U.S. Budget Deficit Reaches $316 Billion: Key Insights

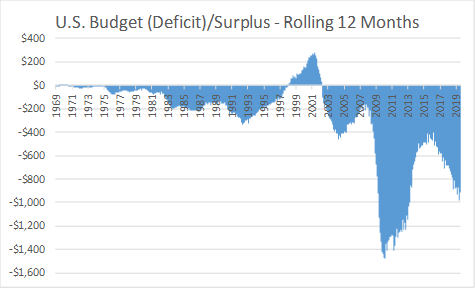

The U.S. budget deficit has become a pressing issue, reaching a staggering $316 billion in May alone, indicating a 14% rise in the annual shortfall compared to the previous year. This multi-billion dollar deficit arises after a brief surplus in April, resulting in a total deficit of $1.365 trillion for the fiscal year to date. Frighteningly, escalating financing costs have played a significant role, with interest payments on the national debt exceeding $92 billion amid a massive $36.2 trillion government debt. Consequently, fiscal challenges have compounded, leading to a debt financing projection exceeding $1.2 trillion for this fiscal year. As these interest payments continue to soar, they have surpassed all government expenditures save for Medicare and Social Security, painting a bleak picture of the nation’s fiscal health.

The current state of the national fiscal framework can be described as a financial imbalance, marked by a substantial shortfall in federal funding compared to expenditures. Known in economic terms as the annual deficit, this financial gap reached $316 billion in May, showcasing an alarming trend in government debt accumulation. Factors such as rising interest payments on public debt have exacerbated this situation, leading many experts to express concerns regarding future fiscal sustainability. Treasury yields remain persistent, reinforcing the costs associated with debt financing and highlighting the need for fiscal reforms. As the deficit continues to expand, discussions around potential strategies to mitigate these financial burdens are more relevant than ever.

Understanding the Current U.S. Budget Deficit

The U.S. budget deficit is a critical indicator of the nation’s financial health, with the recent figure of $316 billion for May marking a significant 14% year-on-year increase. This yearly comparison is essential as it underscores the growing fiscal challenges faced by the government. As the deficit swells amidst rising government debt, it is crucial to comprehend the underlying factors that contribute to this trend, particularly interest payments resulting from the ongoing debt financing.

This fiscal year, the total budget deficit has reached a staggering $1.365 trillion so far, a reflection of the persistent economic strains on the federal budget. Record-high interest payments, surpassing $92 billion, amplify concerns over sustainability. Coupled with a debt load exceeding $36 trillion, the implications of this budget deficit extend beyond mere numbers; they hint at potential adjustments in fiscal policies or changes in taxation to stabilize future economic outlooks.

The Impact of Interest Payments on the U.S. Fiscal Year Deficit

Interest payments have escalated to become one of the most significant expenditures of the U.S. government, second only to Medicare and Social Security. This rise is rooted in the substantial national debt, with interest payments alone exceeding $92 billion last month. Such high expenses are drawing public attention and raising questions about the overall fiscal responsibility of governance. Balancing these payments against other essential services highlights the complexities of managing a growing fiscal year deficit.

Financial analysts have projected that the debt financing for this fiscal year may exceed $1.2 trillion, emphasizing the unsustainable nature of current spending practices. With interest payments rising faster than other budgetary components, the pressure on the fiscal landscape becomes evident. The relationship between interest payments and the fiscal year deficit is becoming a focal point in discussions on economic policy, where prioritizing sustainable financial strategies is crucial to avert a deeper fiscal crisis.

Trends in Government Debt and its Economic Implications

The government debt in the U.S. has become a pivotal concern among economists and policymakers, currently standing at over $36 trillion. This staggering amount not only suggests potential instability in financial markets but also indicates substantial future obligations in terms of interest payments and principal repayment. As this debt continues to accumulate, the implications for the economy and public services are profound, with rising fiscal year deficits indicating a trajectory that may require intervention or strategic reforms.

With tariffs and other sources of revenue making modest gains, the larger picture of government debt remains troubling. On the one hand, tariff collections in May reached $23 billion, contributing to offsetting some of the budget deficits; however, the overall reliance on increasing government debt to finance expenditures is unsustainable in the long run. This duality highlights the urgent need to address fiscal policies to manage the government debt responsibly while ensuring that essential services are funded adequately.

