Trump’s National Debt Bill: Key Insights and Controversies

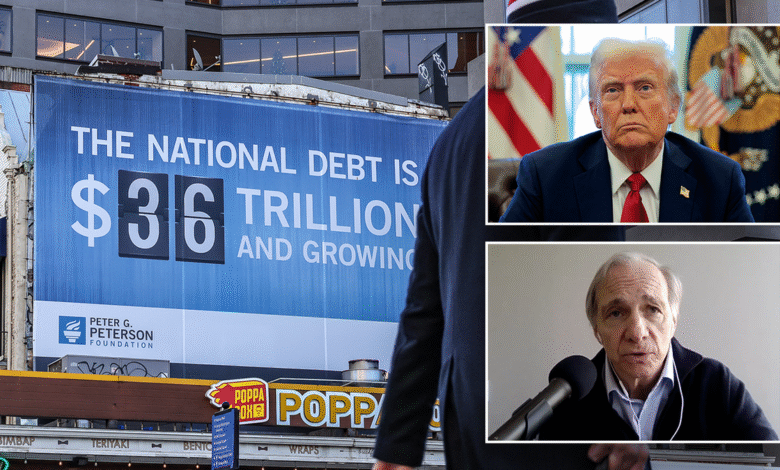

President Trump’s national debt bill, signed into law earlier this month, is set to add an astonishing $3.4 trillion to the U.S. national debt over the next decade, igniting heated debates across the political spectrum. This significant national debt increase has arisen from a complex legislative package that extends Trump’s previous tax cuts while integrating substantial military spending and funding controversial initiatives. Critics argue that the bill will lead to a staggering health insurance loss, with approximately 10 million Americans projected to be without coverage by 2034. Moreover, concerns surrounding ACA premium changes have arisen, particularly since this bill has been viewed as favoring wealthy Americans at the expense of essential social programs. As Americans grapple with the potential implications of this legislation, the focus sharpens on how it will impact the economy and the lives of everyday citizens.

The recently enacted debt-adjusting legislation under President Trump, widely referred to as a pivotal fiscal bill, has sparked considerable interest and scrutiny. This sweeping package, while preserving aspects of the 2017 tax reforms, injects considerable sums into military funding and touches on welfare implications that could reshape the landscape of American healthcare. With projections suggesting a sharp increase in the uninsured population, the political ramifications of such measures are far-reaching, especially regarding the Affordable Care Act and its associated premium adjustments. Proponents argue it emphasizes economic rejuvenation for working families, yet detractors highlight the underlying risks, including cuts to vital support programs. The dynamic elements of this financial statute will undoubtedly affect discourse in the coming elections as voters weigh its widespread effects.

Understanding Trump’s National Debt Bill

President Donald Trump’s recent legislation, dubbed the “big beautiful bill,” represents a significant shift in fiscal policy, one that many critics argue will markedly increase the national debt. According to the Congressional Budget Office, the bill is projected to add an astonishing $3.4 trillion to the U.S. national debt over the next decade. This historic increase raises concerns about long-term economic sustainability and financial accountability. Proponents, however, assert that the benefits afforded by the bill, especially those aimed at stimulating economic growth and job creation, could justify this financial expansion.

The implications of Trump’s national debt bill go beyond mere numbers; they impact everyday Americans, particularly in terms of government spending priorities. With an estimated 10 million more people projected to be without health insurance by 2034, as noted in the CBO report, the question arises about how such a drastic increase in national debt will affect essential services. Critics argue that the spending cuts targeting programs like Medicaid and SNAP, essential for low-income families, expose a troubling contradiction in the bill’s framework.

The Impact of Trump’s Tax Cuts

One of the central elements of Trump’s national debt bill is the extension of the 2017 tax cuts. These tax breaks have been framed by supporters as a boon for the middle and lower classes. However, critics maintain that such policies disproportionately benefit the wealthy and exacerbate income inequality. Tax deductions for tips and overtime are perceived as minor concessions against a backdrop of significant fiscal expansion and growing national debt.

As the debate continues, it is crucial to evaluate whether these tax cuts genuinely lead to sustainable economic growth or merely inflate national debt without corresponding benefits. The relationship between tax policy and national debt becomes increasingly complex as lawmakers grapple with balancing fiscal responsibility and economic stimulation. The ramifications of these tax cuts will play a pivotal role in shaping public perception and electoral outcomes for Republicans come midterm elections.

