed chair nominations, especially with candidates like Zervos entering the fray. As interest rises, understanding how these predictions can impact broader economic strategies becomes imperative for stakeholders monitoring financial trends.

David Zervos: A Contender Among Fed Chair Candidates

David Zervos’s profile as a Federal Reserve chair candidate is increasingly elevated as the market speculates on who will succeed Jerome Powell. His background as Chief Market Strategist at Jefferies gives him significant credibility in financial circles. Furthermore, with Trump evaluating a diverse range of potential candidates, Zervos’s economic insights and strategies could resonate well with an administration focused on strengthening economic growth, particularly through monetary adjustments.

Moreover, Zervos’s approach towards adjusting interest rates has been closely monitored by those speculating on his Fed chair odds. Market speculation often considers the candidate’s past positions and current sentiments about monetary policy. Zervos’s name being linked to Trump’s consideration enhances his visibility, and as traders react to this evolving narrative, it could set the stage for an exciting nomination cycle ahead.

Political Influence on Federal Reserve Nominations

The Federal Reserve chair position is often intertwined with political motivations, as demonstrated by Trump’s recent deliberations. The selection of candidates such as Zervos and Waller reflects the intricate balance between economic strategies and political affiliations. Trump’s administration has shown a clear interest in reshaping the Fed’s direction, aiming for candidates that align closely with his economic policies and vision, especially concerning interest rates.

As the political landscape shifts, so do the implications for Fed chair candidates like David Zervos. Understanding how Trump’s nominations play into the overall structure of the Federal Reserve policy will be crucial for analysts and investors alike. This connection underscores the necessity for stakeholders to remain vigilant regarding the interplay between political maneuvers and economic policy decisions.

Market Reactions to Fed Chair Speculation and Betting

Market movements often respond decisively to speculation surrounding Federal Reserve chair candidates. Following the recent reports about Zervos being a strong contender, shifts in the Kalshi market have demonstrated how quickly trader sentiment can change. Such fluctuations can have ripple effects throughout the financial markets, which rely heavily on the Federal Reserve’s decisions regarding monetary policy and interest rates.

With Trump’s evaluations attracting significant attention, the betting markets reflect not just the candidates’ qualifications but also the evolving political dynamics surrounding the Federal Reserve. Investors keenly observe these market reactions, as they can inform their strategies and expectations about future economic conditions based on who is likely to lead the Fed.

The Buzz Around Trump Nominations and Their Impact

Trump’s exploration of potential nominees for the Fed chair position comes with high stakes, not just for the candidates but for the economy at large. With names like David Zervos and Chris Waller being floated, the implications of their appointment on monetary policy could shape future fiscal landscapes. The buzz around these nominations can drive market speculation, which is crucial for investors gauging the Federal Reserve’s forthcoming decisions.

The candidacy of Zervos, in particular, could signify a shift towards more proactive measures in dealing with interest rates. The market has reacted swiftly, as traders place their bets on Kalshi, indicating their expectations and sentiments towards who Trump will ultimately select. Each nomination carries potential consequences that traders must stay current on, further emphasizing the intersection of politics and economics in financial markets.

Anticipating Future Federal Reserve Direction

As the conversation around who will replace Jerome Powell as Fed chair heats up, anticipating the future direction of the Federal Reserve becomes paramount. With Trump considering figures like David Zervos who advocate for more aggressive monetary policy, the landscape is poised for potential shifts. These decisions will inevitably affect economic stability and growth.

Market analysts are already predicting how Zervos’s policies might differ from Powell’s, particularly regarding interest rates and inflation management. Observing these trends on platforms like Kalshi provides invaluable insights into potential market responses, making it essential for traders to remain engaged with these discussions as they unfold. The future of the Federal Reserve’s approach to economic challenges hinges significantly on this forthcoming nomination.