Evaluating Treasury Yields Against Debt Financing

In assessing the economic landscape, Treasury yields serve as a barometer of investor confidence and market conditions. The current 10-year Treasury yield remains steady around 4.4%, reflecting a cautious outlook amid rising government debt levels. High yields may result from investor nerves concerning the sheer size of U.S. debt financing and its implications for future interest rates and inflation. The interaction between Treasury yields and debt financing is vital for understanding the broader economic context.

As yields remain elevated, there is a significant risk for the U.S. government in financing its debt. With projections indicating a trajectory of rising interest payments, the necessity of effective debt management strategies becomes paramount. Conservative estimates suggest that if yields rise further, the fiscal year deficit could expand dramatically, potentially leading to severe financial repercussions both domestically and internationally. Thus, the dynamics of Treasury yields and debt financing present a critical area of focus for economic policymakers.

Tariff Revenues and Their Role in Reducing the Deficit

Tariff revenues have emerged as a somewhat unexpected ally in mitigating the impacts of the U.S. budget deficit. With collections hitting $23 billion in May, this figure shows a marked increase compared to prior years, highlighting the potential role of international trade policies in shaping fiscal outcomes. The 59% rise in gross tariff collections provides a crucial buffer in offsetting some of the financial pressures associated with the burgeoning deficit and escalating government debt.

Yet, while tariffs contribute to federal revenue streams, they should not be viewed as a long-term solution to addressing structural budget deficits. Reliance on tariff revenues may lead to economic strain on trading partners and could result in retaliatory measures affecting U.S. exports. As such, while current figures appear promising, a sustainable approach to reducing the deficit must encompass broader economic reforms and innovative strategies to boost overall tax revenue without compromising international economic relations.

Economic Note: The Warning Signals from Prominent Investors

Recent warnings from influential financial leaders underscore the prevailing concerns surrounding the U.S. budget deficit and government debt. High-profile figures such as Jamie Dimon and Larry Fink emphasize the risks associated with a high debt-to-GDP ratio. Their caution reflects a growing apprehension that the current fiscal trajectory could lead to financial instability, particularly given that the deficit exceeds 6% of gross domestic product.

This scenario is particularly alarming in an era of otherwise stable economic indicators. Investors and analysts are closely monitoring these developments as the alarming margins signal potential vulnerabilities in the economy. The credibility of U.S. debt sustainability hangs in the balance, with the implications of heightened awareness regarding government debt extending far beyond investor circles, influencing public policy decisions in real-time.

Managing the Fiscal Challenges Ahead: Solutions and Strategies

As the U.S. grapples with increasing budget deficits and government debt, effective strategies are essential for navigating these fiscal challenges. Policymakers must focus on a balanced approach that encourages growth while controlling expenditure, particularly regarding interest payments associated with debt financing. Innovative solutions may involve reforming tax policies, enhancing efficiency in public spending, and revising fiscal targets to create a sustainable budget framework.

Furthermore, addressing the root causes of deficits through a combination of revenue enhancement and spending restraint can create a more favorable economic environment. Fostering economic growth through infrastructure investment and education can also be pivotal in reducing the national debt burden in the long-term. It is crucial to establish a comprehensive strategy that tackles these challenges head-on while ensuring that interest payments do not inhibit future economic prosperity.

The Significance of Budget Surpluses in Fiscal Management

The significance of budget surpluses cannot be overstated, particularly in the context of fiscal management and overall economic health. Moments of surplus, like the brief period witnessed in April due to tax revenues, provide governments with the opportunity to reduce debt levels and lessen future interest payments. Thus, they are invaluable in reversing the trajectory of ever-increasing national debt.

Encouraging conditions for producing surpluses often include responsible tax collection, efficient public spending, and prudent fiscal policies. The current climate of rising deficits underscores the urgent need for strategic measures to cultivate opportunities for surpluses—creating a safety net that can absorb future shocks from rising interest rates and economic downturns. A focus on sustainable fiscal policies that aim toward generating budget surpluses could significantly alter the current economic landscape that is fraught with fiscal issues.

Forecasting the Future: The Path Ahead for U.S. Fiscal Health

Looking into the future, the path ahead for U.S. fiscal health is fraught with both challenges and opportunities. Policymakers will need to grapple with the realities of persistent budget deficits and the climbing government debt. The challenge lies in devising and implementing fiscal measures that can stabilize the economy without stifling growth. As interest payments constitute a significant portion of expenditures, addressing this form of fiscal responsibility will be key to ensuring sustainability.