Health Insurance Loss Due to Legislative Changes

The recent legislation not only extends tax cuts but also modifies components of the Affordable Care Act (ACA), with potentially dire consequences for health insurance coverage. The Congressional Budget Office indicates that, by 2034, the bill could result in 10 million additional Americans lacking health insurance. Such a drastic decline in health coverage raises alarms about health equity and access to essential services for vulnerable populations.

Moreover, with projected changes leading to an estimated 0.6% reduction in average ACA premiums, there’s a dichotomy between perceived benefits and actual outcomes. While some may welcome a decrease in premium costs, it doesn’t alleviate the significant number of individuals projected to lose their health coverage entirely. This gap underscores the importance of closely monitoring not just the economic implications of the bill but its social repercussions as well.

Military Spending Volume and Its Consequences

An integral part of Trump’s national debt bill is the substantial increase in military spending, which is estimated to amount to hundreds of billions of dollars. This spending is often justified on the grounds of national security and global positioning. Supporters argue that a strong military presence is crucial for securing American interests, while opponents contend that such prioritization comes at the expense of critical domestic programs, including healthcare and education.

This focus on military funding further complicates the U.S. debt landscape, as funds diverted towards defense spending could otherwise be allocated to social programs that ensure the well-being of American families. The priorities laid out by this legislation reflect a longstanding debate over the balance between national security investment and social support systems, challenging the narrative of what constitutes true security for citizens.

Analyzing the Social Safety Net Cuts

In addition to enhancing military funding, Trump’s national debt bill contains significant cuts to vital social safety nets, including Medicaid and SNAP benefits. These cuts have raised concerns among economists and social advocates regarding the long-term implications for the most vulnerable populations. As the national debt continues to increase, the resulting loss of support for low-income families could exacerbate existing inequalities and deepen the financial struggles faced by many Americans.

The trade-offs inherent in this legislation prompt critical discussions about the value of investing in social programs versus tax reductions for higher-income households. As legislators promote the narrative of ‘working families,’ the contrasting realities of those relying on government assistance must not be overlooked. The consequences of these cuts to the social safety net are likely to resonate in communities across the nation, particularly among those most at risk.

Public Opinion on Trump’s Legislative Changes

Recent public surveys indicate significant discontent with Trump’s national debt bill among diverse demographic groups. Critics argue that the tax cuts primarily benefit the affluent, overshadowing the adverse effects on working-class families who may face rising costs in healthcare or education. This sentiment reflects growing skepticism about the motivations behind the bill, as many feel that the financial burden of the national debt will disproportionately fall on ordinary citizens.

The responses from various political factions highlight a division in public opinion, particularly as Democrats rally against the bill, viewing it as emblematic of a broader trend of prioritizing wealthy interests over grassroots economic health. This growing discontent may have electoral implications for the Republican Party in upcoming elections, challenging their claims of representing the ‘working family’ in a political landscape increasingly defined by income inequality.

Anticipating Economic Growth from Legislation

Despite concerns about rising national debt, proponents of Trump’s national debt bill assert that the economic benefits will materialize in the form of job creation, increased wages, and ultimately a thriving economy. Speaker Mike Johnson’s claims that the bill will provide immediate economic benefits resonate with constituents looking for signs of financial recovery after challenging years. Optimists believe that tax reductions for hardworking families will stimulate spending, thereby creating a ripple effect throughout the economy.

However, the long-term economic impact remains a point of contention. As the CBO outlines a fiscal framework where national debt rises considerably, it raises questions about sustainability and economic resilience. The tension between immediate economic growth and future financial obligations is likely to facilitate ongoing discussions about fiscal responsibility in light of populist tax cuts.

Republican Strategies for Midterm Elections Ahead

Looking towards the midterm elections, Republicans are betting on the success of the national debt bill to sway voter sentiment in their favor. The narrative spun around the legislation emphasizes its potential benefits for working families, with an optimistic outlook claiming these changes will secure more votes in critical districts. Strategists believe that highlighting middle-class tax cuts and military investment will resonate strongly with constituents, positioning the GOP as the party of economic progress.

Yet, the gamble may prove risky, given the consistent backlash against the bill from both the public and political opponents. Democratic leaders are mobilizing against the legislation, framing it as a betrayal of working-class values. As electoral strategies unfold, the effectiveness of Republican messaging in mitigating public discontent will play a crucial role in determining their success in the upcoming midterms.

