Trump’s Big Beautiful Bill: A Recipe for Economic Collapse

In a bold move that has ignited passionate debate, Trump’s Big Beautiful Bill has come under fire from economist Peter Schiff, who warns it may pave the way for an economic collapse and exacerbate the national debt. Schiff, a vocal supporter of gold as a safe investment, criticizes this legislative proposal for its lack of effective fiscal management, claiming it perpetuates unsustainable policies that threaten the stability of the dollar. With a staggering 1,116 pages, Schiff argues that the bill’s provisions do little to address the looming dollar crisis or the increase in government spending. He emphasizes that the real issue lies not in tax reductions, but in the escalating costs that Americans will ultimately bear through higher inflation and interest rates. As the nation grapples with an ever-growing economic burden, the implications of Trump’s Big Beautiful Bill could resonate for generations to come.

Dubbed a potential turning point for America’s economic fate, the legislation known as Trump’s Big Beautiful Bill is framed by critics as a ticking time bomb for the nation’s fiscal health. Schiff’s warnings about this extensive bill highlight serious concerns around financial oversight and the looming threat of a dollar collapse, emphasizing that it may fuel the nation’s already staggering debt. His assertions reflect a broader dialogue about the effectiveness of recent fiscal proposals and their implications for taxpayers everywhere. As discussions around economic policy evolve, the nuances within this bill spark critical conversations about budget management and long-term stability in the face of potential economic upheaval. In a rapidly changing financial landscape, the ramifications of such legislation warrant close examination and scrutiny.

The Financial Implications of Trump’s Big Beautiful Bill

The ramifications of Trump’s Big Beautiful Bill are extensive, particularly concerning the national debt and its foreseeable impact on the economy. Critics, including economist Peter Schiff, have pointed to the bill’s failure to address crucial fiscal management principles. Instead of reducing the deficit, the legislation appears to expand government spending significantly. Such an approach not only ignores the growing national debt but may also accelerate the looming dollar crisis, further aggravating an already fragile economic situation.

In addition, the bill’s extensive length of 1,116 pages conceals the real costs associated with the increase in national debt. Schiff argues that the bill is laden with provisions designed to mislead the public regarding its fiscal responsibility. With no tangible plans for reducing future deficits, concerns mount that this bill could trigger an economic collapse, making it imperative for lawmakers and citizens to scrutinize the long-term financial consequences.

Peter Schiff’s Economic Forecast: A Warning Against Fiscal Irresponsibility

As an accomplished economist and vocal critic of government spending, Peter Schiff has warned against the potential economic ramifications of Trump’s legislation. He emphasizes that the bill not only perpetuates fiscal irresponsibility but could ultimately lead to a catastrophic economic collapse. Schiff argues that policies lacking in fiscal management create an unsustainable growth model which might contribute to the next dollar crisis. His warnings resonate amidst a backdrop of escalating national debt that continues to rise unchecked.

Schiff’s stance is rooted in a deep understanding of economic principles; he argues that the Big Beautiful Bill represents a turning point in U.S. fiscal policy. If taken at face value, it presents a false promise of tax reductions while, in reality, prioritizing increased spending without addressing existing economic issues. The perception that ongoing support for such a bill will stabilize the economy is misguided and could lead to significant long-term effects on the financial health of American citizens.

The Debate Over Deficit Reduction and Spending

A core criticism of the Big Beautiful Bill lies in its disregard for deficit reduction strategies. Peter Schiff insists that without a genuine effort to cut expenditure, any purported reduction in taxes is misleading. He highlights the irony that the bill, which is framed as a pathway to economic revival, could instead culminate in heightened deficits and inflation. This points to a broader debate on whether increasing government outlay, especially in areas like healthcare and infrastructure, can truly stimulate growth or will simply add to the already staggering national debt.

Detractors of the bill, including Schiff, assert that the approach taken does not align with sound economic theory. They argue that pumping more money into the economy without a plan for sustainable deficit management will lead to inflationary pressures. Such measures could erode purchasing power and diminish economic growth, ultimately harming taxpayers who will bear the brunt of the financial fallout.