Zervos’s Economic Philosophy and Its Appeal to Trump

David Zervos’s economic philosophy resonates with the current administration’s priorities, especially in terms of redefining fiscal approaches to promote growth. His outlook on monetary policy aligns with Trump’s vision of aggressive economic expansion, which makes him an appealing candidate for the Fed chair. This alignment could influence significant decisions affecting interest rates and overall fiscal responsibility.

By favoring candidates like Zervos, Trump aims to reshape how the Federal Reserve operates, potentially leading to more favorable conditions for investors and consistent economic performance. As discussions around these nominations progress, the market’s reception will be a telling indicator of the anticipated future direction under the new leadership, making Zervos a pivotal figure in this narrative.

Frequently Asked Questions

What are the current odds for Trump nominating David Zervos as Fed Chair according to Kalshi?

As of now, the odds of Trump nominating David Zervos for the position of Fed Chair have risen to 15% on the Kalshi market. This increase follows a CNBC report indicating that Trump is evaluating Zervos along with 10 other candidates to succeed Jerome Powell.

How does David Zervos compare to other Fed Chair candidates in Trump’s evaluation?

Currently, David Zervos’ odds of being nominated by Trump have surpassed those of former Fed Governor Kevin Warsh, reaching 17% compared to Warsh’s 15%. Zervos is now seen as a strong contender among candidates such as Chris Waller and Kevin Hassett.

What factors are influencing the Trump Zervos Fed Chair odds on Kalshi?

The Trump Zervos Fed Chair odds are influenced by recent media reports, market sentiment, and Trump’s public comments about various candidates. The increasing interest in Zervos can be attributed to speculation regarding Trump’s preference for candidates willing to adjust monetary policy significantly.

Why is David Zervos considered a viable candidate for the Fed Chair position?

David Zervos is regarded as a viable candidate for the Fed Chair position partly due to his role as Chief Market Strategist at Jefferies and the recent surge in odds on prediction markets like Kalshi. Analysts believe his economic strategies resonate with Trump’s approach to monetary policy.

What implications does Trump’s consideration of David Zervos for Fed Chair have on financial markets?

Trump’s consideration of David Zervos for Fed Chair could have significant implications for financial markets, especially if investors anticipate changes in interest rate policies. The market’s reaction to Zervos’ rising odds on Kalshi highlights concerns about future monetary policy directions influenced by the Trump administration.

When does Jerome Powell’s term as Fed Chair conclude, and how does this affect Trump’s nomination process?

Jerome Powell’s term as Fed Chair concludes in May 2026, creating a timeline for Trump to finalize his selection of the next Fed Chair. This upcoming transition is fueling speculation and betting activity on candidates like David Zervos in markets such as Kalshi.

What other candidates are being considered by Trump for the Fed Chair position besides David Zervos?

In addition to David Zervos, Trump is considering candidates like former Fed Governor Larry Lindsey, BlackRock’s Rick Rieder, and Chris Waller, currently leading the odds at 31%. The dynamics among these candidates are actively influencing market forecasts on Kalshi.

How have Trump’s previous comments impacted the Fed Chair nomination odds?

Trump’s previous comments have significantly impacted Fed Chair nomination odds by publicly expressing support for candidates like Kevin Hassett and Kevin Warsh. Such endorsements can inflate their market odds while simultaneously affecting speculation around other candidates like David Zervos.

| Candidate | Current Odds | Context |

|---|---|---|

| David Zervos | 17% | Chief Market Strategist at Jefferies, seeing a rise after Trump considers him as replacement for Powell. |

| Chris Waller | 31% | Currently leading the market, noted for his willingness to adapt monetary policy. |

| Kevin Hassett | 20% | Director of National Economic Council, mentioned positively by Trump. |

| Kevin Warsh | 15% | Former Fed Governor, previously seen as a strong contender. |

Summary

The rising odds of Trump nominating David Zervos for Fed Chair highlight the fluctuating nature of political influence on economic appointments. As the situation develops, market expectations will likely continue to evolve, especially with various candidates positioning themselves as viable replacements for Jerome Powell. This dynamic landscape emphasizes the potential impact of political decisions on monetary policy and the broader economy.