Proactive fiscal planning, including transparent budgeting practices and adaptable revenue policies, will be fundamental in addressing the risks associated with the current budget deficit. The outlook for the American economy hinges on the ability to strategically navigate these issues while fostering an environment conducive to long-term fiscal stability. Effective management of the fiscal situation will quell fears of economic turmoil and contribute positively to both domestic and global financial markets.

Frequently Asked Questions

What is the current U.S. budget deficit for the fiscal year 2025?

As of May 2025, the U.S. budget deficit reached $316 billion, marking a significant increase of 14% compared to the previous year. This brings the total fiscal year deficit to approximately $1.365 trillion.

How do interest payments impact the U.S. budget deficit?

Interest payments on the national debt, which have exceeded $92 billion in May 2025, are a major contributing factor to the rising U.S. budget deficit. With government debt currently at $36.2 trillion, these payments significantly affect overall fiscal health.

What are the main contributors to the increase in the U.S. budget deficit?

The key contributors to the increase in the U.S. budget deficit include rising debt financing costs, which are projected to exceed $1.2 trillion for the fiscal year, and increased expenditures, particularly in Medicare and Social Security.

How does the current U.S. budget deficit relate to the national debt?

The U.S. budget deficit contributes to the national debt, which currently stands at $36.2 trillion. Each fiscal year’s deficit adds to this total, illustrating the growing gap between government spending and revenue.

What role do fiscal year deficits play in government financing?

Fiscal year deficits necessitate debt financing, as they highlight the shortfall between government expenditures and tax revenues. As of now, debt financing is projected to exceed $1.2 trillion, reflecting ongoing challenges in balancing the budget.

How do Treasury yields affect the U.S. budget deficit?

Treasury yields, particularly the 10-year yield hovering around 4.4%, influence government borrowing costs and subsequently impact the U.S. budget deficit. Elevated yields can increase interest payments, compounding fiscal challenges.

Are tax revenues increasing in relation to the U.S. budget deficit?

Yes, tax revenues have increased by 15% in May 2025, although this has not fully offset the U.S. budget deficit. Total receipts are up 6% from the previous year, yet expenditures are rising more rapidly.

What future implications does the U.S. budget deficit hold for the economy?

The U.S. budget deficit, exceeding 6% of GDP, raises concerns among economists and financial leaders about potential economic turmoil. Continuous large deficits could hinder future economic growth and increase overall government debt.

What measures are being taken to address the U.S. budget deficit?

Measures to address the U.S. budget deficit include evaluating expenditure cuts, increasing tax revenues, and adjusting tariff policies. Recent tariff collections have risen significantly, contributing to deficit offsetting efforts.

How does the U.S. budget deficit compare historically?

The current U.S. budget deficit of $1.365 trillion places it among the highest in history, especially in peacetime. The 14% increase compared to last year highlights an ongoing trend of escalating fiscal challenges.

| Key Point | Details |

|---|---|

| U.S. Budget Deficit | The deficit reached $316 billion in May, a 14% increase from last year. |

| YTD Deficit | Year-to-date total stands at $1.365 trillion. |

| Financing Costs | Interest payments on $36.2 trillion debt exceeded $92 billion. |

| Tax Revenue | Tax receipts rose 15% in May, total revenues up 6% from the previous year. |

| Expenditures | Expenditures increased by 2% monthly and 8% YOY, mainly on Medicare and Social Security. |

| Debt Financing Projected | Debt financing is expected to surpass $1.2 trillion for this fiscal year. |

| Tariff Collections | Gross customs duties totaled $23 billion in May, a significant increase from last year. |

| Economic Concerns | The deficit exceeds 6% of GDP, a scenario rarely seen in peacetime. |

Summary

The U.S. budget deficit has risen significantly, reaching $316 billion in May, reflecting ongoing fiscal challenges. This increase highlights the persistent gap between government revenues and expenditures, raising concerns among economists and financial leaders. With interest payments on the national debt continuing to climb and a potential turmoil warning echoed by key market figures, addressing the U.S. budget deficit remains a crucial issue for the nation’s financial health.