The Role of Medicaid Cuts and Their Economic Ramifications

Another focal point in the discussion about Trump’s Big Beautiful Bill is its proposed cuts to Medicaid. Schiff expresses skepticism about the bill’s promises to reduce spending in this critical area, arguing that such cuts are overly optimistic and unlikely to materialize. If implemented, these cuts could dismantle a critical support system for millions of Americans while simultaneously contributing to budget shortfalls and economic instability.

The debate surrounding Medicaid cuts exemplifies the complexities of fiscal management in the context of ongoing spending increases. Critics argue that while the intended cuts may be presented as fiscally responsible, they could lead to vastly negative outcomes for public health and welfare. This disconnect highlights the potential for political motivations to overshadow sound economic policies, raising alarms about the long-term effects of such legislation on the country’s economic landscape.

The Illusion of Tax Reductions Under Trump’s Proposed Bill

Supporters of the Big Beautiful Bill claim it offers crucial tax cuts to stimulate the economy; however, Peter Schiff challenges this assertion vehemently. He argues that the bill effectively increases government spending, which, in turn, constitutes a hidden tax on citizens as their financial burdens grow larger. The illusion of tax reductions could mask the reality that increased deficits will lead to rising inflation and interest rates, starkly contrasting the bill’s purported benefits.

This misrepresentation of fiscal policy creates significant concerns regarding public trust in government financial commitments. Citizens may be lulled into a false sense of security by the promise of tax relief without realizing the long-term repercussions of elevated spending habits. Schiff’s warnings illuminate the critical need for transparency and accountability in government initiatives, especially as they relate to the pressing issues of national debt and economic sustainability.

Long-Term Economic Stability: A Critical Examination

In the wake of Trump’s Big Beautiful Bill, the dialogue surrounding long-term economic stability is more relevant than ever. Economists like Peter Schiff express profound concerns about the viability of policies that disregard fundamental principles of fiscal management. The risk of an economic collapse looms larger when legislation is not designed to address and rectify the burgeoning national debt. Schiff’s positions underscore the necessity for coherent and responsible economic policies that prioritize stability.

For meaningful long-term growth, the focus must shift from superficial tax cuts and expansive spending to intelligent fiscal management that promotes sustainable practices. Schiff advocates for a reevaluation of government priorities to truly serve the interests of the American populace rather than presenting legislation that exacerbates economic uncertainty. The current trajectory, if unaltered, could lead to dire consequences for the financial system, prompting a call to action for policymakers.

Addressing Structural Issues in Government Finance

Many proponents of Trump’s Big Beautiful Bill argue it addresses unresolved structural issues stemming from previous administrations. However, Peter Schiff challenges the effectiveness of these claimed reforms, suggesting they may only scratch the surface of the underlying problems. By refusing to tackle the real fiscal challenges, such as the national debt and chronic deficits, the bill does little more than perpetuate financial complacency among legislators.

Such arguments raise vital questions about the integrity of the current bill as it seeks to paint a picture of fundamental change. Investors and taxpayers alike should be asking whether this new legislation serves as a genuine solution or merely a temporary fix that masks deeper economic inefficiencies. Advocates for fiscal responsibility argue that the true path to addressing structural issues lies in an honest acknowledgment of spending burdens rather than disguising them under misleading claims.

The Economic Realities: Taxpayer Burdens and Inflation

The economic reality of Trump’s Big Beautiful Bill is stark, as it poses an imminent threat to taxpayers who may find themselves at the heart of increased fiscal burdens. Schiff articulates the notion that while the bill may appear to focus on tax cuts, it ultimately leads to a situation where average citizens must shoulder the financial consequences of elevated government spending. This development raises serious concerns regarding inflation and the viability of the dollar, making everyday expenses considerably harder to manage.

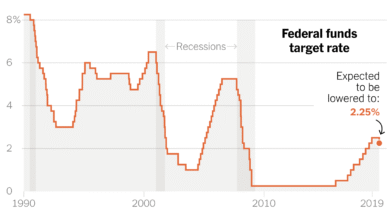

As economic pressures continue to build, the potential for an inflationary spiral becomes more pronounced. Increasing interest rates and a devalued dollar all compound the challenges faced by American families. Schiff’s critical insights serve as a warning that reliance on reckless fiscal policies can endanger the long-term prosperity of individuals and the economy as a whole, highlighting the urgent need for prudent and sustainable legislative practices.