Conclusion: The Broader Implications of Trump’s Legislation

As Trump’s national debt bill takes effect, its implications extend far beyond fiscal projections. The intertwining of tax cuts, military spending, and rolling back social safety nets encapsulates key debates about fiscal policy and the underlying philosophy guiding such legislation. Understanding the potential ramifications for economic equity and access to essential services will be critical as the nation grapples with the realities of increased national debt.

Moreover, the intersection of public opinion, electoral strategies, and social outcomes will shape the political landscape in the months to come. As critics and supporters alike weigh the merits and drawbacks of Trump’s policies, the conversation around national debt will undoubtedly remain a focal point of debate leading into the future.

Frequently Asked Questions

How will Trump’s national debt bill impact the future of federal spending?

Trump’s national debt bill is projected to add $3.4 trillion to the U.S. national debt over the next decade. The Congressional Budget Office (CBO) reports that while the bill includes some spending cuts, they are overshadowed by a substantial decrease in revenue, ultimately increasing federal spending.

What are the projected effects of Trump’s national debt bill on health insurance coverage?

According to the CBO, Trump’s national debt bill is expected to increase the number of people without health insurance by 10 million by 2034. This is partly due to changes made to the Affordable Care Act (ACA) included in the legislation.

Will Trump’s national debt bill lead to changes in military spending?

Yes, Trump’s national debt bill allocates hundreds of billions of dollars towards new military spending, reflecting a continuation of the administration’s focus on increasing defense budgets.

How does Trump’s national debt bill affect the Affordable Care Act premiums?

The CBO analysis indicates that the changes brought by Trump’s national debt bill may decrease average premiums for the standard benchmark ACA plan by approximately 0.6% in 2034.

In what ways does Trump’s national debt bill provide tax benefits?

The national debt bill extends Trump’s 2017 tax cuts and introduces tax deductions for tips and overtime pay for the next four years, which proponents argue will benefit working families.

What criticisms have been raised regarding Trump’s national debt bill?

Critics argue that Trump’s national debt bill disproportionately favors the wealthy, funded by cuts to social programs such as Medicaid and SNAP, which could harm low-income families and reduce essential benefits.

How does Trump’s national debt bill relate to the economic outlook for middle and lower class earners?

Supporters, including Speaker Mike Johnson, claim that Trump’s national debt bill is designed to benefit middle and lower class earners by increasing wages and promoting economic growth, despite the potential negative impacts of cuts to safety net programs.

What political implications does Trump’s national debt bill have for the GOP in upcoming elections?

Leaders like Speaker Mike Johnson express confidence that Trump’s national debt bill will be positively received by voters, suggesting it could help Republicans gain seats in the upcoming midterm elections.

What are the projected long-term financial effects of Trump’s national debt bill on taxpayers?

The long-term financial effects for taxpayers could include higher national debt and an increased tax burden, as the CBO estimates the bill’s costs will significantly exceed its revenue generation, challenging fiscal sustainability.

| Key Point | Details |

|---|---|

| National Debt Increase | The bill will add $3.4 trillion to the U.S. national debt over the next decade. |

| Uninsured Individuals | Estimated increase of 10 million people without health insurance by 2034. |

| Bill Support & Passage | Passed by Republicans along party lines in Senate (51-50) and House (218-214). |

| Tax Cuts Extension | Extends Trump’s 2017 tax cuts and provides deductions for tips and overtime pay for four years. |

| Military Spending | Includes hundreds of billions of dollars in new military spending. |

| Budget Cuts | Offsets new spending with cuts to Medicaid, SNAP, and clean energy. |

| Net Spending | Net spending cuts of $1.1 trillion are outweighed by $4.5 trillion in decreased revenue. |

| Public Opinion | The bill is unpopular among Americans and framed by Democrats as favoring the wealthy. |

| Republican Support | Some Republicans frame the bill as benefiting working families, expecting electoral rewards. |

| ACA Changes | Changes to the Affordable Care Act expected to decrease average premiums by about 0.6% by 2034. |

Summary

Trump’s national debt bill is a significant legislative changes that will impact the U.S. financial landscape for years to come. Signed into law by President Donald Trump, it is set to increase the national debt by $3.4 trillion while also altering health insurance coverage for millions. While the bill promises tax benefits and military spending, it has faced substantial opposition and criticism for its effects on low-income families and the working class. The coming midterm elections will be a crucial test to see how voters respond to this contentious legislation.