Understanding the Economic Landscape: Challenges Ahead

The economic landscape is shifting rapidly, and the implications of Trump’s Big Beautiful Bill are just beginning to unfold. With Peter Schiff sounding the alarm about fiscal mismanagement, individuals and businesses alike must navigate an increasingly complex financial environment. The looming challenges presented by potential dollar crises and rising national debt are complexities that cannot be ignored by policymakers or the public.

It is essential for economists and political leaders to engage in meaningful discussions about the future of fiscal policy, aiming to prioritize sustainability over short-term gains. The economic future hinges on a collective understanding of the interconnectivity between government actions and their broader consequences. Schiff’s warnings are a critical part of this discourse as we strive for a more stable and prosperous financial environment.

Frequently Asked Questions

What are the main concerns about Trump’s Big Beautiful Bill as raised by Peter Schiff?

Peter Schiff criticizes Trump’s Big Beautiful Bill for perpetuating unsustainable fiscal management practices and exponentially increasing the national debt. He argues that it fails to address deficit reduction and may trigger an economic collapse and a dollar crisis.

How does Peter Schiff view the potential impact of Trump’s Big Beautiful Bill on the national debt?

Peter Schiff warns that Trump’s Big Beautiful Bill is likely to exacerbate the national debt, calling it a ‘complete sham.’ He emphasizes that the bill’s provisions primarily increase government spending, which undermines any claims of tax cuts.

What is the significance of the length of Trump’s Big Beautiful Bill according to Schiff?

Schiff points out that Trump’s Big Beautiful Bill spans 1,116 pages, yet contains no plans for future deficit reduction. He argues that this extensive length serves to mask the bill’s true financial impacts.

Does Trump’s Big Beautiful Bill actually reduce taxes according to Peter Schiff?

No, Peter Schiff claims the assertion that Trump’s Big Beautiful Bill cuts taxes is misleading. He states that the increased government spending effectively acts as a tax burden on taxpayers, leading to higher inflation and interest rates.

What does Peter Schiff say about the Medicaid provisions in Trump’s Big Beautiful Bill?

Peter Schiff expresses skepticism regarding the Medicaid cuts included in Trump’s Big Beautiful Bill, suggesting they are unlikely to be implemented. He believes there is a deception regarding the timing of these cuts, which are projected to take effect five years later.

Why does Peter Schiff describe Trump’s Big Beautiful Bill as a ‘betrayal’?

Schiff refers to Trump’s Big Beautiful Bill as a betrayal because it exacerbates existing financial issues rather than providing real solutions. He argues that it misrepresents its intent to reduce the national debt and manages to protect damaging fiscal policies.

What arguments do supporters of Trump’s Big Beautiful Bill use to counter Peter Schiff’s criticisms?

Supporters of Trump’s Big Beautiful Bill contend that it clarifies tax policy and addresses unresolved issues from past administrations, asserting that it can pave the way towards economic stability, despite Schiff’s concerns.

| Key Points | Details |

|---|---|

| Peter Schiff’s Criticism | Peter Schiff warns that Trump’s ‘Big, Beautiful Bill’ represents a poor fiscal strategy that could lead to an economic collapse. |

| Length of the Bill | The bill consists of 1,116 pages but fails to address future deficit reduction. |

| Impact on National Debt | Schiff claims the bill will significantly increase national debt and is detrimental to fiscal health. |

| Misleading Tax Cuts | The assertion that the bill reduces taxes is false; it increases government spending, equating to a tax hike for Americans. |

| Criticism of Medicaid Cuts | There is skepticism regarding proposed cuts to Medicaid, as they may not happen as claimed. |

| Support for the Bill | Supporters argue that it addresses structural issues and clarifies tax policies, suggesting it can lead to economic stability. |

Summary

Trump’s Big Beautiful Bill has sparked significant debate among economists and politicians alike. While supporters claim the bill addresses structural issues and aims to clarify tax policy, critics, including Peter Schiff, argue that it may lead to an economic collapse and further inflate national debt. Schiff emphasizes that the bill fails to provide a path for deficit reduction, ultimately increasing taxpayers’ burden through higher costs and inflation. As the discussion continues, it remains evident that the implications of Trump’s Big Beautiful Bill will have lasting consequences for the American economy.